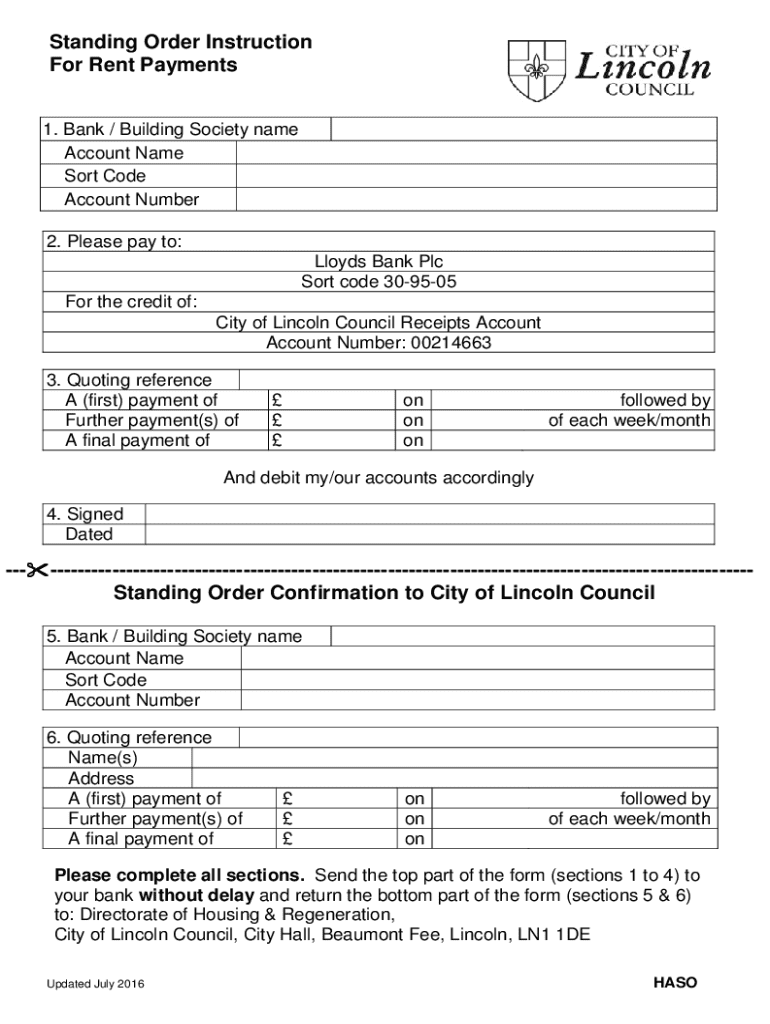

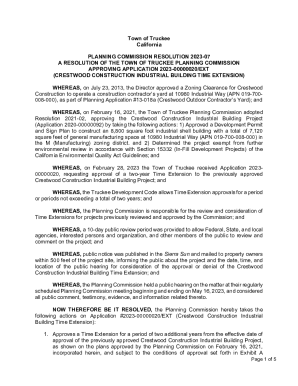

Get the free Lloyds bank standing order form pdf ...

Get, Create, Make and Sign lloyds bank standing order

Editing lloyds bank standing order online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lloyds bank standing order

How to fill out lloyds bank standing order

Who needs lloyds bank standing order?

Your Guide to Lloyds Bank Standing Order Form

Understanding standing orders

A standing order is a bank instruction that authorizes the automatic payment of a fixed amount of money at regular intervals, typically from your bank account. This mechanism is crucial for anyone looking to ensure their payments—be it rent, mortgage, or utility bills—are consistently made on time without the need for constant manual intervention.

It's essential to distinguish between standing orders and direct debits. While both facilitate regular payments, standing orders are initiated by the account holder and specify the amount and frequency, providing a level of control. On the other hand, direct debits allow the payee to withdraw varying amounts as agreed, making them more flexible but less controllable by the payer.

The common use cases for standing orders include rent payments, subscriptions to services, and consistent charitable donations. Since these payments occur regularly, organizing them via a standing order ensures hassle-free financial management.

