Get the Free Truist Direct Deposit Authorization FormPDF

Get, Create, Make and Sign truist direct deposit authorization

How to edit truist direct deposit authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out truist direct deposit authorization

How to fill out truist direct deposit authorization

Who needs truist direct deposit authorization?

Comprehensive Guide to the Truist Direct Deposit Authorization Form

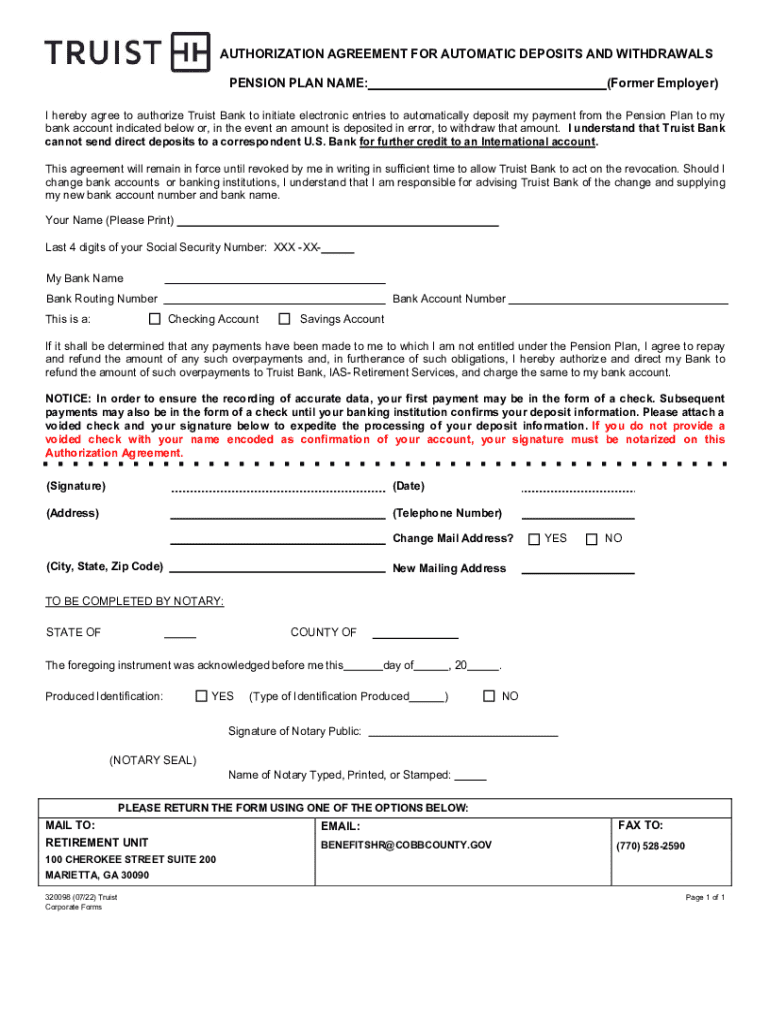

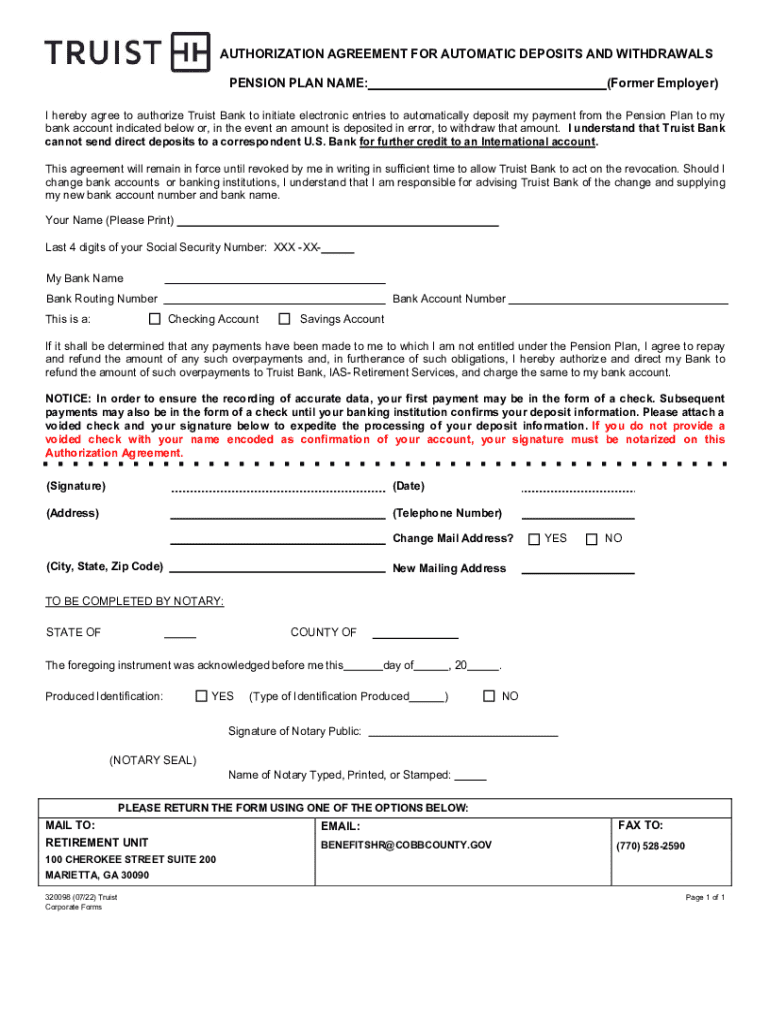

Overview of the Truist Direct Deposit Authorization Form

The Truist Direct Deposit Authorization Form serves as a critical document for individuals looking to set up direct deposits for their salary or benefits directly into their bank account. By completing this form, recipients can ensure that their funds are transferred electronically and securely, eliminating the need for paper checks and ensuring prompt access to funds.

