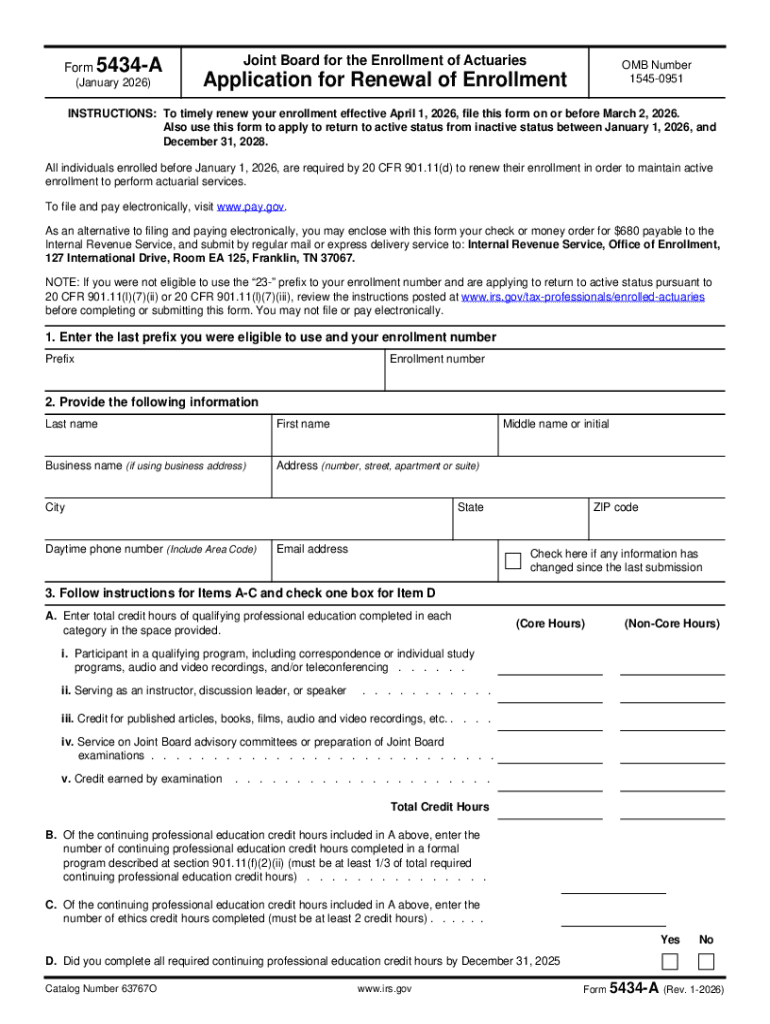

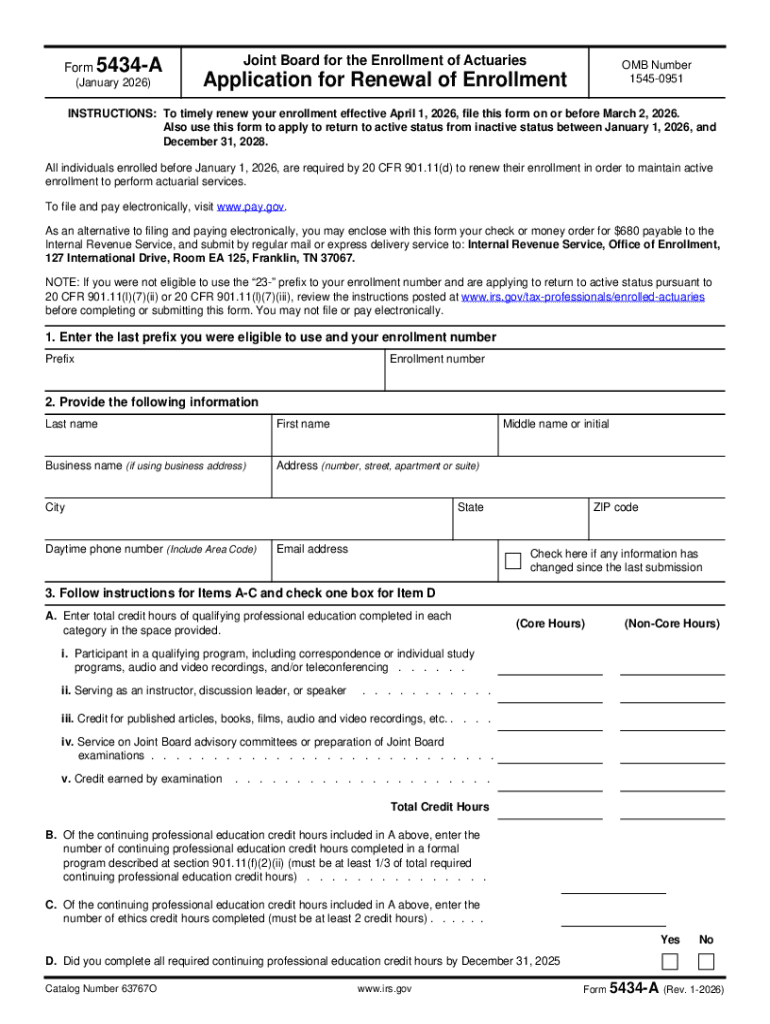

IRS Form 5434-A 2026 free printable template

Get, Create, Make and Sign IRS Form 5434-A

How to edit IRS Form 5434-A online

Uncompromising security for your PDF editing and eSignature needs

IRS Form 5434-A Form Versions

How to fill out IRS Form 5434-A

How to fill out form 5434-a rev 1-2026

Who needs form 5434-a rev 1-2026?

Form 5434-A Rev 1-2026: A Comprehensive Guide to Accessing, Completing, and Managing Your Document

Overview of form 5434-a rev 1-2026

The form 5434-A Rev 1-2026 is a crucial document that serves various purposes depending on the specific industry context. It often facilitates regulatory compliance or assists in the collection of important financial data. This revision, coming in 2026, brings significant updates that reflect the evolving nature of documentation requirements.

One of the key changes in the 2026 revision is an enhanced layout designed for improved user experience, coupled with updated fields to capture modern data points more effectively. This ensures that users are equipped to meet contemporary standards in both regulatory and business environments.

How to access form 5434-a rev 1-2026

Accessing the form 5434-A Rev 1-2026 is streamlined through pdfFiller, a robust cloud-based platform. Users can locate the form through a simple search process, which is designed for efficiency and convenience.

To download the form, follow these steps:

Ensuring access to the latest version means regularly checking for updates on pdfFiller, as revisions can occur based on usage trends and regulatory changes.

Step-by-step guide to filling out form 5434-a rev 1-2026

Filling out the form 5434-A Rev 1-2026 effectively requires understanding the required information and layout. The process involves several preliminary steps:

The form itself can be broken down into sections that need careful completion:

When filling the form, be aware of common pitfalls. Double-check accuracy to avoid delays in processing due to incorrect information.

Editing and modifying form 5434-a rev 1-2026

Once you have filled out the form 5434-A Rev 1-2026, you might need to make changes. pdfFiller provides robust editing tools specifically designed for this purpose. The following step-by-step approach simplifies making modifications:

The ability to make modifications easily ensures that users can respond to dynamic requirements without starting anew.

Collaborating with team members on form 5434-a rev 1-2026

