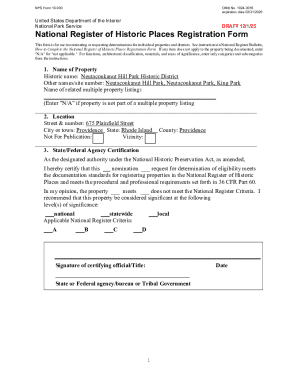

Get the free How to update withholding to account for tax law changes ...

Get, Create, Make and Sign how to update withholding

Editing how to update withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to update withholding

How to fill out how to update withholding

Who needs how to update withholding?

How to update withholding form: A comprehensive guide

Understanding withholding and its importance

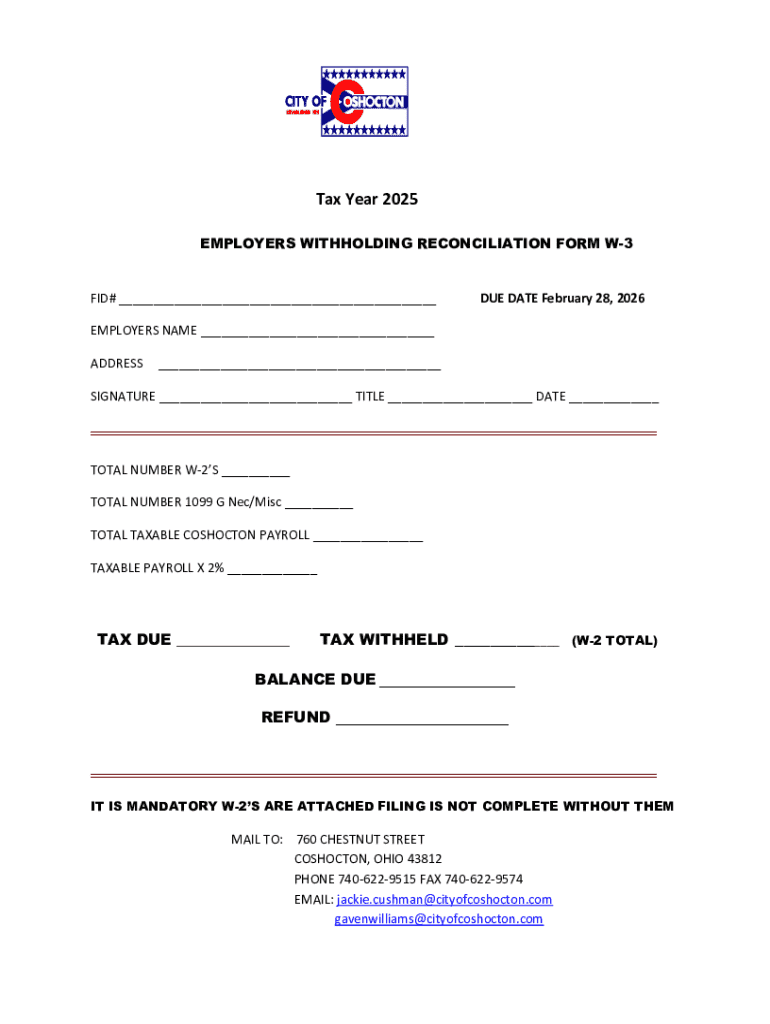

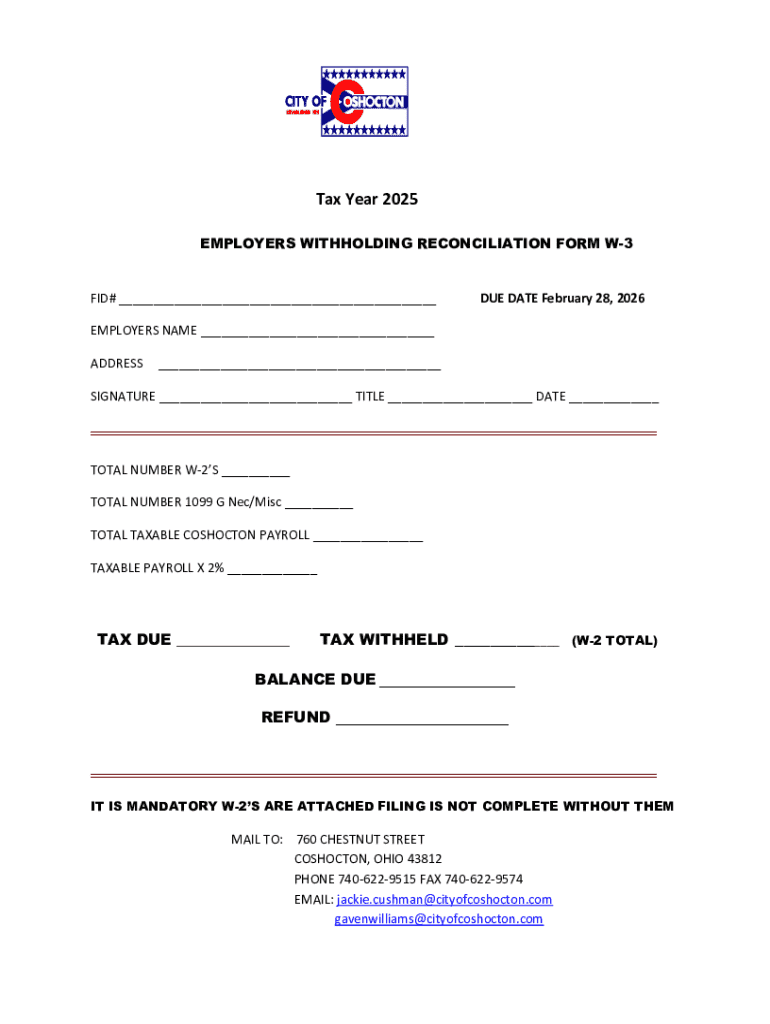

Tax withholding is the process by which an employer deducts a portion of an employee's earnings to pay their tax liabilities on their behalf. This preemptive approach ensures that taxes are settled incrementally throughout the year, rather than as a lump sum during tax season. Without accurate withholding, you might find yourself in a situation where you owe taxes unexpectedly or have overpaid and issued an unnecessary tax refund. Updating your withholding form is crucial to maintain a correct balance between what you earn and what you owe.

