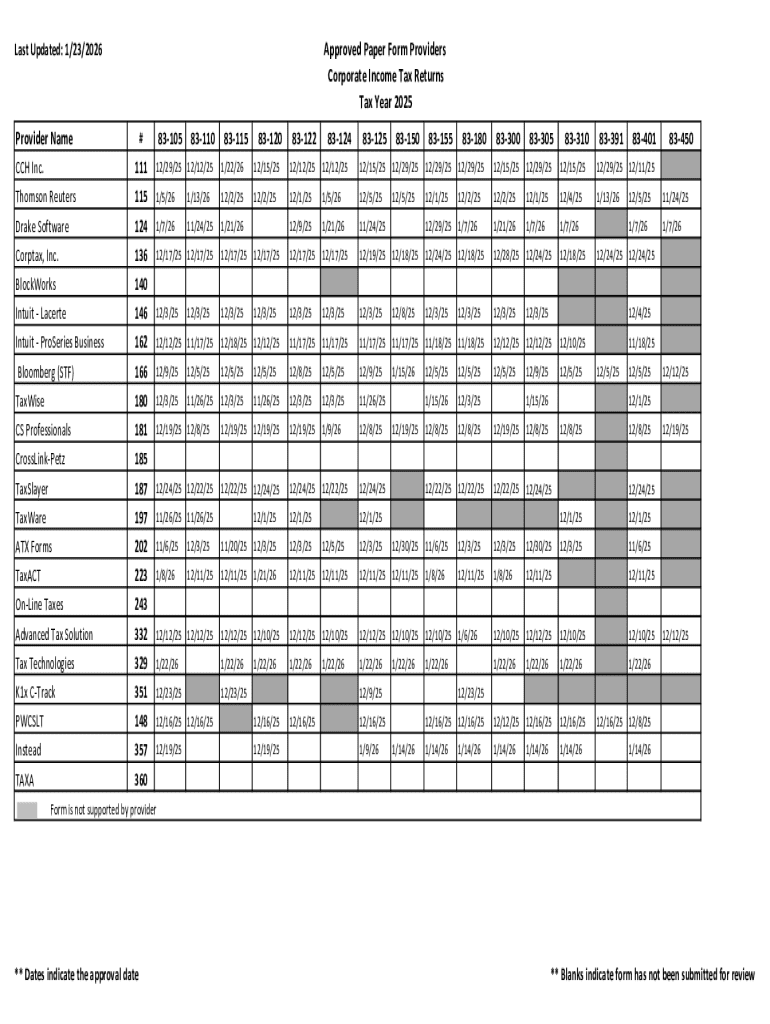

Get the free Business TaxMississippi Department of Revenue

Get, Create, Make and Sign business taxmississippi department of

How to edit business taxmississippi department of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business taxmississippi department of

How to fill out business taxmississippi department of

Who needs business taxmississippi department of?

