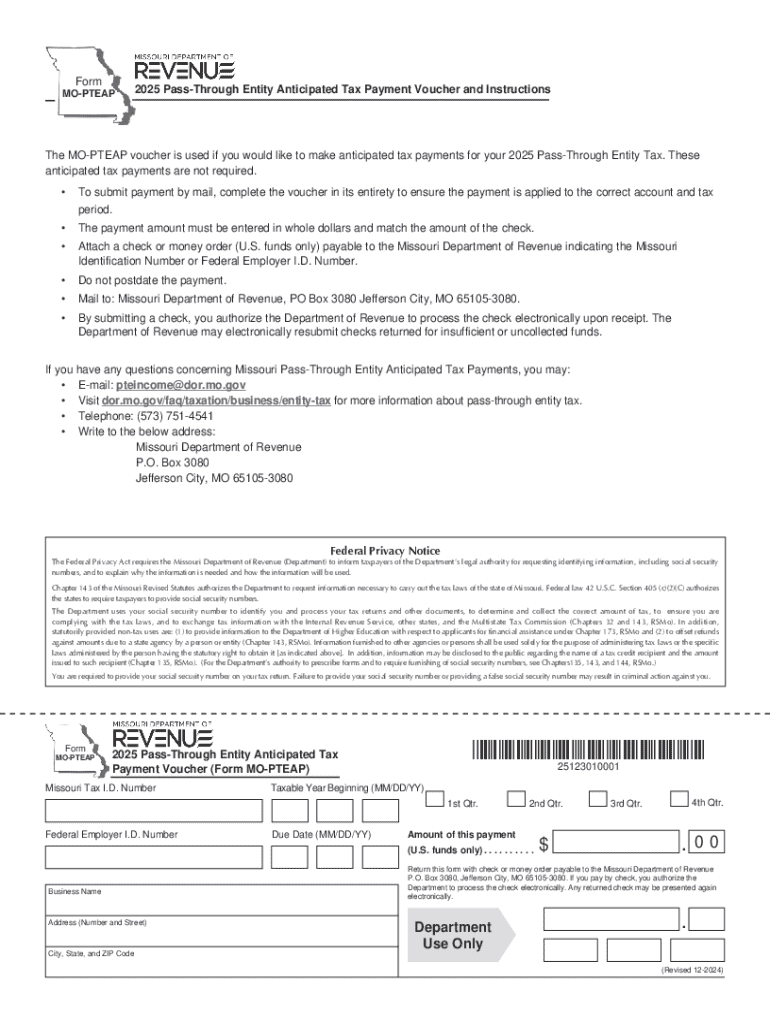

Get the free MO-PTEAP Pass-through Entity Anticipated Tax Payment Voucher ... - dor mo

Get, Create, Make and Sign mo-pteap pass-through entity anticipated

How to edit mo-pteap pass-through entity anticipated online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mo-pteap pass-through entity anticipated

How to fill out mo-pteap pass-through entity anticipated

Who needs mo-pteap pass-through entity anticipated?

