Get the free military-affidavit-for-motor-vehicle-tax-exemption. ...

Get, Create, Make and Sign military-affidavit-for-motor-vehicle-tax-exemption

How to edit military-affidavit-for-motor-vehicle-tax-exemption online

Uncompromising security for your PDF editing and eSignature needs

How to fill out military-affidavit-for-motor-vehicle-tax-exemption

How to fill out military-affidavit-for-motor-vehicle-tax-exemption

Who needs military-affidavit-for-motor-vehicle-tax-exemption?

Military Affidavit for Motor Vehicle Tax Exemption: A Comprehensive Guide

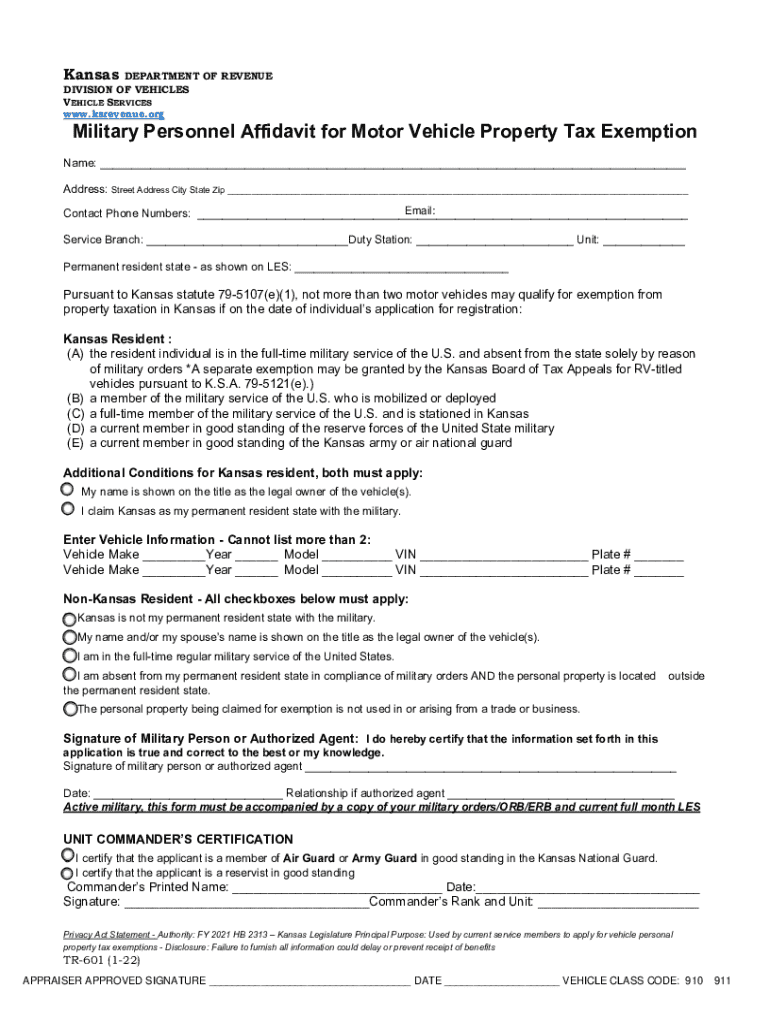

Understanding the military affidavit for motor vehicle tax exemption

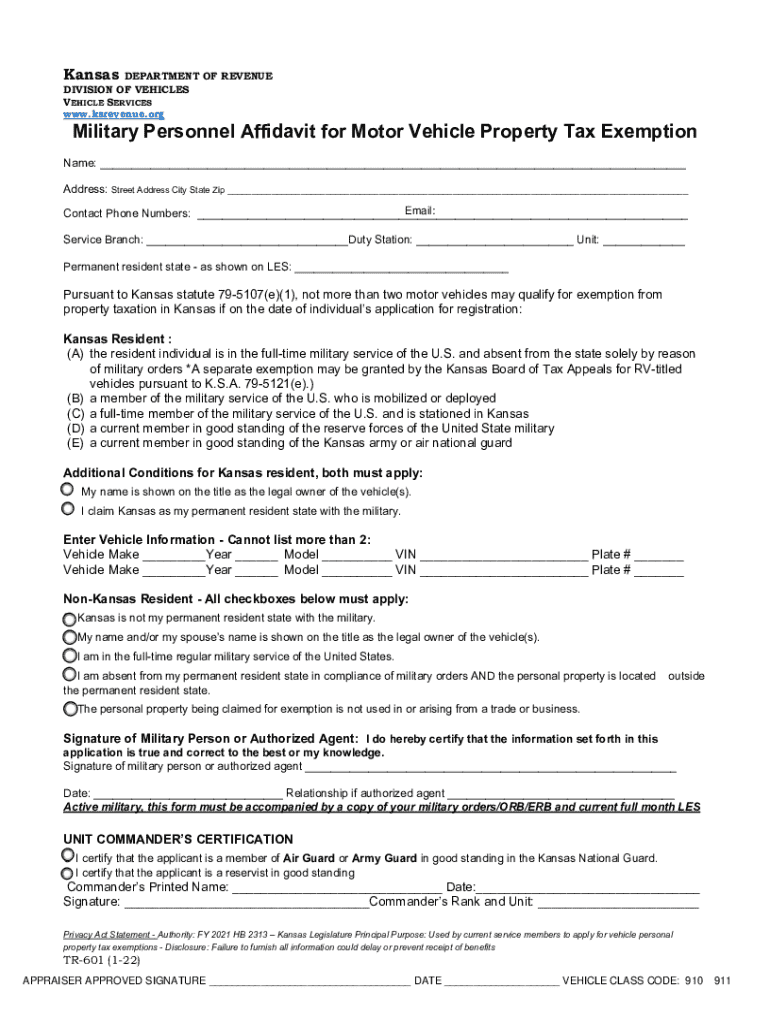

The military affidavit for motor vehicle tax exemption is an essential document that allows eligible military personnel to seek exemptions from certain taxes associated with vehicle ownership. This form primarily serves to validate the applicant’s active duty status, thereby helping them mitigate the financial burdens often linked to vehicle registration and related taxes. By obtaining this exemption, military members can redirect their financial resources toward other vital aspects of their service and life.

The significance of tax exemption for military personnel cannot be overstated. It recognizes their dedication and sacrifices while providing tangible financial relief. As many servicemen and women are frequently deployed, understanding their rights and benefits regarding vehicle tax exemptions is crucial. This guide aims to illuminate the steps and requirements involved in obtaining and submitting the military affidavit for motor vehicle tax exemption.

Eligibility criteria

