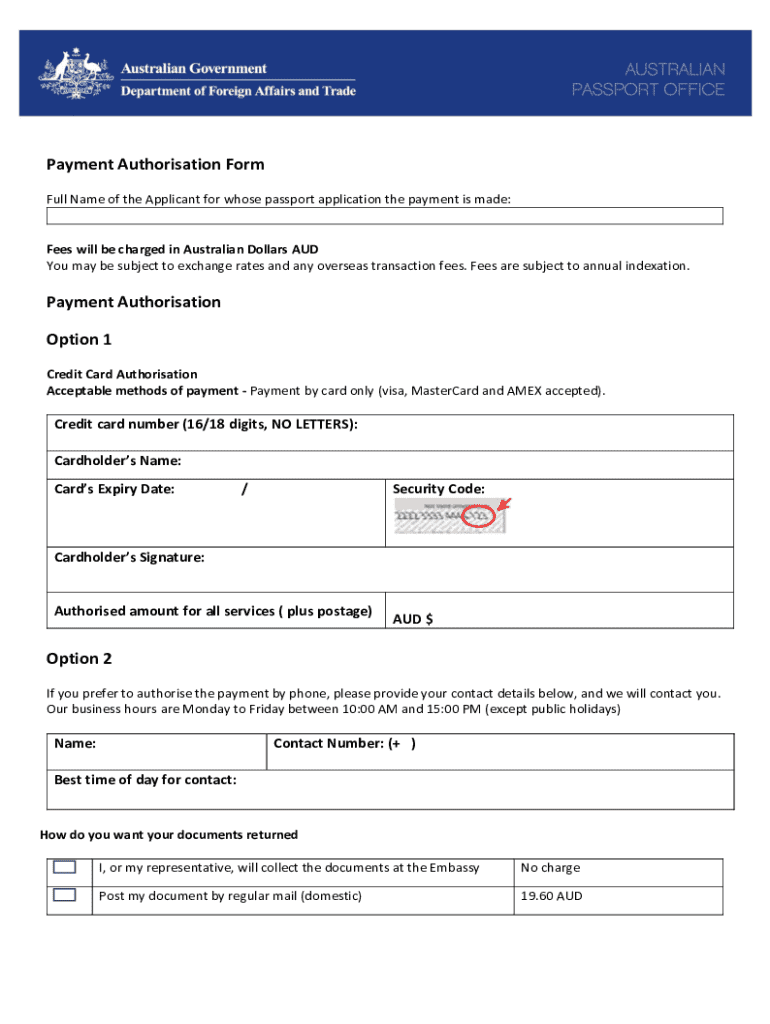

Get the free Payment Authorisation Form Payment Authorisation Option 1 Option 2

Get, Create, Make and Sign payment authorisation form payment

How to edit payment authorisation form payment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out payment authorisation form payment

How to fill out payment authorisation form payment

Who needs payment authorisation form payment?

