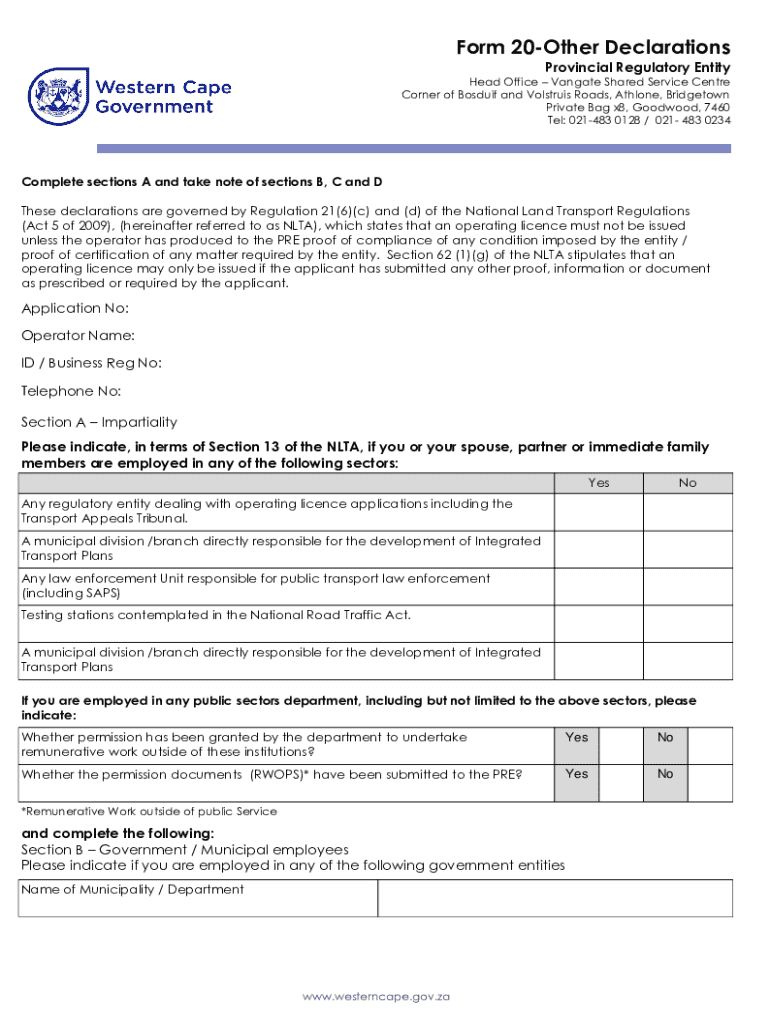

Get the free Form 20-Other Declarations

Get, Create, Make and Sign form 20-oformr declarations

How to edit form 20-oformr declarations online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 20-oformr declarations

How to fill out form 20-oformr declarations

Who needs form 20-oformr declarations?