To qualify for the motor vehicle tax exemption, applicants must meet specific criteria. Typically, the exemption applies to active duty members of the military, including those in the Army, Navy, Air Force, Marine Corps, and Coast Guard. Additionally, certain reservists and members of the National Guard may also qualify, depending on state-specific regulations.

It's worth noting that different states may have varying definitions regarding eligibility. Therefore, it is advisable to check the specific guidelines set by the local Department of Motor Vehicles (DMV) or military support services. Keeping abreast of these regulations will not only ensure compliance but will also help facilitate a smoother exemption application process.

Overview of the motor vehicle tax exemption process

Obtaining a motor vehicle tax exemption starts with thorough research. Each state has its own procedures and requirements, so it’s crucial to identify what documents are necessary and whether additional applications or approvals are needed before submitting the military affidavit.

Consulting with military support services can provide clarity and guidance throughout this process. Many installations have personnel trained to assist with tax inquiries, including those related to vehicle ownership and exemptions. They can help clarify eligibility, provide the necessary paperwork, and even assist in filling out the forms accurately.

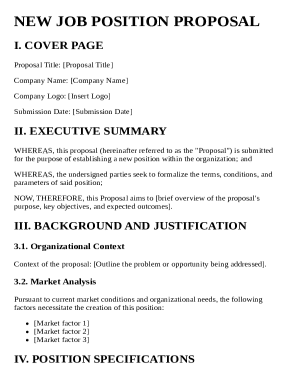

Detailed instructions for filling out the military affidavit

The military affidavit form comprises several components that applicants must fill out accurately. Understanding each section can simplify the completion process and enhance the chances of approval without delay. Typical components include personal information, military service information, and vehicle details.