Understanding Payment Authorisation Forms: A Comprehensive Guide

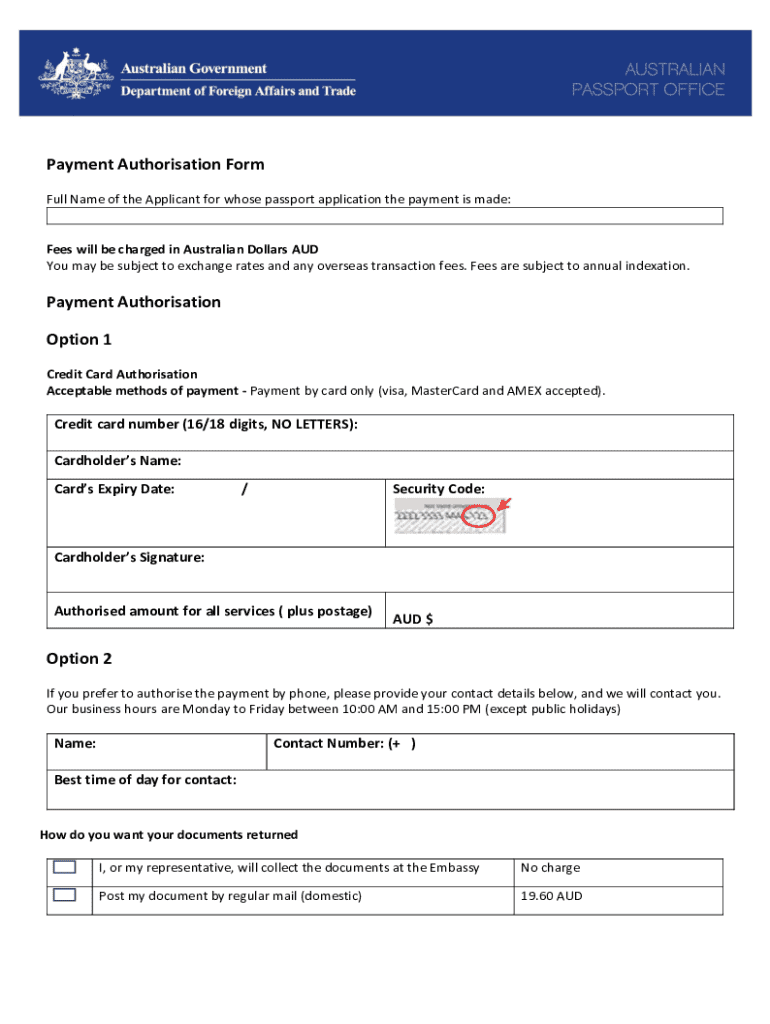

Understanding the payment authorisation form

A payment authorisation form is a crucial document that facilitates the approval of payments through various payment methods. Its primary purpose is to obtain consent from the cardholder, ensuring that transactions are carried out securely and in compliance with financial regulations. This form can significantly reduce the risk of unauthorized transactions, protecting both businesses and consumers in the electronic payments landscape.

Employing a payment authorisation form is important for several reasons. Primarily, it establishes a clear record of consent from the customer, which is vital for preventing disputes and chargebacks. Additionally, it reassures businesses that their payment processes are legitimate, enhancing trust among customers and clients. From e-commerce shops to restaurants using credit card authorization forms, this documentation plays a pivotal role in seamless transaction workflows.

Common scenarios requiring a payment authorisation form encompass monthly subscription services, high-value purchases, or any situation where recurring payments are involved. By standardizing the payment authorisation process, companies can mitigate risks associated with fraud while ensuring that transactions are valid and authorized.

Key components of a payment authorisation form

A payment authorisation form typically includes several essential components. Required information often encompasses personal details from the cardholder, such as their name, address, and contact information. Furthermore, the payment method details are crucial, necessitating the inclusion of credit card numbers, expiration dates, and security codes to ensure proper processing of the payment.

Additionally, the form includes an authorization statement. This statement formally acknowledges that the cardholder consents to the transaction and understands the terms associated with the payment. Beyond these core components, optional fields may allow for extra notes or instructions, contributing to clearer communication between parties involved in the transaction.

Accuracy is paramount when filling out a payment authorisation form. Any discrepancies in personal information or payment details can lead to significant challenges, such as transaction rejections or delays. Businesses should emphasize the necessity of thorough checks to ensure that the form is filled correctly, minimizing potential errors that could disrupt payment processes.

How to fill out a payment authorisation form

Completing a payment authorisation form doesn't have to be daunting. By following a simple step-by-step approach, anyone can navigate this process effectively. Here’s a guide to help you through the completion of the form:

When filling out the form, consider setting aside sufficient time to avoid rushing, which can lead to errors. A well-prepared and accurate form submission can significantly reduce the chances of payment issues down the line.

Interactive tools for creating and managing your payment authorisation form

Creating and managing your payment authorisation form has never been easier, thanks to pdfFiller’s user-friendly tools. The platform provides a variety of interactive templates designed for optimal usability. You can customize your payment authorisation form to include all the necessary details while maintaining a professional appearance that aligns with your brand.

Features such as document editing, real-time collaboration, and cloud storage make it straightforward to manage your forms effectively. You can share your payment authorisation form with relevant parties and collaborate in real-time, ensuring a streamlined process from creation to submission. This eliminates the need for printing and manual handling, making the process more efficient and environmentally friendly.