Form 20-OFORMR Declarations Form: A Comprehensive Guide

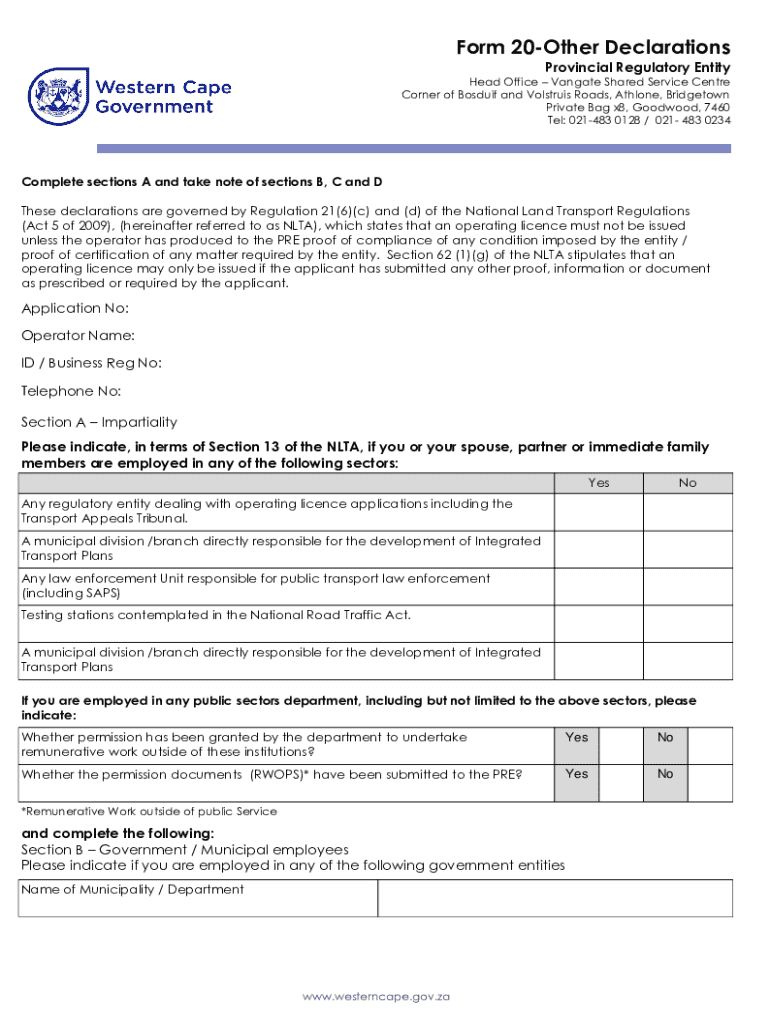

Understanding the Form 20-OFORMR

The Form 20-OFORMR is a critical document often required in various official capacities to declare specific information. This form serves as a formal declaration where individuals or entities affirm certain facts for regulatory or compliance purposes. Its importance cannot be overstated, as these declarations often facilitate processes in business dealings, governmental compliance, and legal matters.

Common uses of the Form 20-OFORMR include financial declarations, compliance submissions for regulatory bodies, and situations where confirmation of identity or operational status is needed. The completion of this form is essential for maintaining transparency and accountability in financial disclosures and ensures adherence to mandated regulations.

Who needs to use the Form 20-OFORMR?

The Form 20-OFORMR is primarily intended for individuals, business owners, and organizations that need to make specific declarations for legal or regulatory requirements. This includes entrepreneurs submitting documentation for business licensure, individuals seeking loans or grants, and companies undergoing audits or compliance checks.

Situations that necessitate the use of this form encompass tax filings, regulatory compliance checks, and instances where an authority requests a declaration of actual financial status. Ensuring the appropriate use of the Form 20-OFORMR is essential for all stakeholders involved in official documentation processes.

Key features of the form

The Form 20-OFORMR features a structured layout that includes sections requiring specific information to be filled by the declarant. Each section is designed to capture vital personal and financial details, making it easier for authorities to process the information accurately.

Related forms tend to include tax forms, business registration documents, and financial disclosure forms. Understanding how these documents interact with the Form 20-OFORMR can assist users in navigating compliance requirements effectively.

Filling out the Form 20-OFORMR

Completing the Form 20-OFORMR involves several systematic steps to ensure accuracy and compliance. First, gather all necessary personal and financial details before diving into the form itself. This preparation can streamline the process significantly.

Step-by-step instructions for completion

Section 1: Personal Information

In this section, you will need to input your full name, contact information, and possibly your business registration details if applicable. It’s crucial to double-check the spelling of your name and other identifying details to avoid unnecessary delays in processing.

Common pitfalls include omitting vital information such as your email address or phone number, which can hinder follow-up communication. Ensure that every detail is accurate to safeguard against errors.

Section 2: Declarations

This section is where you declare your financial status and any relevant information that pertains to the purpose of your submission. Be honest and precise in your declarations, as inaccuracies can lead to penalties or rejection of the form.

It’s vital to cross-verify figures and statements before submitting this portion, as it represents your formal commitment to the accuracy of the information provided.

Section 3: Supporting Documentation

Collecting and attaching the required supporting documents is crucial. This may include tax returns, identification proofs, or financial statements depending on your declarations. Carefully read through the requirements to ensure that all necessary documentation is included.

Tips for gathering supporting documents involve organizing your files beforehand and checking for the latest versions of each document to prevent submitting outdated information.

Interactive tools for filling out the form

Utilizing pdfFiller's interactive features can significantly enhance your experience while filling out the Form 20-OFORMR. The platform allows you to complete the form digitally, providing ease and convenience, especially for users who prefer a cloud-based solution.

To use the online tools effectively, navigate to the specific form section, use the built-in prompts to guide your entries, and take advantage of features like auto-fill and error correction suggestions, which can provide a smoother documentation process.

