Get the free Get ready for annual open enrollment

Get, Create, Make and Sign get ready for annual

How to edit get ready for annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out get ready for annual

How to fill out get ready for annual

Who needs get ready for annual?

Get ready for annual form: Your comprehensive guide

Understanding the importance of annual forms

Annual forms are essential not just for compliance, but for a thorough understanding of your financial and legal standing. They hold significant weight in many aspects of personal and business decision-making and can affect everything from loans to tax liabilities. Failure to submit these forms accurately or on time can result in severe penalties, thus emphasizing their importance.

Legal implications are perhaps the most prominent factor when it comes to annual forms. Businesses must provide transparent financial records to remain compliant with state and federal regulations. Individuals, too, must complete their forms properly to avoid fines or future complications concerning their financial records.

Key elements typically required in annual forms

While the specific requirements can differ between forms and industries, all annual forms will generally require certain fundamental elements. Personal information like your name, address, and contact details is standard. Financial records, including income, expenses, and assets, constitute the bulk of any form. The need for signatures and certifications adds another layer of responsibility, ensuring the integrity of the information provided.

Preparing for the annual form process

Preparation is half the battle when it comes to filling out your annual form. Start by making a checklist of required documents to minimize stress and chaos as deadlines loom. Commonly requested documents include W-2s, 1099s, bank statements, and previous year’s tax returns.

Once you’ve gathered your documents, organizing them is crucial. Create categorized folders, either digitally or in physical form, to streamline the task of filling out your annual form. Digital storage systems make it easier to access and back up essential information, further reducing the likelihood of errors.

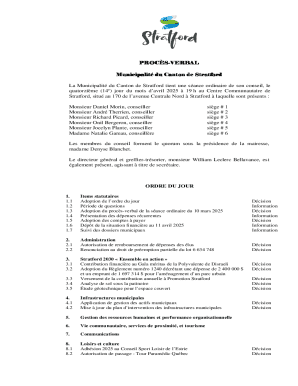

Understanding the timeline

Setting a timeline is equally as important. Knowing key dates and deadlines will help you pace your preparation effectively. For instance, many tax-related forms need to be completed by April 15 each year, which gives individuals ample time to gather their documents and complete the form. Use alarms or calendar reminders to track tasks and avoid last-minute scrambles.

Step-by-step guide to filling out your annual form

Breaking down the form into digestible sections makes the process less intimidating. Begin with personal information. Ensure you provide accurate details but confirm you aren't sharing unnecessary information. For financial information, accuracy is paramount; double-check against your source documents to avoid potential legal issues or delays.

Pay close attention to areas where errors commonly occur. Small mistakes can derail the entire submission, so take the time to verify your entries against your source documents. By doing so, you ensure you fully comply with required certifications and regulations.

Utilizing technology for efficient form management

Leveraging technology can drastically streamline your form-filling process. Platforms like pdfFiller simplify editing PDFs, allowing users to directly input and correct information wherever needed. This ensures you can make necessary changes without creating multiple versions of the same document.

Additionally, utilize interactive tools such as checklists for document completion and templates specific to your form type to guide you through the filling process, ensuring you don’t overlook critical information.

Collaboration and sharing options

If you're filling out annual forms as a team or with an advisor, collaboration is key. Platforms like pdfFiller allow you to set up document shares for collaborative input. Review changes and comments in real-time, enabling you to finalize documents with valuable insights from various contributors.

When it’s time to send your completed form, ensure you follow best practices for sharing sensitive information. Use encrypted emails or secure platforms when submitting documents electronically to minimize the risk of data breaches.

After submission: Ensuring compliance and storing your documents

Once your annual form has been submitted, it’s equally important to confirm that it has been received. Keep a record of submission receipts, and regularly check back with the relevant institution to ensure your documents are processed without issues.

Equally critical is how you store your documents post-submission. Create organized digital folders for easy retrieval, and implement regular backups to avoid losing critical data. This also prepares you for any future audits that might arise.

Anticipating changes for next year’s form

Taking a moment to reflect on the current year's submission can yield valuable insights for next year. Consider what worked well and what caused stress, enabling you to plan your efforts more effectively moving forward.

Additionally, stay informed about any new requirements that may affect the form. Constantly track industry trends and regulatory updates to avoid any unpleasant surprises as deadlines approach, ensuring you’re fully prepared for the next cycle.

Frequently asked questions (FAQs)

Common concerns regarding annual forms often stem from uncertainties about the correct procedures. For instance, what if you make a mistake on the form? The best course of action is to address errors promptly, as most organizations allow for amendments under specific conditions.

Unique scenarios can complicate the form-filling process. If you have a complex financial situation or work in a specific profession that requires additional certifications, consult with an expert to ensure you're meeting all necessary guidelines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify get ready for annual without leaving Google Drive?

Can I edit get ready for annual on an iOS device?

How do I complete get ready for annual on an iOS device?

What is get ready for annual?

Who is required to file get ready for annual?

How to fill out get ready for annual?

What is the purpose of get ready for annual?

What information must be reported on get ready for annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.