Direct deposit offers numerous benefits, including enhanced security and faster access to funds, making it especially vital for payroll and benefit distributions. It allows employers to streamline their payment processes, ultimately benefiting both parties economically.

This form is essential for anyone receiving wages from Truist as well as organizations setting up payroll systems. It is a user-friendly, efficient way to manage financial transactions directly.

Key features of the Truist Direct Deposit Authorization Form

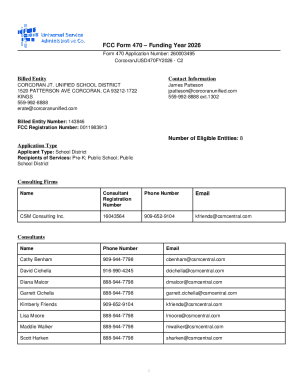

When filling out the Truist Direct Deposit Authorization Form, certain elements must be included to ensure compliance and accuracy. Essential personal information such as your full name, account number, and Social Security number are vital for processing your request.

Details pertaining to your employer—including their name, address, and pay frequency—should also be provided. This information helps facilitate smooth transactions.

Security is paramount when dealing with sensitive financial documents. Submitting the form via secure methods not only protects your information but also aligns with privacy regulations governing financial data.

Step-by-step guide to filling out the Truist Direct Deposit Authorization Form

Before you begin filling out the Truist Direct Deposit Authorization Form, gather all necessary documents such as bank statements, employer details, and any identification required. Access the blank form through the pdfFiller platform for a seamless experience.

After completing the form, take a moment to review your entries. Double-check every detail for accuracy and, if possible, save a copy for your personal records before submission.

Editing and customizing the form on pdfFiller

pdfFiller offers numerous tools to edit and customize the Truist Direct Deposit Authorization Form. Utilizing its editing features allows you to add any additional fields or notes that might be necessary for your specific situation.

Furthermore, the platform supports collaboration, enabling teams to work together effectively on filling out the form. You can set permissions to control who has access to the document, allowing for a secure and well-organized approach to financial management.

Submitting the Truist Direct Deposit Authorization Form

Submitting your completed Truist Direct Deposit Authorization Form can be done through various methods. Online submission via pdfFiller is secure and typically the fastest way to ensure your form is processed efficiently.

In contrast, paper submissions can be prone to delays. If you choose to submit a hard copy, ensure it is mailed securely to your employer or the designated Truist department. Once submitted, tracking your submission becomes critical. If you don’t receive confirmation within a reasonable timeframe, don’t hesitate to contact Truist directly for follow-up.

Common issues and troubleshooting

Several common issues can arise when filling out the Truist Direct Deposit Authorization Form. Users might face problems related to incomplete sections or incorrect banking details, both of which can lead to processing delays.

Understanding why a form may be rejected is also crucial. Typical reasons include mismatches in banking information or failure to provide a required signature. Should you encounter these issues, pdfFiller offers robust support resources to guide you through resolving them, alongside the Truist customer service team for any specific inquiries.

Valuable tips and best practices

To enhance the security of your financial information when using the Truist Direct Deposit Authorization Form, employ strategies like encryption and secure password protocols. It’s essential to avoid sharing sensitive data through unsecured channels.

Knowing the typical processing times for direct deposits can also be beneficial. Expect to see funds posted within one to two pay cycles after your form has been successfully processed.

Lastly, staying informed about changes to your direct deposit can be managed easily through pdfFiller, allowing for swift updates to your forms without unnecessary delays.

Additional forms related to direct deposit and payroll management

In addition to the Truist Direct Deposit Authorization Form, other relevant documents include W-4 forms, employee information sheets, and various tax-related forms. Ensuring these forms are kept up-to-date and submitted accurately can aid in efficient payroll management.

Exploring additional templates for other financial documents on the pdfFiller platform can streamline organization and record-keeping processes.

Why choose pdfFiller for your document management needs

pdfFiller stands out as a comprehensive document management platform, designed specifically for users seeking to create, edit, sign, and manage forms seamlessly from any location. Its cloud-based technology guarantees easy access and collaborative capabilities, making it ideal for both individuals and teams.

Furthermore, pdfFiller’s tools ensure that your direct deposit authorization form is not only accurate but also securely stored, highlighting its effectiveness as a solution for efficient document management.

User testimonials and experience

Users have shared positive experiences with pdfFiller, particularly regarding the ease of setting up the Truist Direct Deposit Authorization Form. Many appreciate how user-friendly the platform is, highlighting its clear instructions and efficient workflow.

Success stories often illustrate how pdfFiller has enabled teams to collaborate on financial documents, ensuring timely submissions and reduced processing times, leading to more efficient payroll outcomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get truist direct deposit authorization?

Can I sign the truist direct deposit authorization electronically in Chrome?

How do I edit truist direct deposit authorization on an iOS device?

What is truist direct deposit authorization?

Who is required to file truist direct deposit authorization?

How to fill out truist direct deposit authorization?

What is the purpose of truist direct deposit authorization?

What information must be reported on truist direct deposit authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.