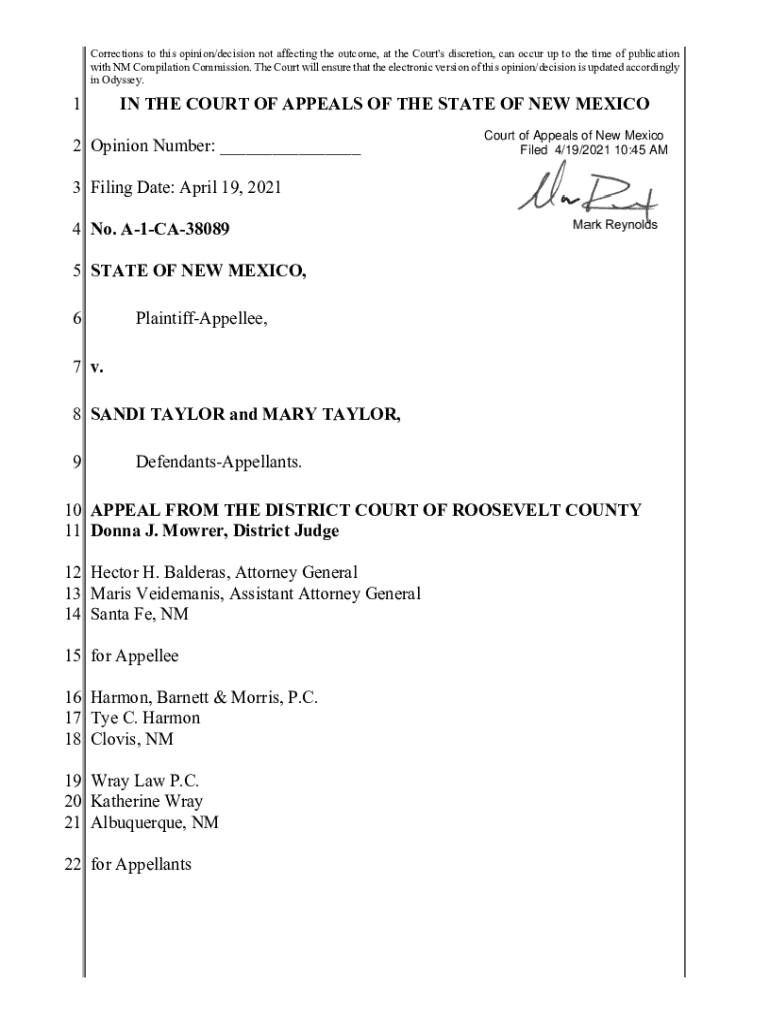

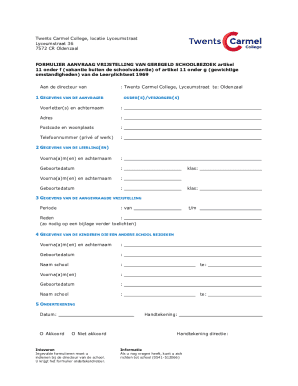

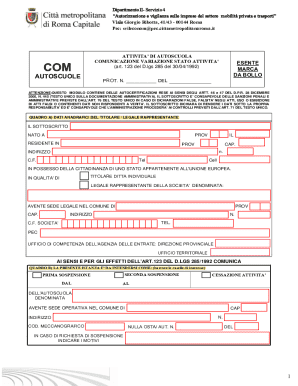

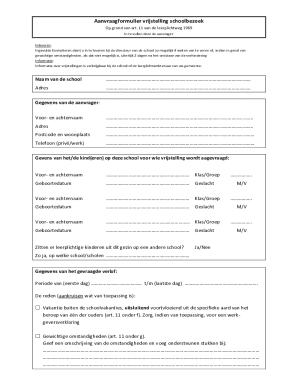

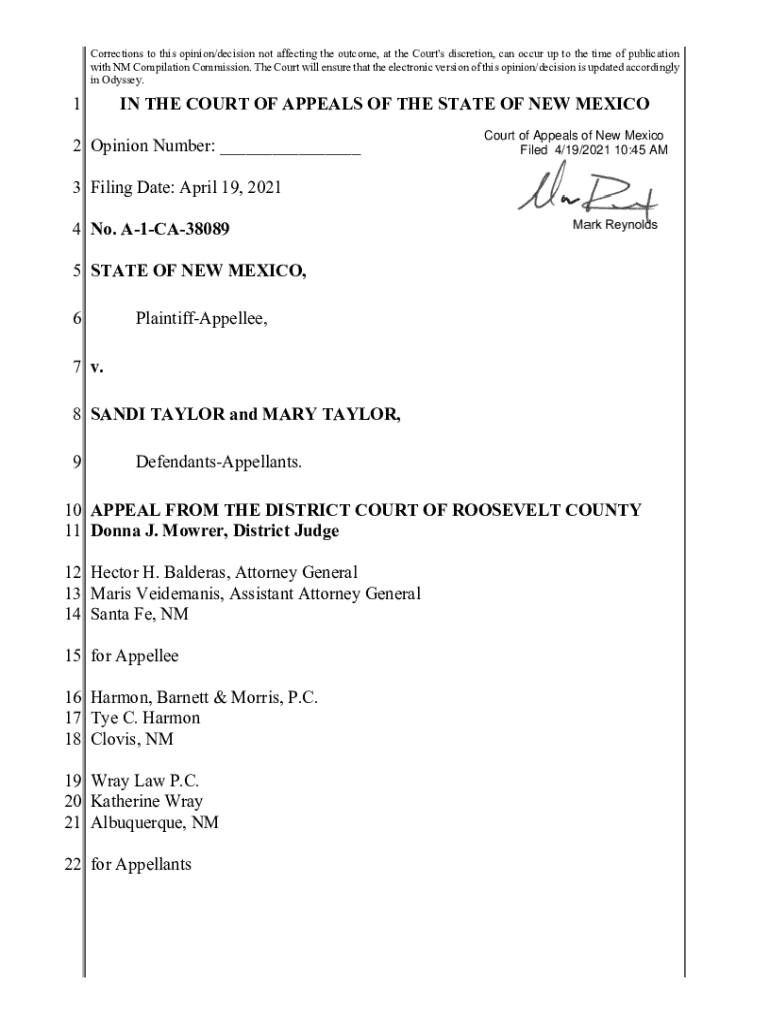

Get the free A-1-CA-38089 4-19-21 FILED FO, State v. Taylor, ZaMY - coa nmcourts

Get, Create, Make and Sign a-1-ca-38089 4-19-21 filed fo

How to edit a-1-ca-38089 4-19-21 filed fo online

Uncompromising security for your PDF editing and eSignature needs

How to fill out a-1-ca-38089 4-19-21 filed fo

How to fill out a-1-ca-38089 4-19-21 filed fo

Who needs a-1-ca-38089 4-19-21 filed fo?

A comprehensive guide to filing Form a-1-ca-38089

Understanding Form a-1-ca-38089

Form a-1-ca-38089 is a critical document that individuals and organizations need to file for various compliance and reporting purposes. It serves as a declaration of financial information in a structured format, ensuring that all necessary details are captured accurately. Filing this form accurately is not just a procedural formality; it represents a commitment to transparency and facilitates easier processing of financial data by authorities.

The importance of filing the a-1-ca-38089 accurately cannot be overstated. Errors in this document can lead to delays, penalties, or even legal issues. Understanding the contexts in which this form is used—be it for personal finances, business operations, or team collaborations—enables filers to prepare effectively and avoid common pitfalls.

Preparation steps before filling out Form a-1-ca-38089

Before diving into filling out Form a-1-ca-38089, it’s crucial to prepare adequately. Start by gathering all required documents and information that will be necessary for completing the form. This includes personal identification details such as your full name, Social Security number, and address, as well as financial records like income statements, expense reports, and account information.

Additionally, understanding the specific terminology used in the form is vital for accurate completion. Being familiar with terms like ‘gross income’, ‘net expenses’, and ‘reportable assets’ will help you avoid confusion and ensure that you are providing the correct information where needed.

