Get the free Vehicle Personal Property Tax - Forms & Filing Procedures

Get, Create, Make and Sign vehicle personal property tax

Editing vehicle personal property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out vehicle personal property tax

How to fill out vehicle personal property tax

Who needs vehicle personal property tax?

Vehicle Personal Property Tax Form - A Comprehensive How-to Guide

Understanding vehicle personal property tax

Vehicle personal property tax is an important aspect of local taxation, levied on the assessed value of vehicles owned by residents within specific jurisdictions. Unlike income or sales tax, this tax is based purely on vehicle ownership and is required to be filed annually in many states. Understanding how this tax works is essential for compliance and avoiding unnecessary penalties.

Filing your vehicle personal property tax is not just a legal obligation but a means of contributing to essential local services such as education, law enforcement, and infrastructure maintenance. It's crucial to recognize that vehicle taxes differ significantly from real estate taxes, as they are calculated based on vehicle depreciation rather than land value increase.

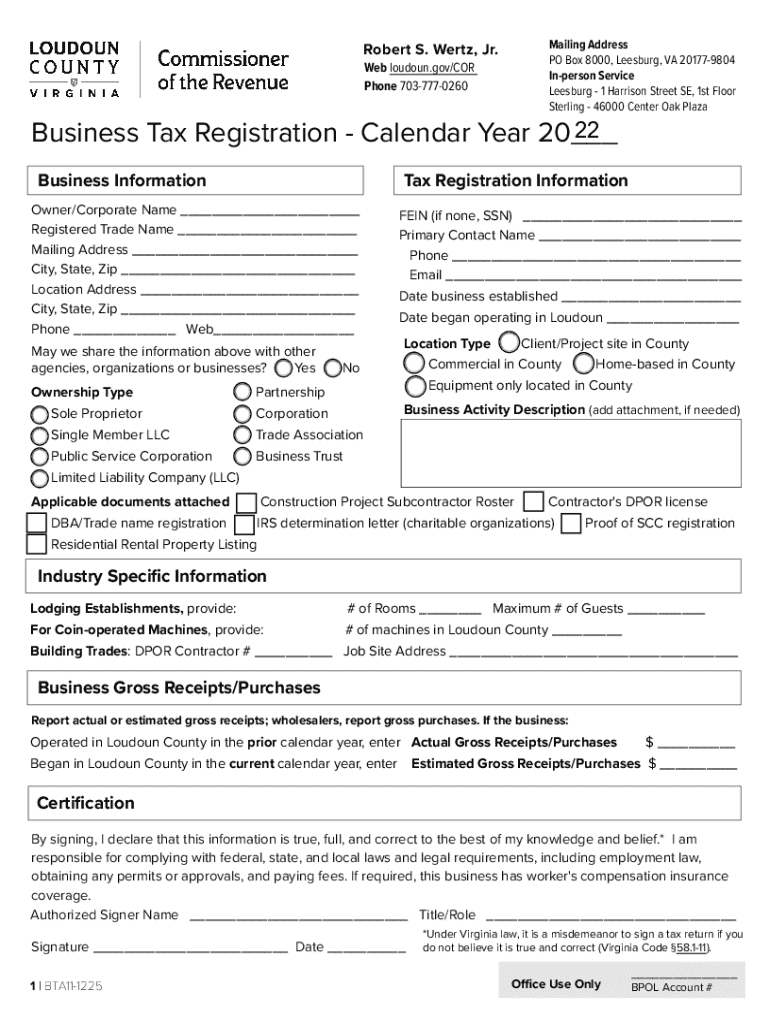

Tax administration for vehicle personal property

The administration of vehicle personal property taxes is managed primarily by local and state tax agencies, which establish regulations and processes governing assessment and collection. Each locality has unique laws regarding tax assessments, making it essential for vehicle owners to comply with their specific jurisdiction's rules.

Typically, the assessment process considers various factors, such as the vehicle's make, model, year, and condition. Most jurisdictions utilize common valuation methods, including the National Automobile Dealers Association (NADA) guidelines, which provide standardized information for valuing vehicles at the time of tax assessment.

