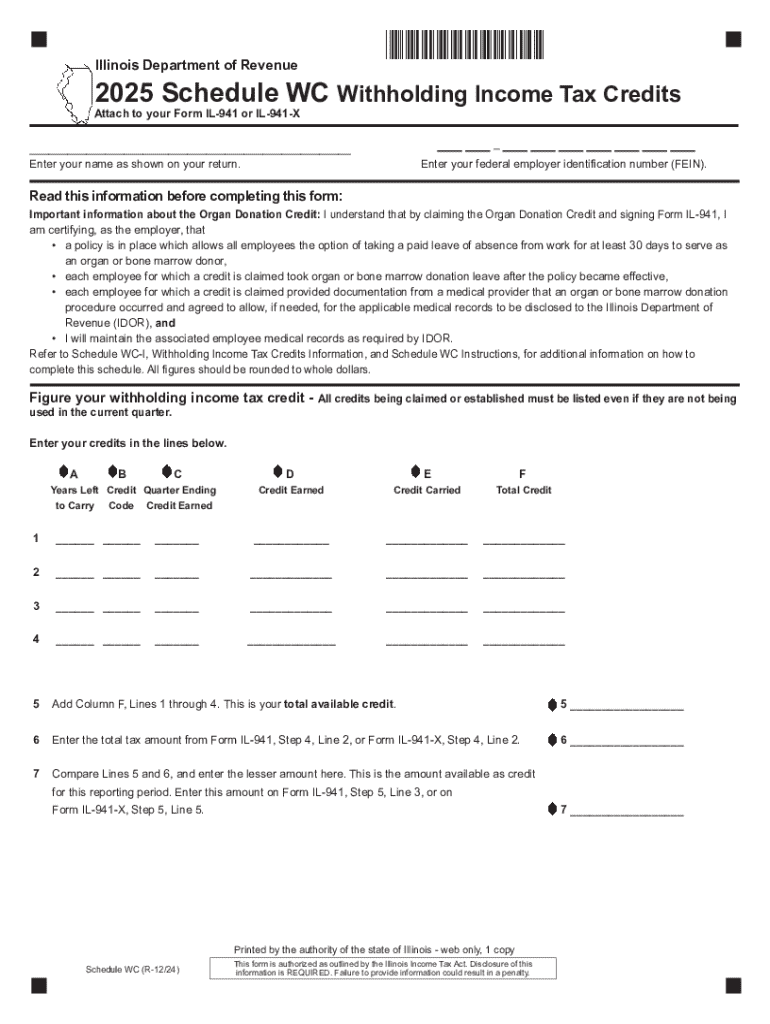

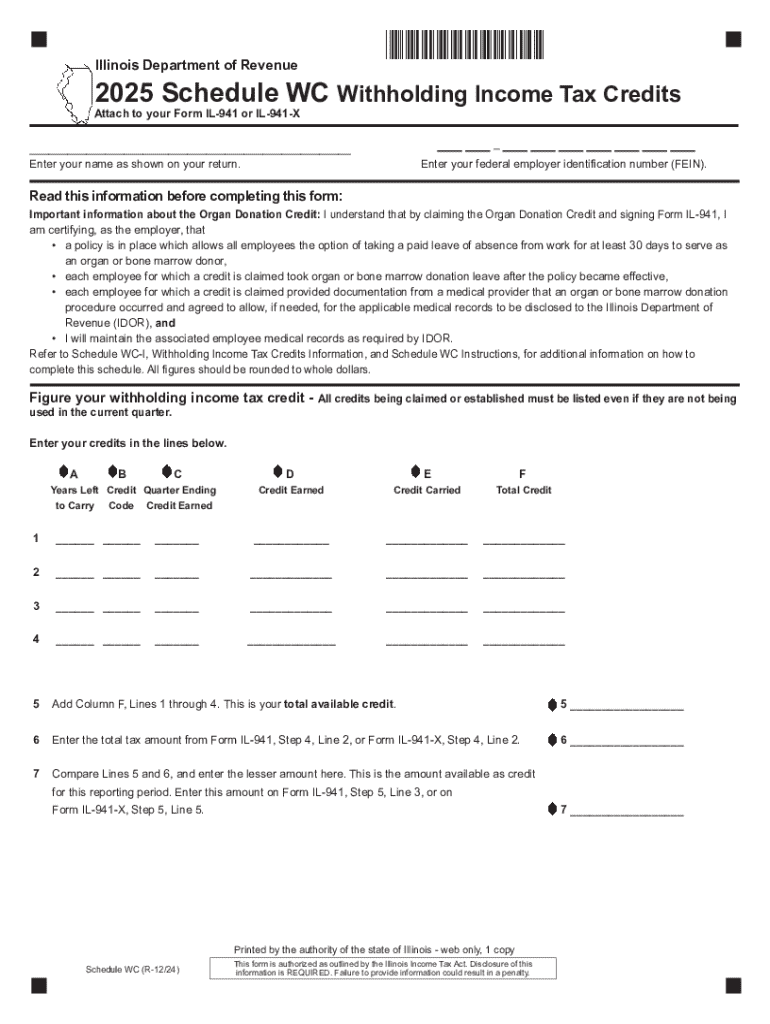

Get the free Withholding Income Tax Forms - Illinois Department of Revenue - tax illinois

Get, Create, Make and Sign withholding income tax forms

Editing withholding income tax forms online

Uncompromising security for your PDF editing and eSignature needs

How to fill out withholding income tax forms

How to fill out withholding income tax forms

Who needs withholding income tax forms?

Understanding Withholding Income Tax Forms

Overview of withholding income tax forms

Withholding income tax forms play a crucial role in the tax system. These forms ensure that the correct amount of tax is withheld from employees’ paychecks throughout the year, preventing unexpected tax bills come filing season. Essentially, these forms help employees balance their tax payments with their earnings, simplifying tax liability management.

Accurate tax withholding is vital because it dictates the amount of income tax that employers deduct from employees' wages. If too little is withheld, workers may face a tax liability they cannot cover when it comes time to file their returns. Conversely, excessive withholding results in reduced take-home pay and lower cash flow throughout the year.

Any employee or contractor receiving income subject to tax needs to be aware of and file the appropriate withholding income tax forms. This includes individuals working full-time, part-time, freelancers, and contractors, ensuring compliance across various employment structures.

Types of withholding income tax forms

Understanding the different types of withholding income tax forms is key to managing your tax obligations effectively. Below are the most commonly used forms.

Common forms explained

