IRS 8865 - Schedule K-1 2025-2026 free printable template

Show details

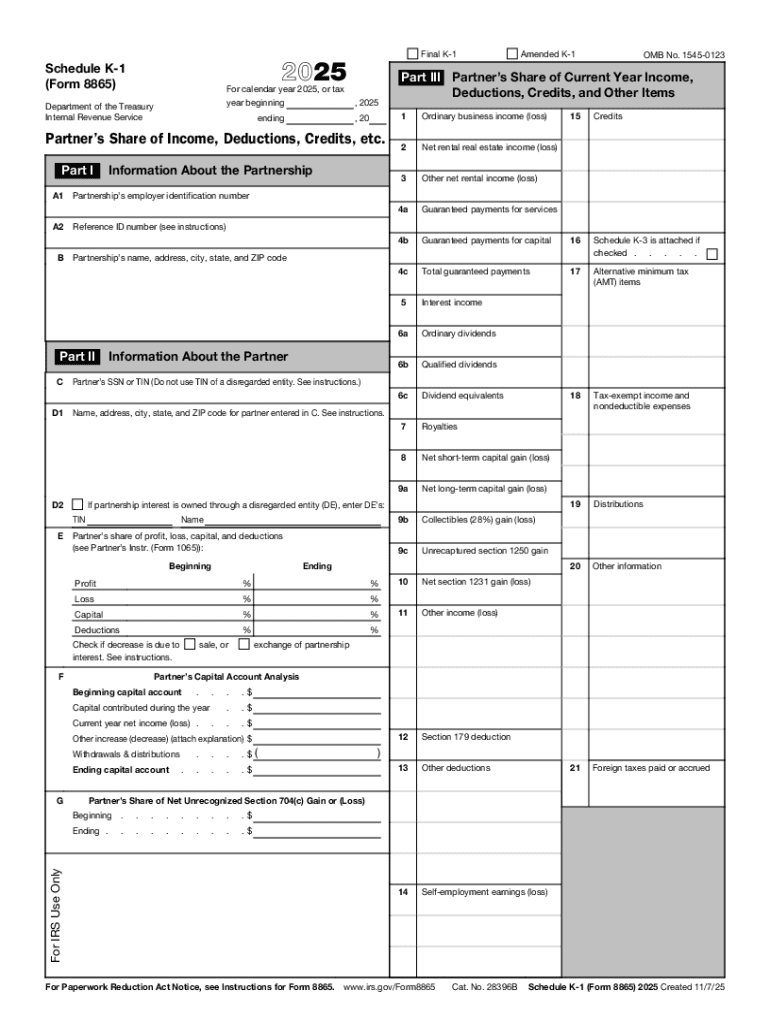

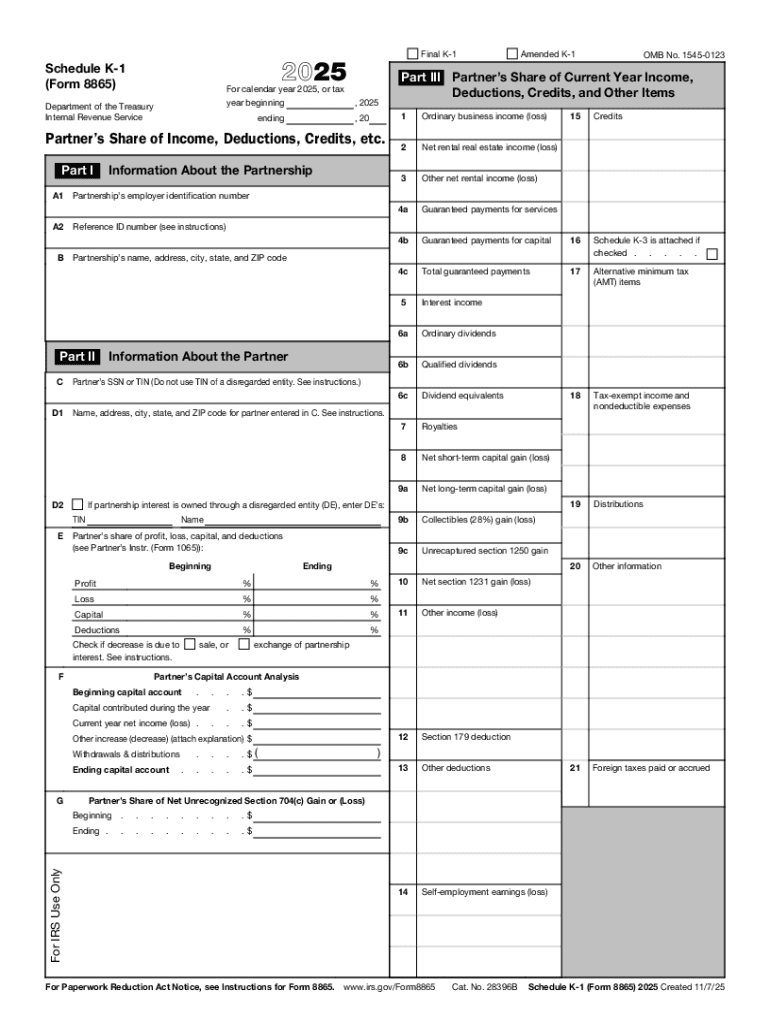

Final K12025Schedule K1

(Form 8865)For calendar year 2025, or tax

year beginningDepartment of the Treasury

Internal Revenue Serviceending, 2025

, 20Partners Share of Income, Deductions, Credits, etc.

Part

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 8865 - Schedule K-1

Edit your IRS 8865 - Schedule K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 8865 - Schedule K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 8865 - Schedule K-1 online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit IRS 8865 - Schedule K-1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8865 - Schedule K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 8865 - Schedule K-1

How to fill out 2025 schedule k-1 form

01

Obtain a copy of the 2025 Schedule K-1 form from the IRS website or your tax preparer.

02

Enter the partnership or S corporation's name, address, and EIN (Employer Identification Number) at the top of the form.

03

Fill in your name and taxpayer identification number (TIN) in the designated fields.

04

Report your share of income, deductions, credits, and other items as outlined on the form.

05

Review the instructions provided with the form for any specific details based on the type of entity.

06

Ensure that all amounts are accurate and complete before submitting the form.

07

Keep a copy of the completed K-1 form for your personal tax records.

Who needs 2025 schedule k-1 form?

01

Individuals who are partners in a partnership or shareholders in an S corporation need the 2025 Schedule K-1 form to report their share of income, deductions, and credits on their personal tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to file 8865?

