Get the free The Corporate Transparency Act: What you need to know ...

Get, Create, Make and Sign form corporate transparency act

Editing form corporate transparency act online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form corporate transparency act

How to fill out form corporate transparency act

Who needs form corporate transparency act?

How to Navigate the Corporate Transparency Act Form: A Comprehensive Guide

Overview of the Corporate Transparency Act

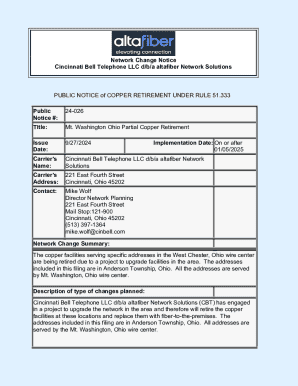

The Corporate Transparency Act (CTA) was implemented to enhance transparency in the corporate sector by requiring certain entities to disclose their beneficial ownership information. Enacted as part of the Anti-Money Laundering Act of 2020, the CTA aims to combat the illicit financing that often occurs through the use of anonymous companies. This groundbreaking legislation impacts both domestic and foreign entities operating in the United States, promoting a culture of accountability and responsibility among business owners.

On a practical level, the act mandates that companies engaged in certain business activities must file a Corporate Transparency Act form with the Financial Crimes Enforcement Network (FinCEN). By instituting this requirement, the government aims to diminish the opportunities for money laundering and other financial crimes that thrive on secrecy and lack of accountability. The act represents a significant shift in the regulatory landscape, compelling businesses to be more open and transparent about their ownership structures.

Who is required to file a Corporate Transparency Act form?

Under the Corporate Transparency Act, specific criteria determine which entities are required to file a Corporate Transparency Act form. A 'reporting company' is defined as any corporation, limited liability company, or similar entity created under U.S. federal or state law or registered to do business in the United States. Moreover, there are threshold criteria that differentiate small businesses from larger entities, primarily based on the number of employees and revenue thresholds.

Small businesses with fewer than 20 employees and less than $5 million in revenue are less likely to be classified as reporting companies. However, many factors contribute to the determination, necessitating careful assessment of your business operation. Importantly, some entities are exempt from filing requirements, such as larger companies, certain regulated entities like banks and credit unions, and government-owned entities. Understanding these nuances is key to compliance with the CTA and avoiding penalties.

Understanding beneficial ownership information

Beneficial ownership information refers to the identity of individuals who ultimately own or control a company. According to the CTA, a beneficial owner is defined as any individual who, directly or indirectly, exercises substantial control over a reporting company or owns at least 25% of its ownership interests. Clear identification of these individuals is vital, as their information contributes to enhancing transparency and reducing the likelihood of corporate entities being used for illicit purposes.

Accurate reporting of beneficial ownership information has far-reaching implications. Ethically, stakeholders demand a higher level of integrity from businesses, and non-compliance could expose companies to legal consequences, including substantial fines and penalties. Transparency in ownership not only complies with regulations but also enhances a company’s reputation and fosters trust with customers and investors. Thus, ensuring that ownership information is reported clearly and accurately is critical to maintaining compliance with the CTA.

How to file a Corporate Transparency Act form

Filing a Corporate Transparency Act form involves several key steps to ensure compliance with the regulations set forth by the CTA. The process begins with gathering the required information, including details about the reporting company and its beneficial owners. Collecting this information in advance enables a smoother filing experience. A checklist can help you ensure that you do not miss any critical details.

Next, you'll need to utilize the specific form designated for Corporate Transparency Act filings. Once you have the correct form, follow the detailed instructions to complete it accurately, providing all necessary information related to ownership and company structure. After completing the form, you'll have options for submission, which typically include online submission through the FinCEN website or paper filing via mail. Be sure to track your submission status and follow up on any communications from FinCEN regarding your filing.

Common challenges and solutions

Many businesses encounter common challenges when filing their Corporate Transparency Act form. Among these challenges are errors often made during the filing process, such as incorrect or incomplete information. To mitigate these errors, it's crucial to double-check all entries and ensure that all required information is modified appropriately, particularly with respect to beneficial ownership. Additionally, seeking guidance from legal or compliance professionals can help eliminate uncertainties in the filing process.

If you realize that you've submitted incorrect information, an amendment process is available to update your filings. FinCEN has outlined specific procedures for making revisions to previously submitted forms. In the event of a rejection or a request for clarification from FinCEN, companies should promptly address any issues raised and provide the necessary clarification or documentation requested. These proactive measures can help ensure that your company remains compliant and avoids potential penalties.

Tools and resources for streamlined filing

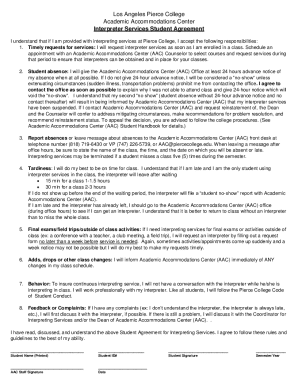

When it comes to filing a Corporate Transparency Act form, leveraging tools like pdfFiller can significantly streamline the process. pdfFiller offers robust features that facilitate the editing and eSigning of documents, making it simple to create and manage your Corporate Transparency Act forms. The platform also includes collaborative tools that enable teams to work together seamlessly, ensuring that all necessary information is collected and reported accurately.

Moreover, pdfFiller provides access to interactive templates specifically designed for Corporate Transparency Act filings, alongside a checklist feature that helps users verify that every detail is accurate before submission. These tools can enhance the filing experience, making it not only more efficient but also less stressful, as users can ensure compliance in a timely manner.

Additional considerations

Filing deadlines for the Corporate Transparency Act forms are crucial for compliance. Businesses must be aware of specific deadlines to avoid penalties for late submission. The initial filing requirement dictates that newly formed entities must submit their Corporate Transparency Act form shortly after formation, while established companies must comply with the CTA filing requirements within a specified timeframe to remain in good standing.

Furthermore, understanding the implications of non-compliance is paramount. Companies that fail to file or provide inaccurate information may face substantial penalties, including fines and potential legal repercussions. Keeping abreast of updates to the act or future changes is essential, as regulatory bodies like the Department of the Treasury may amend rules or implement additional requirements that could impact your filing obligations.

Best practices for document management post-filing

Once you have successfully filed your Corporate Transparency Act form, maintaining organized documentation is essential. Proper storage and security of these documents ensure that you can provide requested information to regulatory agencies easily and efficiently. Recommendations include implementing a secure cloud-based document management system to store your filings and related ownership information, allowing easy access for authorized personnel.

Additionally, regular audits of your compliance status can be beneficial. This involves reviewing your documented information periodically to ensure it remains current and accurate, especially if there are changes in ownership or business operations. Staying proactive about compliance not only preserves your company’s standing but also reinforces your dedication to transparency and ethical practices in business.

Conclusion

Navigating the Corporate Transparency Act form may seem daunting, but with the right approach, it can be a straightforward process. By understanding the requirements, deadlines, and associated best practices, businesses can ensure compliance while fostering a culture of transparency. Leveraging platforms like pdfFiller can enhance this experience, allowing users to manage their filing requirements seamlessly from any location. The overall impact of the Corporate Transparency Act will be felt in increased accountability within the corporate ecosystem, which benefits all stakeholders involved.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form corporate transparency act?

How do I edit form corporate transparency act straight from my smartphone?

Can I edit form corporate transparency act on an iOS device?

What is form corporate transparency act?

Who is required to file form corporate transparency act?

How to fill out form corporate transparency act?

What is the purpose of form corporate transparency act?

What information must be reported on form corporate transparency act?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.