Comprehensive Guide to the MO-PTEAP Pass-Through Entity Anticipated Form

Overview of the MO-PTEAP Pass-Through Entity Anticipated Form

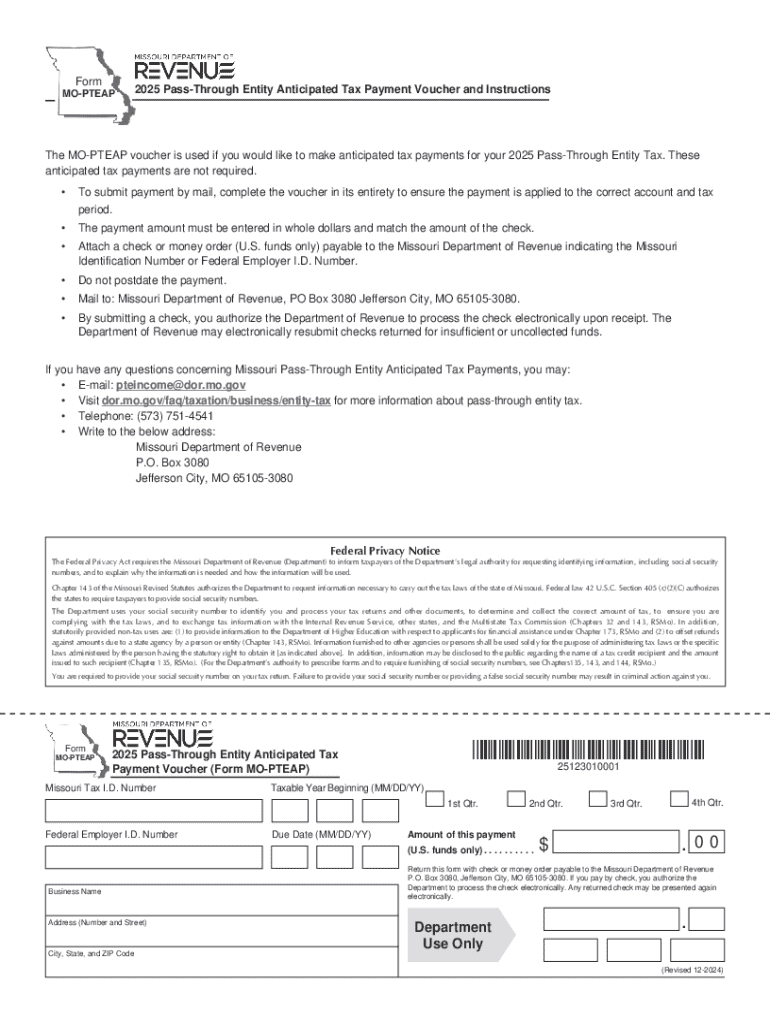

The MO-PTEAP Pass-Through Entity Anticipated Form is an essential document that streamlines tax filing processes for pass-through entities operating in Missouri. This form serves as an anticipated income tax return, allowing entities like partnerships, S corporations, and LLCs to efficiently report income and avoid potential penalties due to underpayment. Its significance lies in its ability to meet the compliance requirements set by the Missouri Department of Revenue.

Utilizing the MO-PTEAP form presents key benefits, particularly in enhancing the transparency of financial operations. By providing a comprehensive overview of the entity’s anticipated income, this form aids in establishing clearer communication with stakeholders, including investors and tax authorities. Furthermore, it helps entities to accurately estimate tax obligations, ultimately avoiding unexpected tax liabilities during the filing process.

Eligibility and Requirements

Understanding who should utilize the MO-PTEAP form is paramount for compliance. Entities required to file this form include partnerships, S Corporations, and limited liability companies that choose to elect taxation as pass-through entities. The form must be completed whenever these entities expect to owe taxes based on their income for the year, providing a predictable approach to tax contributions.

Before filing, entities must ensure they have the necessary documentation and information at hand. Key prerequisites include having accurate financial records, tax identification numbers, and details of all partners or shareholders. Additionally, preparation should also involve familiarizing oneself with potential pitfalls; common mistakes include errors in income reporting, overlooked deductions, and missing signatures. Such oversights can lead to complications in tax compliance and increased liability.

Step-by-Step Guide to Filling Out the MO-PTEAP Form

Filling out the MO-PTEAP form involves several critical steps. Start with the preparation stage — gather entity information, financial details, and necessary documentation such as prior year tax returns or estimated income data. Accumulating all required data beforehand facilitates smoother completion and diminishes errors in submissions.

Each section of the form needs careful attention. For instance, the Entity Information section requires legal names, addresses, and tax identification numbers. When it comes to Income Information, accurately reporting income from various sources is essential to avoid penalties. Details concerning deductions and credits need to be separately documented, alongside specific pass-through information connected to partners. Finally, ensure the form is signed appropriately before submission through designated eSign processes.