Overview of Lloyds Bank standing order form

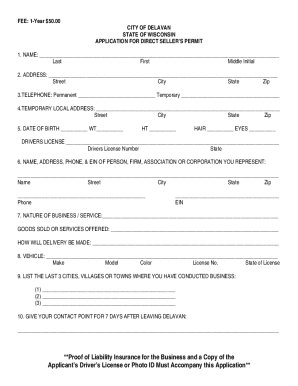

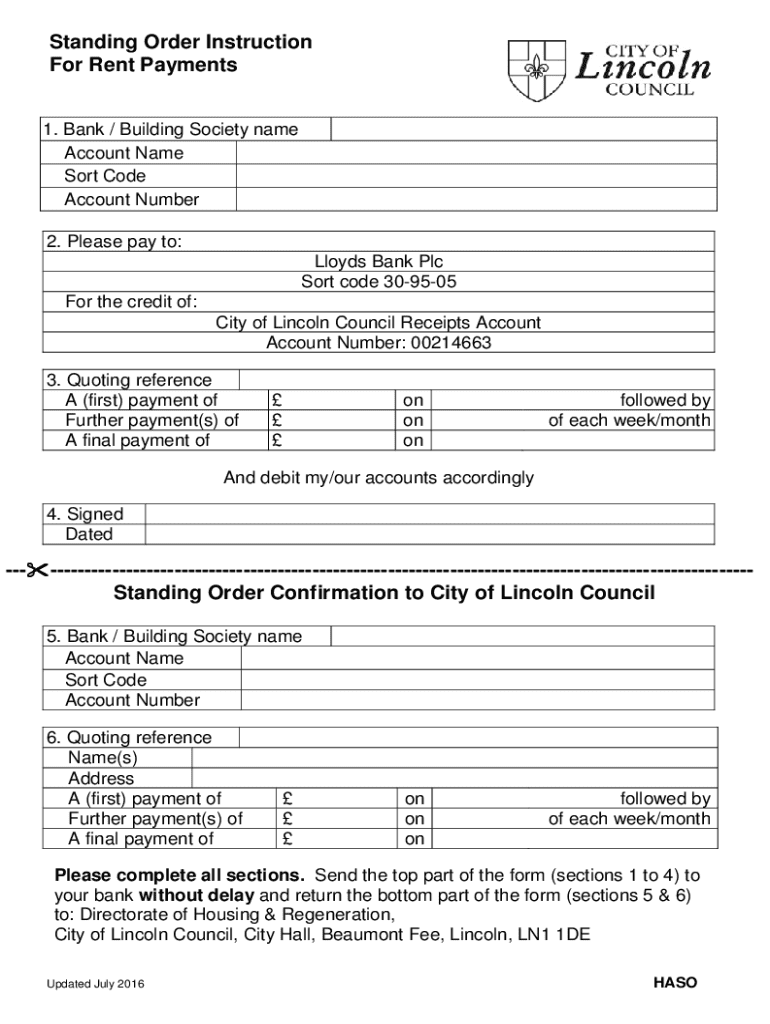

The Lloyds Bank standing order form is a key tool for customers wishing to set up regular payments. It typically includes essential features such as predefined sections for personal information, payee details, and payment specifications, ensuring a straightforward and smooth process.

Using the official form is vital as it guarantees compliance with Lloyds Bank’s banking protocol, ensuring that your transaction adheres to their standards and minimizes the risk of errors. Additionally, organizing your banking details, including names, addresses, and account numbers, is crucial for effective management and easy updates to your standing orders in the future.

Step-by-step instructions for filling out the Lloyds Bank standing order form

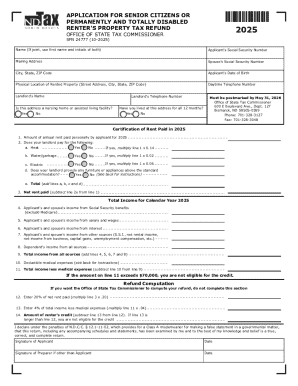

Essential information required

To complete the Lloyds Bank standing order form, you’ll need to furnish essential personal information such as your name, address, and account number. This personal information is required to verify your identity and process the form accurately.

Equally important is the payee information, which needs the recipient's name as well as their bank details. This establishes the connection between your financial institution and the payee's, ensuring that the payments are correctly directed.

Specifying payment details

In this section, you will specify the amount to be paid and the frequency of payments. Determine whether you want the payment to occur weekly, bi-weekly, monthly, or at another interval. It's also important to select a start date from which the payments will commence, along with a duration if applicable, defining how long the standing order should remain active.

