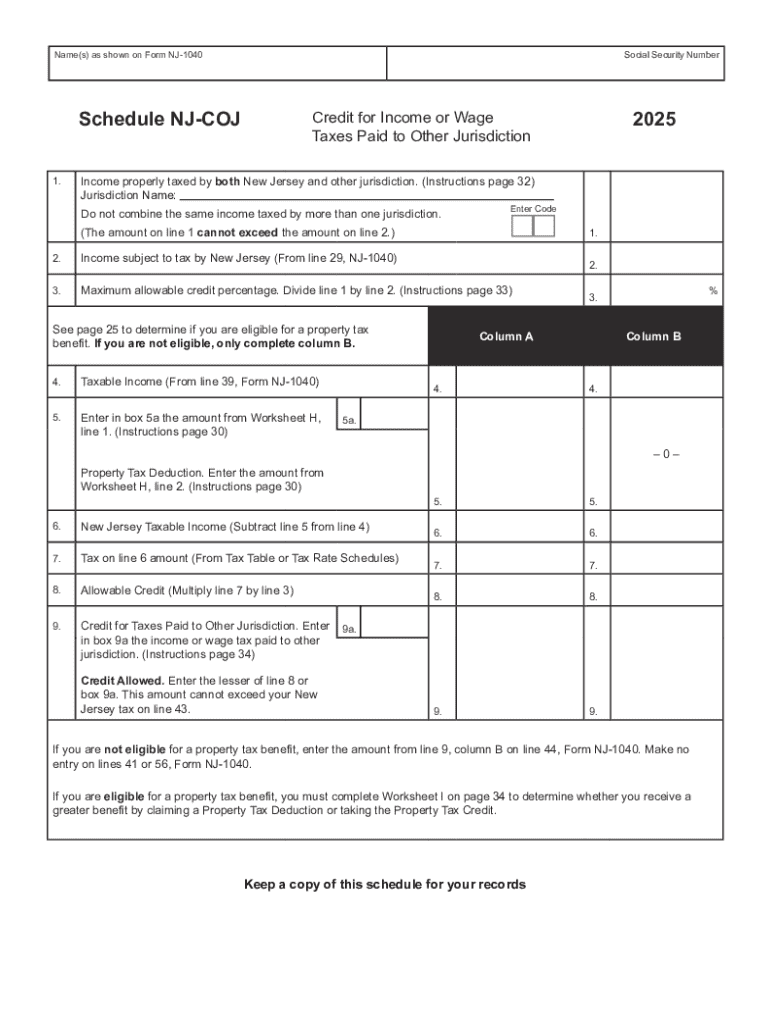

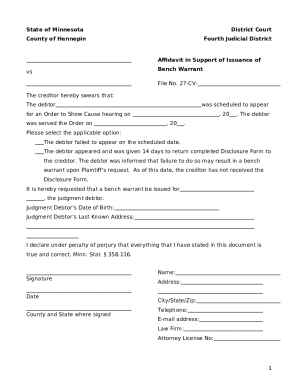

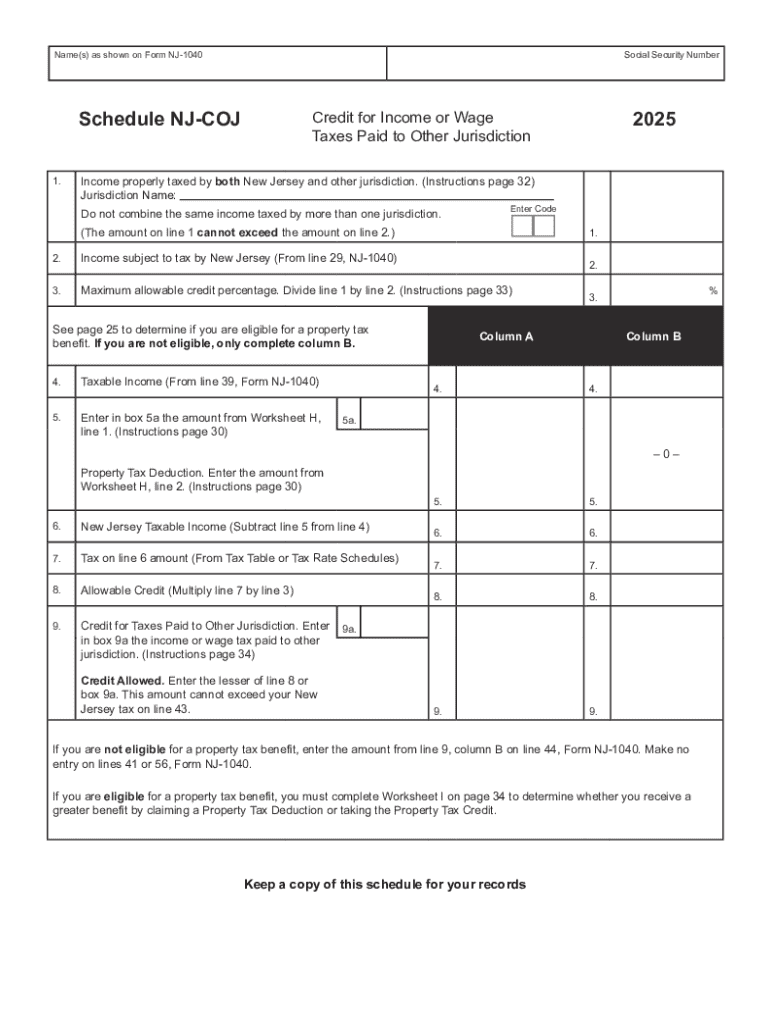

Get the free Credit for Income or Wage

Get, Create, Make and Sign credit for income or

Editing credit for income or online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit for income or

How to fill out 2025 nj-1040 resident income

Who needs 2025 nj-1040 resident income?

2025 NJ-1040 Resident Income Form: A Comprehensive How-to Guide

Understanding the NJ-1040 resident income form

The 2025 NJ-1040 Resident Income Form plays a vital role for residents of New Jersey who need to report their income to the state. This form simplifies the tax filing process for individuals earning income in the state, ensuring compliance with state tax regulations.

Eligibility for using the NJ-1040 form generally includes individuals who are residents of New Jersey for the entire tax year, which runs from January 1 to December 31. Certain exceptions may apply for part-year residents. For the 2025 tax year, the state has introduced key changes aimed at addressing various economic challenges faced by residents.

Gathering necessary documents

Before filing, it's crucial to gather all necessary documents to ensure accuracy and completeness when filling out your 2025 NJ-1040 form. Start with the essential financial documents.

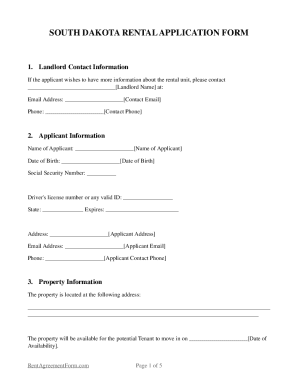

In addition to financial documents, it's essential to gather required personal information. This includes Social Security numbers for all dependents, ensuring accuracy when claiming any tax benefits. Additionally, you’ll need your bank account information for direct deposit options.

Navigating the NJ-1040 form sections

Completing the NJ-1040 form involves several key sections, each requiring specific information that contributes to your overall tax filing.

