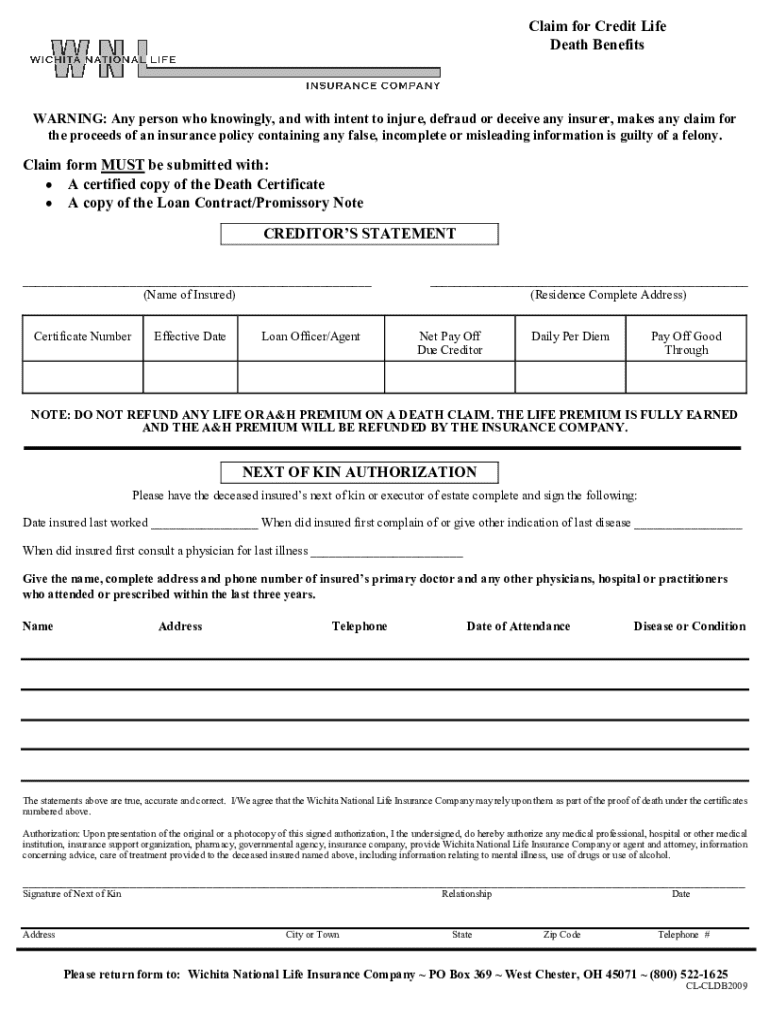

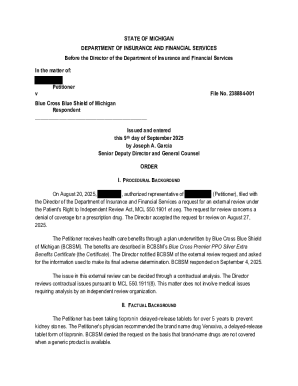

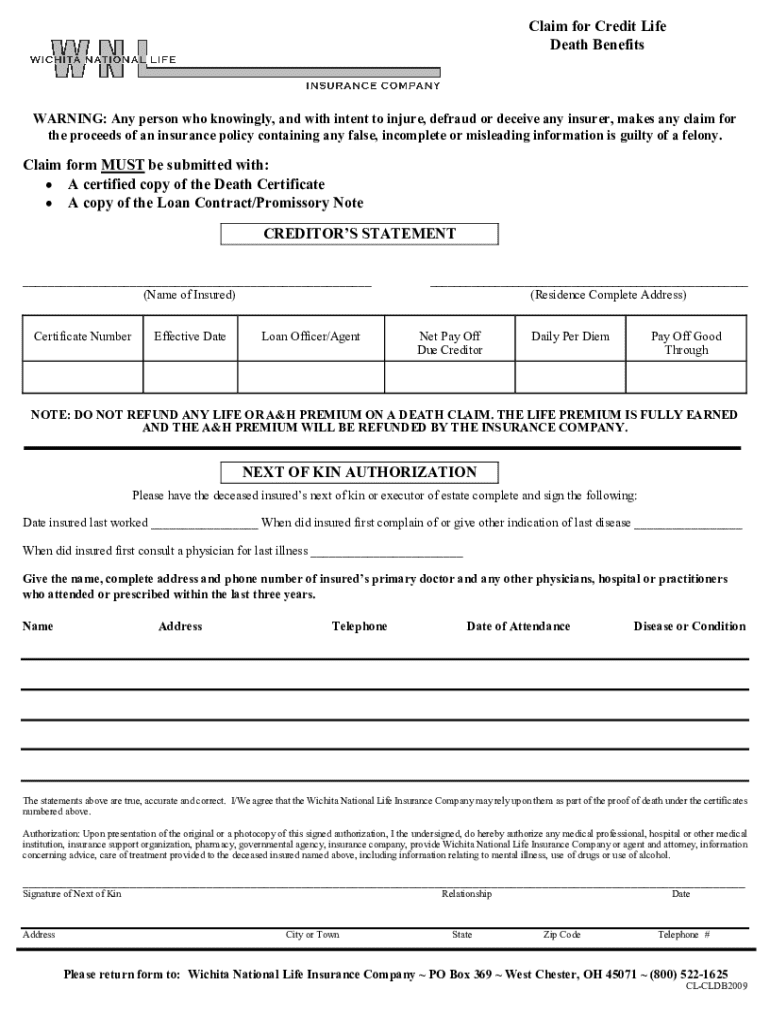

Get the free Claim form MUST be submitted with:A certified copy of the Death ...

Get, Create, Make and Sign claim form must be

How to edit claim form must be online

Uncompromising security for your PDF editing and eSignature needs

How to fill out claim form must be

How to fill out claim form must be

Who needs claim form must be?

Claim form must be form: Your comprehensive guide to effective claims submission

Understanding the claim form

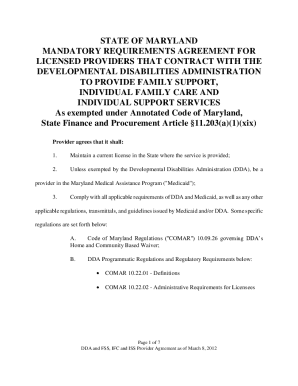

Claim forms are essential documents utilized across various industries, designed to formally request a specific benefit or reimbursement. Their primary purpose is to collect all necessary information that justifies a request for payment or service from an organization. Whether you are filing an insurance claim, medical claim, or travel reimbursement, understanding the claim form is crucial for successful submission.

Accurate claim submission is paramount; incomplete or incorrect claims can lead to delays or denials. This not only affects your finances but can also cause frustration during an already stressful period. For instance, insurance claims require thorough documentation to validate the incident and substantiate the claim being filed.

Essential elements of a claim form

