Get the free U MICROFINANCE BANK LIMITED STATEMENT OF FINANCIAL ...

Get, Create, Make and Sign u microfinance bank limited

Editing u microfinance bank limited online

Uncompromising security for your PDF editing and eSignature needs

How to fill out u microfinance bank limited

How to fill out u microfinance bank limited

Who needs u microfinance bank limited?

A comprehensive guide to the u microfinance bank limited form

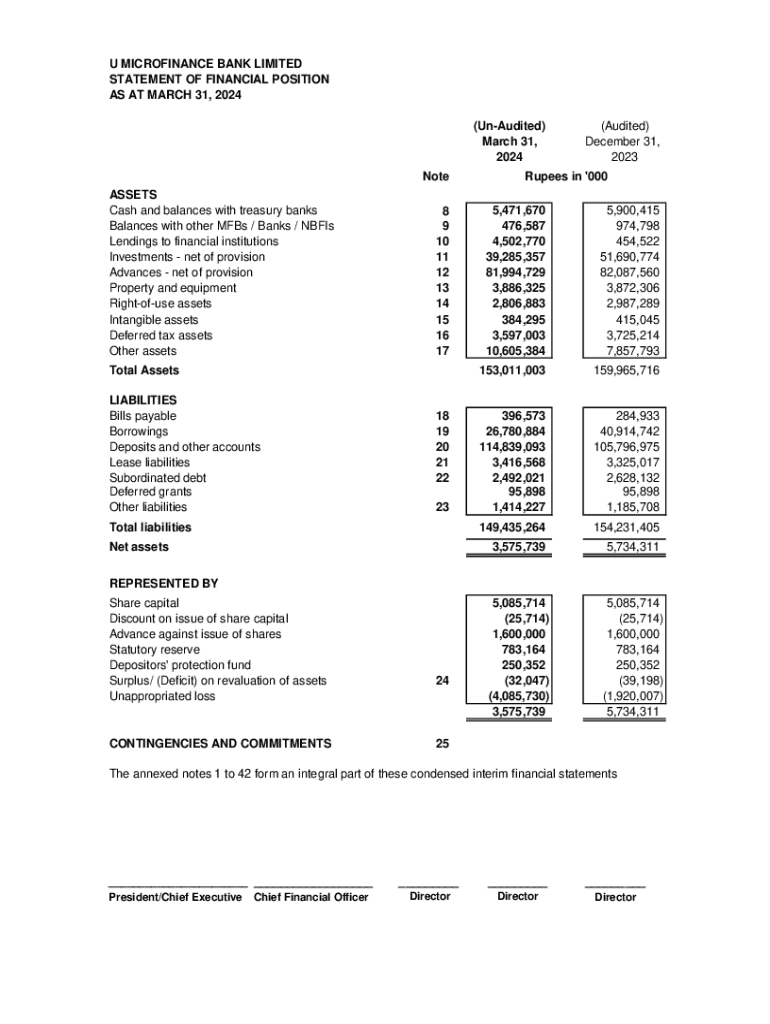

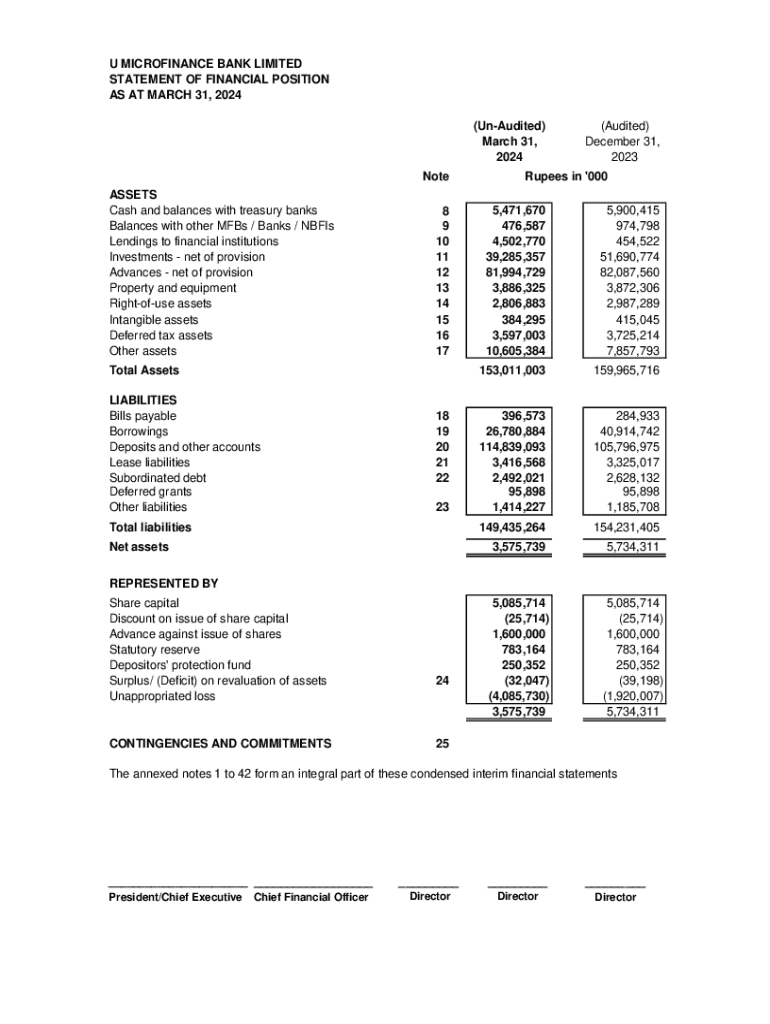

Overview of u Microfinance Bank Limited Form

The u Microfinance Bank Limited form serves as a pivotal document for individuals seeking financial assistance or investment from the bank. Designed to streamline the application process, it captures essential information necessary for assessing the borrower's eligibility for various financial products and services.

Utilizing the correct version of this form is crucial, as errors or outdated forms can lead to delays or rejections. By ensuring compliance with the latest requirements, applicants stand a better chance of securing the needed support in a timely manner.

Key features of the u Microfinance Bank Limited form include the detailed sections for personal and financial information, as well as clear instructions guiding applicants through the completion process. This systematic approach fosters transparency and accuracy, which are vital for both the bank and the applicant.

Understanding the u Microfinance Bank Limited Form Structure

The structure of the u Microfinance Bank Limited form is organized into distinct sections, each addressing specific areas of inquiry. This aids both the bank's evaluation team and the applicants in facilitating a comprehensive review and clear communication.

Within the form, certain fields are marked as required, indicating they must be completed for the application to proceed, while others may be optional, allowing flexibility depending on the applicant's circumstances. Understanding this distinction ensures completeness and accuracy in submissions.

Step-by-step guide to filling out the u Microfinance Bank Limited form

Filling out the u Microfinance Bank Limited form accurately can significantly enhance the likelihood of loan approval. Here's a step-by-step guide to navigating this process efficiently.

Editing and modifying the u Microfinance Bank Limited form