Completing the form

Once all sections of the form have been filled, it’s crucial to review the information for accuracy. Double-check your account number, payment amounts, and payee details to avoid any potential mishaps. Common mistakes to avoid include typos in account numbers or the incorrect frequency of payments, which could result in late fees or missed payments.

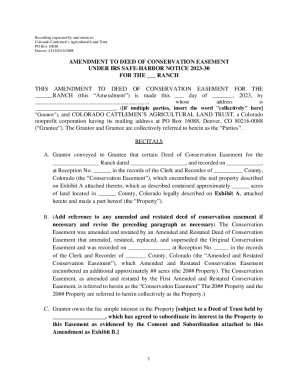

Editing and customizing your standing order form

Utilizing tools like pdfFiller can enhance your experience when managing your standing order form. With pdfFiller, you can customize forms easily by adding or editing fields, ensuring that all necessary information is accurately captured.

Moreover, adding eSignatures can streamline the submission process and ensure that the form is secure and compliant. Collaboration features also allow teams to work together on forms, making updates in real-time, which is especially useful for businesses managing multiple standing orders.

Submitting the Lloyds Bank standing order form

Options for submission

After completing your Lloyds Bank standing order form, you have various options for submission. Digital submission directly to Lloyds Bank can be done through their online banking platform, where you can efficiently send your completed form to the bank for processing.

If you prefer a traditional approach, you can also print the form for mailing or submit it in person at your nearest branch. However, digital submission is generally faster and allows for better tracking of your submission.

Tracking your submission

Once you've submitted your standing order form, confirming the receipt of your standing order is essential. This can typically be done through your online banking portal or by contacting customer service. Checking the status of your standing order with Lloyds Bank ensures that your payments are set up correctly and prevents any interruptions.

Managing your standing order post-submission

After submitting your standing order, managing it effectively is crucial. Modifying existing standing orders can be done via your online banking account. Lloyds Bank allows you to easily change payment amounts, frequency, or other details as your financial situation evolves.

If you need to cancel a standing order, follow these steps carefully: log into your bank account, navigate to the standing order section, select the relevant order, and follow the prompts to cancel. Additionally, regularly checking your account is important to ensure all payments are processed correctly, preventing any unwanted surprises.

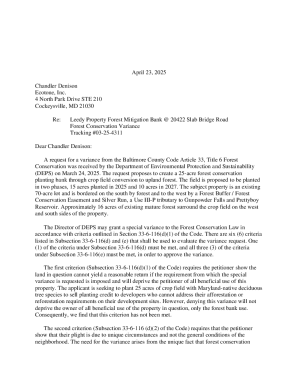

Troubleshooting common issues

Occasionally, issues may arise concerning standing orders. If payments are not being processed, the first step is to verify that the standing order is active and that there are sufficient funds in your account. If everything seems in order, reaching out to Lloyds Bank customer support is the next step.

Resolving entry errors on your standing order form is also essential. If you realize mistakes after submission, document them and contact customer support for assistance. Lloyds Bank is generally helpful in resolving issues swiftly, ensuring that you maintain your financial commitments.

Leveraging pdfFiller for enhanced document management

pdfFiller offers a cloud-based document management solution to enhance your experience with forms like the Lloyds Bank standing order form. With the ability to store, edit, and share documents securely, users can access their forms from any device, ensuring smooth financial management on the go.

The collaboration features allow teams to work seamlessly, sharing documents and making real-time edits to ensure all details are current. This is especially beneficial for businesses needing to manage multiple standing orders across various accounts.

Terms and conditions related to Lloyds Bank standing orders

Understanding the key regulations and guidelines surrounding Lloyds Bank standing orders is critical for all customers. The terms include your rights regarding account management, the ability to modify and cancel orders, and the responsibilities for ensuring sufficient account balance for uninterrupted transactions.

Customers need to be aware of their rights, including the ability to dispute unauthorized transactions and seek redress. Familiarizing yourself with these terms can help prevent unpleasant surprises and ensure a smooth banking experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my lloyds bank standing order in Gmail?

How do I fill out lloyds bank standing order using my mobile device?

How do I fill out lloyds bank standing order on an Android device?

What is lloyds bank standing order?

Who is required to file lloyds bank standing order?

How to fill out lloyds bank standing order?

What is the purpose of lloyds bank standing order?

What information must be reported on lloyds bank standing order?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.