Get the free Alcoholic Beverages Tax Forms and Instructions

Get, Create, Make and Sign alcoholic beverages tax forms

Editing alcoholic beverages tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out alcoholic beverages tax forms

How to fill out alcoholic beverages tax forms

Who needs alcoholic beverages tax forms?

Alcoholic Beverages Tax Forms: A Comprehensive How-to Guide

Overview of alcoholic beverages tax forms

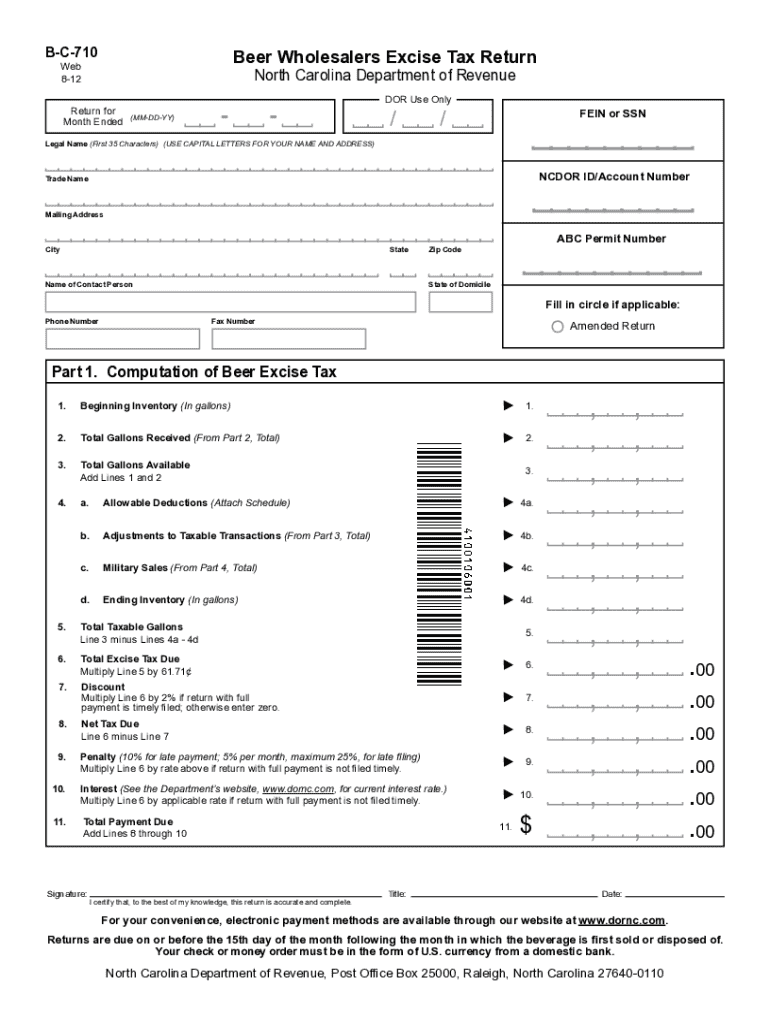

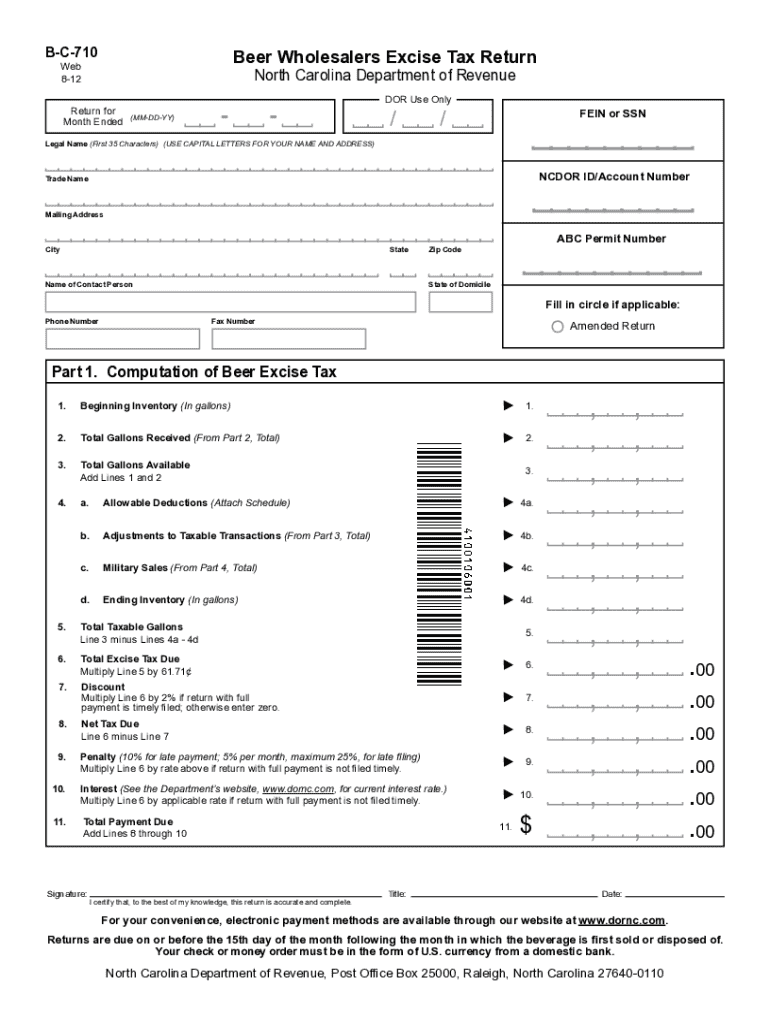

Alcoholic beverages tax forms are essential documents required for the taxation of all alcoholic products sold within the United States. This encompasses a variety of beverages, including beer, wine, and spirits, each with its own unique taxation rules. Understanding the purpose of these forms is vital for any business or individual involved in the sale or distribution of alcoholic beverages.

The primary purpose of alcoholic beverages tax forms is to ensure proper taxation and compliance with both federal and state regulations. These forms help the government manage and regulate the alcohol industry, ensuring that all producers and sellers pay their fair share. The importance of accurate filing cannot be overstated, as it can prevent penalties, legal issues, and fines associated with mismanagement or misunderstanding of regulatory requirements.