The personal information section requires your name, address, and contact information. Meanwhile, the military service information section asks for your rank, service branch, and the dates of your service. Lastly, provide complete details about the vehicle, including the make, model, year, and Vehicle Identification Number (VIN).

A step-by-step approach to completing each section can mitigate data entry errors. For example, when entering personal information, use uppercase letters for clarity. Avoid common mistakes such as omitting crucial details or providing incorrect military service dates, which can lead to delays in processing your exemption. Double-check all entries before submitting to ensure accuracy.

Editing and managing your military affidavit

After filling out your military affidavit for motor vehicle tax exemption, it is important to verify that the document is accurately formatted. Utilizing tools like pdfFiller can enhance your document editing experience. The platform offers various customization tools, allowing users to edit, annotate, and format their documents easily.

The cloud-based features of pdfFiller allow users to save their documents securely, providing convenient access anytime, anywhere. With version control, you can maintain a history of changes made to your affidavit, ensuring you always have the correct version of your document on hand. This capability is particularly beneficial for military personnel who often transition between locations or must access forms from different devices.

Signing the military affidavit

Once the military affidavit is completed, understanding the signing requirements is vital. The affidavit typically needs to be signed by the individual who filled it out, asserting that all provided information is accurate and truthful. This signature has legal implications, making it essential not to overlook this step.

For those opting for a digital signature, pdfFiller allows seamless eSigning processes that comply with legal standards. Follow simple instructions within the platform to create and add your digital signature securely, ensuring that your affidavit maintains its integrity and is ready for submission.

Submitting the military affidavit

With your military affidavit signed and finalized, the next step is submitting it to the appropriate authority. Typically, this involves your local department of motor vehicles (DMV). Depending on the state, you may also have the option to submit your affidavit online, making the process even more convenient.

It's important to keep a record of your submission. Many DMVs provide receipts or confirmation numbers upon submission that can serve as evidence of your application. After submitting, monitor the status of your exemption request closely to address any potential issues proactively.

Frequently asked questions (FAQs)

FAQ sections are invaluable for addressing common inquiries surrounding the military affidavit for motor vehicle tax exemption. Applicants often seek clarification on their eligibility and the benefits associated with the exemption. Questions may include, 'What documentation do I need to provide?' or 'Will this exemption affect my future registrations?'

Additionally, navigating the nuances of form completion can be challenging. Many individuals have concerns about what to do if their affidavit is rejected or how to amend any mistakes. Providing clear answers in this section can help demystify the process for applicants.

Additional tips and best practices

Preparation is key when requesting a military affidavit for motor vehicle tax exemption. Maintaining a checklist of necessary documents, such as proof of military status and details about the vehicle, will ensure a smooth submission process. Being organized and having all materials ready can eliminate delays and streamline the entire process.

Furthermore, understanding your obligations under local and federal laws is imperative. Regularly consulting resources related to military tax regulations and vehicle exemptions can help you stay updated and compliant. This proactive approach fosters better preparedness, ensuring no last-minute surprises when filing your tax exemption.

Utilizing interactive tools on pdfFiller

pdfFiller not only simplifies the military affidavit for motor vehicle tax exemption process but also enhances it with interactive tools tailored for military personnel. Utilizing these features can significantly streamline form completion and provide collaborative capabilities, allowing teams to work together seamlessly.

For example, features like real-time document editing and cloud storage allow multiple users to contribute to the affidavit form as needed, ensuring that every detail is accurate and up-to-date. This is particularly beneficial for military families or units where multiple approvals or inputs may be required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit military-affidavit-for-motor-vehicle-tax-exemption on an iOS device?

How can I fill out military-affidavit-for-motor-vehicle-tax-exemption on an iOS device?

How do I complete military-affidavit-for-motor-vehicle-tax-exemption on an Android device?

What is military-affidavit-for-motor-vehicle-tax-exemption?

Who is required to file military-affidavit-for-motor-vehicle-tax-exemption?

How to fill out military-affidavit-for-motor-vehicle-tax-exemption?

What is the purpose of military-affidavit-for-motor-vehicle-tax-exemption?

What information must be reported on military-affidavit-for-motor-vehicle-tax-exemption?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.