Get the free FAQs - Insurance Claims & Loss Draft

Get, Create, Make and Sign faqs - insurance claims

How to edit faqs - insurance claims online

Uncompromising security for your PDF editing and eSignature needs

How to fill out faqs - insurance claims

How to fill out faqs - insurance claims

Who needs faqs - insurance claims?

FAQs - Insurance Claims Form: Your Complete Guide

Understanding the insurance claims form

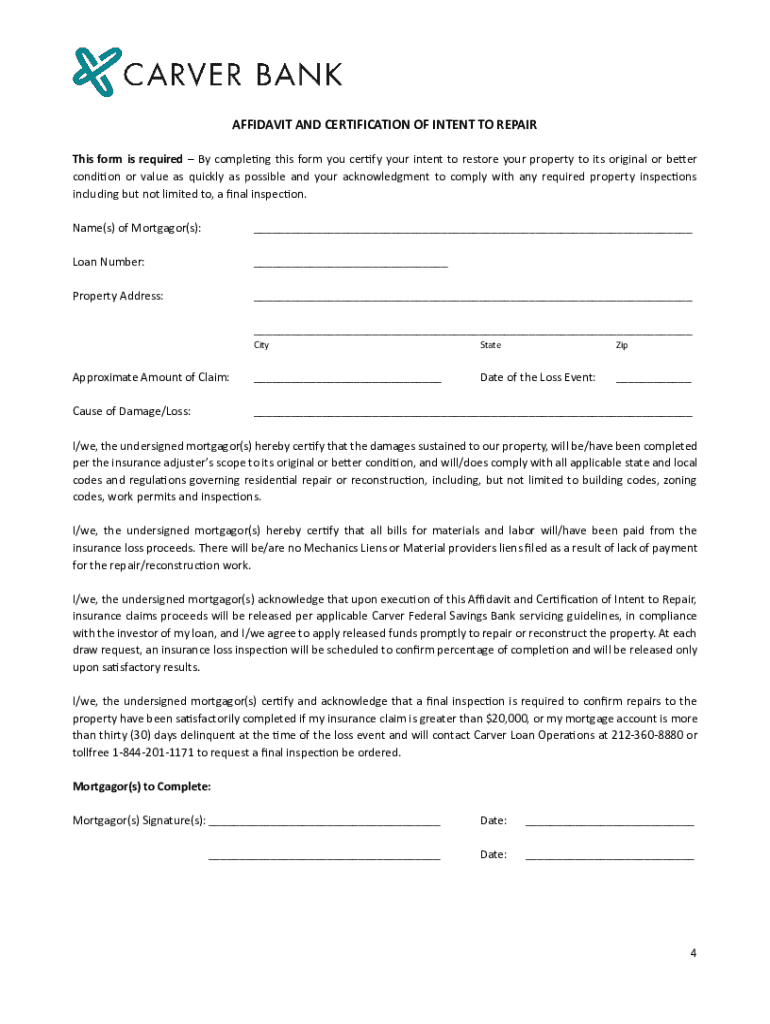

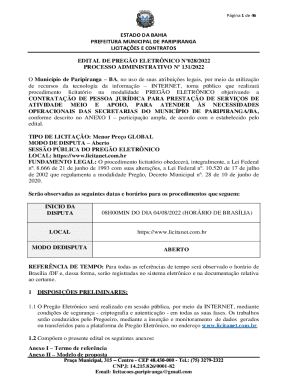

An insurance claims form is a document submitted to an insurance company to request payment or compensation for a covered loss. This form serves crucial functions, from providing necessary details about the incident or loss to verifying that the claim falls within the policy's coverage. Submitting an accurate claims form is essential because it directly impacts the outcome of your claim. Errors or omissions may lead to delays, claim denials, or difficulties in the claims process.

There are many scenarios that warrant the initiation of an insurance claim, including accidents, natural disasters, health emergencies, or financial losses. Understanding when to file a claim and the information required helps streamline the insurance process, allowing you to recover faster.

Step-by-step guide to completing the insurance claims form

Step 1: Gather required information

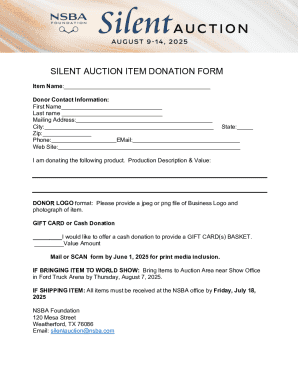

Before starting your claims form, gather all relevant information. You will need personal information, including your name, address, and contact details. Additionally, have your insurance policy number and any specifics on the coverage you are claiming under ready, as this can significantly enhance the claims process.

Consider any supporting documents necessary for your claim type. These may include police reports, medical records, repair estimates, and photographs of damages or injuries. Having this information consolidated beforehand allows for a smoother and more efficient claims submission.

