Get the free VITA Program - volunteer income tax assistance - A New Leaf

Get, Create, Make and Sign vita program - volunteer

Editing vita program - volunteer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vita program - volunteer

How to fill out vita program - volunteer

Who needs vita program - volunteer?

VITA Program - Volunteer Form

Overview of the VITA Program

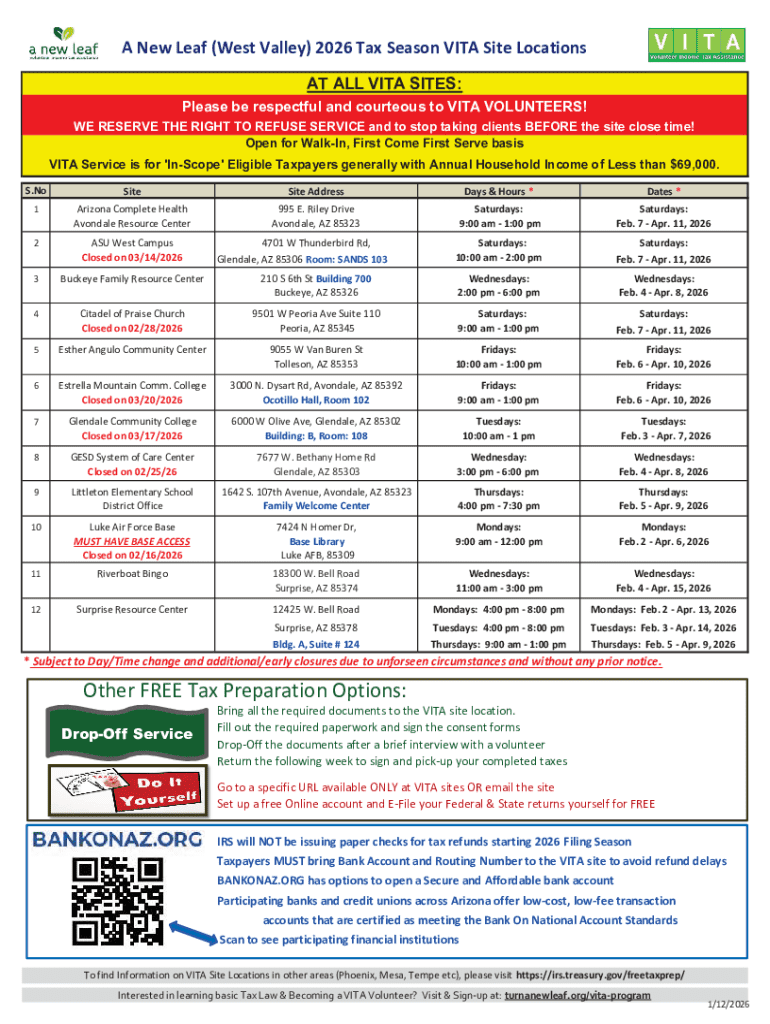

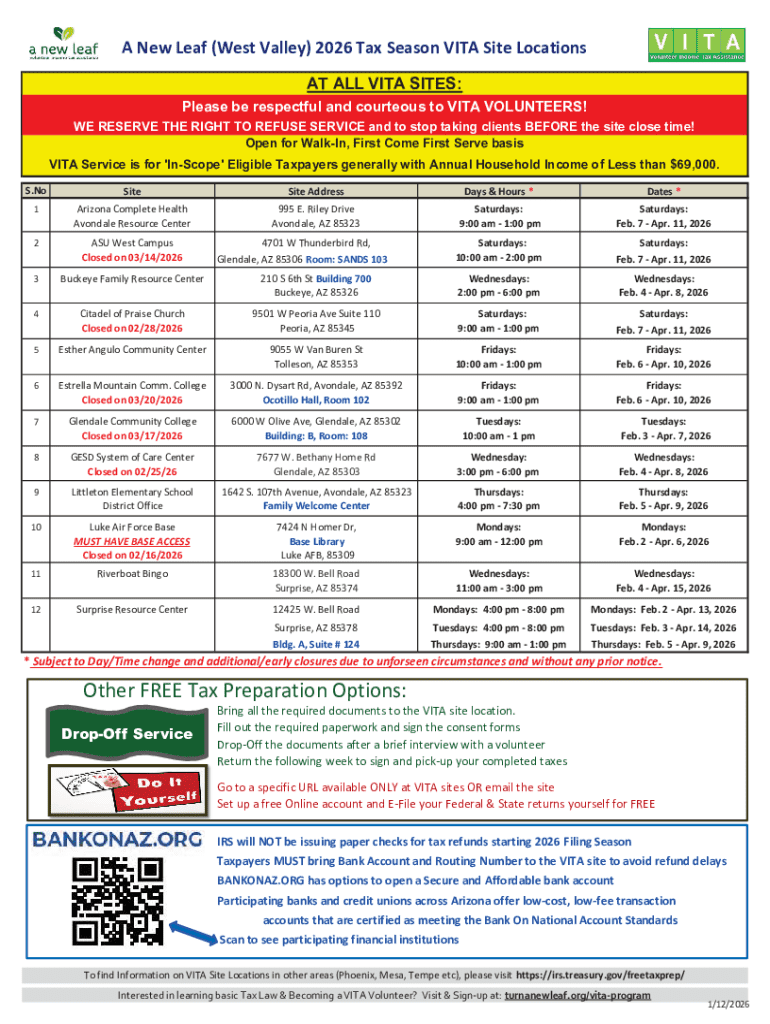

The Volunteer Income Tax Assistance (VITA) program is designed to provide free tax help to low-income individuals and families, ensuring they have access to the resources needed for filing their taxes accurately and efficiently. This initiative is invaluable, especially for those who may find tax regulations complex or prohibitive. The work of VITA volunteers not only makes a tangible difference in the lives of participants; it also enhances financial literacy within the community.

