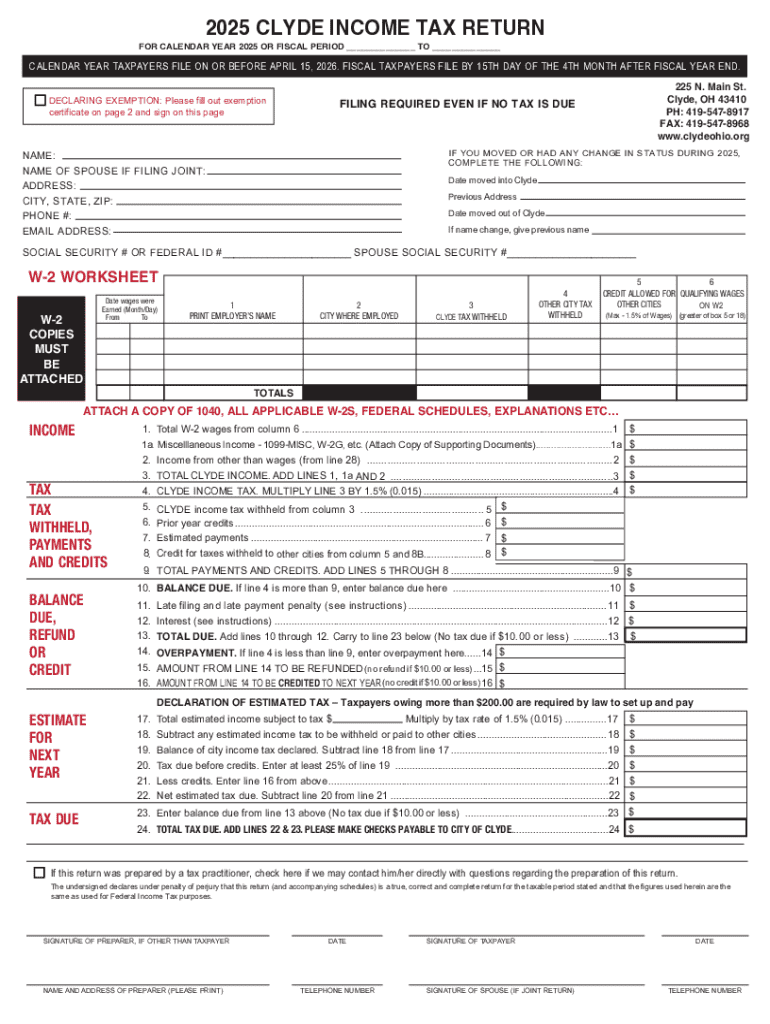

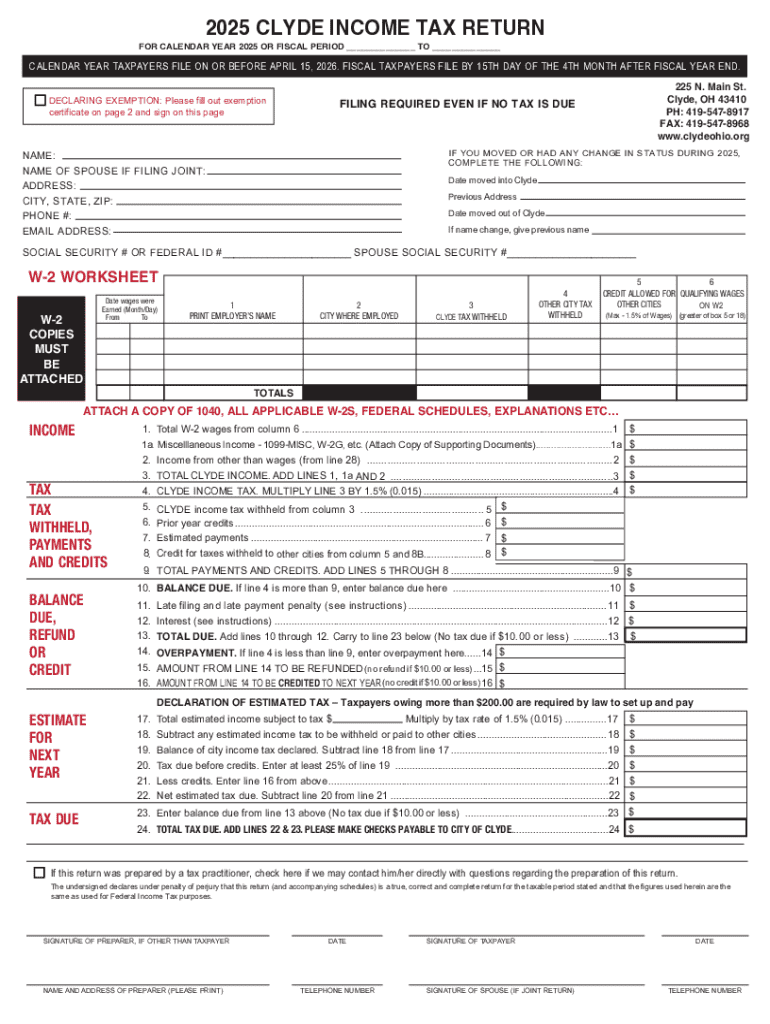

OH Income Tax Return - City of Clyde 2025-2026 free printable template

Get, Create, Make and Sign OH Income Tax Return - City

How to edit OH Income Tax Return - City online

Uncompromising security for your PDF editing and eSignature needs

OH Income Tax Return - City of Clyde Form Versions

How to fill out OH Income Tax Return - City

How to fill out clyde_flat_taxreturn_2018

Who needs clyde_flat_taxreturn_2018?

