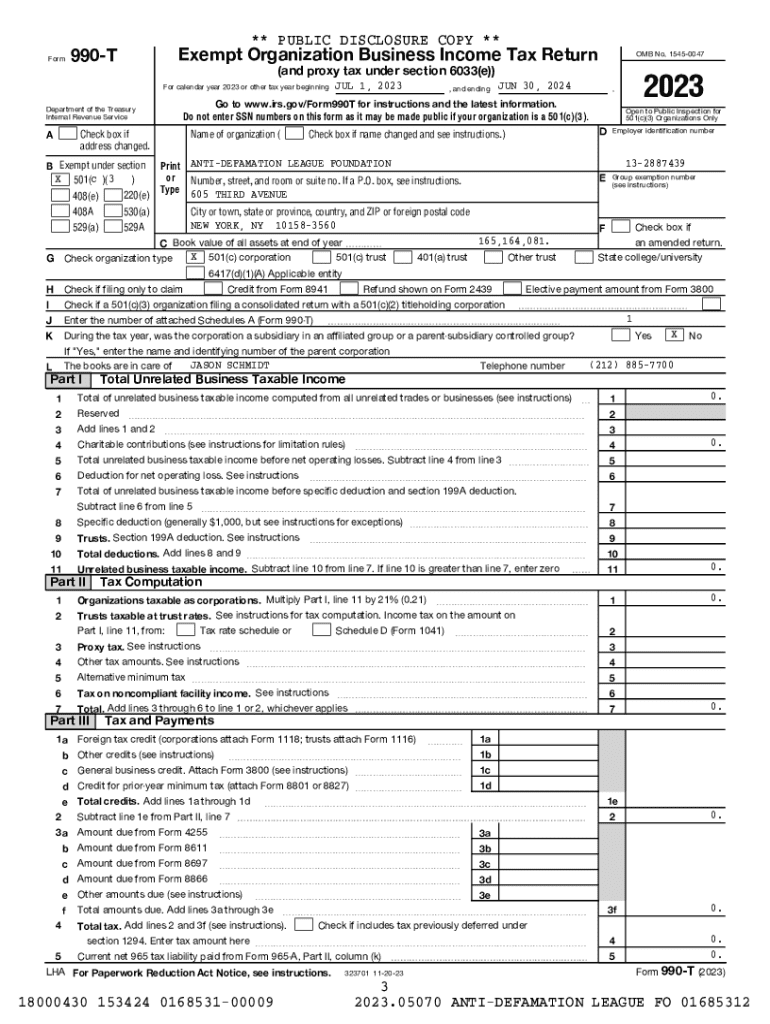

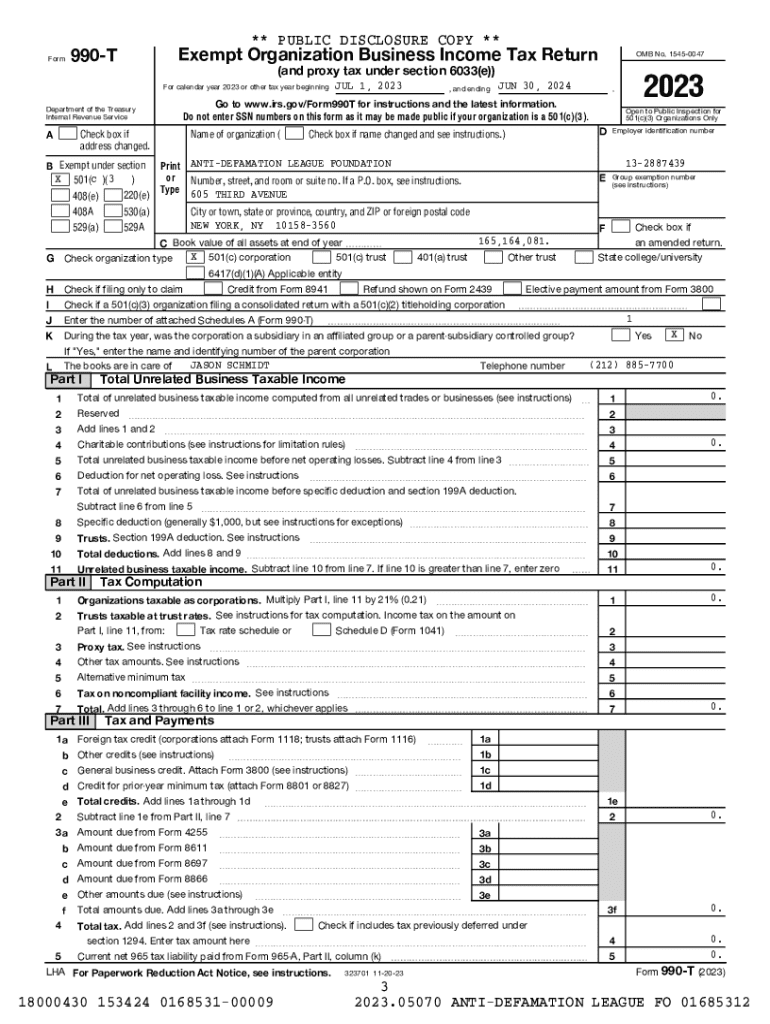

Get the free For calendar year 2023 or other tax year beginning JUL 1, 2023

Get, Create, Make and Sign for calendar year 2023

Editing for calendar year 2023 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out for calendar year 2023

How to fill out for calendar year 2023

Who needs for calendar year 2023?

