Get the free Corporate Forms - Income Tax

Get, Create, Make and Sign corporate forms - income

Editing corporate forms - income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate forms - income

How to fill out corporate forms - income

Who needs corporate forms - income?

Understanding Corporate Forms: A Comprehensive Guide to Income Forms

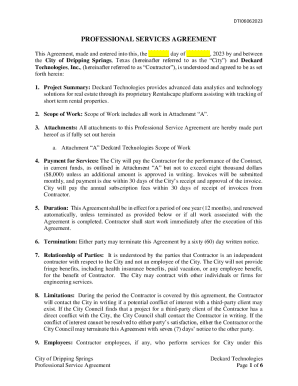

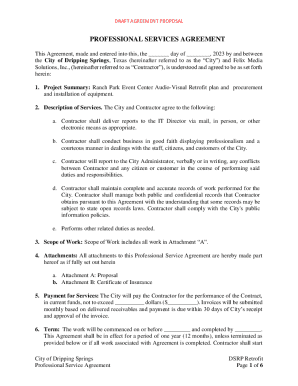

Understanding corporate forms and income forms

Corporate forms, fundamental frameworks for structuring a business, define the legal status under which a company operates. From a Limited Liability Company (LLC) to a corporation or partnership, each form offers a distinct set of advantages and regulatory requirements. Understanding these forms is crucial for compliance, operational efficiency, and strategic growth.

Particularly important is the income form associated with these corporate structures. Income forms serve as the mainstay records for capturing an entity's revenue and profit details, facilitating transparency and adherence to tax laws. They play a vital role in both internal business assessments and external tax obligations.

Types of corporate forms

When considering corporate structures, businesses primarily choose between forms such as LLCs, corporations, or partnerships. Each structure impacts liability, taxation, and administrative responsibilities differently.

For instance, LLCs provide limited liability protection along with the tax flexibility of partnerships. Corporations, by contrast, may offer shares and a more formal structure while facing double taxation. Partnerships allow for shared ownership but expose individual partners to liability risks.

Income form overview

Income forms are essential tools that allow businesses to report their earnings, track their financial health, and comply with taxation requirements. These forms are often tailored to the structure of the corporation, ensuring that revenue and expenses are accurately documented.

