Get the free SUBSCRIPTION FORM QUALIFIED INSTITUTIONAL INVESTORS ...

Get, Create, Make and Sign subscription form qualified institutional

Editing subscription form qualified institutional online

Uncompromising security for your PDF editing and eSignature needs

How to fill out subscription form qualified institutional

How to fill out subscription form qualified institutional

Who needs subscription form qualified institutional?

Understanding the Subscription Form Qualified Institutional Form

Understanding the Subscription Form Qualified Institutional Form

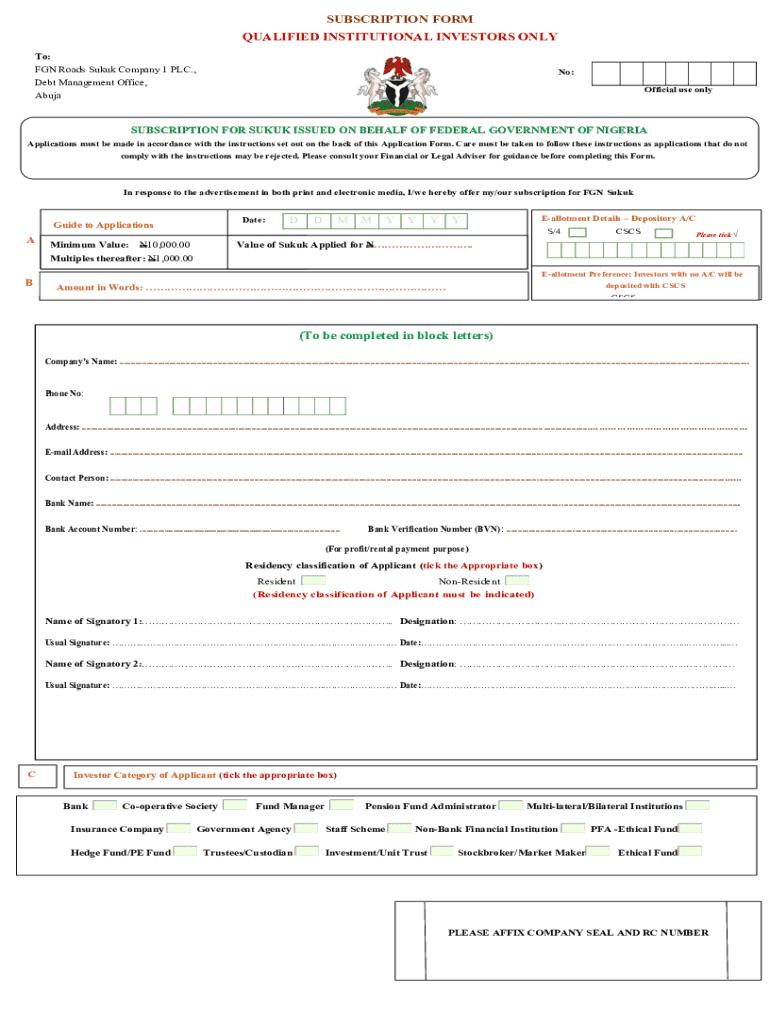

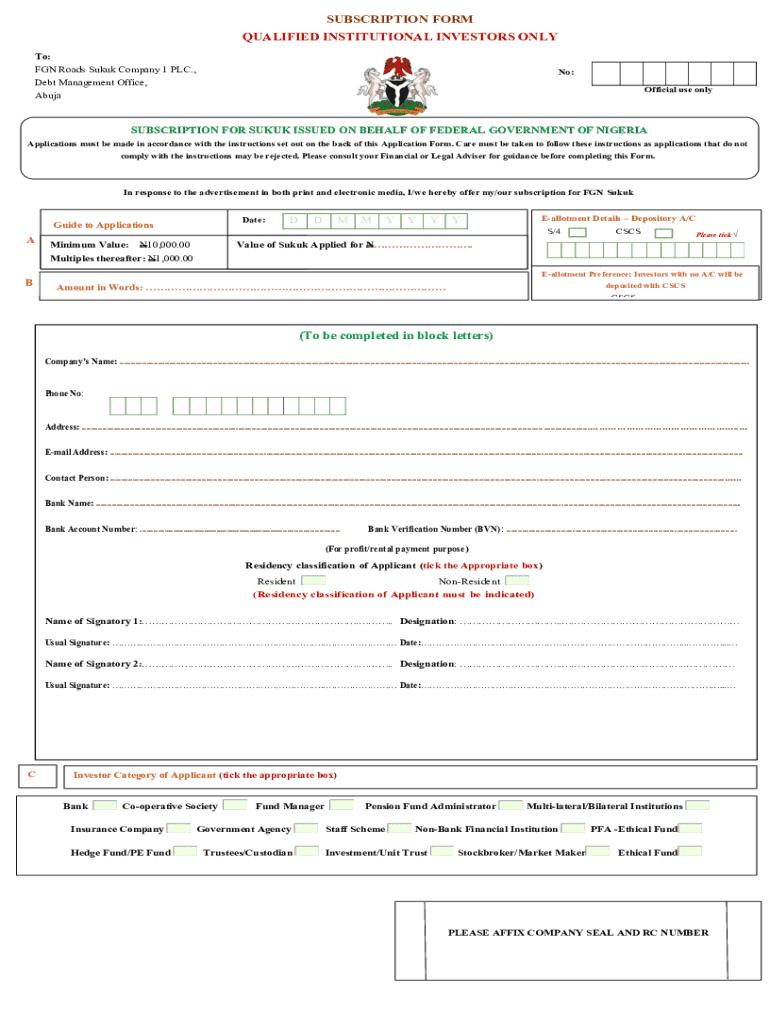

The Subscription Form Qualified Institutional Form is a critical document used by institutional investors looking to participate in private placements or other direct offerings. This form acts as a formal application for purchasing securities and holds significant implications for compliance and regulatory oversight. The completion and accuracy of this form ensure that the transaction adheres to the necessary legal frameworks governing investments.

Institutional investors, categorized as Qualified Institutional Buyers (QIBs), benefit from a streamlined process when engaging with securities issuers. QIBs are typically entities such as large insurance companies, mutual funds, pension funds, and other large financial institutions that meet specific regulatory thresholds. This specialized status allows QIBs to access investment opportunities unavailable to retail investors, making the Subscription Form Qualified Institutional Form a vital tool in their investment strategy.

Key components of the Subscription Form Qualified Institutional Form

To fully understand the intricacies of the Subscription Form Qualified Institutional Form, several key components should be examined closely. Each section of the form serves a specific purpose and is paramount in ensuring accurate submissions that fulfill regulatory requirements and expectations. Below is a breakdown of these components:

Filling out the Subscription Form Qualified Institutional Form

Completing the Subscription Form Qualified Institutional Form requires attention to detail and adherence to legal standards. Here’s a step-by-step guide to ensure you fill out the form accurately:

Interactive tools for managing your subscription

pdfFiller provides users with a suite of interactive tools designed specifically to enhance the management and submission of the Subscription Form Qualified Institutional Form. Leveraging cloud technology, pdfFiller allows institutional investors to easily edit, sign, and share their documents while maintaining security and compliance with regulatory standards.

