Get the free SILEHW Annuity Fund Beneficiary Form

Get, Create, Make and Sign silehw annuity fund beneficiary

Editing silehw annuity fund beneficiary online

Uncompromising security for your PDF editing and eSignature needs

How to fill out silehw annuity fund beneficiary

How to fill out silehw annuity fund beneficiary

Who needs silehw annuity fund beneficiary?

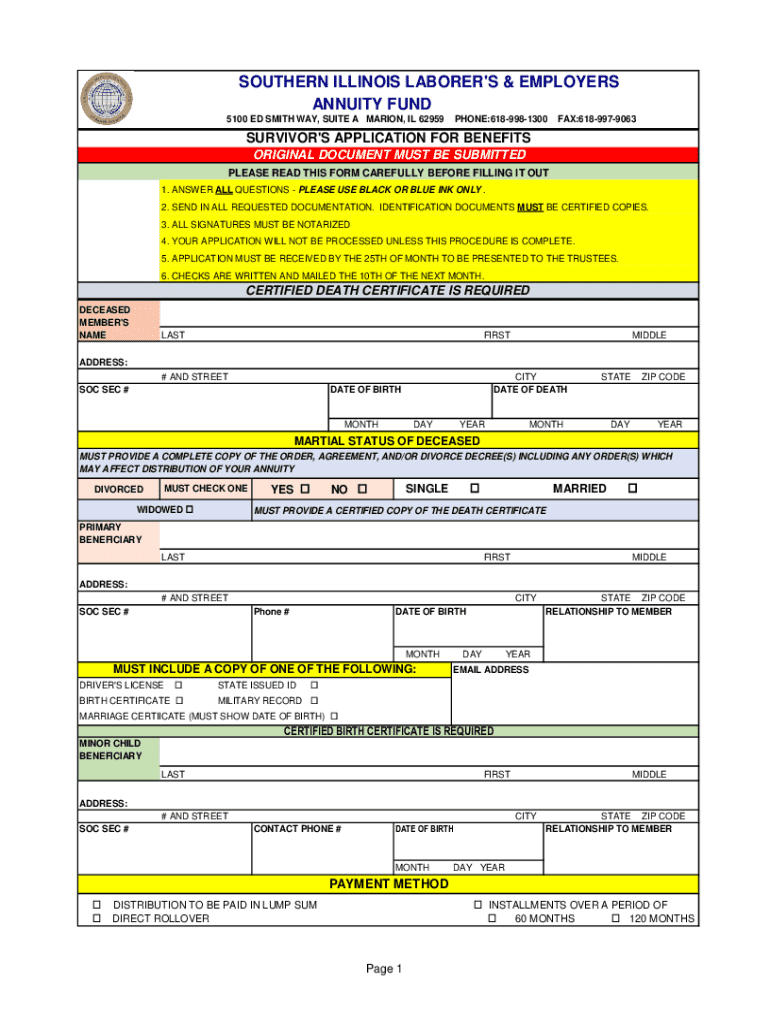

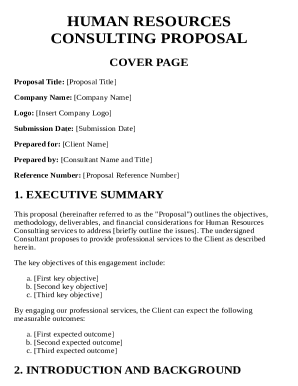

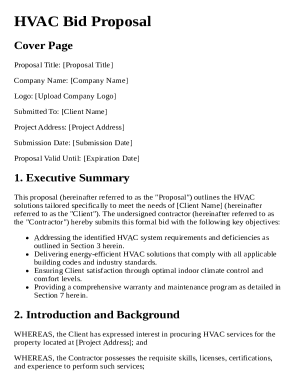

Understanding the Silehw Annuity Fund Beneficiary Form

Understanding Silehw Annuity Fund Beneficiary Form

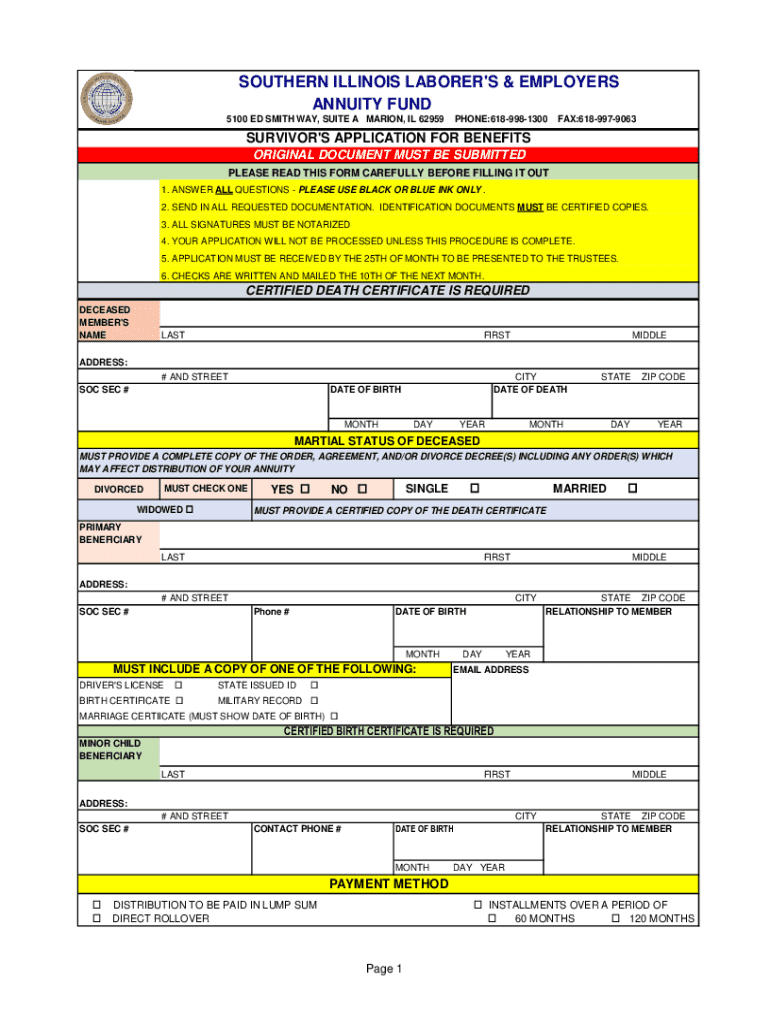

The Silehw Annuity Fund Beneficiary Form serves as a crucial document that designates who will receive the benefits of your annuity upon your passing. It is essential for ensuring that your financial legacy is directed according to your wishes. This form is more than just a document; it reflects your intent and preference for how your funds should be distributed.

Designating a beneficiary is vital, as it streamlines the transfer of assets and avoids probate situations, which can be lengthy and costly. Moreover, an untimely oversight in beneficiary choices can lead to funds being allocated to unintended recipients, which can be emotionally and financially distressing for loved ones.

The Silehw Annuity Fund is designed to provide participants with a structured way of saving for retirement while ensuring their loved ones can benefit from these funds in case of the account holder’s death. Understanding the nuances of the beneficiary form helps in maximizing the advantages of this financial instrument.

Key components of the beneficiary form

The Silehw Annuity Fund Beneficiary Form contains several key components that are crucial for accurate completion. It gathers essential information that ensures clarity in handling your annuity benefits after your death.

Step-by-step guide to completing the beneficiary form

Completing the Silehw Annuity Fund Beneficiary Form may seem daunting, but following a few straightforward steps can simplify the process. Begin by preparing adequately before you start filling out the form.

When filling out the form, start with your personal information, ensuring each detail is correct. Move on to the beneficiary selection carefully, as you want to ensure the right people are designated. Be clear about the distribution percentages, ensuring they total 100% between beneficiaries.

It's important to avoid common mistakes like incomplete information or incorrect beneficiary designations, which could invalidate your form and lead to significant challenges later on.

Editing and managing your completed beneficiary form