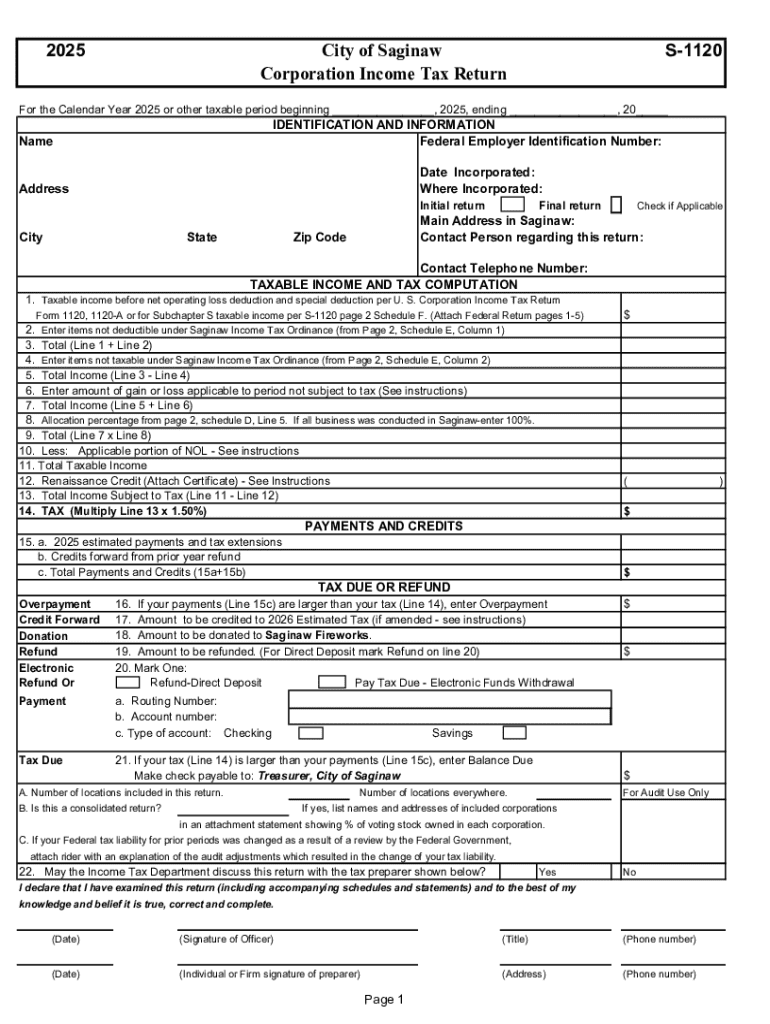

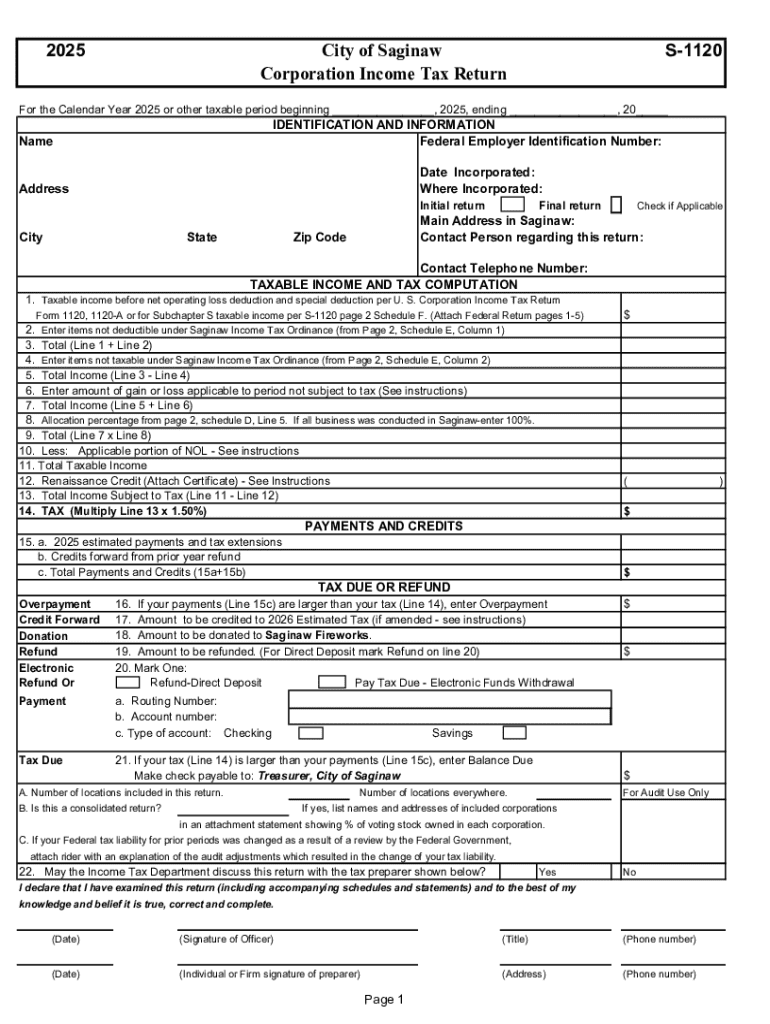

Common types of income forms include tax reports like the IRS Form 1120 for corporations, and profit-loss statements which help to convey the financial standing of a business over a specific period. Each of these forms plays a pivotal role in budgeting and financial planning, thereby enhancing overall operational performance.

Preparing to fill out an income form

Before delving into the completion of an income form, meticulous preparation is key. Start by gathering all necessary financial documents, including prior tax returns and corporate records, which form the foundation of your data input.

Understanding key financial terms is essential. Familiarize yourself with concepts such as gross income (total revenue before deductions), and taxable income (net income after allowable deductions). This foundational knowledge will aid in accurately completing the forms and ensuring compliance with regulations.

