Get the free 12 DTE R 21 20242 Brans. Subteran Cu BMPT Pe Soclu ...

Get, Create, Make and Sign 12 dte r 21

How to edit 12 dte r 21 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 12 dte r 21

How to fill out 12 dte r 21

Who needs 12 dte r 21?

Understanding the 12 DTE R 21 Form: A Comprehensive Guide

Overview of the 12 DTE R 21 form

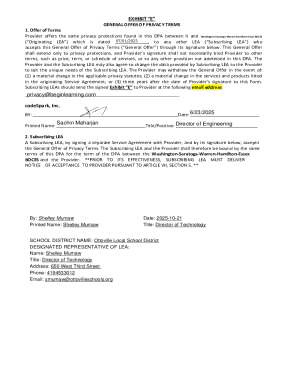

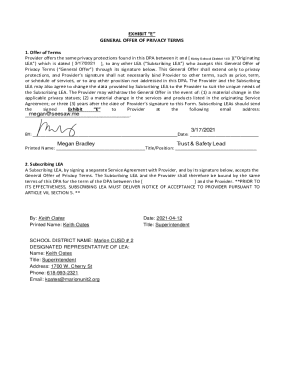

The 12 DTE R 21 form is a specialized document used primarily in the context of financial disclosures, tax submissions, or eligibility assessments. This form serves as an essential tool for individuals and organizations to report necessary information accurately, ensuring compliance with regulatory standards. By adhering to the guidelines laid out for the form, users can streamline their submission process and avoid potential complications.

Accurately completing the 12 DTE R 21 form is vital for several reasons. Errors or omissions may lead to delays in processing, additional requests for information, or even penalties for non-compliance. Thus, understanding the ins and outs of this form is crucial for anyone required to submit it.

Typically, individuals, businesses, and organizations that need to disclose specific information—often pertaining to financial matters—are required to fill out the 12 DTE R 21 form. Knowing who falls under this requirement is essential for compliance and efficiency.

Key features of the 12 DTE R 21 form

The 12 DTE R 21 form contains multiple sections designed to capture comprehensive information. Understanding each section's purpose will help ensure a complete and accurate submission.

Additionally, the form includes unique attributes such as editable fields that allow users to modify information easily. Digital signatures are another critical aspect, enabling users to sign documents electronically, streamlining the process further.

Step-by-step guide to filling out the 12 DTE R 21 form

Before you begin filling out the 12 DTE R 21 form, gather all necessary documentation. This prep work can simplify the completion process and reduce errors. Common documents you may need include tax returns, financial statements, and any relevant legal documents.

When filling in each section, consider the following instructions:

Also, beware of common errors such as inaccuracies in financial figures or neglecting to sign the document. Always review your work and consider a second pair of eyes for final verification.

Interactive tools and resources

Accessing the 12 DTE R 21 form online is crucial for convenient and efficient handling. pdfFiller provides easy access to the form, allowing users to fill it out from anywhere, as long as they have internet connectivity. This flexibility is essential for individuals and teams who frequently manage various documents.

When using pdfFiller’s interactive features, take advantage of the eSigning capability, which allows for secure and legally recognized digital signatures. The collaborative editing option is particularly useful for teams that need to discuss or modify the document together.

Managing your 12 DTE R 21 form

Once you complete the 12 DTE R 21 form, it’s vital to know how to manage your documents effectively. Ensuring you save the completed form securely should be your first priority. Consider using pdfFiller's secure cloud storage solutions to keep your forms accessible yet protected.

By maintaining an organized archive, you enhance your ability to retrieve documents efficiently when needed.

Frequently asked questions (FAQs) about the 12 DTE R 21 form

Users often have questions about the nuances of the 12 DTE R 21 form. Addressing these questions helps ensure you understand the implications of your submissions.

Updates and changes to the 12 DTE R 21 form

Staying updated on recent modifications in regulations related to the 12 DTE R 21 form is essential. As laws and requirements evolve, new versions of the form may be released, incorporating changes that reflect these adjustments. Ensure you have the latest information to remain compliant.

To remain informed, consider subscribing to updates through platforms like pdfFiller, which will alert you to any changes or necessary re-filing requirements. This proactive approach can save time and prevent last-minute scrambles to comply with new regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my 12 dte r 21 in Gmail?

How do I edit 12 dte r 21 in Chrome?

How do I edit 12 dte r 21 straight from my smartphone?

What is 12 dte r 21?

Who is required to file 12 dte r 21?

How to fill out 12 dte r 21?

What is the purpose of 12 dte r 21?

What information must be reported on 12 dte r 21?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.