Get the free Iowa Withholding Tax InformationDepartment of Revenue

Get, Create, Make and Sign iowa withholding tax informationdepartment

Editing iowa withholding tax informationdepartment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out iowa withholding tax informationdepartment

How to fill out iowa withholding tax informationdepartment

Who needs iowa withholding tax informationdepartment?

Iowa withholding tax information department form: A detailed guide

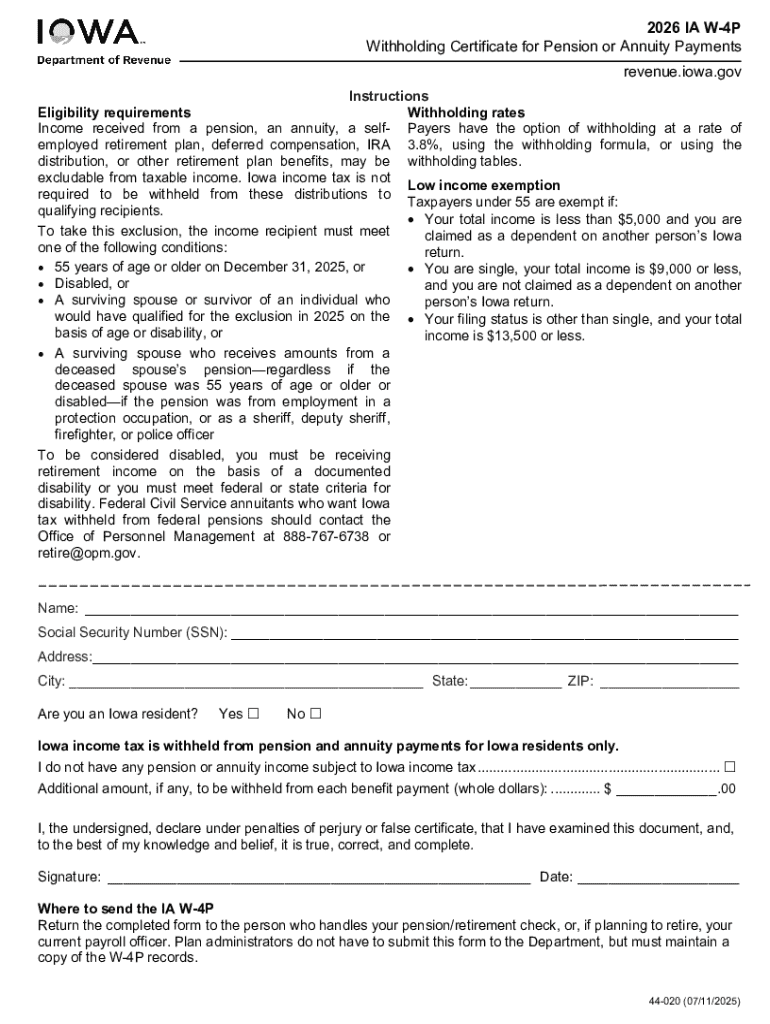

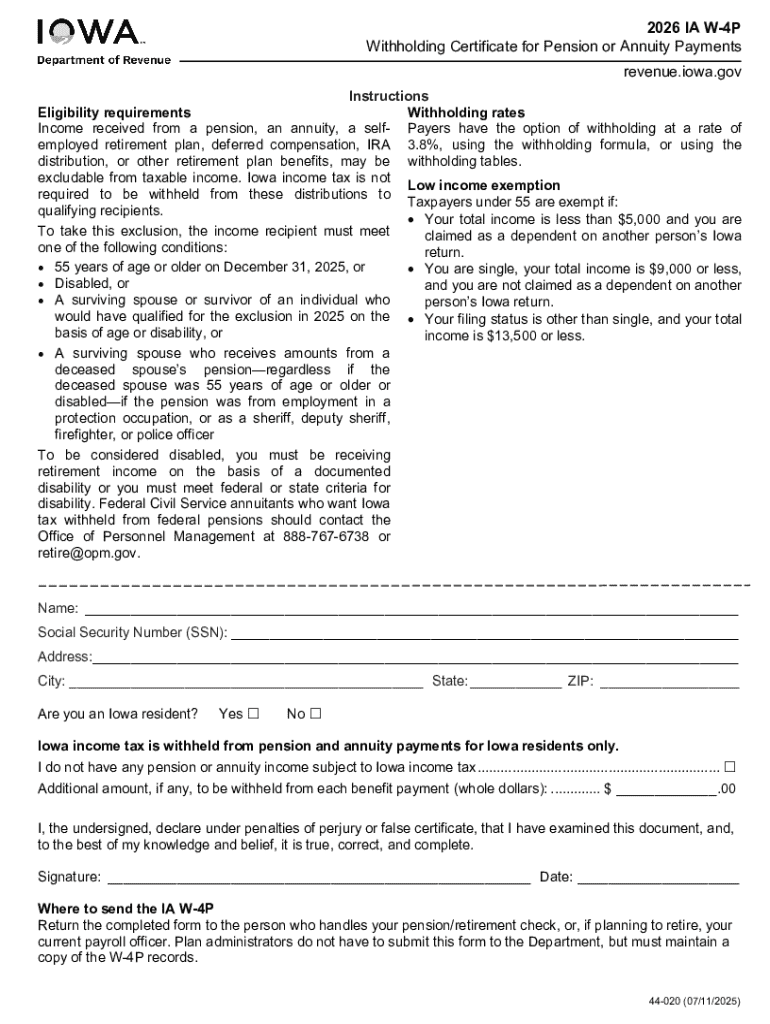

Understanding Iowa withholding tax

Withholding tax is a crucial component of the American taxation system, particularly for states like Iowa. This tax is deducted from an employee's wages by the employer and is submitted directly to the state. It ensures that income tax is collected throughout the year, rather than as a lump sum during tax season, making it easier for individuals to manage their finances.

