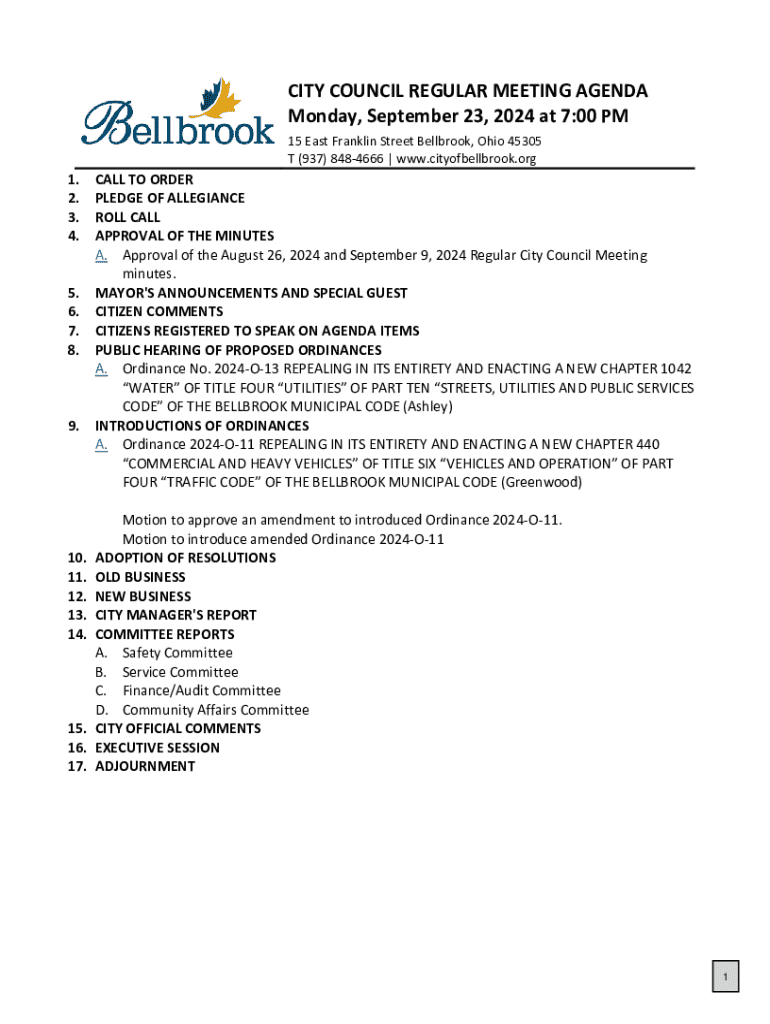

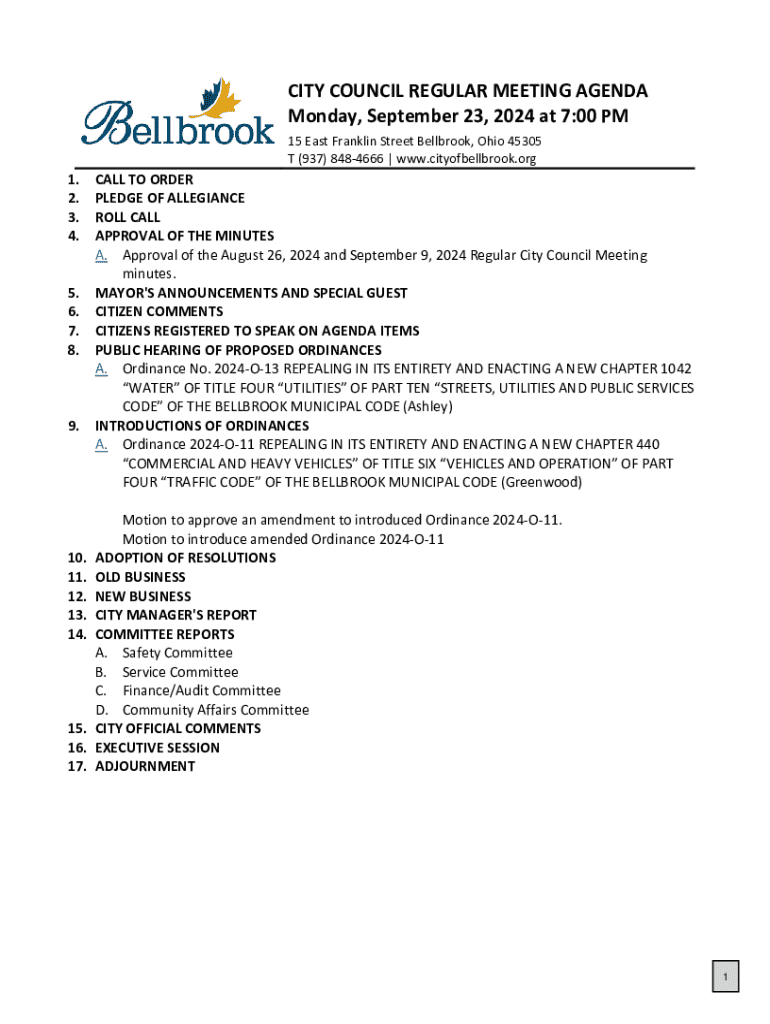

Get the free 2024-O-13 REPEALING IN ITS ENTIRETY AND ENACTING A NEW CHAPTER 1042

Get, Create, Make and Sign 2024-o-13 repealing in its

How to edit 2024-o-13 repealing in its online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2024-o-13 repealing in its

How to fill out 2024-o-13 repealing in its

Who needs 2024-o-13 repealing in its?

