Get the free Form CT-1040 Connecticut Resident Income Tax Return

Get, Create, Make and Sign form ct-1040 connecticut resident

Editing form ct-1040 connecticut resident online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ct-1040 connecticut resident

How to fill out form ct-1040 connecticut resident

Who needs form ct-1040 connecticut resident?

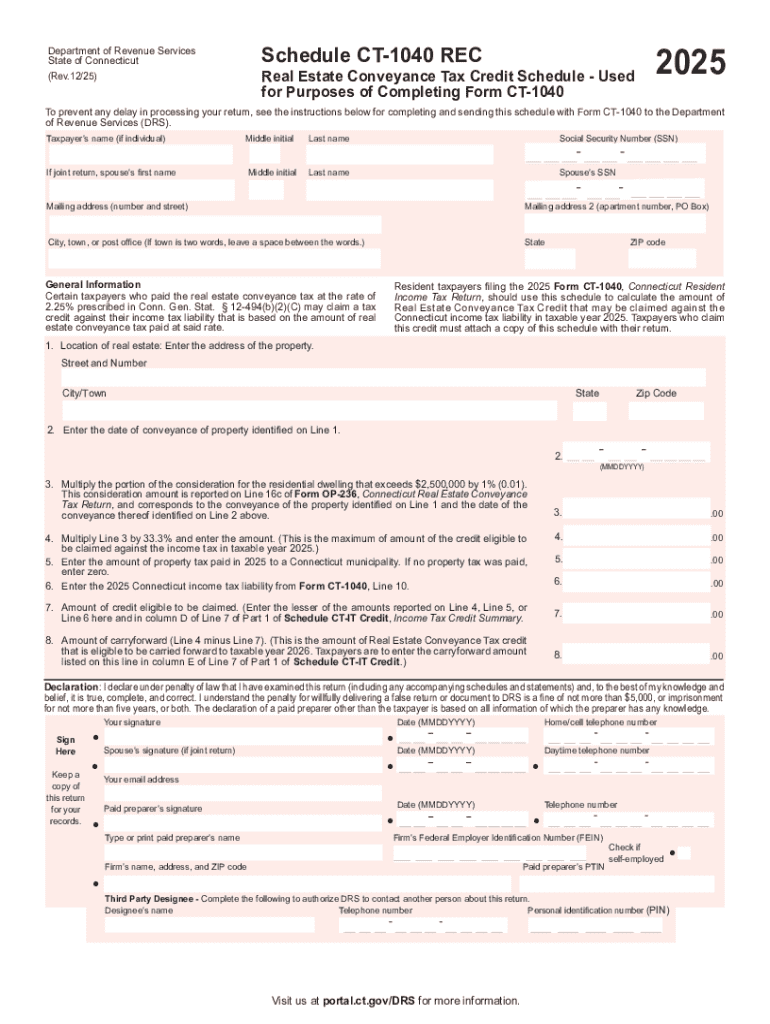

Understanding the Form CT-1040 Connecticut Resident Form

. Understanding the Form CT-1040

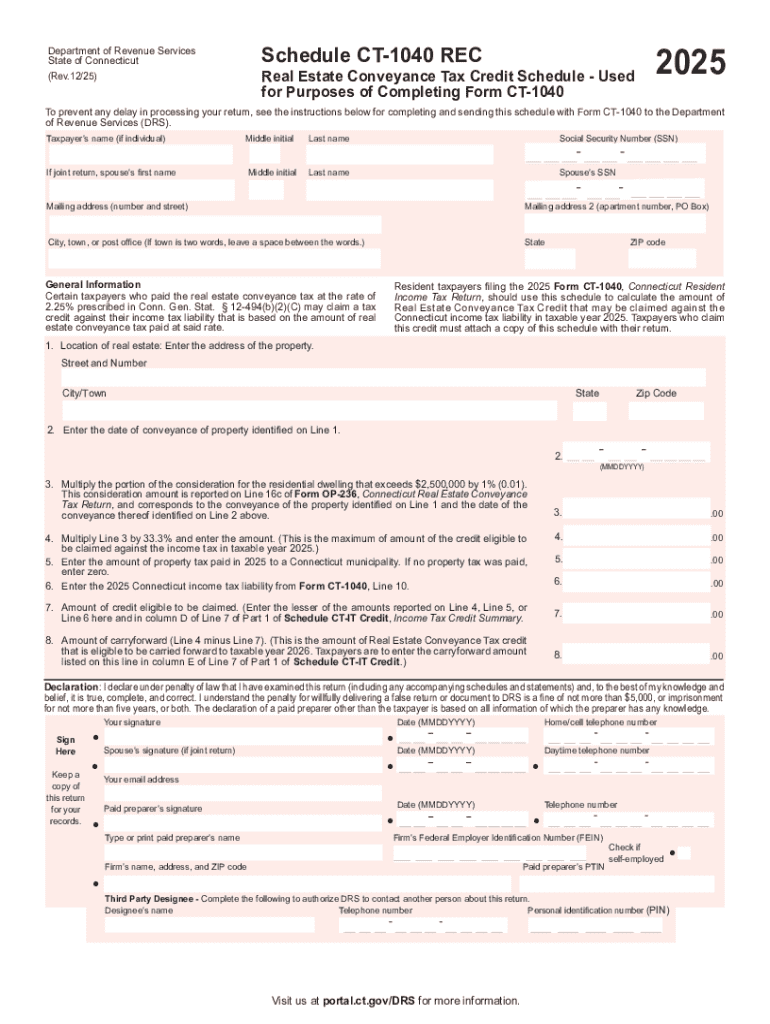

The Form CT-1040 is essential for Connecticut residents to report their state income tax. This form is designed to calculate the amount of state tax owed based on the taxpayer's income and eligibility for various deductions and credits. It's necessary for every resident whose taxable income exceeds the state-defined thresholds, ensuring that they comply with local tax laws.

B. Key tax terminology

Familiarizing yourself with key tax terminology is crucial when filing the Form CT-1040. Terms such as taxable income, deductions, and credits play significant roles in determining your final tax liability. Taxable income refers to the total income after allowable deductions; taxpayers must claim deductions correctly to minimize their liabilities. Tax credits can directly reduce the amount of tax owed, making them invaluable for financial planning.

. Eligibility criteria for filing