Step-by-step instructions for completing Form a-1-ca-38089

Completing Form a-1-ca-38089 can seem daunting, but breaking it down into sections makes the process manageable. The first section requires your personal information. Ensure you fill out your name, address, and contact details accurately; any discrepancies here can lead to administrative issues.

The financial overview section is crucial for reporting income and expenses. Here, you must itemize your income streams and detail your expenses thoroughly. Accuracy is paramount in this section, as errors can trigger audits or additional inquiries.

Finally, the additional disclosures section is where you provide any extra pertinent information that may affect the assessment of your financial profile. Be judicious about what you include, omitting any irrelevant details, and double-check your information to prevent common errors.

Editing and reviewing your form

After completing your form, it’s crucial to review it for errors. Utilizing pdfFiller's tools gives you the ability to edit your document efficiently. Simple corrections can often be made with just a few clicks, and pdfFiller’s features enhance your capability to track changes and updates effectively.

Creating a checklist for your final review can greatly improve your accuracy. Focus on key details such as the correctness of your identification information, calculation errors in your financial overview, and the completeness of the disclosures. This systematic approach ensures you don't miss anything important before filing.

eSigning Form a-1-ca-38089

The importance of eSigning in the submission process of Form a-1-ca-38089 cannot be understated. An eSignature not only authenticates the document but also streamlines your submission process, allowing for quicker processing and fewer visual errors. Using pdfFiller simplifies the eSigning procedure, making it accessible right from your computer.

To add your signature using pdfFiller, simply follow these steps: select the eSign option, choose your pre-created signature, or create a new one, and then place it where necessary on the form. This efficient method ensures that your document is signed securely and accurately without the hassle of printing and scanning.

Submitting your form

Once you have completed and eSigned Form a-1-ca-38089, the next step is submission. There are various submission methods available, with online submission options being the most convenient. Online submission often results in quicker processing times and allows immediate confirmation of receipt.

For those choosing paper submission, ensure to properly print your filled-out form and mail it to the correct address. Keeping track of your submission is easy; use a tracking number from your postal carrier or confirmation email if submitting online to verify the delivery of your form.

Managing your filed form

After your form a-1-ca-38089 has been submitted, managing your filed documents becomes essential. Using pdfFiller provides an excellent solution for securely storing your documents in the cloud. The accessibility of your forms allows for quick retrieval whenever necessary, whether for future reference, tax audits, or team discussions.

Collaborating with team members on document management is also straightforward with pdfFiller. By sharing access to documents, your team can work together efficiently on any updates or revisions, ensuring that everyone stays on the same page.

Troubleshooting common issues

Despite thorough preparation and diligent effort, issues may arise while filling out Form a-1-ca-38089. Common filing issues include incorrect information, incomplete sections, or even technical problems during eSigning. To resolve these, a systematic approach to troubleshooting can be beneficial.

Contacting support for help with Form a-1-ca-38089 can also be an effective course of action. Support teams are often well-equipped to guide you through resolving specific issues. Additionally, keep an FAQ section handy to navigate common inquiries related to filing, editing, and submitting the form.

Best practices for future filings

After successfully filing and managing your a-1-ca-38089 form, it's wise to adopt best practices for future filings. Keeping your records organized can save time and reduce stress during each filing season. Use digital folders and templates to categorize documents logically, ensuring you can find information quickly when needed.

Setting up reminders for future filings can prevent last-minute scrambles. Calendar notifications or task management applications can help ensure you meet deadlines without pressure. Furthermore, staying updated on changes to the a-1-ca-38089 format or submission guidelines will keep your filings compliant and up-to-date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the a-1-ca-38089 4-19-21 filed fo in Chrome?

How do I fill out a-1-ca-38089 4-19-21 filed fo using my mobile device?

How do I complete a-1-ca-38089 4-19-21 filed fo on an iOS device?

What is a-1-ca-38089 4-19-21 filed for?

Who is required to file a-1-ca-38089 4-19-21 filed for?

How to fill out a-1-ca-38089 4-19-21 filed for?

What is the purpose of a-1-ca-38089 4-19-21 filed for?

What information must be reported on a-1-ca-38089 4-19-21 filed for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.