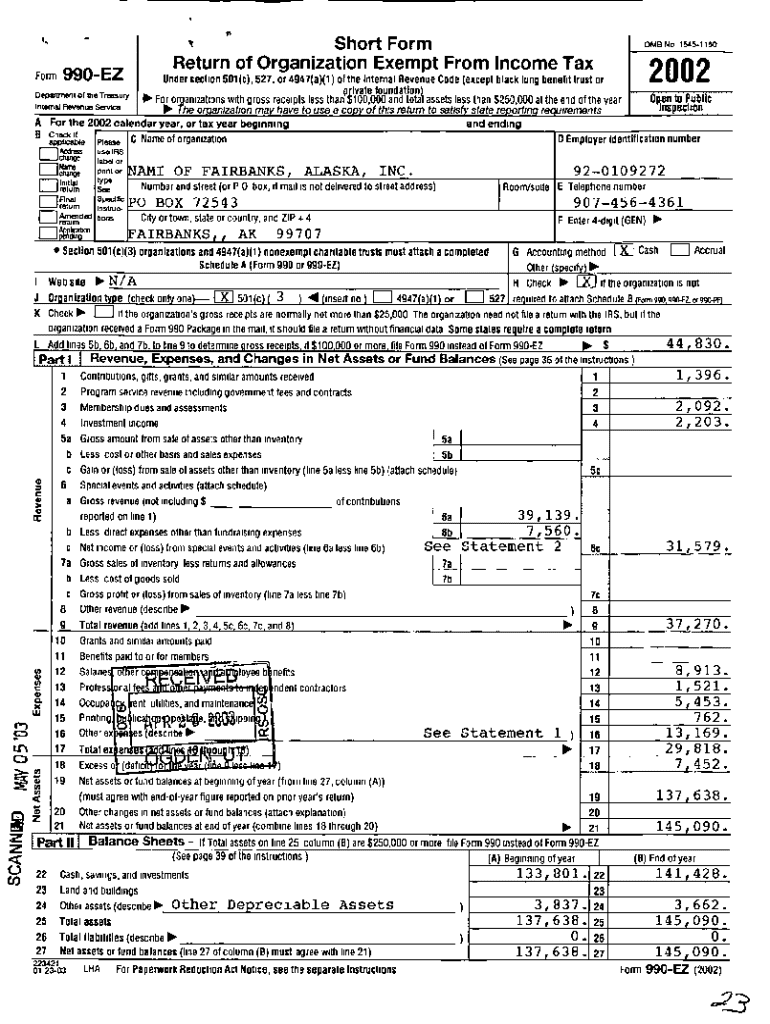

Get the free Form 990-EZ ". Short Form Return of Organization Exempt From ...

Get, Create, Make and Sign form 990-ez quot short

Editing form 990-ez quot short online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez quot short

How to fill out form 990-ez quot short

Who needs form 990-ez quot short?

Form 990-EZ: Short Form How-to Guide

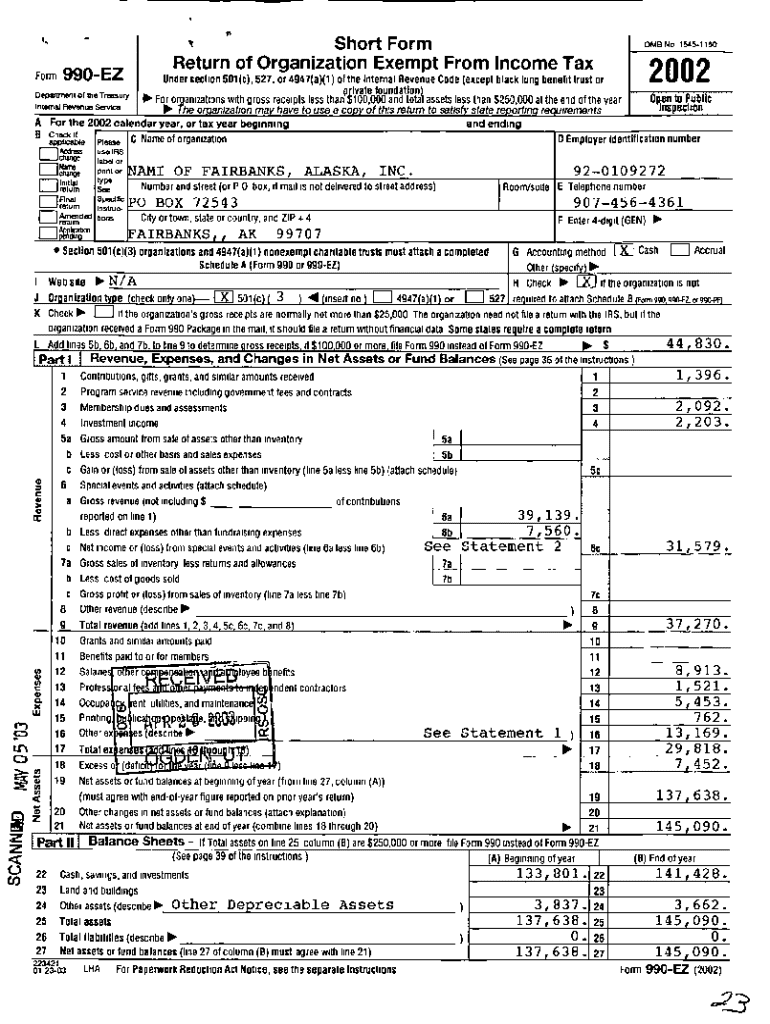

Overview of IRS Form 990-EZ

Form 990-EZ is a streamlined version of the longer Form 990 used by tax-exempt organizations to report their financial information to the IRS. It is specifically designed for smaller organizations with total annual revenues under $200,000, streamlining the filing process while still satisfying the IRS requirements.