To qualify as a Connecticut resident for tax purposes, individuals must have established their domicile in Connecticut. This designation isn't merely about physical presence; it involves establishing Connecticut as a permanent home. Various types of income, including salaries, wages, rental income, and certain investment gains, are subject to state taxation.

B. Special cases

Certain individuals, such as students and service members, face unique circumstances when determining residency for tax purposes. For instance, students may remain domiciled in their home state while attending college in Connecticut, affecting their filing requirements. Service members also have specific regulations regarding domiciliary status based on military assignments.

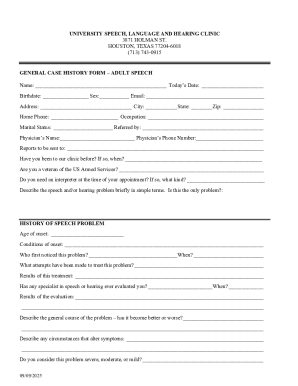

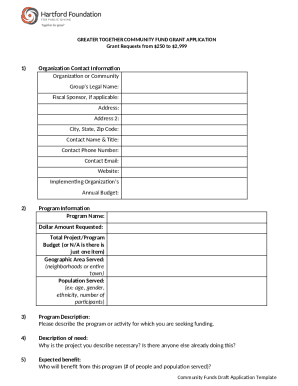

. Preparing to file form CT-1040

Preparation is key when it comes to filing the Form CT-1040. Gathering the necessary documentation is essential for ensuring a smooth filing process. Common documents include W-2 forms, 1099 forms for self-employed individuals, and any other income statements received during the tax year. Accuracy in these documents is paramount; discrepancies can lead to adjustments and potential audits.

B. Understanding deductions and credits available

Connecticut residents may be eligible for a variety of deductions and credits. Standard deductions vary based on filing status, and additional deductions can be claimed for specific expenses, such as medical costs, property taxes, and charitable contributions. Tax credits, such as the Earned Income Tax Credit (EITC), can significantly reduce overall liability and should be thoroughly explored prior to filing.

