Get the free Items to Note1040 Individual: ATX to ProConnect Tax

Get, Create, Make and Sign items to note1040 individual

Editing items to note1040 individual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out items to note1040 individual

How to fill out items to note1040 individual

Who needs items to note1040 individual?

Items to note for 1040 Individual Form

Understanding the 1040 individual form

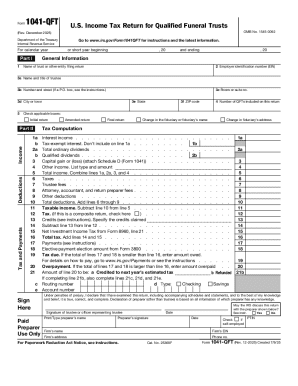

The 1040 form serves as the primary income tax return form used by individual taxpayers in the United States. It is crucial for reporting income, calculating taxes owed, and determining eligibility for various tax benefits. There are variations of the 1040 form: the standard 1040, the 1040-SR specifically designed for seniors, and the 1040-NR for non-resident aliens. Understanding which version of the form to use is essential to ensure compliance and optimize tax benefits.

Essentially, every individual with a specific level of income needs to file a 1040 form to report earnings and pay taxes. The IRS stipulates income thresholds that determine whether a taxpayer must file. Generally, if your income exceeds $12,550 for single filers or $25,100 for married couples filing jointly, you're required to submit a 1040 form by the tax deadline.

Key items to gather before filing

Before filling out the 1040 form, gathering all necessary documentation is crucial for a smooth filing process. Key personal information includes Social Security numbers for the taxpayer, their spouse, and any dependents. This information is vital to verify identities and claim tax benefits associated with dependents, such as the Child Tax Credit.

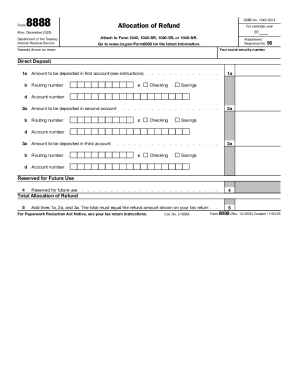

Additionally, bank account information should be collected to set up direct deposit for any potential refunds. Beyond personal details, it's essential to assemble documentation concerning wages and income, such as W-2 forms for each job held and 1099 forms detailing freelance or contract work. Collectively, these items form the backbone of your income reporting.

Common deductions and credits to consider

When preparing to file your 1040 form, it's essential to understand the difference between taking the standard deduction and itemizing deductions. The current standard deduction amounts are $12,550 for single taxpayers and $25,100 for married couples filing jointly. The simplicity of the standard deduction makes it a popular choice, but you should evaluate your personal financial situation to see if itemizing could yield greater tax savings.

Common scenarios where itemizing may offer benefits include significant medical expenses, substantial mortgage interest payments, or considerable charitable contributions. Additionally, taxpayers should familiarize themselves with available tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit, both of which can substantially reduce tax liability. Eligibility for these credits varies, often depending on income levels and family size.

Essential documentation to prepare

Proper documentation is fundamental to a successful tax filing. Income-related documents are the primary focus; be sure to gather all W-2 and 1099 forms. If you're self-employed, it's also wise to prepare profit and loss statements that detail your earnings and expenses, helping to paint a complete picture of your financial situation.

In addition to income documentation, you should compile all necessary support documents for deductions. This includes receipts for medical expenses, property taxes paid, and mortgage interest. Charitable donations need to be documented with proper receipts to ensure you can claim deductions. Organizing these documents well in advance can save immense time and stress during the filing process.

Navigating special situations

Certain situations affect how you fill out your 1040 form, particularly filing as Head of Household. To qualify for this filing status, you must be unmarried and pay more than half the household expenses for a qualifying dependent. This status grants a higher standard deduction and more favorable tax brackets, making it advantageous if eligible.

For individuals earning income abroad, additional considerations are vital. Reporting requirements differ for foreign earned income, which may qualify for the Foreign Earned Income Exclusion (FEIE). It's important to track and report such income correctly to avoid double taxation, and understanding the nuances of this exclusion can significantly reduce tax liability for expatriates.

Step-by-step guide to filling out the 1040 form

Filling out the 1040 form involves a systematic approach; a line-by-line review can help prevent errors. Start by entering your personal information in the designated sections. This includes your name, address, and Social Security number. Proceed to report your income, which encompasses wages, dividends, and any other earnings from various 1099 forms. Make sure to add any additional income if applicable.

Next, calculate your adjusted gross income and deductions. Opt for the standard deduction or itemize based on your documentation. After determining your taxable income, compute your tax liability using the IRS tax tables. Do not forget to include any tax credits you qualify for, as these will directly reduce your final tax bill. Ensuring accuracy at every stage is essential for a smooth tax return and to avoid issues with the IRS.

Filing options and deadlines

When it comes to filing your 1040 form, you have two primary options: electronic filing (e-filing) and paper filing. E-filing is increasingly popular due to its convenience and faster processing times. By using pdfFiller, individuals can easily fill out and submit their tax forms electronically, streamlining the whole tax preparation process. Additionally, e-filing minimizes the chances of errors that can occur with paper submissions.

It's essential to be aware of key deadlines for filing your tax returns, which typically fall on April 15 each year. If you're unable to meet this deadline, consider filing for an extension. However, remember that an extension to file does not grant an extension for payment, so ensure that any owed taxes are paid by the original deadline to avoid penalties.

Post-filing considerations

After submitting your 1040 form, staying informed about the status of your refund is crucial. You can use tools such as the IRS 'Where’s My Refund?' tool to track your refund's progress after e-filing. Typically, refunds are issued within a few weeks when filed electronically, while paper returns might take longer.

Additionally, being prepared for potential audits is necessary. The IRS may select some returns for audits based on various factors. If you receive a notice for an audit, remain calm and responsive. Keep detailed, organized records of your tax documents, as having this information readily available can ease the audit process. Maintaining organized records year-round will minimize stress and foster efficient responses to any inquiries.

Utilizing pdfFiller for 1040 filing

pdfFiller revolutionizes the tax filing process by providing unrivaled accessibility and ease of use. The platform allows individuals to edit PDFs, eSign documents, and collaborate on shared files from anywhere with an internet connection. This flexibility is particularly beneficial during the busy tax season, where timeliness is vital.

Moreover, pdfFiller offers an array of tools tailored to enhance document management. Its cloud-based infrastructure ensures that documents are securely stored and accessible anytime. Tutorials and support are available to facilitate the use of its features, making the eFiling process as efficient as possible. Embracing pdfFiller could significantly enhance your tax preparation and submission experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my items to note1040 individual in Gmail?

How do I edit items to note1040 individual in Chrome?

How do I fill out the items to note1040 individual form on my smartphone?

What is items to note1040 individual?

Who is required to file items to note1040 individual?

How to fill out items to note1040 individual?

What is the purpose of items to note1040 individual?

What information must be reported on items to note1040 individual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.