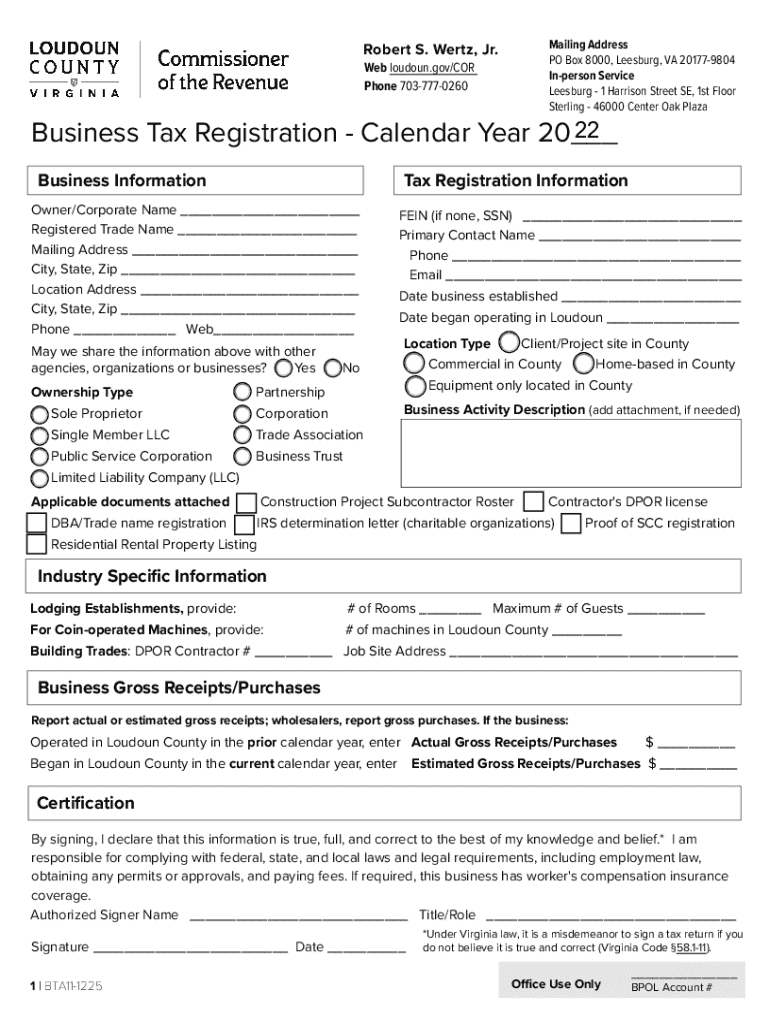

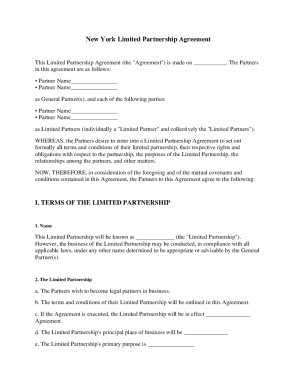

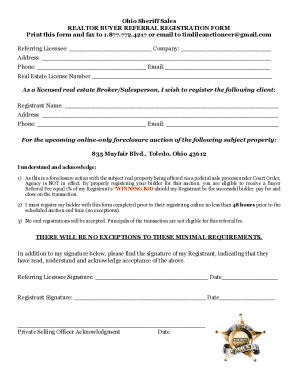

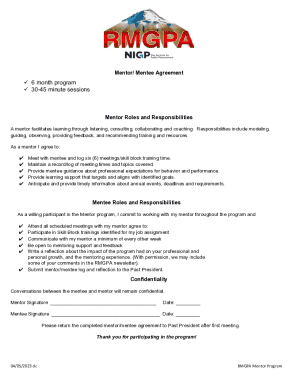

Relevant tax forms

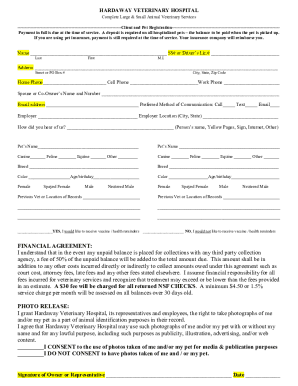

To successfully file your vehicle personal property tax, you must complete specific forms designated by your local tax authority. The main form required is often titled 'Vehicle Personal Property Tax Return.' This form typically demands a description of the vehicle, its value, and proof of ownership.

These forms can typically be accessed and downloaded directly from your local tax authority's website. pdfFiller offers a step-by-step guide to help you navigate these sites efficiently and provides tools to manage your tax documents effectively.

Detailed instructions for completing the vehicle personal property tax form

Completing the vehicle personal property tax form requires careful attention to detail. Start by gathering all necessary information, including the vehicle’s make, model, and year, along with any supporting documents such as ownership proof and previous tax returns.

When filling out the tax form, ensure that your personal identification information is accurate, provide a thorough description of the vehicle, and calculate its assessed value correctly. Don't forget to apply for any exemptions or deductions for which you may be eligible, particularly if you are a veteran or have a disability.

