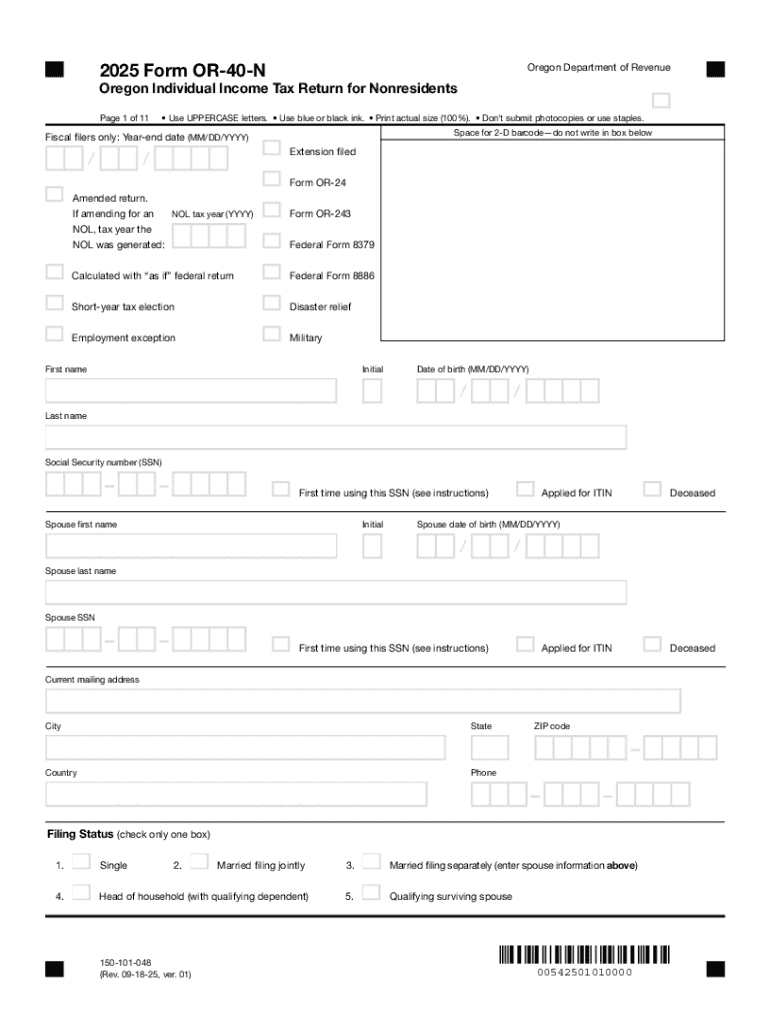

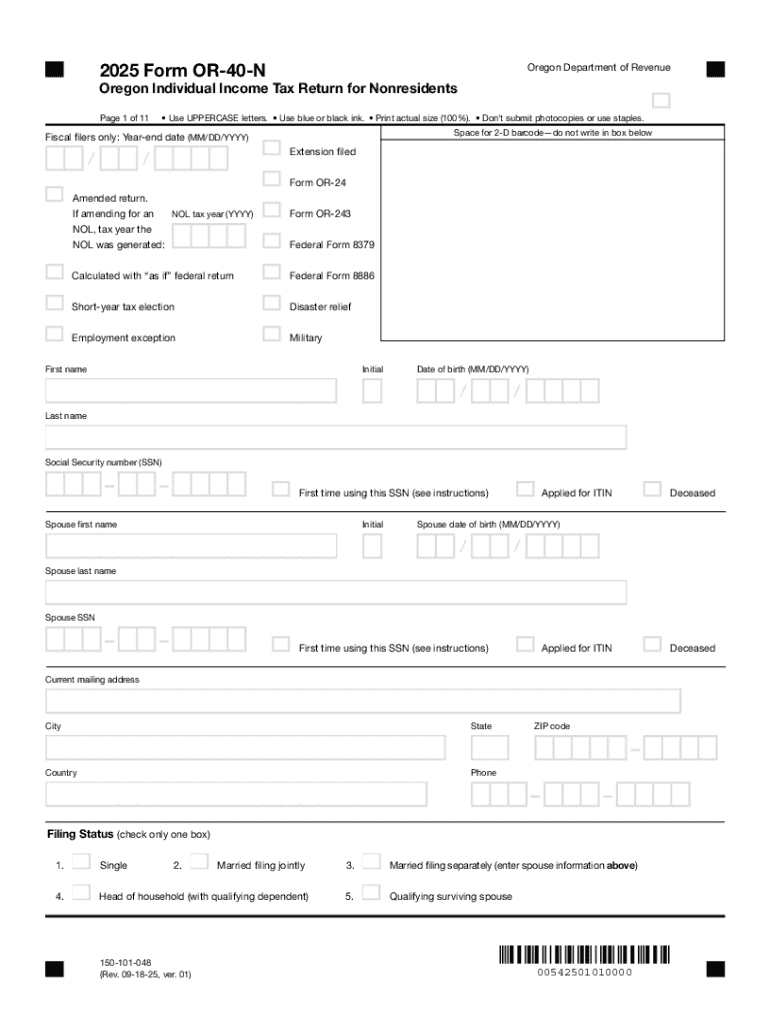

Get the free 2025 Form OR-40-N, Oregon Individual Income Tax Return ...

Get, Create, Make and Sign 2025 form or-40-n oregon

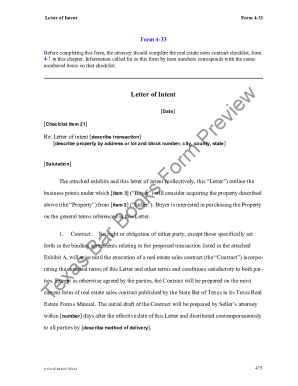

Editing 2025 form or-40-n oregon online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 form or-40-n oregon

How to fill out 2025 form or-40-n oregon

Who needs 2025 form or-40-n oregon?

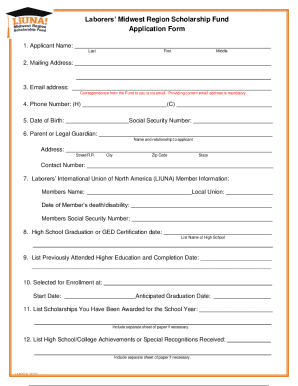

Understanding the 2025 Form OR-40-N Oregon Form: A Comprehensive Guide

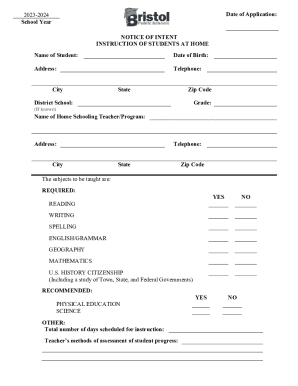

Who needs to file the 2025 form OR-40-N?

The 2025 Form OR-40-N is specifically designed for Oregon residents who meet certain eligibility criteria. Understanding who needs to file is crucial to avoid penalties and ensure compliance with state tax laws. Generally, individuals who are considered residents of Oregon must file after reaching specific income thresholds. The primary distinction here is between residents and non-residents: residents live in Oregon for more than half the year, whereas non-residents may have income sourced from Oregon but live elsewhere.

Particular situations often necessitate the filing of this form. For instance, individuals with multiple income sources, such as those working part-time jobs or receiving income from freelance work, must report all their earnings. Additionally, those who wish to claim deductions or credits to lower their taxable income must submit this form. However, exemptions do exist; if your total income falls below state limits, you may not need to file.

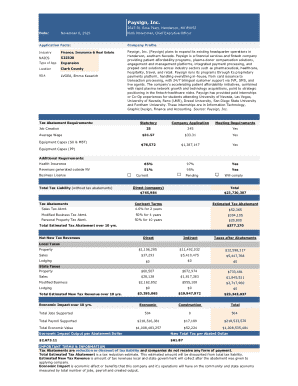

What information do need to file the 2025 form OR-40-N?

Before diving into filing the 2025 Form OR-40-N, it’s essential to gather all your personal and financial information. Firstly, your personal information must be accurate, which includes your Social Security Number, your current address, and your filing status — single, married filing jointly, or head of household.

