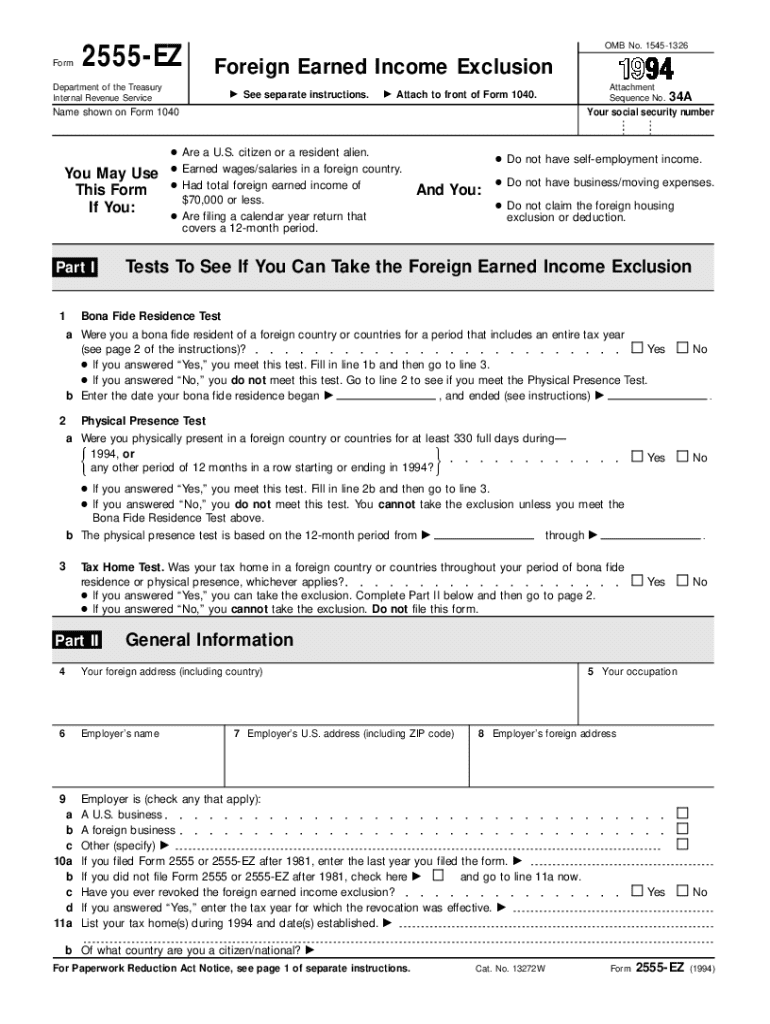

Get the free $70,000 or less

Get, Create, Make and Sign 70000 or less

Editing 70000 or less online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 70000 or less

How to fill out 70000 or less

Who needs 70000 or less?

