Get the free TC-805 Collection Information for Individuals. Forms & Publications

Get, Create, Make and Sign tc-805 collection information for

How to edit tc-805 collection information for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tc-805 collection information for

How to fill out tc-805 collection information for

Who needs tc-805 collection information for?

TC-805 collection information for form: A comprehensive guide

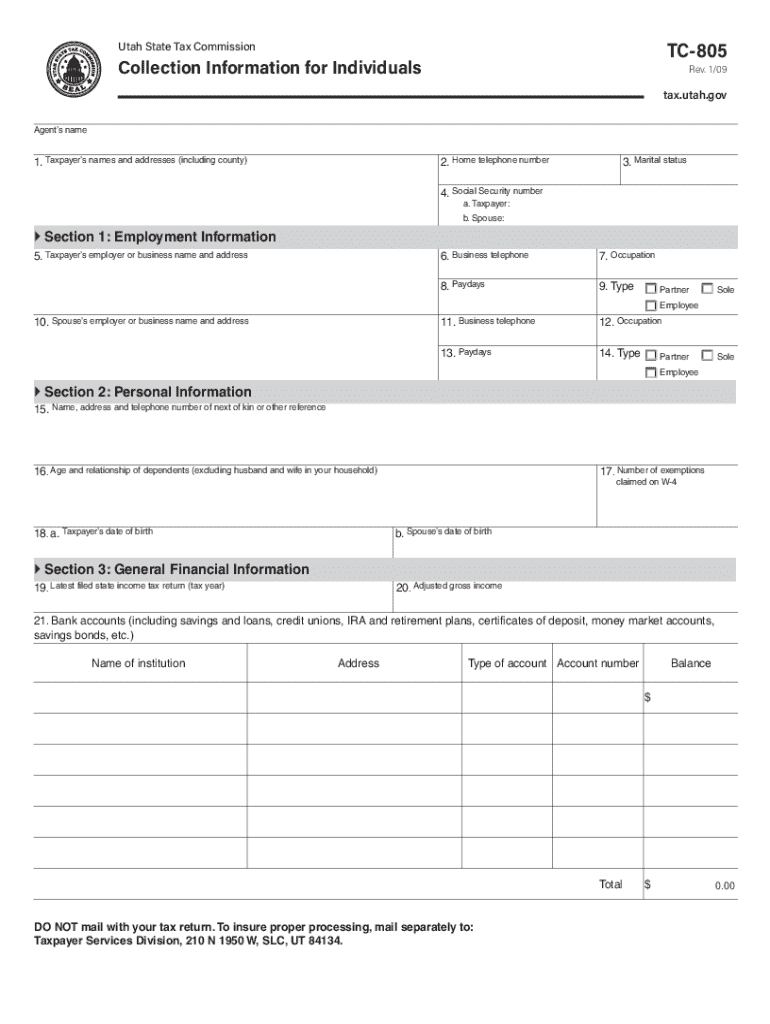

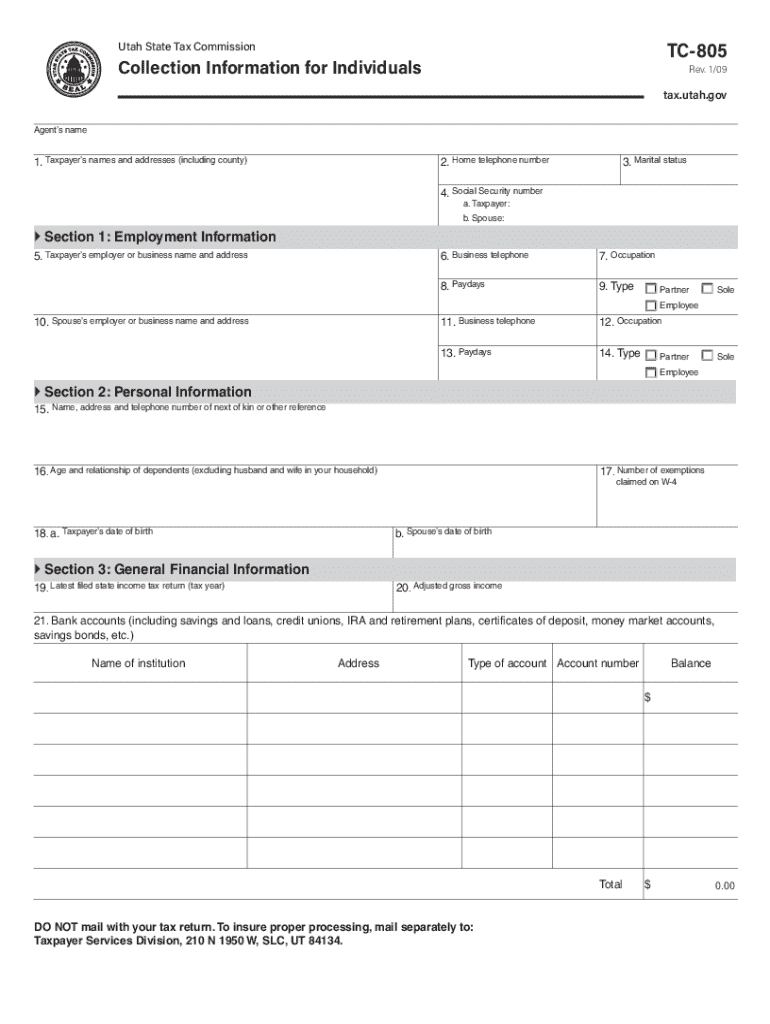

Understanding the TC-805 form

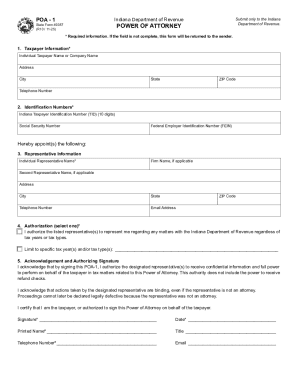

The TC-805 form plays a crucial role in collecting essential information from taxpayers and is primarily used in the context of financial assessments, audits, and other tax-related evaluations. This form serves as a vehicle through which taxpayers provide detailed information about their finances, including details about their dependents, income sources, assets, and liabilities. It gains importance as it ensures that authorities have accurate information to work with, especially during audits or inquiries related to tax compliance.

Understanding the TC-805 form's purpose is vital not only for compliance but also for taxpayers to avoid potential penalties. The goals of this form align with the requirement to maintain transparency and accountability in financial reporting. By accurately filling out this form, individuals can swiftly respond to requests from tax authorities, thereby mitigating stress and potential repercussions associated with tax discrepancies.

Who needs to use the TC-805 form?

Typically, the TC-805 form is aimed at individual taxpayers, business owners, and financial institutions involved in transactions that require transparency about financial activities. It is particularly relevant for those undergoing an audit or those selected for a more in-depth review of their financial situation. Moreover, taxpayers often need to report information concerning their bank accounts, loans, insurance policies, real estate holdings, and living expenses, making it a critical document for comprehensive financial disclosure.

Key features of the TC-805 form

Accessing the TC-805 form

Accessing the TC-805 form has been streamlined with multiple avenues available for users. It can be conveniently downloaded directly from the official pdfFiller platform, offering easy online access from any device. Users will find printable versions readily available for those who prefer traditional paperwork. These printed forms can often be sourced from local tax offices or financial institutions as well.

For those who seek enhanced functionality, pdfFiller offers a host of interactive tools that aid in filling out forms electronically. Users can leverage cloud storage to save their completed TC-805 forms securely, ensuring they are accessible from any location and easily retrievable whenever necessary. This feature is especially beneficial for individuals managing multiple versions or requiring collaboration with team members.

Filling out the TC-805 form

Completing the TC-805 form effectively hinges on a meticulous approach. Here’s a step-by-step breakdown that will help guide you through the process.

Common mistakes to avoid include skipping sections or failing to provide complete details. Before submission, always double-check the information inputted. A missed signature or incorrect number can delay processing and lead to further inquiries from tax authorities.

Editing the TC-805 form

Editing the TC-805 form is simple with pdfFiller’s intuitive PDF editing tools. Users can make necessary changes, adding or removing information with ease. Begin by uploading your completed TC-805 form onto the platform, where you can directly manipulate the text fields as needed.