Volunteer assistance is central to the VITA program's success. Volunteers become the bridge that connects individuals to vital tax services, offering support that goes beyond simply filing taxes. By engaging in this program, volunteers help to alleviate some of the financial burdens faced by clients, ultimately fostering a stronger, more financially savvy community.

Eligibility requirements for volunteers

To volunteer with the VITA program, interested individuals must meet specific eligibility requirements aimed at ensuring the right support for clients. Primarily, volunteers are required to be at least 18 years old and possess a high school diploma or equivalent. These educational qualifications ensure that volunteers have the foundational knowledge necessary for assisting with tax preparation.

Additionally, background checks may be conducted to ensure the safety and privacy of clients. Once eligibility is confirmed, volunteers will undergo training that equips them with the knowledge needed to assist clients effectively. This training is essential and helps volunteers build confidence in their roles.

Benefits of joining the VITA program

Participating in the VITA program offers numerous benefits, both for the community and for the volunteers themselves. From a community perspective, volunteers play an instrumental role in providing tax support to low-income individuals and families. This support not only helps individuals file their taxes timely but also educates them about financial literacy, empowering them with knowledge that can lead to better financial decision-making in the future.

On a personal development level, volunteers gain valuable skills such as tax preparation, customer service, and teamwork. These experiences are not only enriching on an individual basis but also create networking opportunities with other professionals in the field, which can lead to further career prospects. Volunteers leave the program with enhanced communication skills and a greater understanding of community needs.

Preparing to volunteer: what to expect

Preparation is key to a successful volunteer experience. Initially, all volunteers must participate in training sessions designed to equip them with the necessary knowledge and skills. These training sessions are usually scheduled before the tax season begins and may vary by location, ensuring volunteers receive relevant and local information.

Training materials are provided, including manuals, online courses, and hands-on workshops. This blend of resources ensures that volunteers are well-prepared for their roles. During their service, volunteers will engage in tasks such as assisting clients with tax preparation and gathering documentation. Collaborating with fellow volunteers will enhance the experience, fostering a sense of camaraderie in a shared mission.

Completing the VITA volunteer form

To officially join the VITA program, interested individuals must complete the VITA volunteer form. This form is readily accessible through pdfFiller, a platform that streamlines the application process. Here’s a step-by-step guide to filling it out:

Being meticulous while completing the form is crucial. Common mistakes include overlooking required fields and inputting wrong personal information. By being diligent, you increase the chances of smooth processing of your application.

After submission: what happens next?

Once the VITA volunteer form is submitted, you can expect a confirmation of your application, which usually comes within a few weeks. It’s essential to remain patient during this timeframe, as background checks and processing can take some time. If you haven’t received feedback after several weeks, reaching out to the program coordinators is advisable.

For those who are approved, the onboarding process will begin. This may involve additional training sessions, orientation regarding your specific role, and preparation for client interactions. You will also receive your initial set of tasks, ensuring you are ready to make a difference in your community right away.

Additional opportunities within the VITA program

The VITA program offers a variety of specialized roles for volunteers beyond just tax preparation. Positions may include outreach coordinators who engage communities to encourage participation in the program, trainers who educate new volunteers, and administrative support roles which help to keep tax sites organized.

Volunteers can also find year-round opportunities to support initiatives focused on improving financial literacy or preparing for the upcoming tax season. This flexibility allows volunteers to remain engaged with their communities in meaningful ways throughout the year.

FAQs about the VITA volunteer form

As potential volunteers navigate the VITA volunteer form, they may have several questions that arise during the application process. A common query includes how to handle special circumstances, such as needing accommodations or unique scheduling needs. The volunteer coordinators are equipped to assist with these inquiries, ensuring that everyone has the opportunity to participate.

If you do not receive confirmation after submitting your application, it’s important to follow up with the program. Communication is crucial, and staying proactive will help to clarify any issues that may arise during the processing of your form.

Testimonials from current volunteers

Many individuals who have volunteered with the VITA program share impactful stories that highlight the difference their work has made in people's lives. Quotes such as, 'I didn’t realize the impact I could have on someone's year until I helped a single mother file her taxes and secure a refund that changed her family's circumstances,' showcase the profound satisfaction that comes from such volunteer work.

Moreover, the community benefits are evident through client success stories. Volunteers often describe how their interactions lead to newfound knowledge in tax processes, helping individuals feel empowered and informed. This personal touch fosters an environment where the community can thrive.

Related forms and resources

Apart from the VITA volunteer form, interested volunteers can access other related forms focused on various volunteer opportunities and registration processes with the VITA program via pdfFiller. This centralized access simplifies the application process for diverse roles.

Additionally, pdfFiller offers tools for document management that can enhance the overall experience for volunteers, including options for eSigning and document collaboration to streamline communication between teams and clients.

Support and assistance

For any questions or concerns regarding the VITA volunteer application process, contacting the program coordinators is the best course of action. They provide crucial support and clarification to ensure a seamless experience for potential volunteers.

In the event that issues arise with the volunteer application, resources are available to guide you through problem-solving steps. Maintaining clear communication is essential in addressing any challenges effectively, especially during busy tax seasons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find vita program - volunteer?

How do I edit vita program - volunteer online?

Can I edit vita program - volunteer on an Android device?

What is vita program - volunteer?

Who is required to file vita program - volunteer?

How to fill out vita program - volunteer?

What is the purpose of vita program - volunteer?

What information must be reported on vita program - volunteer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.