Understanding the 70000 or Less Form: A Comprehensive Guide

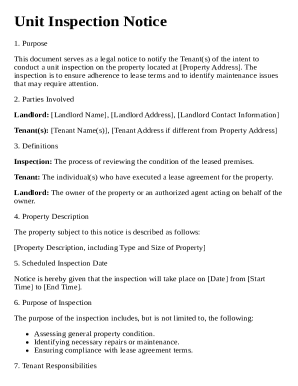

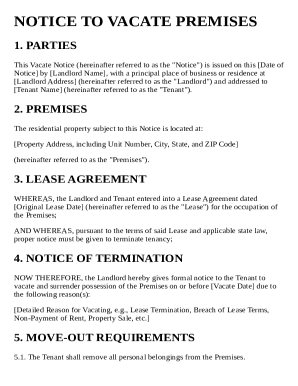

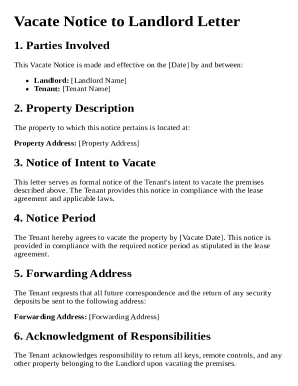

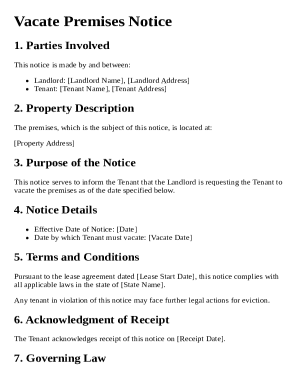

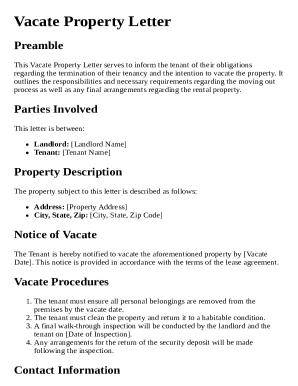

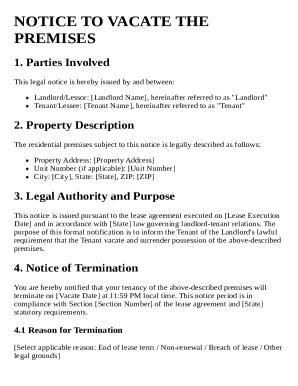

Understanding the 70000 or less form

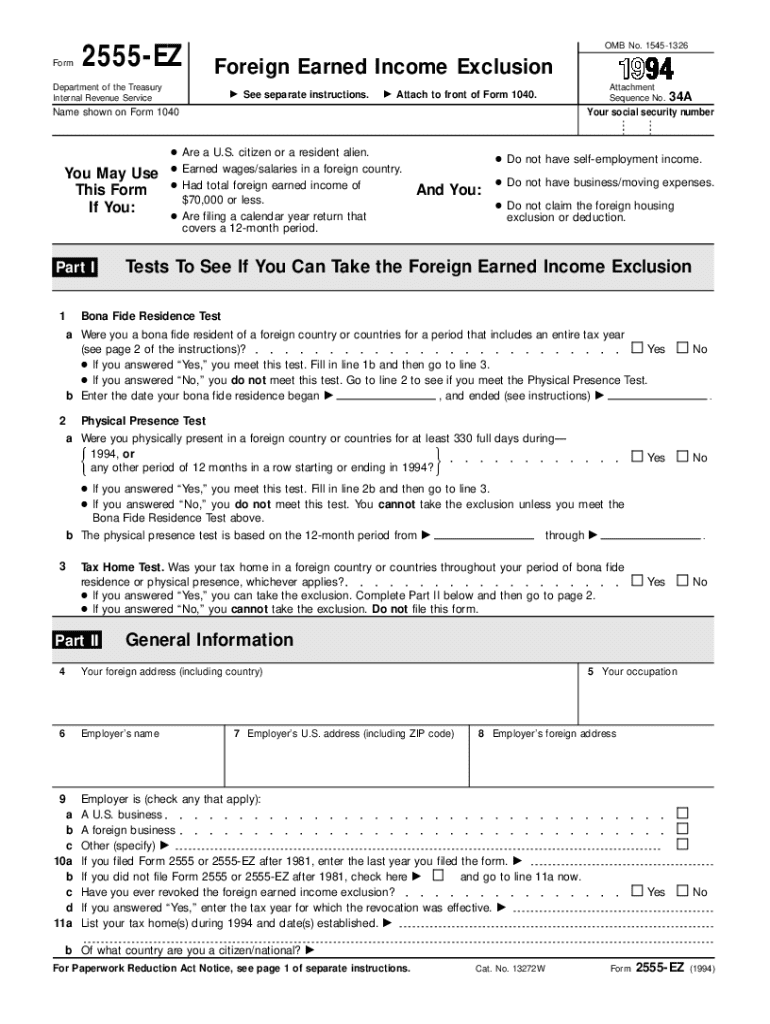

The 70000 or less form is a crucial document used primarily for tax filings. This form is specifically designed for individuals and businesses that have a total taxable income below $70,000. The main purpose of this form is to simplify the filing process by ensuring that those with lower incomes can easily report their earnings, deductions, and credits.

Accurate completion of the 70000 or less form is essential not only for compliance with IRS regulations but also for maximizing potential tax refunds. By correctly reporting income subject to taxation and claiming all relevant deductions and credits, filers can significantly reduce their tax obligations. Failing to complete the form accurately may lead to unnecessary tax liabilities or delays in processing refunds.

Specific individuals required to use this form typically include low to moderate-income earners, smaller businesses, and self-employed individuals within the income threshold. Understanding your filing requirements is vital to ensure compliance and avoid complications with tax agencies.

