Get the free Senior Citizens' Property Tax FreezeCity of Houston Lake

Get, Create, Make and Sign senior citizens039 property tax

How to edit senior citizens039 property tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out senior citizens039 property tax

How to fill out senior citizens039 property tax

Who needs senior citizens039 property tax?

Comprehensive Guide to the Senior Citizens Property Tax Form

Overview of property tax benefits for senior citizens

Property tax exemptions play a crucial role in providing financial relief to senior citizens, many of whom are on fixed incomes. Understanding the various property tax benefits available can help seniors minimize their tax burdens significantly. Different states offer specific benefits that can include full or partial tax exemptions, reductions in assessed value, or even property tax deferrals. Research indicates that accessing these benefits can enhance the quality of life for seniors by keeping more money in their pockets.

State-specific benefits vary widely, so seniors should familiarize themselves with the rules and exemptions applicable in their district. For instance, some states have eligibility criteria focused on income levels, while others may grant exemptions based on age or residency. It’s essential to explore these options, as property tax relief not only aids in financial stability but also helps seniors remain in their homes longer.

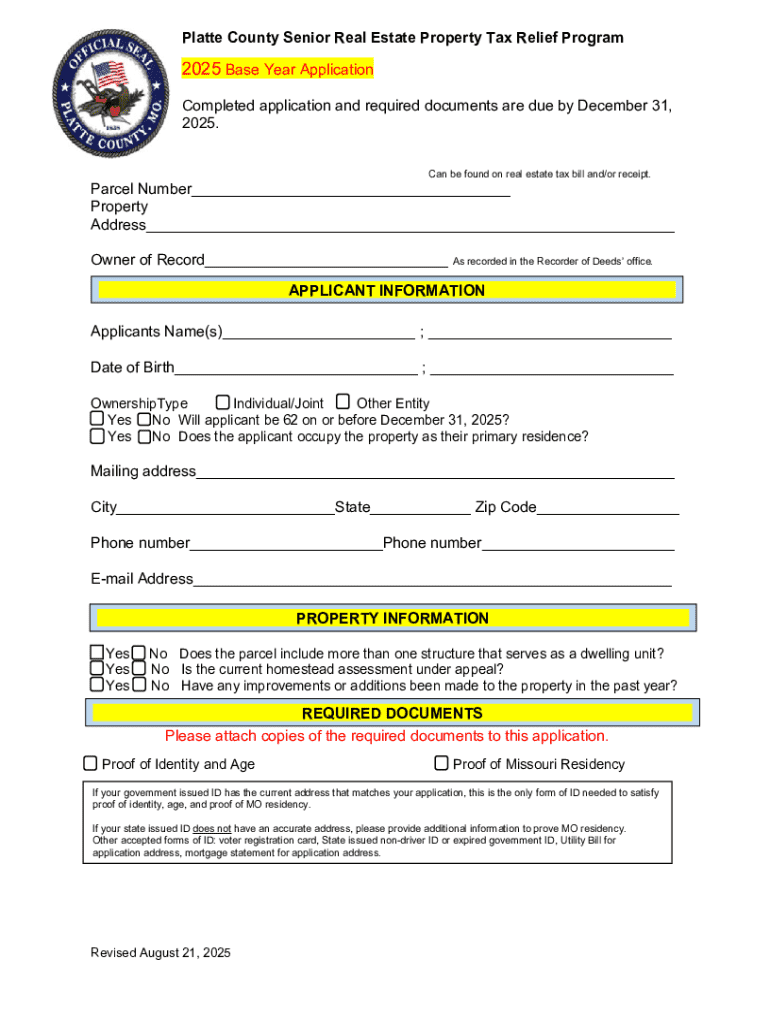

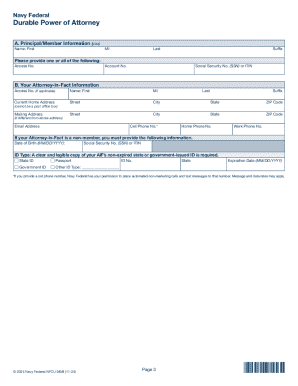

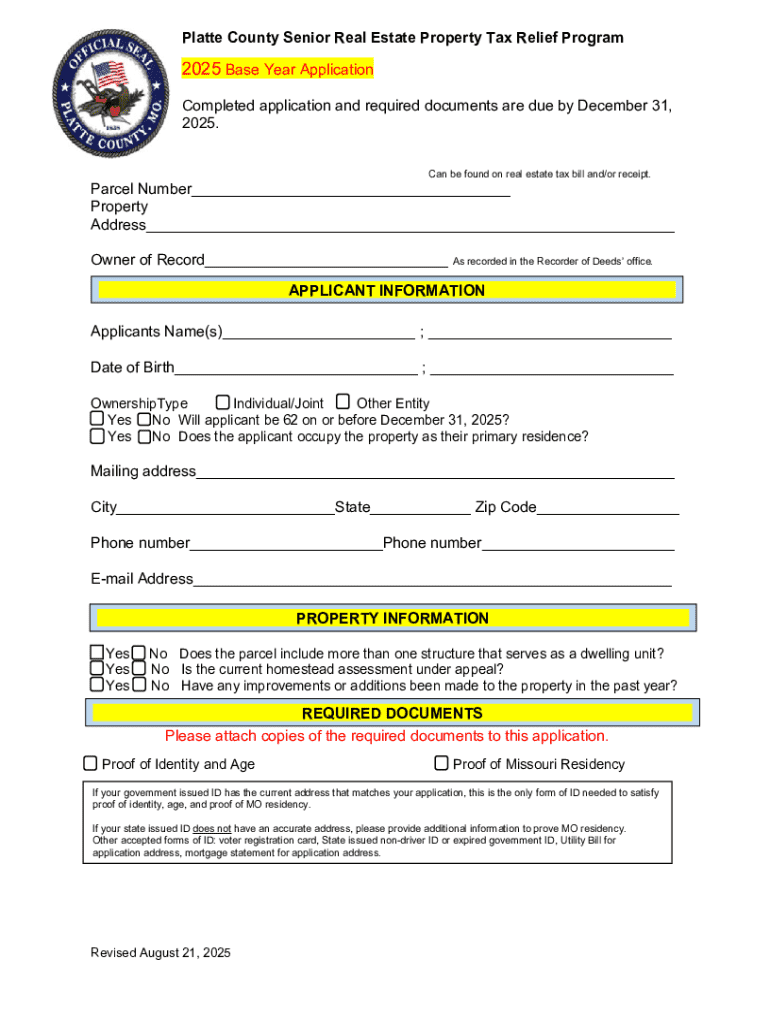

Detailed explanation of the senior citizens property tax form

The senior citizens property tax form is designed as a straightforward means for eligible seniors to apply for property tax relief. This form serves multiple purposes, including documenting the applicant’s age, income, and homeownership details to facilitate the assessment for tax exemptions. Most importantly, this form is integral to the tax relief process, enabling local tax authorities to evaluate claims and provide appropriate benefits.

Key features of this form typically include sections for personal information, income details, and any additional claims for exemptions. Understanding the structure of the form ensures that applicants can present their information clearly, which aids in the swift processing of their applications. Accurate completion of this form is vital, as it determines the level of property tax exemptions they may receive.