Editing and managing your MO-PTEAP form

Efficient document management is crucial, especially when handling vital forms such as the MO-PTEAP. pdfFiller provides robust editing capabilities, allowing users to modify their forms even after initial completion. Users can easily access the pdfFiller platform to revise document content, ensuring accuracy before final submission.

If errors are noticed post-submission, users can amend their MO-PTEAP forms with straightforward procedures. The ability to track changes ensures that all alterations are logged, promoting organizational transparency and accountability during the tax preparation process.

Collaboration features for teams

For teams working collaboratively on the MO-PTEAP form, effective communication tools can enhance operational efficiency. pdfFiller offers features that allow users to share forms with colleagues quickly, enabling collective efforts in filling out the form. This functionality ensures that all team members are aligned and informed regarding their responsibilities.

Moreover, users can leverage comments and notes directly within the document to discuss changes or share insights, significantly improving collaboration. With continuous updates and changes tracked within the system, every member remains informed about the form's progression, minimizing confusion and promoting timely submissions.

eSigning the MO-PTEAP form

Today, eSigning is integral in expediting document processes, including the MO-PTEAP form. Familiarity with eSignature requirements ensures compliance and enhances convenience. The process involves preparing the document correctly for signature, which may include verifying the signer’s identity and ensuring all information is complete before finalizing.

It's crucial to understand the legal considerations surrounding eSigning pass-through entity forms. Validity depends on adherence to state laws regarding electronic signatures. Familiarizing oneself with these guidelines positions individuals adequately should a query arise during audits or by tax authorities.

Landing and using the form: accessing from anywhere

Accessibility of the MO-PTEAP form is essential for efficiency, particularly for businesses operating remote or hybrid models. Cloud-based solutions simplify document access, ensuring that entities can retrieve necessary forms anytime and anywhere. This convenience ensures that tax deadlines are met without the burden of locating physical documents.

Using pdfFiller for the MO-PTEAP form brings added advantages. Features such as mobile access and real-time data saving cater to users' needs on the go, enhancing flexible work environments. Security remains a top priority, with advanced protocols in place to protect sensitive information, making it a user-friendly and safe choice for managing tax documents.

Common FAQs regarding the MO-PTEAP form

Navigating the intricacies of the MO-PTEAP form may raise questions. One common concern involves missed filing deadlines; it’s critical to know that late filings could incur penalties. To mitigate these risks, proactive planning and ensuring all documents are submitted on time can alleviate potential issues.

Another frequently asked question pertains to the differences between individual and entity filing. Understanding that pass-through entities avoid double taxation by passing income directly to partners is essential. Inquiries from tax authorities can also arise, necessitating a clear communication strategy; being prepared with organized records can facilitate prompt and effective responses.

Conclusion: making the most of your MO-PTEAP form

In summary, the MO-PTEAP Pass-Through Entity Anticipated Form is a vital tool for effective tax management for pass-through entities in Missouri. Understanding its operational nuances aids entities in coping with the complexities of compliance and alleviates tax-related stress. The advantages of utilizing tools such as pdfFiller cannot be overstated, as they empower users to efficiently manage documents, collaborate with teams, and ensure timely compliance.

By embracing the functionalities available through pdfFiller, entities can position themselves for streamlined tax processes and enhanced visibility into their financial standing, leading to better strategic decision-making. Ongoing support services also constitute valuable resources for users, ensuring they have assistance readily available when needed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mo-pteap pass-through entity anticipated in Gmail?

How do I make edits in mo-pteap pass-through entity anticipated without leaving Chrome?

Can I edit mo-pteap pass-through entity anticipated on an Android device?

What is mo-pteap pass-through entity anticipated?

Who is required to file mo-pteap pass-through entity anticipated?

How to fill out mo-pteap pass-through entity anticipated?

What is the purpose of mo-pteap pass-through entity anticipated?

What information must be reported on mo-pteap pass-through entity anticipated?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.