Before submitting your application, editing is a crucial step that allows for correcting errors or ensuring clarity in responses. This can drastically improve the quality of your application.

Tools like pdfFiller are invaluable for this purpose. By accessing the form through pdfFiller, users can easily edit their documents with a range of available features designed for efficient output.

Signing the u Microfinance Bank Limited form

eSigning your application is an essential step in validating your submission and ensuring authenticity. The process is straightforward with the right tools.

pdfFiller’s eSignature feature simplifies this process, allowing you to affix your signature digitally and securely.

Submitting the u Microfinance Bank Limited form

After completing the form and affixing your signature, the final step is submission. This can be done through multiple avenues.

Tracking your application status is often possible through options provided by the bank, ensuring you remain informed throughout.

Frequently asked questions about the u Microfinance Bank Limited form

Navigating the application process can raise numerous questions. Here are answers to common inquiries regarding the u Microfinance Bank Limited form.

Additional tips for a successful application

Providing a coherent and accurate application significantly boosts the chances of swift approval. Here are some strategies to enhance your submission.

User feedback and testimonials

Feedback from individuals who have navigated the u Microfinance Bank Limited form can provide insight and encouragement for future applicants.

Many users have reported a streamlined experience when using pdfFiller, highlighting its intuitive interface and robust document management capabilities as major benefits. The ease of access combined with reliable editing options allows users to submit their applications with confidence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute u microfinance bank limited online?

Can I create an electronic signature for the u microfinance bank limited in Chrome?

How do I edit u microfinance bank limited on an Android device?

What is u microfinance bank limited?

Who is required to file u microfinance bank limited?

How to fill out u microfinance bank limited?

What is the purpose of u microfinance bank limited?

What information must be reported on u microfinance bank limited?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.