Get the free Guide to Internet Banking Registration for Corporate Users

Get, Create, Make and Sign guide to internet banking

How to edit guide to internet banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out guide to internet banking

How to fill out guide to internet banking

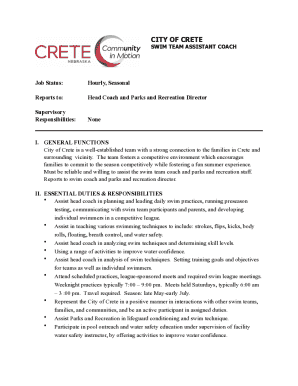

Who needs guide to internet banking?

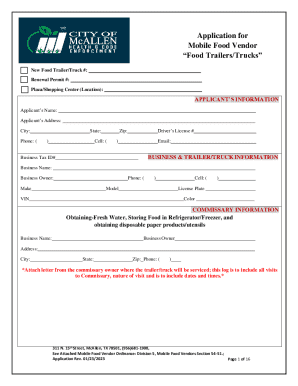

Guide to Internet Banking Form

Understanding internet banking

Internet banking, often referred to as online banking, allows users to conduct financial transactions via the internet. This approach eliminates the need for physical branch visits, providing customers with a more streamlined banking experience. With just a few clicks, users can access their accounts, make transfers, and manage their finances effectively.

The benefits of using internet banking are substantial. From convenience to enhanced security, online banking platforms cater to users' needs efficiently. Here are several key advantages:

Key features of internet banking forms

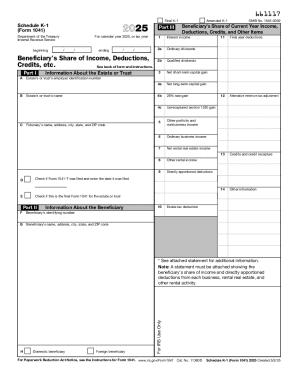

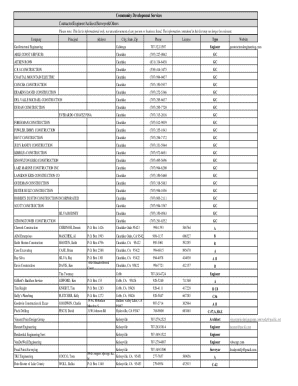

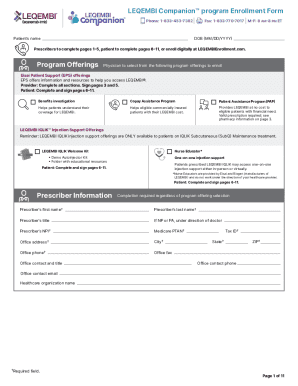

Internet banking forms serve as essential tools for executing various banking functions. Common internet banking forms include applications for loans, account management requests, and transaction requests. These forms are designed to be user-friendly and accessible, making them crucial for the digital banking experience.

Interactive tools enhance user engagement, ensuring that customers can fill out forms accurately and efficiently. Some notable features include:

Digital signatures have also gained prominence in the banking sector. They offer a legally binding way to authenticate documents electronically, ensuring that submitted forms are valid and secure.

Step-by-step guide to using internet banking forms

Using internet banking forms can seem daunting, but by following a systematic approach, it becomes manageable. Here’s how you can navigate the process:

Filling out your internet banking form

Accurate completion of internet banking forms is essential. Here’s a step-by-step guide to help you enter your personal and financial information:

If using pdfFiller, take advantage of its features that simplify form filling. You can edit forms directly, making necessary adjustments easily, and adding eSignatures is straightforward with just a few clicks.

Reviewing and submitting your form

After completing your form, reviewing it is crucial. Here are some aspects to consider before submission:

Upon submission, the process varies by bank. Typically, you will receive a confirmation email, and many platforms allow you to track the status of your form. Remain vigilant in monitoring communications from your bank regarding your submission.

Managing your internet banking forms

Post-submission management of your internet banking forms is essential for keeping your financial data organized. This involves knowing how to retrieve and edit forms you've already submitted. Most banks allow users to access their previous submissions directly through their online portal.

Additionally, securely storing and organizing banking documents is crucial. Utilizing cloud-based storage solutions ensures that your information is not only backed up but also easily accessible. Keep track of notifications and updates from your bank as they often provide essential information regarding your forms and account activities.

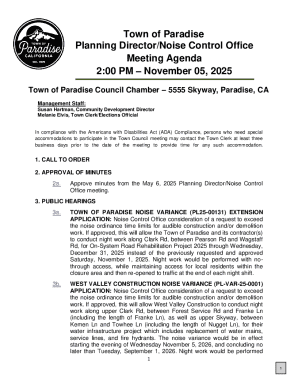

Troubleshooting common issues with internet banking forms

While internet banking forms are generally straightforward, issues may arise. Here are some common problems and their resolutions:

Advanced features of internet banking form management

As digital banking evolves, advanced features are becoming more common, especially for teams managing financial documents collaboratively. Collaborative tools allow team members to engage with banking documents seamlessly. This not only enhances workflow but fosters better communication.

Leveraging pdfFiller can significantly boost your productivity. Integration with other applications simplifies process management, enabling you to handle forms efficiently and effectively.

Ensuring security and privacy in internet banking

Ensuring the security of your transactions is paramount in internet banking. Adopting best practices protects your information. Always use strong, unique passwords, and enable two-factor authentication when possible. Regularly update your devices and software to safeguard against vulnerabilities.

In addition, an understanding of regulatory compliance in banking forms is essential. Banks adhere to stringent security measures, ensuring that your data remains protected during transactions.

Frequently asked questions (FAQs) about internet banking forms

Individuals often have queries regarding the intricacies of filling, submitting, and managing Internet banking forms. It’s key to address these concerns to build confidence in using digital banking platforms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the guide to internet banking electronically in Chrome?

How do I fill out the guide to internet banking form on my smartphone?

Can I edit guide to internet banking on an Android device?

What is guide to internet banking?

Who is required to file guide to internet banking?

How to fill out guide to internet banking?

What is the purpose of guide to internet banking?

What information must be reported on guide to internet banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.