Clyde Flat Tax Return 2018 Form: Your Comprehensive Guide

Overview of Clyde Flat Tax Return 2018

The Clyde Flat Tax Return 2018 form is an essential document for individuals and entities participating in the Clyde flat taxation system. Its primary purpose is to facilitate a simplified taxation process by allowing filers to report their income and deductions succinctly. Accurate tax filing is paramount, as it ensures compliance with tax regulations and helps avoid potential penalties. Understanding the key features of the Clyde Flat Tax Return form reduces confusion and promotes efficient financial literacy among taxpayers.

Understanding the Clyde taxation system

The Clyde taxation system utilizes a flat tax rate, which is a single tax rate applied to all taxpayers regardless of income level. This system contrasts sharply with progressive taxation models, where tax rates increase with higher income brackets. The simplicity of the flat tax structure is appealing; it eliminates complex calculations and makes tax liabilities predictable for individuals and businesses alike.

Comparing the benefits, a flat tax system can lead to more economic transparency and could encourage compliance since all taxpayers know exactly what they owe. For teams and small businesses, the predictability in tax planning can aid in strategic financial decision-making, potentially allowing for better resource allocation throughout the fiscal period.

Preparing to fill out the Clyde Flat Tax Return 2018 form

Before diving into filling out the Clyde Flat Tax Return 2018 form, it's crucial to gather all necessary documents and pieces of information. This preparation includes collecting W-2 forms, 1099s, and other pertinent income statements. Knowledge of available deductions and credits is also fundamental to ensure that you optimize your filing and minimize your tax liability.

Setting up a pdfFiller account can streamline this process. The sign-up process is straightforward, allowing you to quickly access a range of features tailored toward managing tax documents efficiently. Tools such as secure storage, document editing, and e-signing enhance your tax preparation experience.

Step-by-step guide to filling out the Clyde Flat Tax Return 2018 form

Filling out the form can be simplified through a systematic approach:

Common mistakes to avoid when filing

While filling out the Clyde Flat Tax Return 2018 form, awareness of common pitfalls can save considerable time and grief. Misreporting income is a frequent and potentially damaging error that can lead to audits. Additionally, ignoring available tax credits may result in overpaying taxes. It is also crucial to ensure the document is correctly signed, as an unsigned form can render it invalid.

Lastly, many filers overlook the tools at their disposal. pdfFiller’s features can significantly enhance the ease of filing and ensure comprehensive and accurate submissions.

FAQs on Clyde Flat Tax Return 2018 form

A few common inquiries associated with the Clyde Flat Tax Return 2018 form include:

Using pdfFiller to manage your tax documents

pdfFiller offers comprehensive document management solutions. Among its collaborative features, users can invite team members to participate in real-time editing, ensuring everyone contributes to the filing process if needed. Additionally, pdfFiller provides a robust storage system to easily retrieve previous tax forms, which simplifies recordkeeping.

Enhanced security measures protect sensitive information, while templates for future tax returns save time and frustration come tax season.

Additional tips for maximizing your tax refund

To ensure you're optimizing your tax refund, consider keeping track of expenses throughout the year instead of waiting until tax season. This organization can make distinguishing between deductible and non-deductible expenses much easier, ultimately resulting in a more favorable tax outcome.

Staying informed about tax legislation changes can also affect your filings significantly. Lastly, effective record-keeping practices using pdfFiller can enhance your filing accuracy, ensuring you capture all eligible deductions.

Interactive tools and resources on pdfFiller

Using pdfFiller, you can access a suite of interactive tools that simplify the process of filling out tax forms. The platform includes example scenarios and how-to videos tailored to visual learners, making the tax filing experience less daunting.

Furthermore, pdfFiller fosters a user community where individuals can ask questions related to tax filing, ensuring support is readily available.

People Also Ask about

Where to get Michigan tax forms?

Where can I get IRS paper forms?

What is Schedule C 1040?

What tax form do I fill out when starting a new job?

What forms do I need to file Michigan taxes?

Is Cleveland a Rita or CCA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit OH Income Tax Return - City in Chrome?

Can I create an eSignature for the OH Income Tax Return - City in Gmail?

How do I fill out OH Income Tax Return - City using my mobile device?

What is clyde_flat_taxreturn_2018?

Who is required to file clyde_flat_taxreturn_2018?

How to fill out clyde_flat_taxreturn_2018?

What is the purpose of clyde_flat_taxreturn_2018?

What information must be reported on clyde_flat_taxreturn_2018?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.