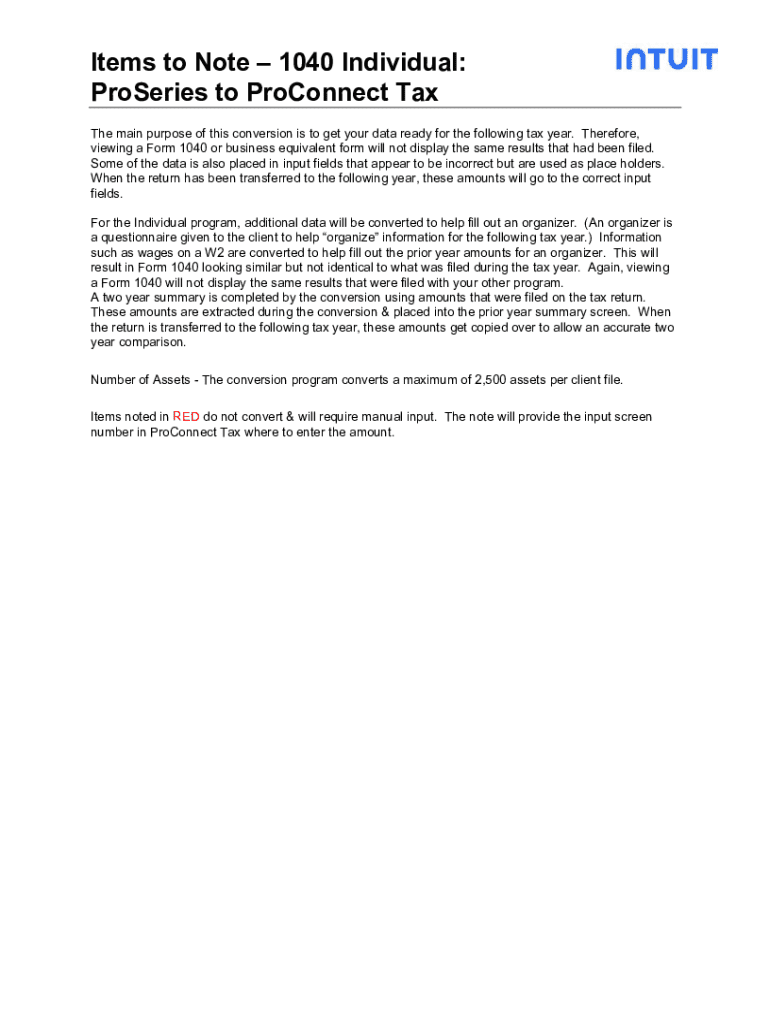

Get the free Items to Note 1040 Individual: ProSeries to ProConnect Tax

Get, Create, Make and Sign items to note 1040

Editing items to note 1040 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out items to note 1040

How to fill out items to note 1040

Who needs items to note 1040?

Items to Note 1040 Form: A Comprehensive Guide

Understanding the 1040 Form

The 1040 Form is a crucial component of the U.S. tax system, designed for reporting individual income tax obligations. Unlike simpler forms such as 1040A and 1040EZ, which cater to those with uncomplicated tax situations, the standard 1040 accommodates a broader range of income sources and deductions.

While 1040EZ has been phased out, understanding the differences between these forms is vital. The 1040 allows for various income types, including self-employment income, and can be used by investors and those claiming specific tax credits.

Who needs to file the 1040?

Filing the 1040 form is necessary based on certain criteria, which vary across different life scenarios. U.S. citizens and residents who earn above a certain threshold must submit their tax return, reflecting their financial situation in the previous year.

For individuals, the income requirements differ based on age and filing status. Families with dependents may also file the 1040 to claim eligible deductions and credits. Self-employed individuals absolutely need to use the 1040 to report their earnings and pay self-employment taxes.

Essential items to note before filling out the 1040 form

Before you start filling out the 1040 form, gather all necessary documentation. Proper preparation ensures accurate and thorough reporting, thus minimizing errors that could delay processing or increase your tax liability.

Understanding filing status options

Your filing status can significantly impact your tax rate and potential deductions. Understanding the distinctions between these statuses is crucial for optimizing your tax position. The IRS classifies individuals based on their marital status and family situation.

Key sections of the 1040 form breakdown

The 1040 is divided into several pertinent sections, each requiring careful attention. Providing accurate personal information is non-negotiable; mistakes might lead to processing delays. Every detail, from your name to Social Security number, must be error-free.

Next, accurately report all income earned throughout the year including wages, interest, dividends, and capital gains. Deductions are equally significant and may determine overall tax liability. Familiarize yourself with common adjustments like retirement contributions, which can lower taxable income.

Important considerations and common errors

Accuracy is paramount when filing your 1040 form. Many common errors can result in unwanted delays or adjustments. Double-check your math and ensure that all income sources are reported correctly. Missing signatures can lead to returns being rejected, compounding your stress during tax season.

Consider your filing options carefully. Whether opting for online filing or paper submissions can affect your experience. Services like pdfFiller enhance efficiency and security when filing online.

Utilizing interactive tools for a seamless experience

pdfFiller adds a modern solution to your tax season needs, allowing for easy editing and management of the 1040 form. Users can seamlessly upload documents, edit them according to their requirements, and even digitally sign forms without hassle.

Additionally, collaboration features on pdfFiller allow users to work alongside accountants or team members seamlessly. Securely sharing documents for review ensures accuracy and minimizes errors.

Reviewing and submitting your 1040 form

Before hitting submit, a thorough review of your 1040 form is advisable. Key areas to revisit include personal information, income reported, and the correctness of deductions claimed. It's crucial to save copies of your submission and confirm the filing method.

After submission, tracking your return can give you peace of mind. The IRS typically provides an estimated timeline for processing, and users can track their refund status online for hassle-free updates.

Quick tips for future tax preparations

Preparing for tax season year-round can alleviate the stress of last-minute filings. Be diligent about maintaining organized records throughout the year to ensure that you can easily access required documentation when needed.

Stay updated on changes in tax laws and provisions by following reliable IRS communications and utilizing trusted resources. Understanding how tax laws can shift year over year can save you time and financial burden in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit items to note 1040 in Chrome?

Can I edit items to note 1040 on an iOS device?

How do I edit items to note 1040 on an Android device?

What is items to note 1040?

Who is required to file items to note 1040?

How to fill out items to note 1040?

What is the purpose of items to note 1040?

What information must be reported on items to note 1040?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.