Get the free which-insurance-has-no-waiting-period

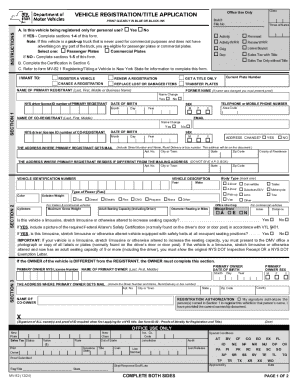

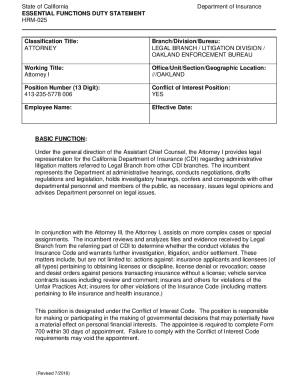

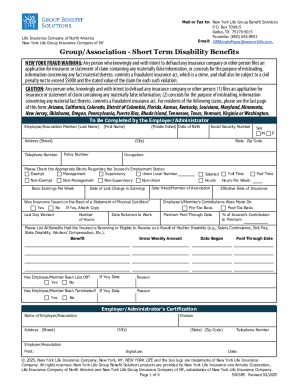

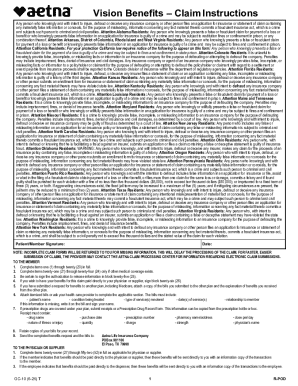

Get, Create, Make and Sign which-insurance-has-no-waiting-period

Editing which-insurance-has-no-waiting-period online

Uncompromising security for your PDF editing and eSignature needs

How to fill out which-insurance-has-no-waiting-period

How to fill out which-insurance-has-no-waiting-period

Who needs which-insurance-has-no-waiting-period?

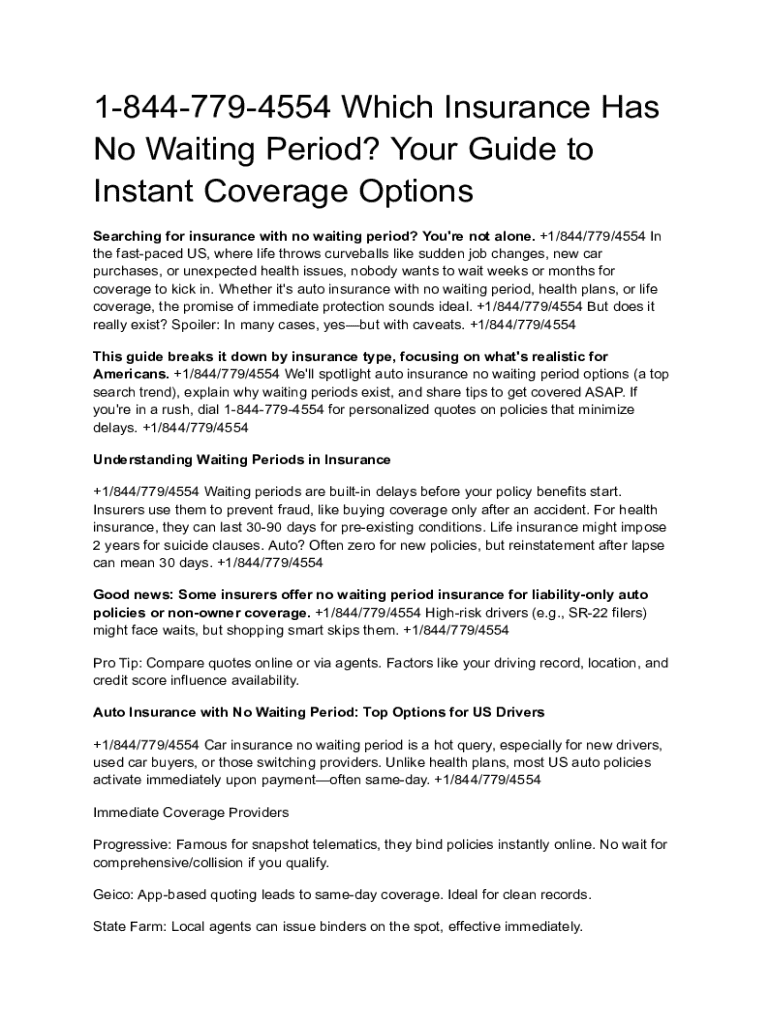

Which Insurance Has No Waiting Period?