Filing options for the NJ-1040

Once you’ve completed the NJ-1040 form, you need to decide how to file it. There are two primary methods: online filing and paper filing, each with its own benefits.

Avoiding common mistakes can save you time and potential financial penalties. For instance, be mindful of incorrectly entering your Social Security number or failing to sign the form before submission. Filing on or before the deadline is crucial to avoid late penalties.

Exploring interaction features on pdfFiller

pdfFiller’s platform offers various features that enhance document management and collaboration, making it an excellent choice for handling your NJ-1040 form.

Managing your tax documents after filing

After filing your NJ-1040 form, it’s essential to keep track of your tax status and documents. pdfFiller offers an array of tools to help you with this management.

FAQs regarding the NJ-1040 form

Navigating tax forms can be complicated, which is why common questions about the NJ-1040 form arise frequently. Here, we clarify some of the most pertinent inquiries.

Additional tips for NJ residents

As you navigate the tax system in New Jersey, consider these tips to optimize your tax planning strategies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit for income or?

How do I fill out the credit for income or form on my smartphone?

How do I edit credit for income or on an iOS device?

What is 2025 nj-1040 resident income?

Who is required to file 2025 nj-1040 resident income?

How to fill out 2025 nj-1040 resident income?

What is the purpose of 2025 nj-1040 resident income?

What information must be reported on 2025 nj-1040 resident income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.