Your Comprehensive Guide to the Calendar Year 2023 Form

Understanding the calendar year 2023 form

The calendar year 2023 form is a crucial document utilized for various purposes, particularly in payroll and HR functions. This form helps track income, deductions, and other key fiscal data relevant to the tax year ending December 31, 2023. Utilizing the correct form for the calendar year not only ensures compliance with tax regulations but also enhances the accuracy of payroll processing and financial reporting.

Filing the right form is vital for avoiding penalties and ensuring eligible deductions. Furthermore, understanding its intricacies aids teams in optimizing their financial documentation processes, leading to better organizational efficiency.

Key features of the 2023 form

The 2023 form incorporates several key features that distinguish it from previous versions. Notably, there are improved sections for reporting income from multiple pay schedules, which cater to diverse payroll practices. Additionally, the updated layout enhances user experience, reducing complexity and increasing clarity for individuals filling out the form. This form also includes digital interactivity options that streamline data entry.

Getting started with the calendar year 2023 form

To begin with the calendar year 2023 form, accessing the correct template is crucial. The form can be conveniently found on pdfFiller, a platform known for its extensive document solutions. Users can access the form by navigating to pdfFiller’s templates section and searching for 'calendar year 2023 form.' From there, options to download the form or fill it out online are available, making it accessible from anywhere.

Before diving into filling out the form, gather all necessary information. This typically includes personal identification, previous financial records, and detailed income documents. Having these documents ready will streamline the process and minimize time spent locating information during form completion.

Step-by-step instructions for filling out the calendar year 2023 form

Filling out the calendar year 2023 form requires attention to detail and a clear understanding of each section. Start with the 'Personal Information' segment, ensuring your name, address, and social security number are accurately entered. Errors in this section can lead to significant processing delays.

Many users find the digital editing tools on pdfFiller particularly useful for completing the form. Use features that allow you to add text, checkboxes, and even digital signatures, all designed to make your form-filling experience seamless.

Customizing the calendar year 2023 form

One notable benefit of using pdfFiller for the calendar year 2023 form is the ability to customize the layout and design according to your needs. Whether you're filling it out for personal use or for a team, tailoring the form can enhance both accuracy and overall professionalism. Changing fonts, adding logos, or adjusting the structure can make the document visually appealing and more understandable.

Moreover, collaborating with others on this form can significantly enhance efficiency. pdfFiller allows you to invite colleagues or financial advisors to view and edit the document. This ensures everyone involved has input, which can help capture a comprehensive view of the necessary data and submissions.

Managing and storing your completed calendar year 2023 form

Once you have filled out the calendar year 2023 form, securing your document is essential. pdfFiller offers various options for saving your form securely, including both cloud storage for accessibility and PDF downloads for local encryption. Regular backups prevent data loss and ensure you always have access to important information for payroll or tax documentation.

When it comes to sharing the form for signatures or with stakeholders, pdfFiller makes the process straightforward. You can send the document directly through the platform for eSigning, streamlining approvals and collaborations with a few clicks.

Troubleshooting common issues with the calendar year 2023 form

Despite the user-friendly design, issues may arise when using the calendar year 2023 form. If you discover errors after submission, first revisit your filled information to identify necessary corrections. pdfFiller allows users to re-edit previously submitted forms, making the correcting process simple. Always ensure that changes align with official guidelines to maintain compliance.

In addition, many users have concerns about document security and proper handling. Frequently Asked Questions (FAQs) on pdfFiller can help address these issues, providing simple solutions to common problems encountered.

Maximizing the features of pdfFiller for document management

pdfFiller enhances document management beyond just the calendar year 2023 form. The platform offers capabilities to convert, merge, and store multiple document types securely. This system not only saves time but facilitates a more organized approach to paperwork, particularly in a remote work environment where access must be assured for all stakeholders regardless of their locations.

User success stories illustrate how pdfFiller transformed document processes. Customers report improved efficiency in collaboration and reduced processing times, leading to enhanced productivity across teams. The ability to operate from a cloud-based platform means that team members, irrespective of location, can collaborate effectively.

Additional tips for effective document management in 2023

Staying organized is key to effective document management. Utilizing templates, such as the calendar year 2023 form, can aid in future filings and submissions. By keeping all relevant documents stored in a single place, users can enhance efficiency and significantly reduce time wasted searching for essential files, particularly during busy payroll periods.

Lastly, staying informed about upcoming features and updates is essential for maximizing the use of pdfFiller. Anticipated updates for future forms can improve functionality, and engaging with the platform's community can provide insights and tips from other users. This ongoing learning process helps everyone stay at the forefront of document management technology.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the for calendar year 2023 electronically in Chrome?

Can I create an eSignature for the for calendar year 2023 in Gmail?

Can I edit for calendar year 2023 on an iOS device?

What is for calendar year 2023?

Who is required to file for calendar year 2023?

How to fill out for calendar year 2023?

What is the purpose of for calendar year 2023?

What information must be reported on for calendar year 2023?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.