Once you’ve completed the form, managing it effectively is essential. pdfFiller offers convenient features to access and edit your completed Silehw Annuity Fund Beneficiary Form easily.

Remember to save your changes and maintain version control to avoid confusion. The eSigning process via pdfFiller is a straightforward method to capture your signature digitally in compliance with legal standards.

Frequently asked questions

As you navigate the intricacies of the Silehw Annuity Fund Beneficiary Form, you may have some common questions. Here are a few FAQs to consider.

Additional considerations

When filling out your Silehw Annuity Fund Beneficiary Form, consider the legal implications surrounding beneficiary designations. Different regions may have varying laws, and understanding these can protect your intentions.

Additionally, consider the tax implications of death benefits associated with your annuity. Beneficiaries may be subjected to certain taxes depending on how the benefits are structured.

Moreover, ensure that your beneficiary designation aligns with your overall estate plan to avoid unnecessary complications or conflicts among heirs.

Troubleshooting common issues

Despite careful completion, you may face challenges with the Silehw Annuity Fund Beneficiary Form during submission. Addressing these issues promptly is crucial.

Interactive tools and resources

pdfFiller stands out with its interactive tools that allow users to manage their Silehw Annuity Fund Beneficiary Form efficiently. With features like template access and document management, it’s convenient for users focused on streamlining their document workflows.

Access to additional downloadable resources also enhances your ability to manage your documents effectively, ensuring you have everything you need.

Next steps after submission

Once you have submitted your Silehw Annuity Fund Beneficiary Form, knowing the next steps can help you maintain peace of mind.

Contact information for further assistance

If you have further questions or require assistance regarding your Silehw Annuity Fund Beneficiary Form, several resources are available to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get silehw annuity fund beneficiary?

How do I make changes in silehw annuity fund beneficiary?

How do I fill out silehw annuity fund beneficiary using my mobile device?

What is silehw annuity fund beneficiary?

Who is required to file silehw annuity fund beneficiary?

How to fill out silehw annuity fund beneficiary?

What is the purpose of silehw annuity fund beneficiary?

What information must be reported on silehw annuity fund beneficiary?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.