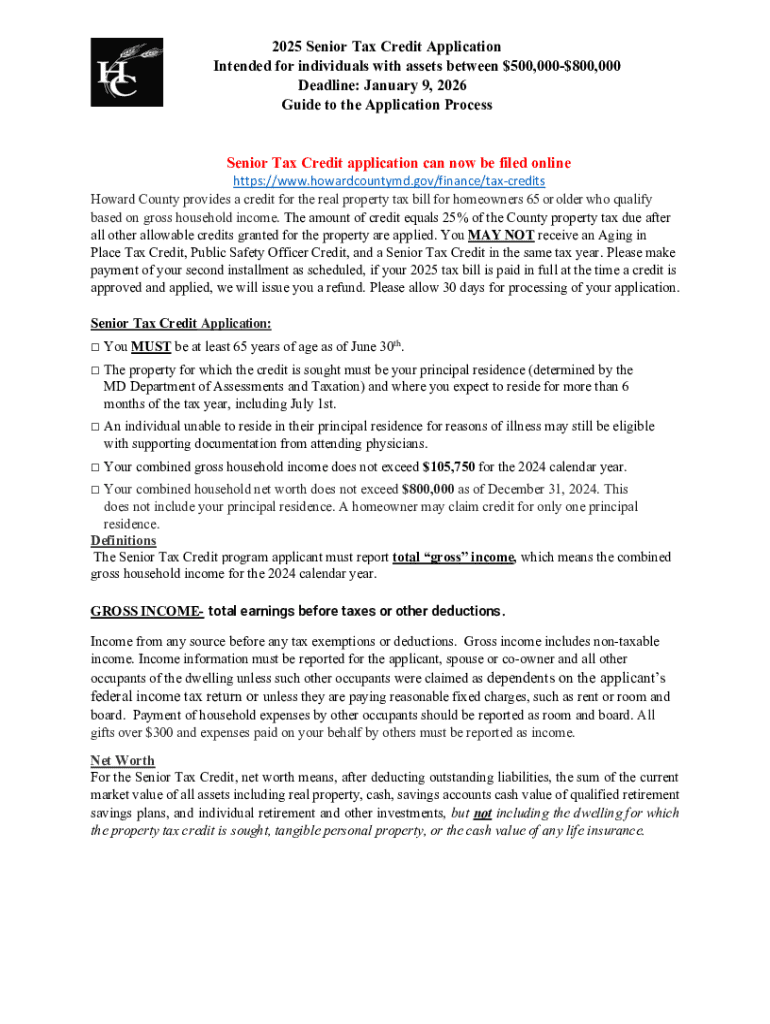

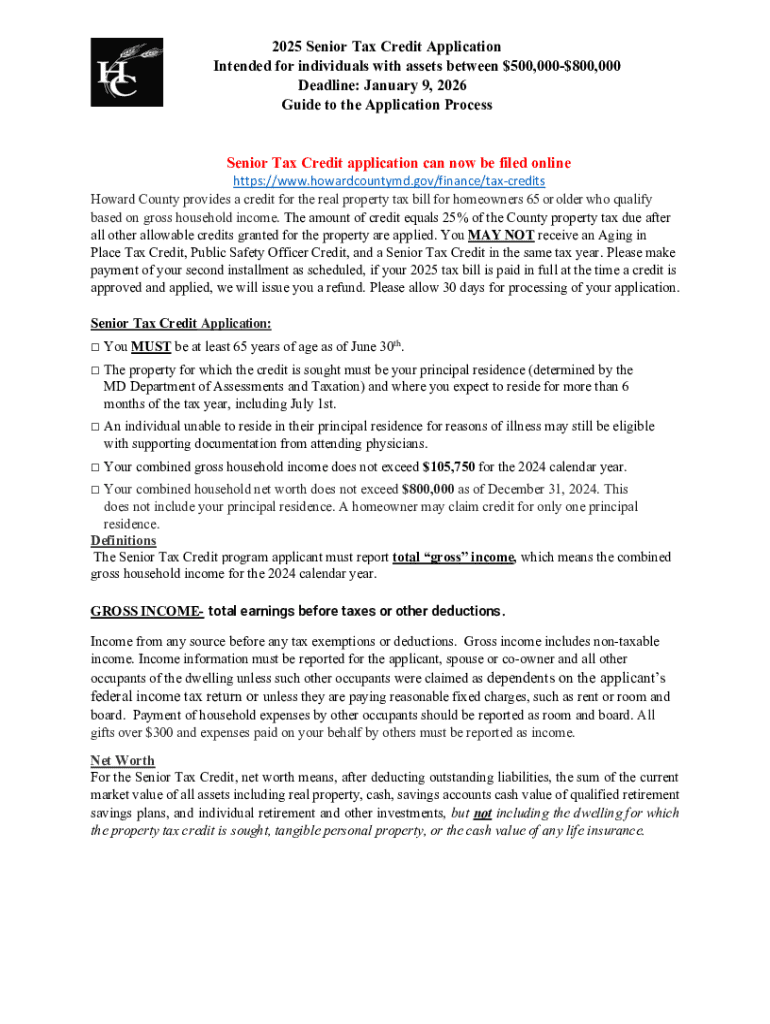

Get the free Senior Tax Credit application can now be filed online

Get, Create, Make and Sign senior tax credit application

Editing senior tax credit application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out senior tax credit application

How to fill out senior tax credit application

Who needs senior tax credit application?