To ensure a claim form is filled out correctly, it's vital to know the essential elements that need to be included. Firstly, personal information will typically require your full name, contact information, and policy or account number associated with the claim. This information establishes your identity and connection to the account or policy in question.

Next is a clear description of the claim, which should detail the incident, including dates and circumstances, and specify the amount being claimed. Supporting documentation must also be included; this might involve invoices and receipts for monetary claims, medical records for health-related claims, or witness statements to strengthen the case.

Step-by-step guide to filling out a claim form

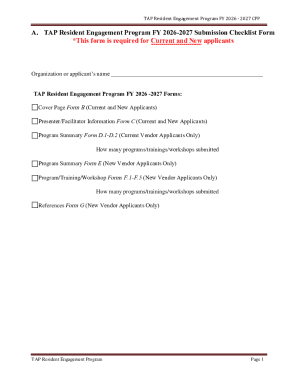

Filling out a claim form correctly involves several steps. First, gather all necessary information related to your claim. This preparation step ensures you have the relevant details on hand, eliminating potential delays caused by missing information.

Next, move on to filling in your personal information. Accuracy is key here; double-check the entries for typos or errors as these could hamper your claim's processing.

After that, you need to provide a detailed description of the incident. Be factual and concise while articulating the event leading to your claim. It’s important to clearly communicate your situation to give the reviewing entity all the essential context.

Once completed, gather all supported documents and ensure they are attached according to the submission guidelines. Lastly, don’t forget to review your claim form. A final checklist that includes verifying all entries, documents, and details can save you from future hurdles.