Understanding waiting periods in insurance

A waiting period in insurance refers to the duration before specific benefits kick in after a policy is purchased. Understanding these waiting periods is vital for policyholders as they can significantly impact immediate access to coverage. Commonly, waiting periods are instituted to mitigate risk and prevent fraud. For example, insurers may implement these periods to avoid situations where individuals purchase insurance only when they know they will need to make a claim. This can affect policyholders by delaying access to necessary services, placing them in financial or health vulnerabilities.

The implications of waiting periods can vary widely across different types of insurance policies, and knowing these details can save policyholders unnecessary stress and expense in critical situations.

Types of insurance policies with no waiting period

Finding an insurance policy that offers immediate coverage can be crucial, especially in emergency situations. Below are some insurance types that commonly provide policies without waiting periods.

Why choose insurance policies with no waiting periods?

Insurance policies with no waiting periods appeal to individuals who prioritize immediate accessibility, particularly when urgent health needs arise. They instill peace of mind knowing coverage is active at the moment it is needed, which can be especially valuable during unforeseen circumstances such as accidents or sudden illnesses.

Additionally, these policies can present financial benefits. Although premiums might be slightly higher compared to policies with waiting periods, the rapid coverage can offset potential costs incurred in emergencies. Moreover, they offer flexibility, making them essential for individuals or families facing last-minute coverage decisions.

Factors to consider when selecting no-waiting-period insurance

When contemplating no-waiting-period insurance, assessing personal needs is crucial. Understanding one’s risk profile is key to determining the extent of coverage required. Furthermore, potential coverage limitations should be evaluated. Many instant coverage policies may exclude certain conditions or services that would typically fall under standard plans. This necessitates a thorough understanding of what is included versus excluded in your selected policy.

Balancing premium costs against benefits is essential. A higher premium may accompany immediate coverage, but understanding the comprehensive benefits level can justify the expense. Ensure to review the policy carefully to align its offerings with your specific needs.

How to get started with no-waiting-period insurance policies

Starting the search for insurance without waiting periods requires careful research. Identifying insurers that specifically advertise no-waiting-period options can streamline your efforts. Some effective steps include checking company websites, reading customer feedback, and consulting with insurance brokers for tailored advice.

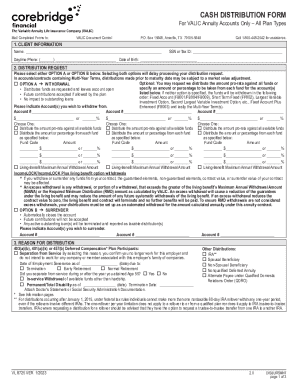

The application process for no-waiting-period policies typically requires basic personal information, health history, and perhaps medical records, depending on the insurer's requirements. Many insurers streamline this process via digital platforms. You can utilize pdfFiller for document management, which simplifies filling, editing, and eSigning necessary paperwork to expedite your application.

Benefits and drawbacks of no-waiting-period insurance

Policies that eliminate waiting periods come with distinct advantages. They provide immediate access to necessary coverage, enhancing peace of mind during urgent circumstances. With the right policy, individuals can rest easy knowing they are protected against unforeseen events.

However, these policies may have drawbacks as well. Often, they come with higher premiums or limited benefits, which may not equate to the comprehensive coverage of traditional policies. Exclusions could significantly impact your out-of-pocket expenses post-incident if not well understood before purchasing.

Real-life scenarios: When no-waiting-period insurance is beneficial

Real-world examples demonstrate the utility of no-waiting-period insurance policies effectively. Consider a scenario where a person suddenly needs surgery due to an unforeseen medical condition. Having a no-waiting-period health policy means treatment can commence immediately, ensuring they do not face a delay in care that could worsen their situation.

Testimonials from satisfied users also highlight the benefits. One individual noted how their accidental death policy provided them peace of mind, knowing their loved ones would receive immediate financial support in the event of an unfortunate incident.

Tips for making an informed decision on insurance with no waiting period

When evaluating which insurance has no waiting period, it’s critical to assess the types of coverage in relation to personal situations. Each individual’s risk exposure varies, making it essential to choose policies that align with specific health needs and life circumstances.

Next steps in your insurance journey

To compare different policies effectively, consider online tools and resources that compile information on various insurers. This can assist in identifying competitive premium prices as well as the terms of coverage. Additionally, tools like pdfFiller can facilitate the management of documents related to your insurance search, making it easier to handle applications and modifications as needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete which-insurance-has-no-waiting-period online?

Can I create an electronic signature for the which-insurance-has-no-waiting-period in Chrome?

Can I edit which-insurance-has-no-waiting-period on an Android device?

What is which-insurance-has-no-waiting-period?

Who is required to file which-insurance-has-no-waiting-period?

How to fill out which-insurance-has-no-waiting-period?

What is the purpose of which-insurance-has-no-waiting-period?

What information must be reported on which-insurance-has-no-waiting-period?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.