Using pdfFiller streamlines the process, enabling institutions to edit their forms seamlessly, even if they are in PDF format. The platform allows uploading of existing forms, where users can fill in required information and digitally sign documents without any hassle.

Best practices for institutional investors

Institutional investors should adhere to best practices when filling out the Subscription Form Qualified Institutional Form to prevent any errors that could complicate investments. Here are several strategies:

Frequently asked questions (FAQs)

Addressing common inquiries surrounding the Subscription Form Qualified Institutional Form can provide additional clarity for institutional investors navigating this process. Here are some frequently asked questions:

The role of pdfFiller in simplifying subscription processes

For institutional investors, choosing pdfFiller for managing the Subscription Form Qualified Institutional Form offers numerous advantages. Its intuitive platform enables users to handle document processes from any device, allowing for seamless collaboration and editing.

The benefits of cloud-based solutions offered by pdfFiller include easy access from anywhere, which is essential for teams that operate across multiple locations. The platform promotes efficient teamwork by allowing users to work together on documents in real-time, simplifying the overall subscription process.

Real-world examples and case studies

Analyzing real-world examples of successful submissions of the Subscription Form Qualified Institutional Form can provide invaluable insights. Case studies illustrate how well-prepared institutions overcome common challenges during the subscription phase.

For instance, an investment firm conducting a substantial capital raise realized that clear communication of their subscription instructions and strict adherence to the legal requirements significantly improved their acceptance rate. Lessons learned from such instances emphasize the importance of due diligence in preparation and the execution phases of investments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find subscription form qualified institutional?

Can I create an electronic signature for the subscription form qualified institutional in Chrome?

How can I edit subscription form qualified institutional on a smartphone?

What is subscription form qualified institutional?

Who is required to file subscription form qualified institutional?

How to fill out subscription form qualified institutional?

What is the purpose of subscription form qualified institutional?

What information must be reported on subscription form qualified institutional?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.