In Iowa, withholding tax serves not just as a means of tax collection but also as a predictor of state revenue. Withholding amounts are based on the employee's income, filing status, and the number of allowances claimed on their Iowa W-4 form. Various legislative measures, including those outlined in the Iowa Administrative Code, govern these procedures and set parameters for employers to follow. Understanding this system is essential for both employers and employees alike.

Who needs to withhold Iowa taxes?

Not all entities are required to withhold Iowa taxes. Typically, employers withhold taxes on behalf of their employees to ensure compliance with state tax laws. Any organization or business entity that pays wages or compensation to employees must also adhere to withholding tax regulations. Employers should regularly review their responsibilities to avoid penalties.

Self-employed individuals, such as contractors, may find themselves in scenarios where they need to account for taxes themselves. In these cases, they may need to make estimated tax payments rather than having taxes withheld. Situations such as fringe benefits and commission payments that vary in amount may require withholding action, as well. Understanding when and how to withhold is critical to maintaining compliance with Iowa’s tax regulations.

Iowa withholding tax forms overview

In dealing with Iowa withholding taxes, different forms serve specific purposes. Key forms include the Iowa W-4, which allows employees to designate their withholding allowances, and the Iowa 941, which is a quarterly withholding report. Familiarizing yourself with these forms is essential for ensuring compliance and making accurate calculations.

Understanding the differences between state and federal withholding forms is also important. For example, the federal W-4 form touches upon federal income tax withholding, while the Iowa W-4 specifically applies to state taxes. For downloadable forms and resources regarding the Iowa withholding tax information department form, you can visit the appropriate links provided by the Iowa Department of Revenue.

Step-by-step guide to completing the withholding tax form

Completing the Iowa withholding tax information department form requires attention to detail and a systematic approach. Here are the steps to follow:

Adhering to these steps ensures accuracy in your withholding, significantly affecting your employees' financial health at tax time.

Managing and adjusting withholding amounts

There are various reasons why withholding amounts may need adjustment. Changes in an employee’s circumstances, such as marital status or a substantial salary increase, are common triggers. In these cases, employees should submit a new Iowa W-4 to adjust their withholding allowances. Employers should also monitor withholding amounts regularly to ensure they reflect the current compensation accurately.

To change employee withholding allowances, provide the revised W-4 forms to the payroll department for processing. It’s vital to keep documentation consistent with state regulations to avoid any misunderstanding regarding withholding amounts.

Common pitfalls and FAQs related to Iowa withholding tax

When filing for Iowa withholding tax, certain common mistakes often arise. Incorrect employee information submissions, miscalculating withholding amounts, and failing to submit paperwork on time are frequently encountered pitfalls. As such, double-checking details can save time, money, and stress.

Additionally, it's always beneficial to clarify frequently asked questions, such as inquiries regarding how to claim deductions and credits, or specifics regarding what should be reported on the Iowa withholding forms. Everyone involved should feel confident in their understanding of tax regulations to ensure compliance and accuracy.

Tools and interactive resources available

Numerous resources exist to help streamline the Iowa withholding tax process. Platforms like pdfFiller facilitate editing and signing forms, allowing users to customize documents according to their needs. Users can also take advantage of online withholding calculators, which help determine the amount of taxes to withhold quickly.

Staying updated with current tax rates, deductions, and credits can be achieved through various online resources. Active engagement with these tools keeps contractors and employees ahead of potential changes in tax legislation and ensures compliance.

Support and assistance for Iowa withholding tax

For issues or uncertainties regarding Iowa withholding tax, the Iowa Department of Revenue provides guidance through their contact information listed on their website. Additionally, business owners may find it beneficial to consult professionals, especially for complex situations involving various employees or fluctuating income.

Community forums can also be an excellent resource for seeking shared experiences and advice. Engaging with fellow employers or tax professionals fosters an environment of collective learning regarding Iowa's withholding tax regulations and best practices.

Important updates and changes in Iowa tax legislation

Iowa's tax landscape is subject to frequent updates, which can significantly impact withholding regulations. Keeping abreast of recent changes is vital to ensure compliance and mitigate risks associated with potential penalties for non-compliance.

For example, modifications to tax brackets or adjustments to allowable deductions can alter the amount withheld from employee paychecks. Resources available on the Iowa Department of Revenue's website provide the latest updates and implications for tax filers, which is essential for anyone handling withholding tax forms.

Conclusion of Iowa withholding tax insights

Understanding Iowa withholding tax is essential for both employers and employees. Accurate withholding is foundational in financial planning and compliance with state law. By utilizing tools like pdfFiller, users can streamline the process of editing, signing, and managing documentation, thereby simplifying administrative duties and focusing on what truly matters—their business and finances.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my iowa withholding tax informationdepartment in Gmail?

How do I complete iowa withholding tax informationdepartment on an iOS device?

How do I fill out iowa withholding tax informationdepartment on an Android device?

What is iowa withholding tax information department?

Who is required to file iowa withholding tax information department?

How to fill out iowa withholding tax information department?

What is the purpose of iowa withholding tax information department?

What information must be reported on iowa withholding tax information department?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.