Common mistakes to avoid

Submitting a claim form can be straightforward, but there are several common pitfalls that claimants should be aware of. One frequent mistake is failing to provide complete information; incomplete forms can lead to delays or outright denials.

Another error includes delaying submission. Many organizations have specific timelines for filing claims, and missing these deadlines can result in forfeiting your right to make a claim. Always check the submission guidelines for deadlines.

Additionally, not including supporting documentation is a major misstep. Be sure to attach all required evidence to back your claim. Lastly, miscalculating the claim amount can lead to issues as well, so it's advisable to review the calculations before sending the form off.

Interactive tools for claim form management

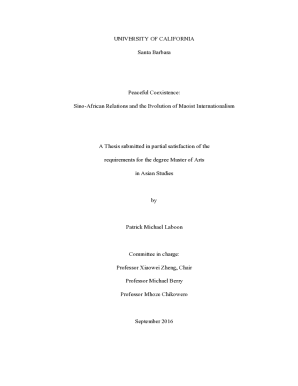

In an increasingly digitized world, tools like pdfFiller provide unique interactive features that streamline the claim form process. Utilizing pdfFiller’s cloud-based document tools allows you to edit claim forms efficiently. Users can easily access templates, fill them out, and save changes directly from any internet-enabled device.

One significant advantage of using pdfFiller is the ability to electronically sign claim forms. This not only saves time but also offers a secure and legally recognized method of signing documents. The collaboration features are especially beneficial for teams working together on submissions; members can share claim forms and collaborate in real-time, which simplifies the review and editing processes.

Tips for submitting claims

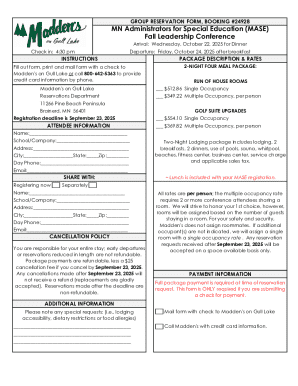

When preparing to submit your claim, consider the optimal method for submission. Digital submissions are often preferred for their speed and accessibility, while paper submissions may still be required by some organizations. Always confirm the preferred submission method to avoid complications.

Tracking your claim status is also an important practice. Many organizations provide tracking systems, and following up on your submission shows your commitment to ensuring its processing. Be aware of the expected response times which can vary widely between organizations; staying informed will help you manage your expectations.

Special considerations for claims

When dealing with claims, understanding the legalities involved is crucial. Different regions and industries may have specific laws governing how claims are processed. It's also essential to be mindful of privacy concerns when sharing personal information on claim forms; ensure any data you provide is properly secured.

If your claim is denied, don't be discouraged. Many organizations offer appeal processes. Prepare to gather all relevant documentation again if you decide to challenge the decision; this includes any evidence that might support your position. Knowing the procedures and requirements for appealing can significantly help increase your chances of a favorable outcome.

pdfFiller’s unique value proposition for claim forms

pdfFiller stands out in the document management space by offering seamless integration of editing and management tools tailored for claim forms. Security features ensure that sensitive information remains protected, which is increasingly important in today’s data-driven environment. The user-centric design of pdfFiller guarantees easy access and modification, so users can efficiently navigate the system.

Moreover, pdfFiller’s robust support system ensures that users have access to resources and FAQs that guide them through the process of filling out, editing, signing, and managing claim forms. Utilizing pdfFiller can significantly enhance your experience, making the journey from submission to approval much smoother.

Conclusion and next steps

Successfully navigating the claim form process requires an understanding of its importance, familiarity with its components, and awareness of common mistakes. By following this guide, you can increase your chances of a successful submission, mitigating potential hurdles along the way.

Take a proactive approach with document management tools like pdfFiller which enable you to efficiently handle your claim forms. By leveraging its capabilities, you empower yourself to gain control over the submission process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit claim form must be from Google Drive?

How do I fill out the claim form must be form on my smartphone?

How do I edit claim form must be on an iOS device?

What is claim form must be?

Who is required to file claim form must be?

How to fill out claim form must be?

What is the purpose of claim form must be?

What information must be reported on claim form must be?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.