2024-O-13 Repealing in Its Form

Understanding 2024-O-13

2024-O-13 is a significant piece of legislation that has attracted necessary attention due to its implications for property taxes and local governance in California. Specifically, this form deals with the regulations surrounding property tax assessments, impacting how homes and businesses are valued within municipal jurisdictions. Given California's unique real estate market, the provisions outlined in 2024-O-13 are foundational in determining tax burdens and property market values for both homeowners and commercial entities.

The legislation's importance is underscored by its potential effects on homeowners, renters, and investors alike, who rely on predictable property tax assessments for financial planning. Therefore, understanding 2024-O-13 is crucial for anyone affected by property taxes, particularly as discussions arise around its repeal and the implications that may follow.

The impacts of repealing 2024-O-13

Repealing 2024-O-13 brings about a range of legal implications that cannot be overlooked. The repeal may lead to a fundamental shift in how property taxes are assessed in California, leading to potential increases in property tax rates across various communities. This change is especially consequential for homeowner-occupiers who might find their property taxes suddenly inflated, thereby affecting their disposable income and financial stability.

From a legal standpoint, the repeal will alter the obligations of local government agencies in terms of tax assessment, necessitating a re-evaluation of existing property values. Moreover, businesses could face heightened tax burdens that could stifle growth, particularly for startups battling against established entities. The overall economic repercussions may include reduced mobility among homeowners unable to afford rising property taxes and an unpredictable market influenced by fluctuating property values.

Who is affected by 2024-O-13 repealing?

Understanding who stands to be most affected by the repeal of 2024-O-13 is essential. Homeowners could see an immediate impact on their property tax assessments, which may lead to an increase in annual tax bills. This added financial burden could affect the housing options available to individuals, as increased costs may push some buyers out of the market. For renters, higher property taxes could lead to increased rents as landlords pass costs onto tenants.

Investors and property developers could likewise feel the sting of added tax burdens. As businesses must allocate more resources to pay increased taxes, their ability to expand or innovate could be hindered. Local and state government agencies will also be forced to reassess their funding strategies, as changes in tax revenue can affect budget allocations for essential services like schools and infrastructure.

The process of repealing 2024-O-13

The repeal process for 2024-O-13 involves several key steps, beginning with drafting and proposing changes to the existing legislation. Local lawmakers or advocacy groups seeking the repeal typically initiate this action, highlighting the need for reform based on current economic or social conditions.

Once proposed, the repeal undergoes a legislative review process, wherein committees responsible for tax policy evaluate the implications of the repeal. Following this review, the proposal proceeds to a voting phase, where a majority vote is necessary for the repeal to pass. If approved, an implementation timeline is established, detailing when the repeal takes effect and how new regulations will be rolled out.

Filling out and managing related documents

As 2024-O-13 faces repeal, individuals and businesses need to prepare for potential changes in documentation. It's critical to determine whether one needs to re-file any tax documents post-repeal. Homeowners may need to adjust their tax filings to reflect new assessments, while businesses might require updated forms aligned with new regulatory frameworks.

Managing these documents can be simplified using pdfFiller, which provides a coherent platform for editing and signing essential forms. Users can navigate through the process using pdfFiller’s interactive tools, allowing them to create, edit, and securely eSign documents related to the repeal of 2024-O-13. By streamlining the document management process, stakeholders can more easily adapt to the changes brought about by this legislative shift.

Engagement and feedback

Community reactions to the repeal of 2024-O-13 have been varied, generating discussions at public forums, city hall meetings, and local social media groups. On one hand, advocates for repeal argue that it may alleviate burdensome taxes and enhance economic mobility across districts. Conversely, critics voice concerns about potential revenue losses that could impact essential city services.

Moreover, expert opinions from economists and legal professionals have weighed in on the matter. Many believe that a repeal could create instability in property values, leading to broader issues within the housing market. Understanding these perspectives will be critical for individuals and organizations navigating the implications of this repeal in the coming months.

Future considerations

Looking ahead, the repeal of 2024-O-13 could signal more extensive legislative trends aimed at reforming property taxation within California. Observers anticipate that this could lead to further discussions around economic equity, taxpayer rights, and equitable practices in property assessments. This climate could initiate a wave of legislation that attempts to balance tax revenue needs with the economic realities faced by homeowners and businesses.

In this context, maintaining proper document management will be crucial. As legal frameworks evolve, being prepared with efficient document creation and distribution systems will be essential for navigating future changes without unnecessary hitches. Solutions like pdfFiller will remain instrumental in supporting these needs, ensuring that individuals and teams stay ahead of evolving regulations.

Key takeaways

The repeal of 2024-O-13 is a multifaceted issue with significant implications across various sectors. Key points include the potential for increased property taxes, the ripple effects on homeowners and businesses, and changes in local governance regarding tax assessments. Understanding these aspects ensures that stakeholders can navigate the upcoming challenges effectively.

Furthermore, as individuals and organizations prepare for this legislative shift, embracing document management solutions like pdfFiller will facilitate a smoother transition. The ability to edit, eSign, and collaboratively manage documents will empower stakeholders to respond efficiently as they adapt to a reformed property tax landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 2024-o-13 repealing in its online?

How do I fill out 2024-o-13 repealing in its using my mobile device?

How can I fill out 2024-o-13 repealing in its on an iOS device?

What is 2024-o-13 repealing in its?

Who is required to file 2024-o-13 repealing in its?

How to fill out 2024-o-13 repealing in its?

What is the purpose of 2024-o-13 repealing in its?

What information must be reported on 2024-o-13 repealing in its?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.