An accurate withholding rate aligns with your current financial situation, minimizing tax burdens or refunds that could disrupt your financial planning. Therefore, understanding how to update your withholding form helps to take control of your finances and ensures that you meet your tax obligations efficiently.

Types of withholding forms

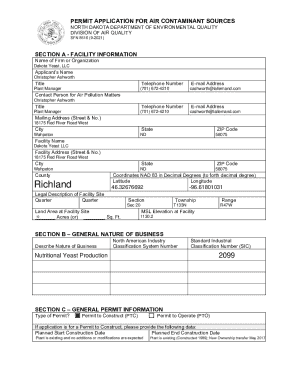

Withholding forms vary at both the federal and state levels and generally include essential information about your employment status, deductions, and dependents. Understanding these forms is vital for effective tax planning.

The main withholding forms you will encounter include:

The key differences between federal and state forms largely lie in how allowances are calculated and the rates applied to your taxable income. State tax obligations can vary widely based on local legislation, income brackets, and deductions available in that region.

When to update your withholding form

Life changes can significantly impact your financial situation and necessitate an update to your withholding form. These changes include, but are not limited to, the following circumstances:

Additionally, adjusting your withholding may be wise if you experience significant changes in income or if you gain new deductions that could lower your taxable income. Regularly reviewing your own circumstances can save you from potential tax burdens later.

Steps to update your federal tax withholding (W-4)

Updating your federal withholding form involves several simple steps. Here’s how to go about it:

Following these steps will help ensure that your federal tax withholding accurately reflects your current tax obligations.

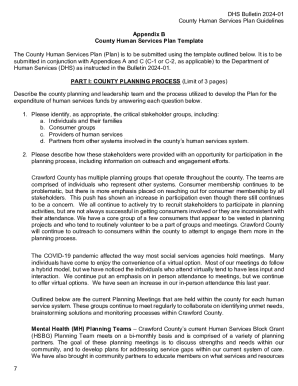

Steps to update state tax withholding

Updating your state withholding form follows a similar process, although you should use the specific form for your state. Here are the steps to take:

States often have unique requirements, so ensure that you are well-informed about your local regulations.

Utilizing pdfFiller for a seamless experience

pdfFiller provides a user-friendly platform for filling, eSigning, and submitting your withholding forms. Its intuitive interface makes it a great solution for individuals and teams looking to manage their documents effectively.

Key benefits of using pdfFiller include:

The flexibility and features make pdfFiller a powerful ally in managing your tax documents, ensuring you've got the right forms prepared quickly.

Common mistakes to avoid when updating your withholding

When updating your withholding forms, certain pitfalls can lead to inaccurate tax filings. Being aware of these can save you time and money.

By remaining vigilant and proactive in managing your withholding updates, you can ensure a smoother tax experience.

Frequently asked questions about updating withholding forms

Updating your withholding form often leads to a series of questions. Here are some of the most common queries addressed.

These answers can guide you in effectively managing your tax obligations and making informed decisions.

Additional help and support

If you require further assistance, multiple options are available for obtaining help with your withholding forms. Here are some suggestions:

Leveraging these resources can greatly decrease your frustration when navigating tax withholdings.

Related information

Understanding tax implications and the necessary annual filing processes is essential for every taxpayer. There are various tools available for estimating your tax obligations throughout the year to assist you in planning ahead and ensuring that you are on track with your financial goals.

Additionally, many online platforms provide calculators and resources for individuals to evaluate potential tax liabilities as income changes. Engaging with such tools proactively sets you up for better financial management and compliance.

User interaction

We invite you to share your experiences in updating your withholding forms. Sharing personal stories can provide valuable insights for others navigating this process.

Also, we value your feedback: was this guide helpful? Let us know how we can improve or what specific topics you’d like to see covered.

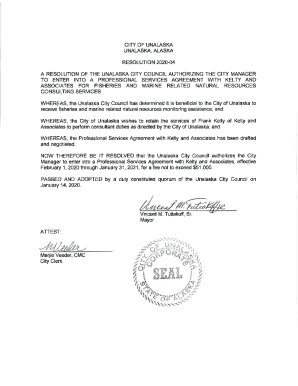

Sign in to your pdfFiller account

For a personalized document management experience, sign in to your pdfFiller account. This allows you to access all saved documents and templates quickly.

Once logged in, find your previously submitted forms in your account dashboard, streamlining the update process and ensuring a seamless transition during your tax planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get how to update withholding?

Can I create an eSignature for the how to update withholding in Gmail?

How do I edit how to update withholding on an iOS device?

What is how to update withholding?

Who is required to file how to update withholding?

How to fill out how to update withholding?

What is the purpose of how to update withholding?

What information must be reported on how to update withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.