Eligibility criteria for senior citizens

To qualify for property tax exemptions, senior citizens typically must meet several eligibility criteria. Age requirements usually stipulate that applicants be at least 65 years old, though some states may allow younger applicants if they are disabled. Income limitations are often imposed to ensure that tax relief is directed towards those with genuine financial needs; therefore, applicants need to bring proof of income, such as tax returns or bank statements.

Residency requirements also play a significant role. Seniors generally must reside in the property they are applying for, and the property must be their primary residence. Additional criteria for special situations may include being a veteran or having certain disabilities that could confer further benefits. Without meeting these criteria, seniors risk losing out on valuable financial relief.

Step-by-step guide to completing the senior citizens property tax form

Completing the senior citizens property tax form can seem daunting, but with the right preparation, the process can be manageable. Start by gathering all necessary documents, including proof of age, such as a birth certificate or driver's license, and income verification, which can include tax returns and bank statements. Having these documents ready simplifies the form-filling process.

As you fill out the form, pay close attention to each section. The personal information section usually requires your name, address, and relationship to the property, like whether you are the owner or likely to claim a spouse as well. The income details section should outline all sources of income to ensure accurate reporting. Don’t forget to check for additional exemptions that you may be eligible for, such as those linked to disabilities. Common mistakes to avoid include leaving sections blank and miscalculating income.

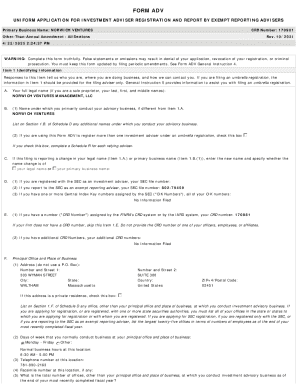

Interactive tools to assist in form completion

For those navigating the senior citizens property tax form, online resources can be invaluable. Various interactive tools are available, such as online calculators that estimate potential tax relief based on provided data. These calculators can offer insights into what exemptions might be applicable based on your specific situation.