Moreover, pdfFiller provides functionality to insert comments and annotations, which is ideal if you are collaborating with team members or advisors. Using comments to highlight specific sections could enhance clarity, making it easier for co-reviewers to understand essential details related to the collection information.

Signing the TC-805 form

The legal validity of eSignatures has significantly impacted how forms like the TC-805 are processed. With pdfFiller, users can sign the TC-805 form effortlessly by navigating to the eSignature feature. The process ensures that your signature is secure and compliant with regulatory requirements.

Tracking signatures is also a seamless process through pdfFiller. The platform allows users to monitor who has signed the form and when, enhancing accountability and reducing the likelihood of overlooked documents.

Submitting the TC-805 form

Once the TC-805 form is completed and signed, the next crucial step is submission. Users have multiple options at their disposal—it can be submitted online through designated platforms, handed in physically at relevant offices, or mailed using certified postal services to ensure tracking.

It's essential to be aware of important deadlines regarding the TC-805 submission. Timely submission prevents penalties and ensures compliance with financial regulations. After submitting the form, users should confirm that their TC-805 forms were successfully received, which often can be verified through electronic acknowledgment or follow-up communication.

Managing TC-805 documents

Effective management of TC-805 documents is vital for anyone engaged in tax-related activities. pdfFiller’s organizational tools allow users to categorize, archive, and easily retrieve their forms whenever necessary. Storing forms in distinct folders based on years or financial activities can significantly reduce the time spent searching for specific documents.

Cloud management solutions further facilitate document retrieval, providing access from anywhere without the hassle of physical storage. The collaboration features available on pdfFiller enable team members to work together more efficiently, making it easier to share information, review submissions, and discuss any changes needed on TC-805 documents.

FAQs about TC-805 form

As individuals prepare to navigate the TC-805 form, they often have specific questions. Common inquiries revolve around how to accurately fill out sections related to personal and financial information, as well as what happens if the information submitted is incorrect. Understanding the purpose of the TC-805 is paramount, as it directly relates to one’s obligations towards tax compliance.

Additional questions often arise regarding the submission process, specifically the implications of late submissions or incomplete information. Key clarifications about this form can aid in ensuring all necessary aspects are covered, reducing the uncertainties that often accompany tax-related endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tc-805 collection information for directly from Gmail?

How do I make changes in tc-805 collection information for?

Can I create an electronic signature for signing my tc-805 collection information for in Gmail?

What is tc-805 collection information for?

Who is required to file tc-805 collection information for?

How to fill out tc-805 collection information for?

What is the purpose of tc-805 collection information for?

What information must be reported on tc-805 collection information for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.