Types of alcoholic beverages tax forms

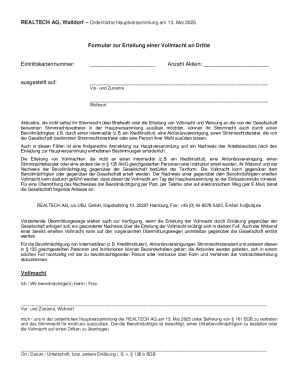

There are several types of alcoholic beverages tax forms, which vary based on federal and state levels. At the federal level, the Alcohol and Tobacco Tax and Trade Bureau (TTB) oversees the collection of taxes on alcoholic beverages. One of the most significant forms is the Form 5000.24, specifically designed for reporting and paying federal excise taxes on alcohol. Each category of alcohol—beer, wine, and spirits—has its specific requirements, which must be adhered to.

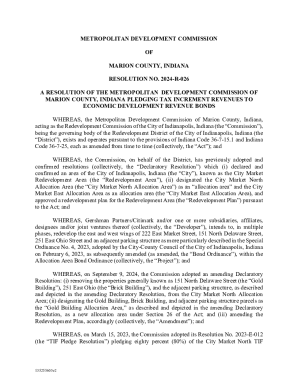

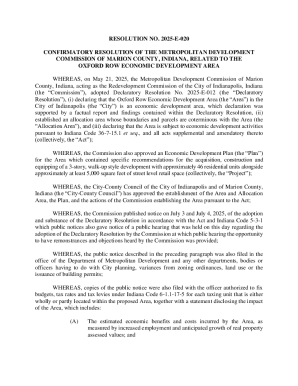

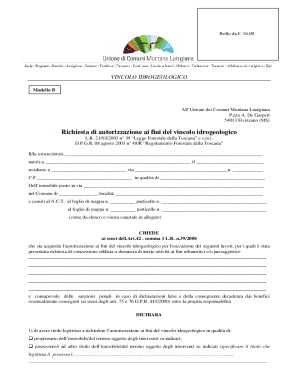

On the state level, tax forms can differ considerably. For example, California has its own alcohol tax forms, while New York utilizes a distinct set of regulations and forms. A few key states might include:

It's crucial to access the correct forms as each state may have nuances that must be addressed before submitting. Many states provide downloadable forms on their Department of Taxation websites.

