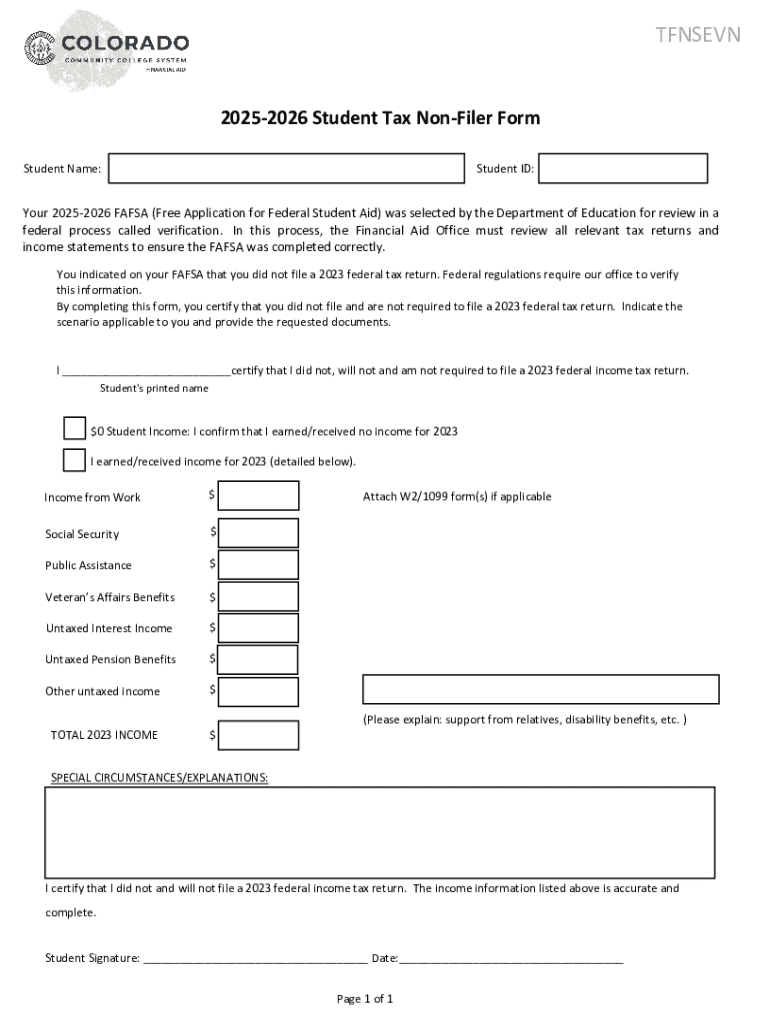

Get the free 2025-2026 Student Tax Non-Filer Form

Get, Create, Make and Sign 2025-2026 student tax non-filer

How to edit 2025-2026 student tax non-filer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025-2026 student tax non-filer

How to fill out 2025-2026 student tax non-filer

Who needs 2025-2026 student tax non-filer?

2 Student Tax Non-Filer Form: A Complete Guide

Understanding the Student Tax Non-Filer Form

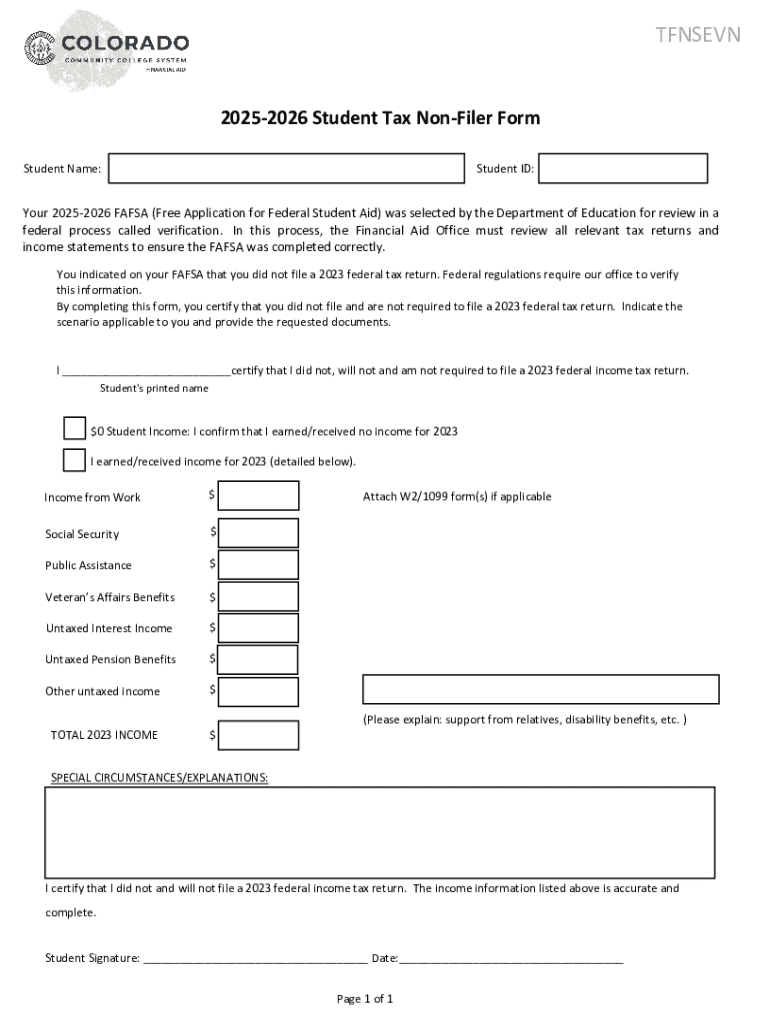

The 2 Student Tax Non-Filer Form serves as a critical document for students who did not earn enough income to be required to file taxes. It's specifically designed to assist with various financial aid applications, ensuring that students can still access vital funding for their education without the need to submit tax returns.