Common challenges with payment authorisation forms

Despite the advantages of using a payment authorisation form, challenges can arise when submitting them. Common issues include incomplete forms, discrepancies in provided information, or a lack of proper signatures. These challenges can result in delays, transaction denials, or disputes that negatively impact customer satisfaction and business operations.

Incorrect information is a significant risk when it comes to managing payments. This can lead to potential chargebacks, wherein a customer disputes a transaction, prompting the bank to reverse the payment. To avoid these common pitfalls, businesses and customers should ensure that they thoroughly review all provided information before submission, double-checking for accuracy and completeness.

Handling payment disputes related to authorisation requires a proactive approach. Establishing clear communication channels and prompt responses to inquiries can assist in resolving issues quickly. Moreover, having a robust process for addressing and rectifying errors can further enhance the customer experience while safeguarding your business's reputation.

Electronic vs. paper payment authorisation forms

In the digital age, businesses often face a choice between electronic and paper payment authorisation forms. Electronic forms significantly streamline the process, facilitating faster submissions and easier data management. They often include features such as e-signatures, which provide a legally recognized method for authorisation, saving time and effort while ensuring compliance.

The legal standing of electronic signatures has been well established in many jurisdictions, making them a reliable option for businesses seeking to modernize their document management. However, there may be scenarios where paper forms are still preferable, such as in industries or regions where electronic methods are not widely accepted or in situations requiring a physical record for compliance.

Frequently asked questions (FAQ)

When it comes to payment authorisation forms, numerous questions may arise. For instance, what happens if a payment authorisation form is denied? Generally, if a form is denied, it may be due to incorrect information or insufficient funds. Customers may need to verify their details with the issuer.

Another common query is regarding the validity period of a payment authorisation form. Typically, these forms remain valid for a limited period, often specified in the agreement. Users are encouraged to check their forms for any expiration dates to avoid payment disruptions.

Revoking a payment authorisation is also a frequent concern. Cardholders can usually do this by contacting their banks or the company in question. Moreover, understanding the process to follow if a payment authorisation form is lost is essential; in such cases, notifying the relevant parties promptly can safeguard against unauthorized transactions.

Download templates and additional resources

For those seeking to simplify their documentation process, pdfFiller offers customizable payment authorisation form templates. These templates can be easily tailored to suit specific business needs, enabling quick adaptation to different payment scenarios. Accessing these templates is straightforward, allowing users to initiate their forms online without any hassle.

Moreover, pdfFiller provides a wealth of resources for further learning. Users can explore articles and guides focusing on document management best practices, as well as webinars and tutorials that delve into the intricacies of using pdfFiller’s platform effectively. These resources ensure users are well-equipped to manage their payment authorisation forms efficiently.

User testimonials and success stories

Businesses and individuals alike have shared positive experiences regarding their use of pdfFiller for payment authorisation forms. Many companies have reported increased efficiency in payment processing, resulting in faster turnaround times for transactions. This improvement not only enhances operational productivity but also increases customer satisfaction.

Individuals utilising pdfFiller have also expressed appreciation for the platform's ease of use, particularly in managing their personal payment authorisation forms. These success stories underline the importance of selecting the right tools for creating, managing, and filling out critical documents like the payment authorisation form.

Staying compliant with payment authorisation regulations

Compliance with regulations surrounding payment authorisation forms is essential for both businesses and consumers. Various legal requirements must be adhered to, including data protection laws and industry standards. Adopting a compliant approach not only safeguards a company’s reputation but also prevents costly fraud and chargebacks.

Staying updated with regulatory changes is crucial in the continuously evolving payments landscape. By implementing proper training for staff and robust processes for handling payment authorisation forms, companies can foster a culture of compliance, reducing risks related to payment practices and enhancing customer trust.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my payment authorisation form payment in Gmail?

How do I fill out payment authorisation form payment using my mobile device?

How can I fill out payment authorisation form payment on an iOS device?

What is payment authorisation form payment?

Who is required to file payment authorisation form payment?

How to fill out payment authorisation form payment?

What is the purpose of payment authorisation form payment?

What information must be reported on payment authorisation form payment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.