The primary difference between Form 990 and Form 990-EZ lies in the complexity and depth of the information required. While Form 990 requires extensive disclosures and is suitable for larger organizations, Form 990-EZ simplifies these requirements, ideal for smaller entities looking to maintain compliance without an overwhelming documentation burden.

Who should file Form 990-EZ?

Eligibility to file Form 990-EZ depends on specific criteria. Primarily, organizations must have gross receipts less than $200,000 or total assets under $500,000 at the end of the year. Organizations such as charitable foundations, educational entities, and service clubs often find themselves in this category.

Failing to file Form 990-EZ can result in penalties, including the risk of losing tax-exempt status, which can significantly impact an organization’s ability to raise funds and operate effectively. On the other hand, timely and accurate filing can enhance credibility and trust with donors and the public, showcasing transparency and accountability.

Step-by-step guide to completing Form 990-EZ

Filing Form 990-EZ necessitates preparation and accurate data. Start by gathering critical information like your organization’s Employer Identification Number (EIN), financial records from the previous year, and documentation pertaining to any program services that were conducted. This foundational step is crucial for ensuring completeness and accuracy while filling out the form.

Once you have gathered necessary materials, access Form 990-EZ through pdfFiller. The platform streamlines your ability to fill, edit, and sign documents. Digital access means you can work on the form anytime and anywhere, facilitating a collaborative approach if you need input from other team members.

Part breakdown of Form 990-EZ

After completing the form, it's essential to review the information meticulously to ensure accuracy. Utilize pdfFiller's review tools to double-check for any errors or omissions in your submissions, ensuring that all numbers and data match your financial records.

Finally, you can file Form 990-EZ through e-filing on the IRS website or send it by mail. Opting for e-filing can expedite the processing time and confirm submission immediately compared to postal delivery.

Understanding extensions and amendments

Organizations sometimes encounter challenges that delay their ability to file Form 990-EZ on time. In such cases, it’s important to know that you can request an extension. By filing IRS Form 8868, organizations can secure an automatic six-month extension to address their filing needs. However, even with an extension, organizations must pay any due taxes to avoid incurring penalties.

If changes need to be made after filing, organizations can amend their form. This process involves filling out Form 990-EZ again with the corrected data, marking it as ‘amended.’ It's important to adhere to IRS guidelines and timeframes when making these amendments to prevent further penalties or compliance issues.

Common questions and challenges

One common concern for organizations is the fear of losing tax-exempt status if they fail to file for three consecutive years. Under IRS guidelines, such failing can automatically result in revocation of your tax-exempt status, emphasizing the need for consistent filing.

Another common query is whether Form 990-EZ can be filed electronically. Yes, IRS allows electronic submissions, making it easier to manage. If organizations face issues with filing or encounter technical problems, pdfFiller offers strong support solutions, providing troubleshooting assistance to work through common challenges effectively.

Maximizing compliance and efficiency

Utilizing pdfFiller can enhance document management for Form 990-EZ. Its features, such as eSigning and collaborative capacities, streamline the filing process, reducing the workload on staff while ensuring compliance with IRS requirements. This allows teams to work together from different locations, ensuring that everyone can contribute to accurate and timely submissions.

For non-profits, maintaining organization and compliance year-round is crucial. Implementing best practices such as maintaining financial records digitally, scheduling reminders for filing deadlines, and conducting regular reviews of IRS guidelines can keep organizations on track. This organized approach assures that all state payroll forms and tax documents are in order, ready for any necessary IRS submissions.

Resources and tools

pdfFiller offers interactive tools specifically designed to assist with Form 990-EZ. These include calculators for estimating tax obligations and customizable templates for various forms. Such resources are invaluable for non-profits looking to ensure accuracy in their documentation.

Additionally, as IRS regulations change, remaining informed is critical. pdfFiller provides users with updates and notifications about relevant changes, ensuring that organizations are aware of new regulations and compliance issues as they arise. This proactive approach facilitates better organizational preparedness and reduces the risk of lapses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in form 990-ez quot short without leaving Chrome?

Can I create an electronic signature for the form 990-ez quot short in Chrome?

How do I complete form 990-ez quot short on an iOS device?

What is form 990-ez short?

Who is required to file form 990-ez short?

How to fill out form 990-ez short?

What is the purpose of form 990-ez short?

What information must be reported on form 990-ez short?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.