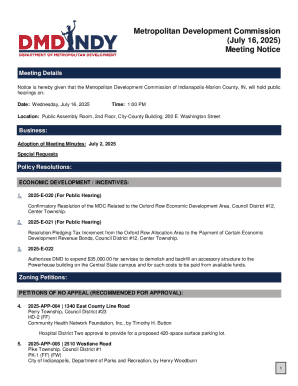

Step-by-step instructions for filling out tax forms

Gaining access to the necessary forms can be done effortlessly through platforms such as pdfFiller. Users can locate and download forms by searching for the specific alcoholic beverages tax forms needed, either through the site’s search feature or by navigating to the IRS or state tax authority section. This straightforward approach ensures you have the latest version of the forms necessary for compliance.

Once the correct form is obtained, filling it out requires careful attention to detail. Sections usually include information about the producer, the type and quantity of alcoholic beverages, and the corresponding federal and state taxes owed. Common pitfalls to avoid include errors in numerical entries and neglecting to include all necessary documentation that validates the amounts being claimed.

After completing the form, utilizing pdfFiller's eSignature feature can streamline the submission process. Users can easily eSign documents and submit either online or via mail, depending on what is mandated by the form’s instructions. Be sure to check for deadlines to prevent any issues related to late submissions.

Interactive tools for managing tax forms

pdfFiller offers innovative PDF editing features that facilitate efficient management of tax forms. Users can edit existing forms, add annotations, and even import previous submissions to maintain consistency and accuracy. This feature is especially valuable for businesses handling substantial volumes of tax filings, as it can minimize the time spent re-entering information.

Collaboration tools are another highlight of pdfFiller, enabling teams to work together on tax forms from anywhere. Sharing options allow multiple users to access the same document while managing version history to track changes. This means that even large teams can coordinate efficiently, regardless of their location.

FAQs related to alcoholic beverages tax forms

Common questions often arise concerning filing alcoholic beverages tax forms. One of the most pressing inquiries is, 'What happens if I miss a filing deadline?' Typically, individuals or businesses may face fines or increased scrutiny from regulatory bodies, emphasizing the importance of timely submissions.

Another frequent issue pertains to amending submitted forms. The process requires careful attention to detail and adherence to specific guidelines provided by both federal and state tax authorities. Often, filing an amendment is straightforward but must be completed correctly to prevent further complications.

Users may also have questions about tax payments. Understanding the payment options available for taxes owed is crucial, as many authorities provide multiple methods of settling obligations.

Additional support and resources

Accessing state and federal resources can offer further guidance on completing alcoholic beverages tax forms. For federal assistance, the TTB provides a wealth of resources on its website, which includes contact information for tax professionals and helplines for individuals with specific inquiries or challenges.

For non-English speakers, many tax authorities offer language assistance options. Multilingual resources can greatly aid in ensuring that all taxpayers understand their obligations and can effectively submit the necessary forms.

Connect with pdfFiller

Using pdfFiller for your alcoholic beverages tax forms offers numerous benefits. The platform streamlines the processes of document management, enabling users to navigate their paperwork with ease. Enhanced security features ensure data protection, particularly for sensitive tax information, giving users peace of mind.

Feedback from users highlights the efficiency of pdfFiller in managing complex tax forms. Testimonials speak to ease of use and the value gained from utilizing the service, demonstrating real success stories where users effectively managed their tax obligations without hassle.

About pdfFiller

pdfFiller stands out as a comprehensive document management solution, guiding users through various legal and tax-related processes. The company is committed to empowering individuals and teams, transforming how they handle paperwork through innovative features.

Their mission focuses on providing a seamless, user-friendly experience that encourages efficient document handling. As the landscape of tax forms continues to evolve, pdfFiller remains dedicated to keeping users equipped with the tools necessary for success in their filing endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the alcoholic beverages tax forms in Chrome?

How do I fill out alcoholic beverages tax forms using my mobile device?

How do I fill out alcoholic beverages tax forms on an Android device?

What is alcoholic beverages tax forms?

Who is required to file alcoholic beverages tax forms?

How to fill out alcoholic beverages tax forms?

What is the purpose of alcoholic beverages tax forms?

What information must be reported on alcoholic beverages tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.