Senior tax credit application form: A comprehensive guide

Understanding senior tax credits

Senior tax credits are financial benefits provided by the government that help reduce the overall tax burden on older citizens. These credits are designed to support seniors financially, especially those living on fixed incomes. By minimizing tax liabilities, seniors can manage their living expenses more effectively, allowing them to allocate their resources towards essential needs such as healthcare, housing, and daily living costs.

The importance of tax credits for seniors cannot be overstated. With rising healthcare costs and the potential for unexpected expenses, these credits serve as a crucial financial buffer. They help ensure that seniors can maintain their standard of living and cover important expenses without the constant worry of financial instability. Furthermore, tax credits encourage economic participation among older adults, allowing for a sense of independence and dignity.

Types of senior tax credits

Seniors may qualify for various types of tax credits, including property tax exemptions and income tax credits. These credits can vary significantly by state, and some may be specific to a particular locality. Property tax exemptions primarily reduce or eliminate the amount of property taxes owed. This is particularly beneficial for seniors who may own their homes outright and are facing increased costs as they age.

Income tax credits, on the other hand, directly reduce the amount of taxable income, which can be a substantial relief for seniors dealing with fixed or limited incomes. Understanding the differences between federal, state, and local tax credits is vital. Each level of government may offer separate programs with varying eligibility and benefits. Familiarizing oneself with these differences can maximize the financial benefits available.

The senior tax credit application form

The senior tax credit application form serves as the official means through which seniors can request these benefits. It requires specific information relating to an applicant's income, residency status, and age verification. Completing this form accurately is critical to ensure that eligible seniors receive the benefits they deserve.

Finding the senior tax credit application form is straightforward. Most local tax offices and state revenue departments provide access to the necessary forms online. Many websites, including the official government portals, offer downloadable PDF versions. For those who prefer digital solutions, pdfFiller provides easy access to editable online forms, making the process user-friendly and efficient.

Step-by-step guide to completing the application form

Completing the senior tax credit application form requires careful preparation and attention to detail. Here’s how to navigate this process effectively.

Editing and managing the application form

Once the senior tax credit application form is completed, managing it effectively can save time and reduce stress. PdfFiller offers robust editing tools that allow users to customize their applications to fit specific requirements.

Moreover, users can securely save and store their completed forms within the pdfFiller platform, ensuring easy access in the future. The version history feature is particularly useful, providing insights into changes made during the application process and allowing for easy reversion to earlier drafts if needed.

Signing the senior tax credit application form

Signing the senior tax credit application form is an essential step in verifying your identity and consent. PdfFiller makes this process seamless with options for electronic signatures, which are legally valid in most states for tax documents.

To add your signature, follow these steps: locate the signature field within the form on pdfFiller, choose the method for signing (typing, drawing, or uploading an image of your signature), and finalize the application with your confirmed signature.

Collaboration and support

Navigating the application process can feel overwhelming, but you’re not alone. Collaboration features on pdfFiller allow you to share your application with trusted family members or financial advisors for assistance on filling it out correctly and efficiently. This real-time collaboration can lead to better accuracy and successful submissions.

Moreover, pdfFiller offers customer support options, including live chat and email assistance, ensuring that users can resolve any concerns promptly while completing their forms.

Tracking the status of your application

After submission, it’s natural to want to know the status of your senior tax credit application. Generally, applicants can expect a confirmation from the tax office. It's wise to keep a record of your submission method and date.

Utilizing pdfFiller can help track your application through their platform. Additionally, contacting the local tax office directly can provide updates and clarify if any further information is needed.

Common FAQs about the senior tax credit application form

Throughout the application process, questions may arise. Common queries include eligibility verification, what constitutes acceptable proof of income, and timelines for receiving tax credits after submission. Understanding the typical requirements for documentation and the timeframe for processing can alleviate concerns for many applicants.

Resolving common issues during the application process can require persistence. It’s advisable to maintain direct communication with your local tax office for clarity on any potential issues or additional requirements.

Additional tips and best practices

When applying for senior tax credits, timing can be crucial. Applicants should stay informed about local deadlines that can affect their eligibility status positively or negatively. Generally, it’s recommended to submit your applications as early as possible in the tax season to avoid rushes and potential mistakes.

Additionally, remaining informed about changes to tax credit laws and regulations can aid seniors in maximizing their benefits. Subscribing to newsletters from local tax offices or online forums can provide valuable updates and tips.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my senior tax credit application in Gmail?

How do I execute senior tax credit application online?

How can I edit senior tax credit application on a smartphone?

What is senior tax credit application?

Who is required to file senior tax credit application?

How to fill out senior tax credit application?

What is the purpose of senior tax credit application?

What information must be reported on senior tax credit application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.