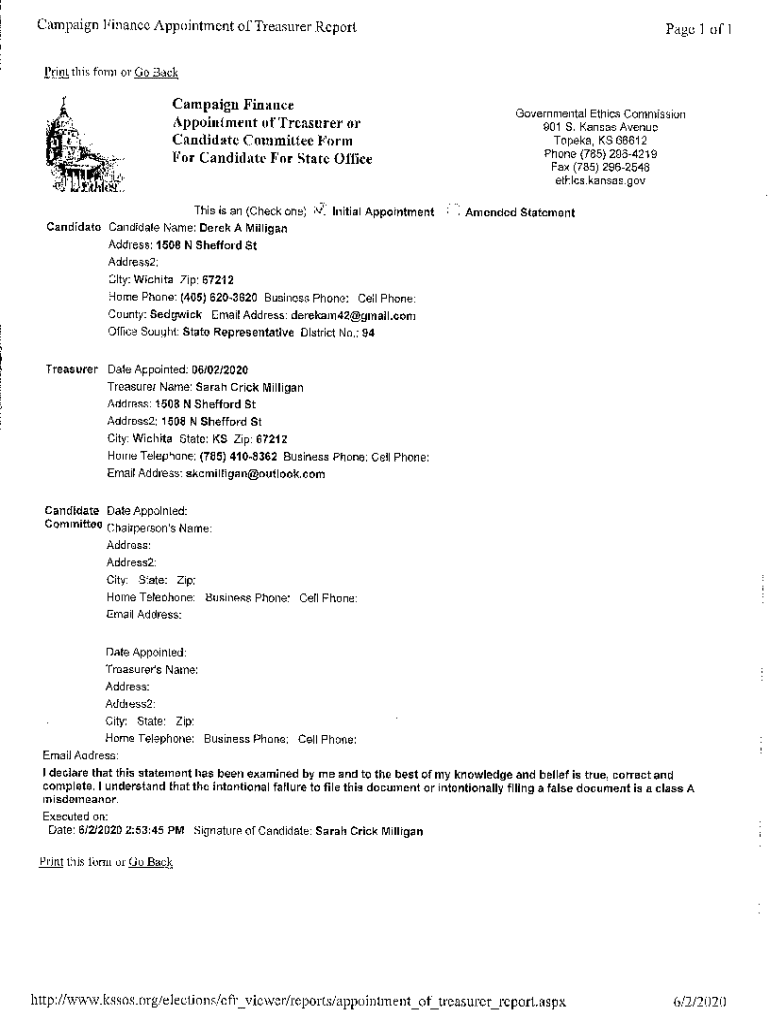

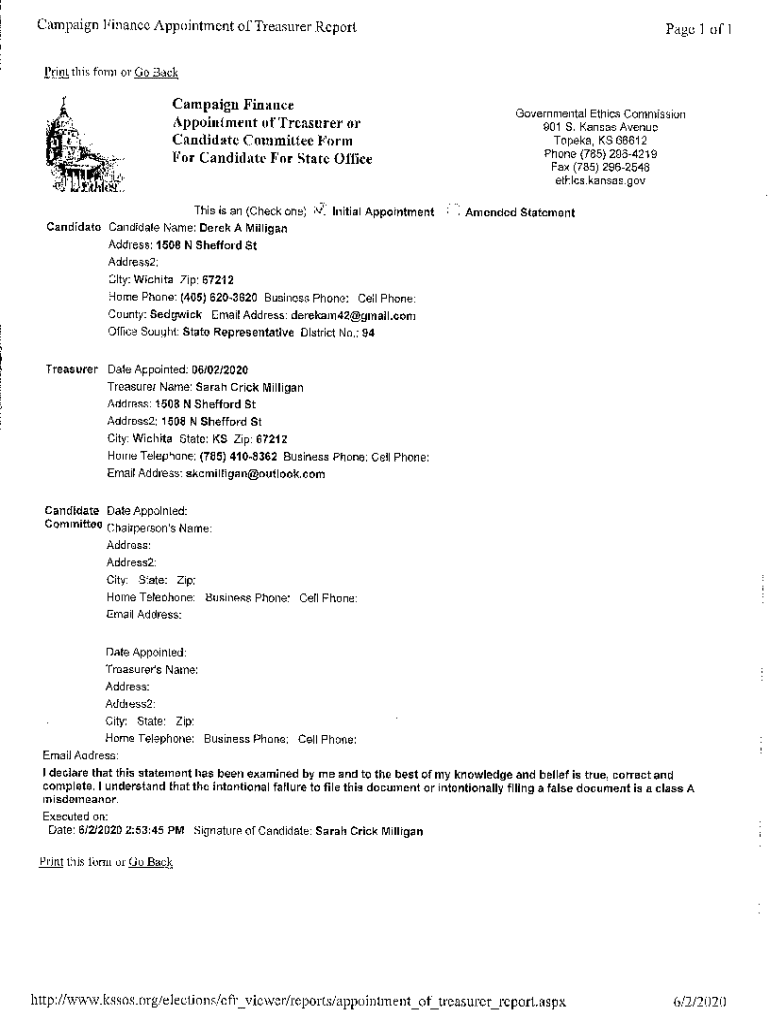

Get the free This is an (Check one) lvi Initial Appointment - ethics ks

Get, Create, Make and Sign this is an check

How to edit this is an check online

Uncompromising security for your PDF editing and eSignature needs

How to fill out this is an check

How to fill out this is an check

Who needs this is an check?

This is a Check Form: A Comprehensive Guide to Understanding, Using, and Managing Checks

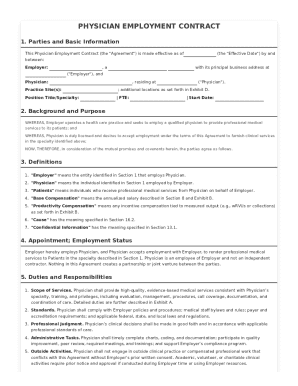

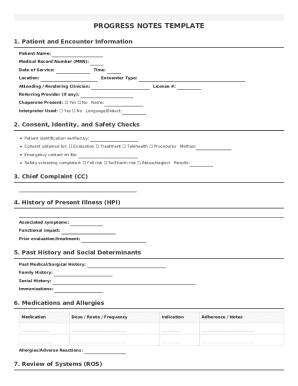

Understanding the check form

A check form is a written document that authorizes the transfer of a specific amount of money from the issuer's bank account to a recipient. This instrument serves as a tangible promise to pay, enabling transactions in various personal and business contexts. The importance of check forms lies in their ability to facilitate secure financial exchanges while offering a record of the transaction for both parties involved. Common scenarios for utilizing check forms include paying bills, sending money as a gift, or settling accounts in a business setting.

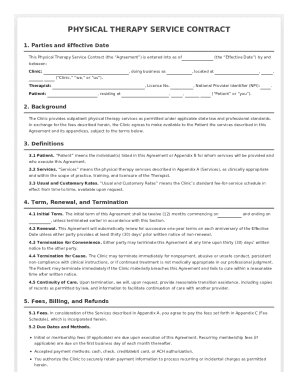

Types of check forms

There are various types of check forms, each catering to specific needs and functionalities. Personal check forms are commonly used by individuals for personal expenses, while business check forms are tailored for organizational transactions. Certified check forms serve as a guarantee of funds, commonly used in significant banking transactions, while money order check forms are popular for sending money without needing a traditional bank account. Understanding these types helps users determine which check form best suits their requirements.

Each type of check form has unique features that cater to its intended purpose. For instance, certified checks often include stamps from the bank verifying their authenticity, while business checks may have additional security features to prevent fraud.