Collaboration is essential for teams completing the form 5434-A Rev 1-2026. pdfFiller supports seamless sharing and real-time collaboration features. Sharing the form can be accomplished with just a few clicks:

Real-time collaboration enables teams to communicate effectively, reducing errors and promoting efficiency during the form completion process.

Signing form 5434-a rev 1-2026

The final step in the process is signing the form 5434-A Rev 1-2026. pdfFiller makes the eSigning process straightforward and user-friendly. Here’s how you can add your signature:

Electronic signatures are legally valid and ensure the authenticity of the document, provided that you comply with your local regulations.

Managing and storing form 5434-a rev 1-2026 in the cloud

Effective management of the form 5434-A Rev 1-2026 involves organizing your saved documents within your pdfFiller account. Here are best practices to keep in mind:

The security features provided by pdfFiller ensure your documents are safe, giving you peace of mind while managing sensitive information.

Troubleshooting common issues with form 5434-a rev 1-2026

Users may encounter various challenges while filling out or submitting the form 5434-A Rev 1-2026. Below are common problems and their solutions:

Troubleshooting effectively can save time and alleviate frustrations for users who need to complete forms promptly.

Frequently asked questions (faqs)

As users engage with the form 5434-A Rev 1-2026, several questions often arise. Here are some common queries and their clarifications:

These FAQs aim to clarify common concerns, promoting a smoother experience for all users.

Additional tips and resources for users

For users engaging with the form 5434-A Rev 1-2026, accessing additional resources can be highly beneficial. pdfFiller offers various related forms and templates that may be needed during the documentation process.

These resources empower users to fully utilize pdfFiller’s capabilities, enhancing efficiency and efficacy in document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IRS Form 5434-A directly from Gmail?

How can I modify IRS Form 5434-A without leaving Google Drive?

Can I sign the IRS Form 5434-A electronically in Chrome?

What is form 5434-a rev 1-2026?

Who is required to file form 5434-a rev 1-2026?

How to fill out form 5434-a rev 1-2026?

What is the purpose of form 5434-a rev 1-2026?

What information must be reported on form 5434-a rev 1-2026?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.