Key features of the 70000 or less form

The layout of the 70000 or less form is intentionally streamlined to aid users in quickly navigating the required sections. The form usually comprises several key areas: personal information, income details, and deduction and credit claims. Ensuring each field is accurately filled out helps maintain the integrity of the return.

Important filing requirements associated with this form include: a detailed breakdown of total income, information regarding any investments, such as dividends, and evidence of deductions for taxes owed. Businesses may need to provide specific data regarding their revenue, operational costs, and any applicable credits they wish to claim.

Step-by-step guide to filling out the 70000 or less form

Filling out the 70000 or less form involves several key steps. The first step is to collect all necessary information and documentation required to complete the form. Essential documents typically include W-2s, 1099 forms, records of other income, and details of deductions and credits.

Next, users should access the form itself. The form is generally available for download from official IRS sites or tax assistance organizations online. Make sure to obtain the most updated version of the form to ensure compliance with current tax laws.

During the completion process, each section must be carefully filled out as follows: the personal information section requires basic identification details; the income information section requires a comprehensive list of all earnings; while the deductions and credits section outlines any claims that can effectively reduce tax liability.

After filling out the form, reviewing and validating the entered information is crucial. Double-check for any typos or incorrect entries that could lead to issues later. Common mistakes include misreporting income or overlooking eligible deductions. Finally, submit the form through the preferred channels, whether online or via mail, while being mindful of filing deadlines to avoid penalties.

Interactive tools to assist with the 70000 or less form

To ease the preparation of the 70000 or less form, several interactive tools can be highly beneficial. Budget calculators can help estimate potential deductions based on your financial situation, ensuring that you do not miss out on savings.

Moreover, interactive checklists can assist in gathering the necessary documentation before you start filling out the form, saving valuable time. Online estimators provide real-time calculations of tax obligations, helping you understand potential refunds or amounts owed.

Editing and managing your 70000 or less form

Using effective tools like pdfFiller can enhance your experience in editing and managing the 70000 or less form. pdfFiller offers powerful features enabling users to edit PDF forms seamlessly, including tools for text and image adjustments.

E-signing options are also available on the platform, allowing complete remote management of your forms. Collaboration features enable multiple team members to review the draft and provide input or adjustments, streamlining the overall process.

Common questions about the 70000 or less form

Addressing common FAQs can demystify many concerns regarding the 70000 or less form. Typical questions include clarifications on who needs to file, what documents are needed, and how to amend the form if discrepancies occur post-filing.

Common issues might involve missing or incorrect information which can delay processing. In such cases, knowing how to amend your form promptly is crucial. Generally, filing amended returns ensures compliance and updates your tax records adequately.

Related information for users

In addition to the 70000 or less form, various other forms may be integral to the overall tax filing process. Understanding these additional forms can further aid users in ensuring compliance and maximizing deductions. It’s also essential for self-employed individuals to understand their unique tax obligations, as they may need to file additional documentation.

Resources for financial advisors can provide valuable insights and guidance. Users should seek professional advice where needed to ensure all tax matters are addressed adequately and efficiently. Knowing where to get help can alleviate stress and potentially save money.

Maintaining records and documentation

Once the 70000 or less form is completed and submitted, maintaining accurate records is paramount. Best practices include keeping both digital and physical copies of all completed forms and supporting documents for future reference. This is crucial in case of audits or discrepancies.

Guidelines for record retention for tax purposes recommend keeping documents for at least three to seven years. Leveraging pdfFiller’s cloud capability can help users securely store documents, making them readily accessible when needed.

Final tips for a smooth filing experience

Navigating the filing of the 70000 or less form can be simplified with careful preparation. As tax laws and forms can frequently change, staying informed about any updates or revisions is recommended to ensure that you are correctly filing.

Utilizing pdfFiller’s unique features can enhance document management long after the filing season is over. Regularly check for new resources and tools online as they become available to keep your tax-related tasks efficient and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete 70000 or less online?

How can I fill out 70000 or less on an iOS device?

How do I edit 70000 or less on an Android device?

What is 70000 or less?

Who is required to file 70000 or less?

How to fill out 70000 or less?

What is the purpose of 70000 or less?

What information must be reported on 70000 or less?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.