After you have completed the form, take the time to review each section for accuracy. Simple errors can lead to significant delays or problems. Common mistakes include misreporting vehicle information and forgetting to include exemptions. It's wise to double-check your entries against your documents before submitting.

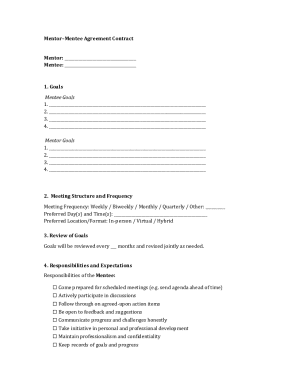

Electronic submission and eSigning

Filing your vehicle personal property tax online can save time and hassle. The benefits of online submission include the ability to file from anywhere and enhanced security features that protect your sensitive information.

Utilizing pdfFiller for electronic signing is a straightforward process. After filling out your form, you can easily sign it electronically by following a few simple steps provided in the pdfFiller user guide. Moreover, collaborating with tax professionals is facilitated through pdfFiller, allowing for seamless review and feedback.

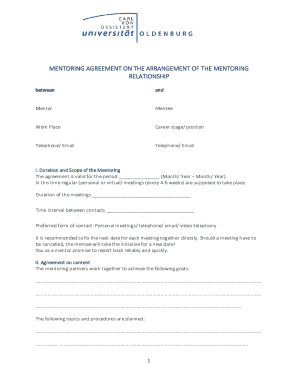

Managing your vehicle personal property tax documents

Once you've filed your vehicle personal property tax forms, it's crucial to manage your documents effectively. Securing them online through a cloud-based solution like pdfFiller offers numerous advantages, such as quick access and the ability to organize your documents and receipts systematically.

Tracking the submission and payment status of your forms can also be done easily with tools within pdfFiller. You can set reminders for important deadlines and keep a comprehensive record of all submissions to ensure compliance with your local tax regulations.

Common FAQs about vehicle personal property tax

One common concern is what to do if you move during the tax year. Typically, if you relocate, you must file your vehicle personal property tax in your new home jurisdiction, adhering to that area's unique filing requirements.

Another common question arises about how taxes are handled for vehicles that are not in use. In many states, you may be eligible for reductions if the vehicle is out of service for extended periods, but this often requires documentation to prove non-use.

Lastly, if you disagree with your vehicle’s assessed value, you have the right to appeal. Each jurisdiction has protocols in place for filing appeals, which may include presenting evidence to support your valuation claim.

Tools and resources for effective tax management

Utilizing interactive tools provided by pdfFiller can significantly streamline your document management process. These tools enable you to edit forms, collaborate with others, and keep all relevant materials organized in one location.

Additionally, your local tax agency often provides links to state-specific resources regarding vehicle personal property tax. Take advantage of educational materials available through pdfFiller or your state’s department of tax administration to stay informed.

Related forms and resources

In addition to the main vehicle personal property tax forms, you may encounter related forms, such as those for exemptions or specific circumstances, like tax status changes. These forms can be downloaded from your local tax authority’s website or accessed through pdfFiller.

It's also beneficial to familiarize yourself with other tax types, such as property or business taxes, and how they may interrelate with vehicle taxes. Understanding the broader tax landscape can provide additional insights into managing your financial obligations effectively.

Utilizing pdfFiller for comprehensive document solutions

pdfFiller enhances the vehicle personal property tax filing process by enabling users to fill out, edit, and manage forms efficiently. The platform’s capabilities allow you to collaborate with multiple users, adding a layer of convenience to review processes, particularly for teams or individuals who frequently manage multiple vehicles.

Moreover, pdfFiller is compatible with various file formats, making it easier to convert and handle complex documents. Its cloud-based platform ensures that you can access your forms from any device, facilitating seamless tax management.

Additional considerations and updates

Staying informed about changes to tax laws relating to vehicle personal property tax is crucial. Many localities adjust their regulations periodically, which can significantly affect how taxes are assessed and filed. Regularly check your local department of tax administration for updates.

For individuals with complex tax situations or uncertainties regarding their obligations, seeking assistance from a tax professional can be beneficial. If you find yourself confused about filings or facing penalties, consulting an expert can provide clarity and guidance tailored to your situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my vehicle personal property tax directly from Gmail?

How can I get vehicle personal property tax?

How do I edit vehicle personal property tax on an Android device?

What is vehicle personal property tax?

Who is required to file vehicle personal property tax?

How to fill out vehicle personal property tax?

What is the purpose of vehicle personal property tax?

What information must be reported on vehicle personal property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.