Step 2: Fill out the form accurately

Completing the insurance claims form accurately is crucial. Each section of the form may ask for various details, including your policy information, details of the incident, and the amount you are claiming. Pay attention to the specific requirements associated with your claim type.

Step 3: Review and edit your submission

Once you have filled out your claims form, it is essential to review it thoroughly. This step helps you catch any errors that could lead to delays. Tips for reviewing include reading each section carefully, verifying that all information is complete, and checking for grammatical errors.

Utilizing tools provided by pdfFiller can enhance your form accuracy. With features such as editing, annotation, and easy navigation, it ensures that your submission is polished before you send it.

Common FAQs about the insurance claims process

Claims frequently asked questions

When considering insurance claims, it's common to have lots of questions. Typical queries include: What types of claims can I submit? Generally, claims can cover damages, medical expenses, or property loss due to unforeseen events, depending on your policy. How long does the claims process take? It varies by insurer and the complexity of your claim, but most should provide a timeline that can be looked up.

Another common concern is what to do if an error occurs on the form. Most insurance companies allow you to resubmit a corrected form. However, delays may arise, so it’s best to ensure accuracy from the start.

Specific documentation questions

Different types of claims require various documentation. For instance, a health claim generally necessitates medical records or bills, while a vehicle claim might require a police report and repair estimates. Knowing what documents you need for specific claims ensures you are well-prepared.

Submitting supporting documents can usually be done online, via fax, or through physical mail. Ensure that you read your insurance company’s guidelines for submitting each type of document to avoid claim processing delays.

Helpful resources to navigate making a claim

Navigating the claims process can feel overwhelming, but several resources are available to assist you. pdfFiller offers downloadable forms and templates tailored for various claims, ensuring you are equipped with the necessary documents right from the start.

Additionally, interactive tools on pdfFiller can help you manage your documents efficiently. You can access user guides designed to guide individuals through the form completion process, ensuring no detail is overlooked.

Ready to start a claim?

Before initiating your claim, it’s beneficial to take a pre-claim checklist into account. Items on this checklist could include verifying your policy coverage, gathering all required documents, and ensuring you have the correct claims form from the insurance provider.

Once you’ve prepared, starting your online claims submission is straightforward. Use pdfFiller’s user-friendly features to streamline the submission process, making it easy to complete and send your claims form securely.

Privacy and security considerations

Filling out forms, especially sensitive insurance claims forms, raises valid concerns about privacy and data security. pdfFiller prioritizes user privacy, implementing robust encryption and secure access protocols. It’s essential to familiarize yourself with consent regulations and submission protocols related to your information.

With pdfFiller, rest assured that your data is handled with utmost care, in alignment with privacy policies designed to protect your personal and financial information.

Post-claim submission questions

After you submit your claim, it is natural to have questions about the next steps. What can you expect? Insurance companies typically review the form and supporting documents, followed by an investigation which can vary in duration based on the claim's complexity.

Tracking the status of your claim is often possible through the insurance company’s portal. They may provide updates via email or phone. If your claim gets denied, don’t panic. Many insurers offer an appeals process where you can provide additional documentation or evidence to support your case.

Disability claims FAQs

Filing for disability claims involves specific considerations. When applying, documentation plays a pivotal role. Ensure you have medical records detailing your condition, treatment, and your healthcare provider's opinion regarding your eligibility for disability.

Expect that these claims may take longer due to the thoroughness required in verifying eligibility. Prepare for additional documentation requests which can arise in processing these claims, delaying payment but necessary to substantiate your claim.

Collaboration and communication with your insurer

Effective engagement with your insurance representative can significantly enhance the claims experience. Open communication is crucial. Use tools provided by pdfFiller to facilitate collaboration, share documents securely, and keep everything organized.

Maintaining a record of communications with your insurer is essential for ensuring transparency. Documenting all interactions can help clarify any points of confusion later down the line, making the claims process smoother.

Unique features of pdfFiller for insurance claims

pdfFiller’s cloud-based platform offers a range of features designed explicitly for handling document management efficiently. Users can easily edit PDFs, eSign, and collaborate within teams, ensuring that all documents related to claims are accessible and up-to-date.

The ability to use electronic signatures speeds up the claims process, allowing documents to be signed in minutes rather than days. Collaboration features that enhance teamwork are particularly valuable for organizations with multiple team members involved in the claims submissions and management process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my faqs - insurance claims directly from Gmail?

How do I edit faqs - insurance claims in Chrome?

How do I edit faqs - insurance claims on an iOS device?

What is faqs - insurance claims?

Who is required to file faqs - insurance claims?

How to fill out faqs - insurance claims?

What is the purpose of faqs - insurance claims?

What information must be reported on faqs - insurance claims?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.