1. **W-4 Form**: Employee’s Withholding Certificate - This form allows employees to declare their tax situation and preferences to ensure the correct amount is withheld from their paycheck. It's vital for indicating marital status, number of allowances, and any additional amounts they wish to withhold.

2. **W-2 Form**: Wage and Tax Statement - Employers must provide this form to their employees, detailing the wages earned and taxes withheld throughout the year. It is crucial for filing annual income taxes.

3. **1099 Forms**: For Non-Employee Compensation - These forms are used to report various types of income other than wages or salaries. Freelancers and contractors typically receive 1099 forms, which include different variations like the 1099-MISC and 1099-NEC, specifying payment amounts and the services rendered.

Step-by-step instructions for completing withholding income tax forms

Filling out the W-4 form

Completing the W-4 form accurately is essential. Start by entering your personal information, including your name, address, Social Security number, and filing status. Understanding allowances is pivotal; more allowances lead to less withholding. Changes in circumstances, such as marriage or the birth of a child, necessitate adjustments in allowances. Use the IRS's worksheets provided with the form for guidance.

Preparing the W-2 form

When preparing the W-2 form, gather all relevant information regarding employee earnings and withholdings for the tax year. Report total earnings, Social Security wages, Medicare wages, and any amounts withheld for federal income tax. Ensure to include the employer's identification number and the employee's information accurately to avoid complications with the Department of Revenue.