Detailed steps for completing a corporate income form

Following a structured approach is vital for accurately completing a corporate income form. Begin by selecting the correct form based on your corporate structure. For example, corporations typically use IRS Form 1120, while LLCs may need to complete different forms depending on their taxation status.

Next, input corporate information, ensuring accuracy with details such as the company's name, Employer Identification Number (EIN), and address. Follow this by reporting income from various sources, carefully categorizing each stream of revenue and adhering to suggested formats for income schedules.

Accounting for deductions and tax credits is an essential step in maximizing potential tax benefits. Identify applicable deductions unique to your business type, and systematically apply credits where applicable before revising the final entries for accuracy.

Using interactive tools

Utilizing tools like pdfFiller can significantly enhance the quality of your form completion. These platforms offer interactive document management systems that simplify the process, enabling users to fill out, edit, and sign forms seamlessly.

With templates for various corporate income forms, users prevent redundancy and ensure that all necessary fields are systematically addressed. Having a standardized template streamlines the documentation process and helps in maintaining organization.

Common issues and troubleshooting

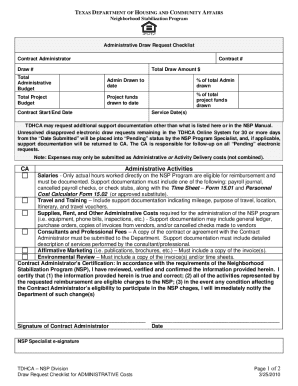

As you embark on form completion, it’s crucial to identify common errors that often impede the process. Frequent mistakes include incorrect math, overlooked deadlines, and incomplete sections, all of which can lead to unnecessary penalties or audits.

To safeguard against these issues, develop a checklist to ensure each section is correctly filled and to verify all calculations. In cases of complex tax situations, seeking help from tax professionals or accountants can provide valuable insights, making the process smoother and more accurate.

Managing and storing completed income forms

Efficient management of corporate income forms is paramount for compliance and future references. Digital solutions such as pdfFiller provide robust systems for storing documents securely online, enabling easy access and retrieval when needed.

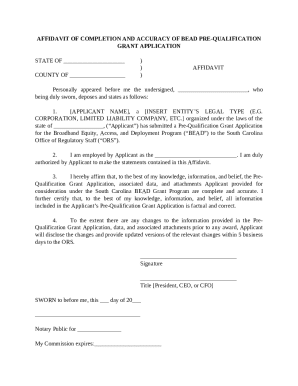

Utilizing cloud storage solutions also offers advantages, such as enhanced security and the flexibility of accessing documents from varied locations. Furthermore, electronic signatures integrate seamlessly with these platforms, ensuring that all collaborators can engage effectively without the need for physical meetings.

Compliance and filing requirements

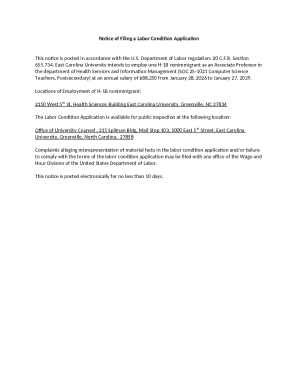

Compliance with income form requirements is crucial for avoiding legal troubles. Understanding filing deadlines is essential since late submissions can incur severe penalties. Generally, corporate income forms are due on the 15th day of the fourth month after the end of the tax year.

Additionally, awareness of the distinctions between federal and state income forms is paramount. While both may share similarities, state-specific requirements can vary significantly, making it vital for corporations to understand their local obligations.

Continuous updates and changes to income forms

It's essential to frequently monitor changes in regulations that influence corporate income forms. Tax laws evolve, necessitating ongoing education for business owners and accountants to avoid pitfalls associated with outdated practices.

Using pdfFiller, users have the advantage of easily accessing updated forms and receiving notifications about changes relevant to their situations. This ensures that all submissions are compliant and accurate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify corporate forms - income without leaving Google Drive?

How can I send corporate forms - income for eSignature?

How do I edit corporate forms - income on an Android device?

What is corporate forms - income?

Who is required to file corporate forms - income?

How to fill out corporate forms - income?

What is the purpose of corporate forms - income?

What information must be reported on corporate forms - income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.