The Form 8865 will need to be filed if a U.S. person owns an interest in a foreign entity that is classified as a foreign partnership for U.S. federal tax purposes.

Who must file IRS form 8865?

A U.S. transferor that is required to provide information with respect to a partnership under Regulations sections 1.721(c)-6(b)(2)(iv) and 1.721(c)-6(b)(3)(xi) must file a separate Form 8865 (along with all necessary schedules and attachments) for each partnership treated as a U.S. transferor under Regulations

What is a Category 3 filer form 8865?

Category 3 Filer for Form 8865 The value of the property contributed (when added to the value of any other property contributed to the partnership by such person, or any related person, during the 12-month period ending on the date of transfer) exceeds $100,000.

Can I file form 8865 separately?

Complete a separate Form 8865 and the applicable schedules for each foreign partnership. File the 2021 Form 8865 with your income tax return for your tax year beginning in 2021.

How are foreign partners taxed?

A partnership must pay the withholding tax for a foreign partner even if the partnership does not have a U.S. TIN for that partner. Foreign partners must attach Copy C of Form 8805 to their U.S. income tax returns to claim a credit for their share of the IRC section 1446 tax withheld by the partnership.

Does a foreign partner have to file a US tax return?

If during a partnership's tax year the partnership has taxable income effectively connected with the conduct of a trade or business within the United States that is allocable to a foreign partner, the Internal Revenue Code requires the partnership to report and pay a withholding tax under IRC Section 1446 to the IRS.

Who files IRS form 8865?