Additionally, many websites provide step-by-step interactive tutorials that guide users through the form-filling process. FAQs are typically compiled based on common issues encountered by applicants, providing quick answers to pressing questions that may arise. These resources bolster confidence and ensure that applicants feel equipped to submit their forms accurately.

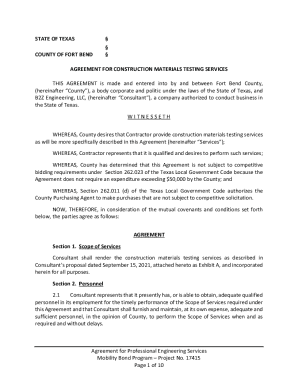

Submission process of the property tax form

Once you’ve completed the senior citizens property tax form, the next step is submission. Ensure your form is reviewed for accuracy before submission to avoid delays. Completed forms typically need to be submitted to your local tax assessor’s office or the relevant property tax district. Check local regulations for the specific address.

Be mindful of submission deadlines, as they can vary by state or locality. Missing these deadlines can result in forfeiture of potential tax relief. After submission, inquire about tracking the status of your application to ease your mind. Knowing when and how your request for relief is progressing is important.

Appeals process for denied applications

If your application for property tax relief is denied, it is essential to understand the reasons for denial to address them. Common denial reasons include incomplete forms, failure to meet eligibility criteria, or errors in income reporting. Once you know the reasons for the denial, you can take steps to appeal the decision.

Preparation is key during the appeals process. Start by gathering supporting documents that verify your claims, such as updated income information or additional proof of age if required. Writing an appeal letter is another crucial step, where you clearly communicate your case and issues faced during the initial application. Keep track of the timeline for the appeals process to avoid further delays.

Special considerations for veterans and disabled seniors

Veterans and disabled seniors often find that they may qualify for additional property tax benefits on top of standard exemptions. These benefits can offer significant financial relief and allow these individuals to manage their property taxes more effectively. For veterans, some states provide total exemptions based on service-related disabilities.

To apply for combined benefits, veterans and disabled individuals typically need to complete specific forms tailored to their situations. It is beneficial to consult local tax authorities or veteran affairs offices for detailed guidance on what paperwork is needed. Being informed about available benefits ensures that deserving seniors receive all the assistance available to them.

FAQs related to senior citizens property tax form

Despite thorough preparation, questions often arise during the process of applying for property tax relief. Here are some frequently asked questions by senior citizens. First, if you miss the deadline for submission, options may still be available, but they can vary by state. Some jurisdictions allow late applications with valid excuses or may have an appeal process for late submissions.

Changes in income can affect eligibility; thus, it is vital to keep tax authorities informed about any significant financial modifications. Resources for further assistance can include local advocacy groups focused on senior citizens' rights and state departments that oversee property tax exemptions.

Managing your property taxes after application approval

After receiving approval for the senior citizens property tax form, it is essential to stay proactive in managing your property taxes for future years. One critical aspect is maintaining eligibility by staying informed about changes in income or property ownership that could affect your tax relief status. Additionally, keeping detailed records is crucial for tax purposes; maintaining organized documentation will make future applications easier.

Planning for financial changes is equally important. Life circumstances can shift unexpectedly, creating a need to reassess your financial eligibility for tax exemptions. Regular audits of your financial situation will help ensure you take full advantage of available relief while preparing for any eventualities.

Conclusion and next steps

Staying updated on changes in tax legislation is crucial for senior citizens looking to maximize their property tax benefits. Each year can bring new laws or adjustments that affect eligibility criteria and available exemptions. Keeping informed through local tax boards or reputable senior organizations ensures you won’t miss out on valuable benefits.

For ongoing support with property tax relief programs, resources such as community workshops, online guides, and state departments can provide valuable assistance. By utilizing the right resources and tools, seniors can navigate the complexities of property tax applications with confidence, ensuring that they secure the financial relief they deserve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my senior citizens039 property tax directly from Gmail?

How can I send senior citizens039 property tax for eSignature?

How can I edit senior citizens039 property tax on a smartphone?

What is senior citizens039 property tax?

Who is required to file senior citizens039 property tax?

How to fill out senior citizens039 property tax?

What is the purpose of senior citizens039 property tax?

What information must be reported on senior citizens039 property tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.