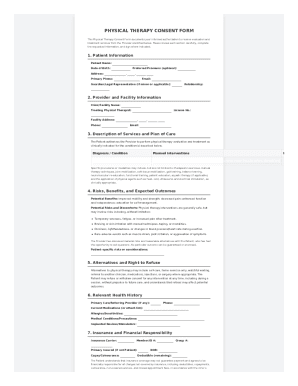

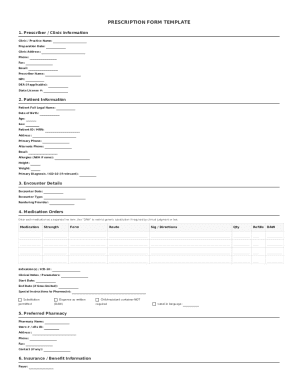

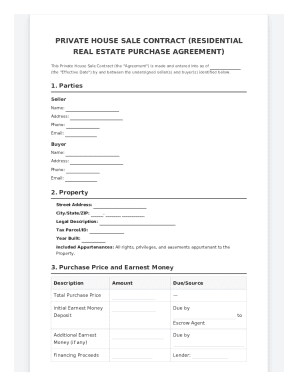

Key components of a check form

A comprehensive check form features several essential components that ensure its validity and functionality. These components include: Payee Information, which identifies who is receiving the funds; Amount (both numeric and written) to clearly indicate the sum being transferred; Date to establish when the transaction is occurring; Signatures that authorize the payment; and a Memo Line to add details about the purpose of the payment. Understanding these elements is crucial for anyone who uses a check form, as inaccuracies could lead to confusion or rejected transactions.

Additionally, understanding routing and account numbers is crucial. The routing number identifies the bank while the account number distinguishes the individual account of the issuer. Security features like watermarks and special inks are also vital for preventing fraud.

How to fill out a check form accurately

Filling out a check form requires attention to detail to ensure accuracy and prevent errors. Here’s a step-by-step guide:

Common mistakes to avoid include forgetting to date the check, misspelling the payee's name, or writing an incorrect amount. These errors can cause delays or complications in processing the check.

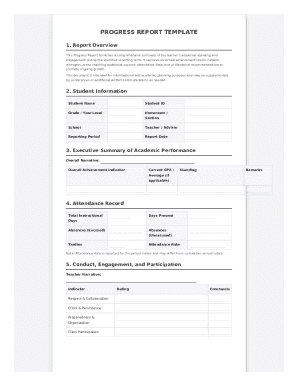

Editing and managing check forms

Managing check forms effectively involves editing and maintaining organized records. This is where tools such as pdfFiller can be highly beneficial. With pdfFiller, users can edit existing templates easily, making adjustments as necessary for future transactions. Additionally, signatures can be added digitally within the platform, facilitating a quicker and more efficient process.

Maintaining digital records of check forms is crucial for audit trails and tracking expenditures. Utilizing cloud-based storage within pdfFiller allows for easy access from anywhere, ensuring that all relevant documents are safely stored and easily retrievable.

Safety and security of check forms

Check forms, while incredibly useful, can pose certain risks, particularly regarding fraud. Best practices for protecting against these risks include verifying payee information, using secure storage solutions for checks, and monitoring bank statements for unauthorized transactions. It's advisable to also familiarize yourself with how to safeguard personal information and avoid sharing checks with unsecured parties.

Additional features of using pdfFiller for check forms

pdfFiller offers a wealth of features that enhance the management of check forms. One of the key advantages of this platform is its cloud-based access, which allows users to edit, sign, and manage check forms from anywhere, at any time. This flexibility is invaluable for individuals and teams that require on-the-go access to their documents.

The collaborative features of pdfFiller streamline workflows, allowing multiple users to interact with check forms at once, facilitating quicker approvals and transactions. This capability proves especially beneficial for teams that require real-time updates and communication.

Frequently asked questions (FAQs) about check forms

Here are some common questions regarding check forms that users often have:

User testimonials and case studies

Many users have found that using pdfFiller for managing their check forms has made financial processes smoother and more efficient. Case studies show that teams have significantly reduced the time spent on transactions thanks to the interactive and collaborative features. Testimonials highlight how easy it is to streamline check management, leading to fewer errors and faster payments.

Next steps in your check form management journey

As you explore check form management, consider diving deeper into the advanced features offered by pdfFiller. Integrating check forms into your broader financial management strategy can greatly enhance efficiency and accuracy. Taking full advantage of the tools available can facilitate a more organized and secure handling of financial transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit this is an check from Google Drive?

Can I create an eSignature for the this is an check in Gmail?

How do I complete this is an check on an Android device?

What is this is an check?

Who is required to file this is an check?

How to fill out this is an check?

What is the purpose of this is an check?

What information must be reported on this is an check?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.