Editing and managing the Form 20-OFORMR

Editing the Form 20-OFORMR can be easily executed with pdfFiller. Their platform offers a comprehensive suite of editing tools that allow you to make necessary changes swiftly. Whether you need to correct a typo or update financial figures, the editing capabilities may help maintain the integrity of your submission.

The benefits of pdfFiller's editing functionalities extend beyond simple corrections; they enhance your overall productivity by providing real-time collaboration tools, enabling teams to work on the document simultaneously.

How to save and organize your document

Once your Form 20-OFORMR is filled out, saving it efficiently is essential for future reference. Utilize the organization features in pdfFiller to categorize and secure your documents within the platform. Create folders based on type, urgency, or completion status to streamline access later.

Employing cloud storage offers an additional layer of security and accessibility. Storing your documents online ensures that you can access them from different devices at any time, making it particularly useful for individuals or teams on the go.

Signing the Form 20-OFORMR

eSigning the Form 20-OFORMR is simplified through pdfFiller's platform. The steps to complete your electronic signature are straightforward; select the e-signing option, place your signature in the designated area, and save the changes.

Legal validity of eSignatures is on par with traditional signatures in most jurisdictions, making this feature not only convenient but also compliant with legal standards, ensuring your submissions hold the same weight as traditional signing.

Collaborating with others

Collaboration capabilities in pdfFiller allow you to share the Form 20-OFORMR with colleagues for input and review. You can invite others to comment or edit directly, enhancing the likelihood of a comprehensive document that meets all requirements.

Managing feedback is simplified through pdfFiller's interface, as users can track changes made by different collaborators, ensuring that every input is analyzed and incorporated as needed.

Submitting your Form 20-OFORMR

Understanding submission requirements is pivotal in the process of filing the Form 20-OFORMR. Different jurisdictions may have varying submission methods, including online submissions through designated portals, physical mail, or in-person deliveries.

Familiarizing yourself with state-specific nuances can save time and ensure compliance, thus improving your chances of a successful submission.

Post-submission steps

After submitting your Form 20-OFORMR, you should be prepared for follow-up actions depending on the agency or entity receiving the document. It's important to track the status of your submission, which may be possible through online tracking systems provided by the agency.

Having documentation of your submission and keeping a copy of the Form 20-OFORMR is advisable in case you need to refer back to it for any inquiries or clarifications.

Troubleshooting common issues

Addressing errors in the Form 20-OFORMR can save you time and frustration. Ensure to double-check all entries before submission, and if you discover a mistake after submission, follow the procedures outlined by the receiving agency to correct it.

Guidance on handling rejection or resubmission often pertains to gathering any additional information that may have been missing and resubmitting promptly to avoid delays.

FAQs related to the Form 20-OFORMR

Common questions about the Form 20-OFORMR revolve around its purpose, the types of required information, and procedural concerns. For those unclear about particular sections or processes, reaching out to customer service through pdfFiller can provide answers.

Additionally, consulting resources that specifically address regulatory requirements can further aid users in understanding expectations associated with this form.

Maximizing the benefits of using pdfFiller

Utilizing pdfFiller for Form 20-OFORMR management presents distinct advantages such as centralized document management, collaboration tools, and the ability to edit documents in real-time without the hassle of printing and rescanning. These features promote organized documentation and transparency.

Real-time collaborative features further enhance productivity, allowing teams to work seamlessly on the form, ensuring that everyone's contributions are considered and accurately reflected in the final submission.

Accessing assistance and support

pdfFiller offers robust customer support options, including tutorials, FAQs, and direct assistance, ensuring that users have access to the resources they need when facing challenges during the completion of the Form 20-OFORMR.

Providing feedback on your experience can also contribute to continuous improvement, allowing pdfFiller to enhance the platform based on user needs.

Conclusion: Simplifying your document management journey

Navigating the complexities associated with the Form 20-OFORMR is made significantly easier through the tools and resources available at pdfFiller. By leveraging their editing, eSigning, and organizational features, users can streamline their documentation processes while ensuring compliance.

Ultimately, accessing such efficient solutions empowers individuals and teams to manage their documents confidently, simplifying their overall paperwork journey and facilitating better outcomes in their endeavors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 20-oformr declarations without leaving Google Drive?

How do I edit form 20-oformr declarations straight from my smartphone?

How do I complete form 20-oformr declarations on an Android device?

What is form 20-oformr declarations?

Who is required to file form 20-oformr declarations?

How to fill out form 20-oformr declarations?

What is the purpose of form 20-oformr declarations?

What information must be reported on form 20-oformr declarations?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.