Filing 1099 forms

It’s essential to know when to file a 1099 form, particularly for contractor payments exceeding $600. Gather required details like the contractor's name, address, and Tax Identification Number (TIN). Complete the form accurately, ensuring no discrepancies to avoid penalties. Include the services performed along with the total payments made during the year.

Interactive tools for managing tax withholding

Utilizing innovative tools can simplify the management of withholding income tax forms. Two notable resources are withholding calculators and editable templates.

Withholding calculators

Online withholding calculators can help users estimate their tax withholding based on their unique financial situations. By inputting data such as income, marital status, and number of dependents, individuals can better understand how much should be withheld from each paycheck.

Templates for withholding tax forms

Using downloadable and editable templates can streamline the form completion process. pdfFiller offers easy-to-use templates for W-4, W-2, and 1099 forms, ensuring that users can quickly edit, save, and share their documents. Step-by-step guides accompany these templates to facilitate user comprehension and accuracy.

Tips for avoiding common mistakes

Avoiding errors in withholding income tax forms is crucial for smooth filings. Common mistakes include miscalculating allowances, which can drastically affect tax liabilities, and entering incorrect personal information such as names, Social Security numbers, or addresses.

How to correct mistakes on submitted forms

If mistakes are found post-submission, corrections need to be made swiftly. For the W-4 form, simply submit a new form to your employer with the correct information. If you have already filed your W-2 or 1099, file an amended return with the correct figures as soon as possible to the IRS to mitigate penalties.

Collaborating on tax documents

Working on tax documents can be cumbersome, but with platforms like pdfFiller, teams can collaborate in real-time. This feature is greatly beneficial for organizations needing to ensure accuracy and compliance across various documents.

Utilizing pdfFiller for team collaboration

With pdfFiller, users can edit and comment on documents simultaneously, enhancing the collaboration process. Features like assigning roles within the team allow for tracked changes and structured workflows, streamlining the completion and submission process of withholding tax forms.

Securely signing and sharing withholding forms

Another advantage of using pdfFiller is its eSigning capabilities that allow users to quickly sign documents digitally and share them with relevant parties. This feature is particularly significant as it expedites the process of getting forms submitted to governmental departments such as the Department of Revenue in Indiana or other states.

Accessing and managing tax forms from anywhere

In today’s world, having access to tax forms and documents from any location is crucial. Cloud-based solutions offer a level of convenience that traditional paper formats cannot match.

Cloud-based solutions for document management

Platforms like pdfFiller allow users to manage their tax forms wherever they are. This means no more searching through piles of paperwork or worrying about losing vital documents. With cloud storage, your documents remain organized, easily searchable, and accessible, providing a seamless experience whether you are at home or on the go.

FAQ section

As withholding income tax forms can be complicated, many common questions arise regarding their usage, deadlines, and the filing process. Here are a few frequently asked questions.

Additional information on withholding taxes

It's important to stay informed about any changes in tax laws relevant to withholding. Legislative updates can impact how much is withheld from paychecks and overall tax liabilities. Regularly review IRS guidelines and consult with tax professionals if necessary to ensure compliance.

Resources for further learning and guidance can be found on official tax websites and through reputable tax preparation services. Engaging with tax forums can also provide community insights and shared experiences, enhancing your understanding of withholding tax forms.

Customer support and assistance

If you encounter issues with your withholding income tax forms or have specific questions, reaching out for assistance is key. pdfFiller offers excellent customer support to help users through these processes.

Support resources are available through pdfFiller, ensuring that you receive timely help whenever needed. Whether it’s through live chat, email, or user forums, expert assistance is just a click away.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send withholding income tax forms for eSignature?

How do I execute withholding income tax forms online?

How do I edit withholding income tax forms in Chrome?

What is withholding income tax forms?

Who is required to file withholding income tax forms?

How to fill out withholding income tax forms?

What is the purpose of withholding income tax forms?

What information must be reported on withholding income tax forms?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.