. Step-by-step instructions for completing form CT-1040

A. Part : Personal information

In Part I of the Form CT-1040, taxpayers need to provide personal information. This includes your full name, address, and Social Security number. It's essential to ensure that all personal data is accurate to avoid delays or complications during processing.

B. Part : Filing status selection

Selecting the appropriate filing status is crucial as it can affect tax rates and deductions. The options are single, married filing jointly, married filing separately, and head of household. Each category has different implications, including how much of the income is taxable.

. Part : Income reporting

Part III focuses on income reporting; taxpayers must accurately disclose all sources of income. This includes both earned income, such as wages and salaries, and unearned income like interest and dividends. Keeping a record of all sources will ensure precise reporting.

. Part : Adjustments to income

In Part IV, taxpayers can claim allowable adjustments to income, which can help reduce taxable income. Common adjustments include contributions to traditional IRAs or student loan interest. Understanding how these adjustments work can significantly affect your net tax liability.

E. Part : Deductions and credits

Finally, Part V requires a careful walkthrough of deductions and credits. Taxpayers need to detail their deductions accurately to maximize tax benefits. This may include providing documentation for medical expenses, educational expenses, or dependent care costs.

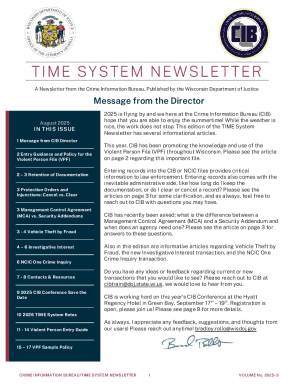

. Tips for efficient form management

Utilizing modern tools like pdfFiller can substantially ease the process of filling out and submitting the Form CT-1040. pdfFiller provides a cloud-based document management system that allows for easy editing and signing without the hassle of printing and scanning. This service offers robust features for those who want to ensure their forms are submitted accurately and on time.

. Common mistakes to avoid when filing form CT-1040

Errors when reporting income are common pitfalls that can lead to audit triggers or delayed processing. Taxpayers often misstate income figures or fail to include all sources. Furthermore, incorrectly claiming deductions or credits can mitigate potential savings, necessitating a careful review before submission.

. Post-filing considerations

After you’ve submitted your Form CT-1040, understanding the timeline for refunds or payments is essential. If a refund is owed, taxpayers can typically expect processing within a few weeks, depending on the submission method. If taxes are owed, payment options include direct withdrawal, credit card payments, or checks.

B. Amending your CT-1040

If you discover an error after filing, it’s crucial to know how to amend your CT-1040. This is accomplished through Form CT-1040X, where you can indicate the reasons for the changes and provide corrections. Proactive approaches to mistakes can save taxpayers from escalating penalties.

. Record-keeping best practices

Maintaining good records is an essential practice after filing. Taxpayers should hold onto their documentation for at least three years. This ensures easy access in case of audits, refund claims, or future filings that require previous year's data. Using a cloud-based platform like pdfFiller can help in organizing and securing these documents efficiently.

. Connecticut state tax resources

For any questions regarding the Form CT-1040 or specific tax situations, taxpayers should know where to find assistance. The Connecticut Department of Revenue Services offers resources online and via contact centers, ensuring that residents can access information specific to their needs.

. Utilizing pdfFiller for ongoing document management

pdfFiller excels as a cloud-based document solution, offering users the ability to manage important tax documents year-round. It not only simplifies editing and signing but also streamlines sharing capabilities, making it easier to collaborate with tax professionals or family members during the filing season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form ct-1040 connecticut resident directly from Gmail?

How can I send form ct-1040 connecticut resident to be eSigned by others?

How do I complete form ct-1040 connecticut resident on an iOS device?

What is form ct-1040 connecticut resident?

Who is required to file form ct-1040 connecticut resident?

How to fill out form ct-1040 connecticut resident?

What is the purpose of form ct-1040 connecticut resident?

What information must be reported on form ct-1040 connecticut resident?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.