The importance of non-filer status for students cannot be overstated. It allows eligible individuals to clarify their tax-filing status to educational institutions and financial aid programs, ensuring they receive appropriate consideration in the financial aid process.

In essence, the key difference lies between non-filers and tax filers; non-filers simply have not met income thresholds, while tax filers must report their earnings regardless of the amount.

Eligibility criteria for non-filer status

Understanding the eligibility criteria for the 2 student tax non-filer form is crucial. To qualify, students must adhere to certain income thresholds set by the IRS: generally, if a student earns less than $12,550 in a year, they may not be required to file taxes. Additionally, a student's dependency status plays a significant role in determining their tax obligations.

Special cases also exist, such as students with no income whatsoever who still need to affirm their non-filer status. Additionally, international students must navigate specific tax responsibilities that may differ from those of domestic students, making it essential for them to assess their particular scenarios.

Step-by-step guide to completing the student tax non-filer form

Completing the 2 student tax non-filer form requires attention to detail. First, gather necessary identification documents such as your Social Security number, and prepare financial information relevant to your income and other earnings for the year's tax period. This will facilitate a smooth process when filling out the form.

When it comes to actually completing the form, look at it section by section. Be wary of common pitfalls, such as misreporting your income or neglecting to provide all necessary documentation, as this could delay your application or affect your financial aid eligibility. Double-checking entries and ensuring consistent information with other forms submitted to the IRS can help preempt any issues.

Tools and resources for managing your form

For students navigating the tax landscape, utilizing online platforms can streamline the completion process of the 2 student tax non-filer form. pdfFiller, for example, offers a robust solution for editing, signing, and managing documents all in one cloud-based platform, allowing users to keep everything organized.

Additionally, interactive financial calculation tools, such as budgeting calculators, can provide valuable insights into your overall fiscal responsibilities. These resources collectively ease the process of estimating potential tax returns and preparing for possible outcomes.

Frequently asked questions (FAQs)

What happens if you miss the deadline for the 2 student tax non-filer form submission? While missing the deadline might affect your financial aid applications, it’s advisable to submit the form as soon as possible to prevent delays. Understanding how non-filer status affects financial aid can also help—many institutions recognize and accommodate non-filer students in their assessments.

These FAQs highlight the significance of understanding your status and exploring the options available to you. The more informed you are, the better equipped you will be to navigate the complexities of tax compliance as a student.

Special considerations for non-filer students

While filing the 2 student tax non-filer form, it's also essential to consider fraud prevention tips. Ensure that you safeguard your personal information because students are often targets for identity theft during tax season. Regularly reviewing the implications for future tax years can also be beneficial, as understanding how your current status may affect future obligations will enhance your long-term financial literacy.

When considering your next filing year, think about what information to keep from this year for reference and what documentation would be useful down the line. Staying organized not only aids compliance but also helps in preparing for any unexpected inquiries.

Navigating further steps after filing the non-filer form

After submitting your 2 student tax non-filer form, tracking your submission status becomes imperative. Many institutions allow you to check the status online, which can provide peace of mind as you await any updates regarding your financial aid. If there’s a need to update your information, having direct communication channels established with your educational institution will facilitate this process.

Finally, understanding how to handle denials or errors in your submission is key. Prepare for possible appeals or further documentation requests, as addressing any concerns promptly can mitigate disruption in your financial aid flow.

Collaborating with advisors and financial aid offices

Maintaining open communication with your school’s financial aid office can significantly simplify the process surrounding your 2 student tax non-filer form. These offices typically have invaluable advice and resources that can assist students in clarifying their financial aid applications. Being in touch with advisors can further illuminate useful insights into what additional documentation may be necessary.

Proactive collaboration not only enhances your understanding but also builds a supportive network that can assist through potential challenges in the financial aid process.

Conclusion and future prep for students

Staying organized is a significant takeaway from the 2 student tax non-filer form process. Organizing records for future reference, such as your non-filer documentation, will not only prepare you for next tax season but also equip you with the necessary knowledge to navigate your financial responsibilities responsibly.

Preparing for next tax season involves understanding your obligations, staying informed about changes in tax laws, and being proactive about your financial situation. By empowering yourself with knowledge, you set a firm foundation for a successful financial future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2025-2026 student tax non-filer in Chrome?

Can I create an eSignature for the 2025-2026 student tax non-filer in Gmail?

How do I edit 2025-2026 student tax non-filer on an iOS device?

What is 2025-2026 student tax non-filer?

Who is required to file 2025-2026 student tax non-filer?

How to fill out 2025-2026 student tax non-filer?

What is the purpose of 2025-2026 student tax non-filer?

What information must be reported on 2025-2026 student tax non-filer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.