Get the free Instructions for Form 8940 (Rev. December 2025)

Get, Create, Make and Sign instructions for form 8940

Editing instructions for form 8940 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 8940

How to fill out instructions for form 8940

Who needs instructions for form 8940?

Instructions for Form 8940: A Comprehensive Guide

Understanding Form 8940

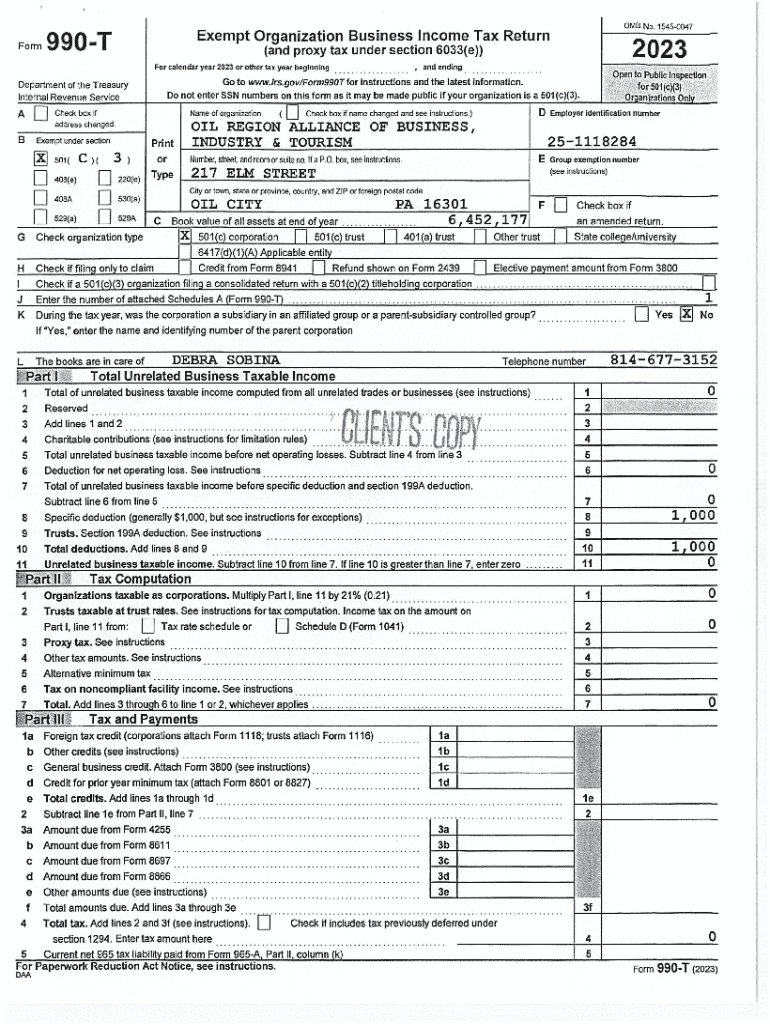

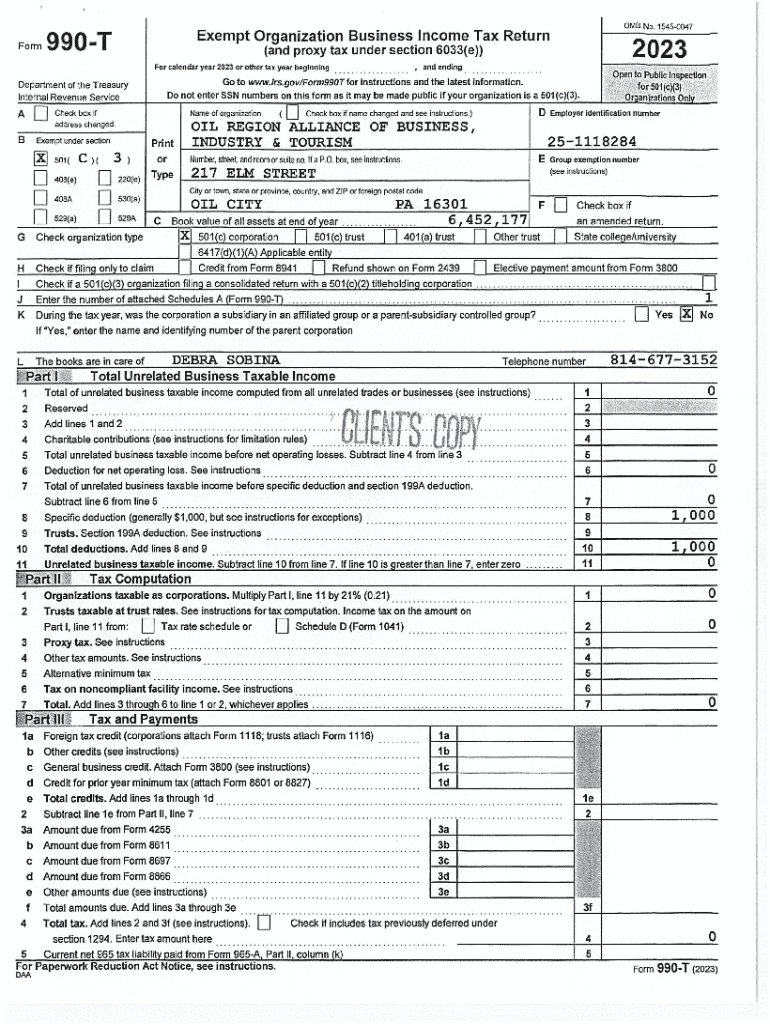

Form 8940, officially known as the 'Request for Miscellaneous Determination,' is a critical document for nonprofit and tax-exempt organizations. Its primary purpose is to request certain determinations from the IRS regarding the organization's exempt status or eligibility for specific benefits. Misunderstandings about this form can lead to confusion, but its significance in ensuring compliance cannot be overstated.