On the financial front, gather your W-2 forms, 1099s, and any other pertinent documentation. This would involve not just income reports but also records of deductions and credits you plan to claim. For example, property tax statements and mortgage interest records can significantly lower your taxable income, acknowledging how local tax regulations apply.

For unique situations, like receiving income from partnerships or S Corporations, specific documentation may be required. For instance, if you have multiple streams of income, including out-of-state earnings, you need to ensure you include all reporting details necessary to maintain compliance with Oregon tax laws.

How to complete the 2025 form OR-40-N

Completing the 2025 Form OR-40-N can seem daunting, but following these step-by-step instructions will streamline the process. To start, download the official form from the Oregon Department of Revenue's website, ensuring that you have the most current version to avoid complications.

Next, when filling in your personal information, accuracy is crucial. Incorrect entries can lead to delays or issues with the state. Then, move on to reporting your income. This section requires a detailed breakdown of various income categories, including wages, dividends, and other sources.

As you claim deductions and credits, be aware of the common deductions available to Oregon filers, such as those for education or childcare. Calculating your eligibility for various credits can significantly influence your final tax amount. Finally, perform a thorough review of your application, double-checking entries for accuracy before submission.

Important deadlines to consider for 2025 form OR-40-N

Filing your tax returns on time is crucial to avoiding penalties, so understanding the important deadlines related to the 2025 Form OR-40-N is essential. The key dates for the 2025 tax year include the federal tax filing deadline, typically set for April 15, and the same date applies to state returns unless you file for an extension.

If you require additional time, Oregon offers extensions but it’s vital to file the extension form before the initial deadline. Furthermore, estimated tax payments must also be addressed. Ensure you submit these payments on time to avoid potential penalties, which can accrue quickly if not managed properly.

Common mistakes to avoid when filing the 2025 form OR-40-N

Despite the best intentions, many filers make common mistakes when completing the 2025 Form OR-40-N. One of the most frequently encountered issues is entering an incorrect Social Security Number. A simple typo can lead to delays or complications with your filing. Additionally, miscalculating taxable income is another prevalent error that can result in underpayment or overpayment.

To prevent these mistakes, utilize online tools and resources, such as pdfFiller, for accuracy. These tools offer user-friendly interfaces that guide you through each section, ensuring that all entries are correct. If you realize you've made a mistake after submission, don't panic; steps are available for amending your form.

Frequently asked questions (FAQs) about 2025 form OR-40-N

Questions often arise concerning specific scenarios related to the 2025 Form OR-40-N. For example, filers often want clarification on whether out-of-state income needs to be declared or how to handle specific types of deductions. The key message is that anyone unsure about their tax situation should seek precise guidance, as multiple factors can influence filing requirements.

For additional assistance, there are resources available, including pdfFiller for advanced document management and the Oregon Department of Revenue's helpline for direct queries. Don’t hesitate to reach out for expert help to ensure your filing process goes smoothly.

Utilizing pdfFiller for enhanced document management

pdfFiller offers a wide array of features tailored specifically for managing your 2025 Form OR-40-N filing effectively. With a cloud-based platform, users can access, edit, and sign documents from virtually anywhere. This flexibility is particularly beneficial for those managing multiple submissions or requiring collaborative efforts on tax filings.

The collaboration tools provided by pdfFiller allow teams to work seamlessly, ensuring all necessary information is included and accurately presented. Numerous success stories underscore the platform's efficiency, showcasing how users have simplified their tax filing processes significantly. Customer testimonials reflect satisfaction in the usability of the tools and the enhancements made to their overall filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my 2025 form or-40-n oregon directly from Gmail?

How can I send 2025 form or-40-n oregon for eSignature?

How do I execute 2025 form or-40-n oregon online?

What is 2025 form or-40-n oregon?

Who is required to file 2025 form or-40-n oregon?

How to fill out 2025 form or-40-n oregon?

What is the purpose of 2025 form or-40-n oregon?

What information must be reported on 2025 form or-40-n oregon?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.