Get the free FLSA Exempt Status for Fire Dept Assistant Chiefs Explained

Get, Create, Make and Sign flsa exempt status for

Editing flsa exempt status for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out flsa exempt status for

How to fill out flsa exempt status for

Who needs flsa exempt status for?

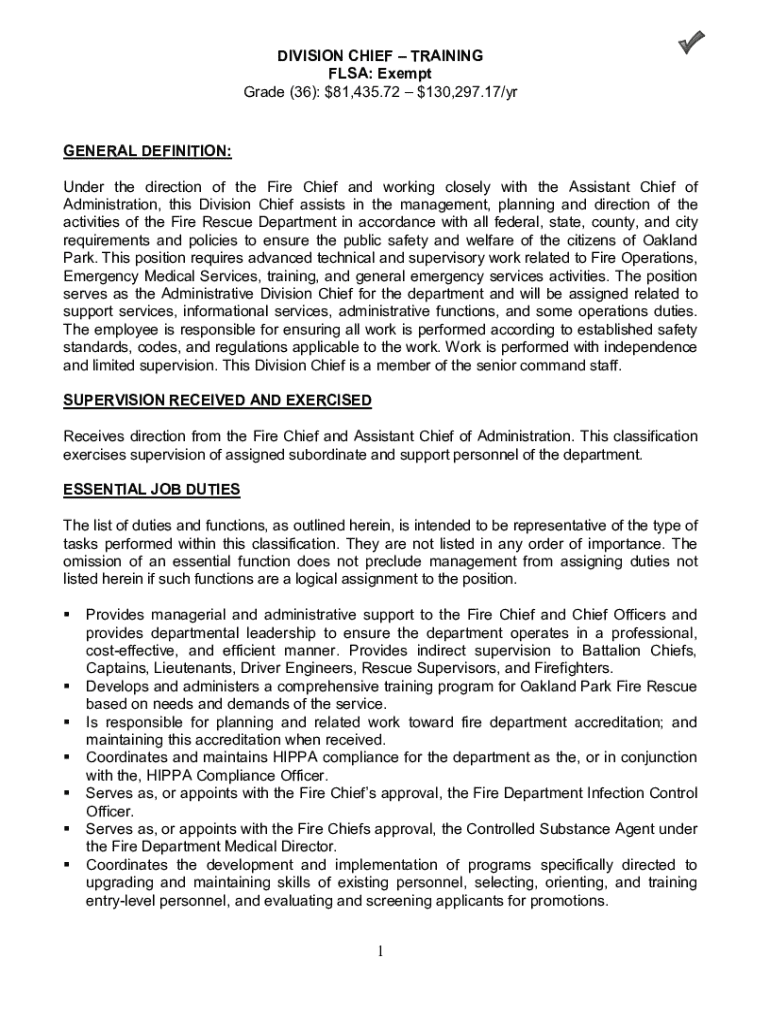

FLSA Exempt Status for Form: A Comprehensive Guide

Understanding FLSA exempt status

The Fair Labor Standards Act (FLSA) is a federal law that establishes minimum wage, overtime pay eligibility, recordkeeping, and youth employment standards. Understanding the FLSA exempt status is crucial for employers and employees alike. This status distinguishes between exempt and non-exempt employees, affecting overtime pay and benefits.

Exempt employees are not entitled to overtime pay, while non-exempt employees are. This distinction plays a vital role in workplace compensation structures. For employers, correctly classifying workers is essential not only for compliance but for ensuring a fair workplace. For employees, it impacts their earnings and work conditions.

Types of FLSA exempt employees

FLSA outlines several categories for exempt employees, each with unique criteria. Understanding these categories can help determine exemption applicability.

Determining FLSA exempt status

To determine a position's FLSA exempt status, employers should conduct a thorough analysis of job descriptions and salary levels. This process typically involves assessing job duties and the independence of the employee within their role.

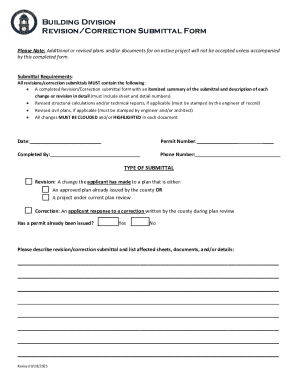

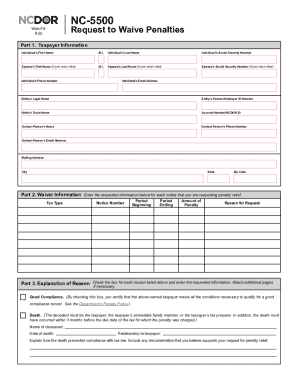

Completing the FLSA exempt status form

Filling out the FLSA exempt status form requires precision and attention to detail. Here’s a step-by-step guide to assist you in this process.

Common mistakes and misconceptions

Navigating the complexities of FLSA exempt status can be challenging, often resulting in misunderstandings and misclassifications. It’s essential for employers and HR professionals to clarify these common issues.

Legal considerations and compliance

Understanding FLSA compliance is vital for businesses to avoid penalties. Misclassification can lead to significant financial consequences, including back pay and legal fees.

Keeping updated with FLSA regulations

Staying informed about changes to FLSA regulations is critical in maintaining compliance and ensuring that organizational policies reflect current law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the flsa exempt status for electronically in Chrome?

How do I edit flsa exempt status for straight from my smartphone?

How do I edit flsa exempt status for on an Android device?

What is flsa exempt status for?

Who is required to file flsa exempt status for?

How to fill out flsa exempt status for?

What is the purpose of flsa exempt status for?

What information must be reported on flsa exempt status for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.