Nonprofit organizations often misinterpret Form 8940 as a routine filing rather than a request needing careful consideration and preparation. Accurate completion and timely submission are vital for retaining tax-exempt status and ensuring eligibility for programs and benefits provided by the IRS.

Who needs to file Form 8940?

Filing Form 8940 isn't just limited to any nonprofit organization; specific eligibility requirements must be met. Organizations that have made significant changes that could affect their status—such as mergers, changes in activities, or requests related to specific tax-exempt categories—should evaluate whether they need to file. Each organization will have unique circumstances that dictate their necessity to complete this form.

Common scenarios necessitating Form 8940 include cases where organizations seek a clarification about their exempt status due to a merger, lose their status, or need to confirm eligibility for a program requiring IRS approval.

Detailed breakdown of Form 8940

Understanding the structure of Form 8940 is crucial for accurate completion. The form is divided into several sections, each requiring specific information pertinent to the request. A line-by-line analysis of each section can demystify the filling process and ensure all requirements are met.

The first section focuses on general information, where organizations must provide their details, including name, address, and employer identification number (EIN). The second section revolves around specific exemptions or qualifications that the organization might be seeking. Lastly, the third section serves as a space for additional information that may support the request.

Filing frequency and deadlines

Timely filing of Form 8940 is critical. To avoid penalties and maintain compliance, organizations must be aware of key dates in the tax calendar. Typically, Form 8940 should be filed by the 15th day of the 5th month after the end of the organization’s tax year. Keeping a calendar and marking these deadlines can help organizations stay on track.

Calculating the filing period can be straightforward once the organization's fiscal year has been confirmed. Ensure that the timeframes align with IRS requirements to facilitate a smooth filing process.

Completing Form 8940

Filling out Form 8940 can be daunting, but following a systematic approach can simplify the process. Before diving into the form, organizations should prepare a checklist of required information, including any supporting documents that substantiate the request.

Essentially, organizations should have their EIN, articles of incorporation, a description of activities, and any previous correspondence with the IRS regarding their status. This preparation can prevent common mistakes that lead to filing delays or rejections.

Common mistakes include providing incorrect EINs, failing to include a required signature, or neglecting to include supporting documentation. Avoiding these errors is key to a successful filing.

eSigning and submitting Form 8940

Once Form 8940 is completed, organizations can opt for electronic signatures, streamlining the submission process. Using platforms like pdfFiller, users can easily add eSignatures to their forms, expediting the process while ensuring compliance with IRS guidelines.

The eSignature process is straightforward: after completing the form, users upload it to an eSigning platform, follow the prompts to sign, and then save the document for submission. This step not only enhances convenience but also adds a level of security to the filing.

After submission, organizations should retain copies of submitted forms and any correspondence related to their filing for future reference.

Managing your Form 8940 after submission

Once Form 8940 is submitted, it's important to track its status. Organizations can check their submission status through the IRS online portal or by contacting the IRS directly. Keeping an eye on the response time is crucial—most organizations can expect a reply within 30 days of submission.

If the IRS requests additional information, handling these requests promptly is essential to avoid delays in processing. Organizations should be prepared to provide supplementary documents or clarifications as needed.

Interactive tools and resources

Using tools like pdfFiller can significantly improve the efficiency of completing Form 8940. The platform offers options to edit and customize forms, providing flexibility for organizations to input their unique details. Users can also collaborate in real-time, making it easier to manage team submissions effectively.

Whether you are working with a team or an individual, pdfFiller's interactive tools make document management seamless and accessible from anywhere.

User experiences and case studies

Real-life experiences provide insights into the effective use of Form 8940. Many organizations have effectively utilized the form to clarify their exempt status, successfully receiving approval from the IRS. Success stories often showcase how timely submissions and thorough documentation led to favorable outcomes.

Organizations report that proper preparation and understanding of the form's requirements significantly shorten the time taken to receive a determination from the IRS. Lessons learned highlight the importance of consulting with tax professionals and incorporating their guidance into the preparation process.

Additional information and insights

Staying updated on changes to Form 8940 is critical for compliance. Recent regulations have impacted how organizations should approach their filings. Regularly reviewing IRS publications and news releases can help organizations stay informed about any updates that may affect their submissions.

Considering the IRS periodically revises forms and requirements, proactive engagement with tax professionals can ensure that organizations are prepared for any changes and can adapt their processes accordingly.

Community engagement and support

Organizations looking for support in filing Form 8940 can benefit from participating in forums and groups where nonprofit leaders share their experiences and advice. Engaging with communities centered around nonprofit activities can provide valuable insights and resources.

Additionally, online workshops and webinars focused on tax compliance can enhance understanding and preparation for Form 8940. Organizations can learn directly from experts, ensuring they are on the right track with their submissions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute instructions for form 8940 online?

How do I make changes in instructions for form 8940?

How do I edit instructions for form 8940 straight from my smartphone?

What is instructions for form 8940?

Who is required to file instructions for form 8940?

How to fill out instructions for form 8940?

What is the purpose of instructions for form 8940?

What information must be reported on instructions for form 8940?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.