A U.S. person files Form 8865 to report the information required under: Section 6038 (reporting with respect to controlled foreign partnerships). Section 6038B (reporting of transfers to foreign partnerships). Section 6046A (reporting of acquisitions, dispositions, and changes in foreign partnership interests).

Does foreign income have to be reported?

In general, yes—Americans must pay U.S. taxes on foreign income. The U.S. is one of only two countries in the world where taxes are based on citizenship, not place of residency. If you're considered a U.S. citizen or U.S. permanent resident, you pay income tax regardless where the income was earned.

How do I report foreign partnership income on 1040?

In general, a U.S. person who is a partner in a foreign partnership is required to file Form 8865 to report the income and financial position of the partnership and to report certain transactions between the partner and the partnership. The form is required to be filed with the partner's tax return.

Who is required to file form 8865?

A U.S. transferor that is required to provide information with respect to a partnership under Regulations sections 1.721(c)-6(b)(2)(iv) and 1.721(c)-6(b)(3)(xi) must file a separate Form 8865 (along with all necessary schedules and attachments) for each partnership treated as a U.S. transferor under Regulations

Can form 8865 be filed electronically?

Form 8865 returns can be electronically filed only if filing Form 1040, 1041, 1120, 1120S, or 1065. Multiple Form 8865 electronic files can be attached to the filer's return, as needed.

What is an IRS form 8865?

Form 8865 is filed for the foreign partnership by another Category 1 filer under the multiple Category 1 filers exception. To qualify for the constructive ownership filing exception, the indirect partner must file with its income tax return a statement entitled “Controlled Foreign Partnership Reporting.”

How do I report income from a foreign partnership?

If a foreign partnership has income from the U.S., they may be required to file Form 1065 to report that U.S. income. If a foreign partnership is considered a controlled foreign partnership, certain US partners may have to file Form 8865 to report their interest in that partnership.

Do I have to report foreign income on US tax return?

Do I still need to file a U.S. tax return? Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live. However, you may qualify for certain foreign earned income exclusions and/or foreign income tax credits.

What is the difference between form 5471 and 8865?

Form 5471 is annual informational form that generally does not result in any tax due for the taxpayer. If you are a partner in a foreign partnership, you would file a Form 8865.

Does UltraTax have form 8865?

UltraTax CS will include Form 8865 in the filer's electronic file.

What is the purpose of form 8865?

A U.S. person files Form 8865 to report the information required under: Section 6038 (reporting with respect to controlled foreign partnerships). Section 6038B (reporting of transfers to foreign partnerships). Section 6046A (reporting of acquisitions, dispositions, and changes in foreign partnership interests).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 8865 - Schedule K-1 to be eSigned by others?

When you're ready to share your IRS 8865 - Schedule K-1, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit IRS 8865 - Schedule K-1 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign IRS 8865 - Schedule K-1 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out IRS 8865 - Schedule K-1 on an Android device?

Use the pdfFiller mobile app and complete your IRS 8865 - Schedule K-1 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is 2025 schedule k-1 form?

The 2025 Schedule K-1 form is used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts to the IRS and the individual partners or shareholders.

Who is required to file 2025 schedule k-1 form?

Partnerships, S corporations, estates, and trusts are required to file a Schedule K-1 form to report the income, deductions, and credits allocated to their partners, shareholders, or beneficiaries.

How to fill out 2025 schedule k-1 form?

To fill out the 2025 Schedule K-1 form, you need to enter the entity's information, such as name, address, and tax identification number, followed by the income, deductions, and credits allocated to each partner or shareholder based on the entity's financial records.

What is the purpose of 2025 schedule k-1 form?

The purpose of the 2025 Schedule K-1 form is to provide detailed information to the IRS and individual partners or shareholders about their share of income, deductions, and credits from the pass-through entity.

What information must be reported on 2025 schedule k-1 form?

The 2025 Schedule K-1 form must report the entity's details, partner or shareholder's information, income, deductions, credits, and any other relevant financial activities that influence a partner or shareholder's tax return.

Fill out your IRS 8865 - Schedule K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 8865 - Schedule K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.