Business Tax Mississippi Department of Form: A Comprehensive Guide

Understanding business taxes in Mississippi

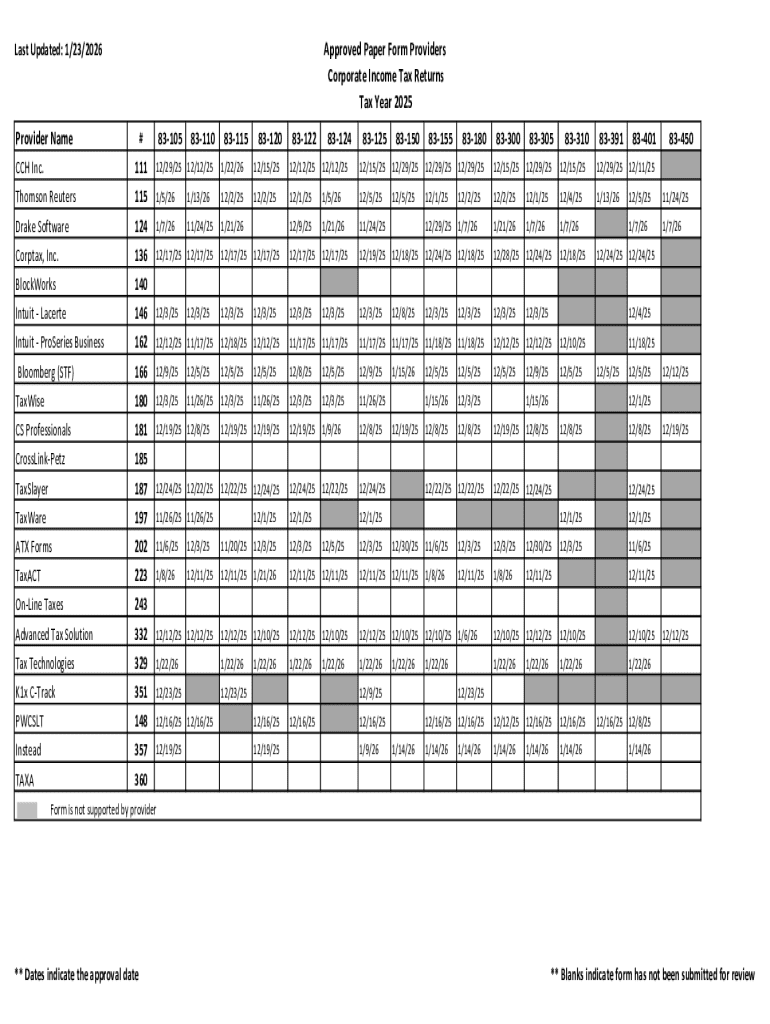

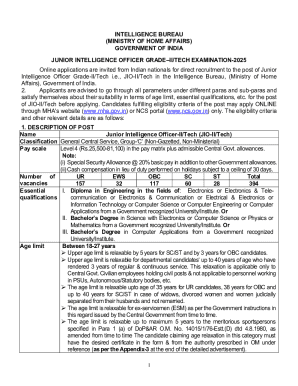

Business taxes in Mississippi encompass a range of responsibilities that every business owner must recognize to remain compliant and avoid penalties. The types of taxes that may affect your business include corporate income tax, franchise tax, and sales tax, among others. Each of these taxes has specific regulations and rates, which vary based on factors such as your business structure and revenue amounts.

Understanding the importance of compliance with state tax regulations is crucial for maintaining your business’s reputation and financial health. Failure to adhere to these regulations can lead to financial penalties and even legal repercussions, highlighting the need for proper tax planning and submission.

The Mississippi Department of Revenue: Your tax authority

The Mississippi Department of Revenue plays a pivotal role in regulating tax collection and ensuring compliance among business owners. With the authority to oversee tax obligations, the department ensures that all businesses fulfill their responsibilities while also providing information and resources to assist in understanding the complexities of state taxes.

For new and seasoned business owners alike, the department’s resources, including tax guides and newsletters, are invaluable. Utilizing these resources can simplify the tax filing process and help business owners stay informed about any changes in tax legislation or forms.

Navigating the business tax form submission process

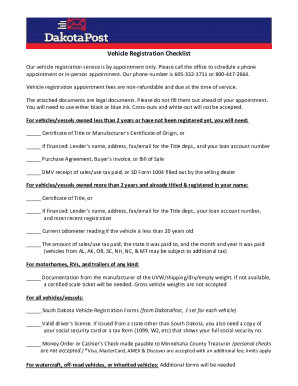

Before filling out your business tax form, it is vital to prepare by gathering all necessary documentation. This includes financial statements, previous tax returns, and any business registration documents. By ensuring you have all of this information readily available, you’ll minimize discrepancies and streamline the completion of your forms.

When entering data into tax forms, focus on accurate data entry. Simple mistakes can lead to significant delays or penalties. Effective proofreading and double-checking your entries will prevent common errors, such as incorrect identification numbers or miscalculated amounts.

Step-by-step guide to filling out the form

When completing the business tax form, take your time to read through each section carefully. Begin by entering your business profile information, including your business name, registration number, and address. Next, move on to report your income. Make sure to include all sources of revenue accurately.

Pay special attention to deductions, as these can significantly affect your tax liability. Be mindful of state-specific deductions, and ensure you keep records supporting any claims you make. Avoid pitfalls like misreporting income or overlooking allowable deductions, which can trigger audits or disputes with the Mississippi Department of Revenue.

Interactive tools for business tax management

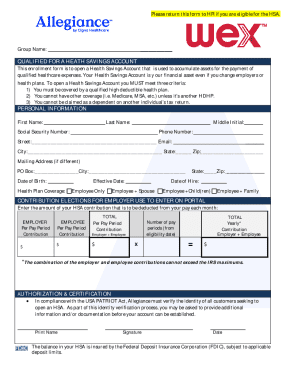

Using tools like pdfFiller can enhance your efficiency in managing business tax forms. The PDF editor allows for straightforward filling out and editing of taxes forms, ensuring that you can make necessary adjustments without starting from scratch. The platform’s cloud capabilities mean you can access your forms from any device, making it an invaluable resource for busy entrepreneurs.

Moreover, eSignature solutions offered by pdfFiller facilitate the signing of documents without the need for printing. This not only saves time but also is a legally accepted manner of signing documents in Mississippi. Utilizing these capabilities allows you to maintain a streamlined workflow while fulfilling your legal obligations.

Filing and submission guidelines

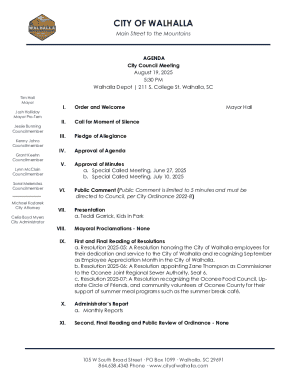

Electronic filing has become the preferred method for many businesses in Mississippi. Submitting your forms online through the Mississippi Department of Revenue's portal offers advantages, such as instant confirmation of submission and reduced processing times. To file electronically, visit the department's website, create or log into your account, and follow the detailed instructions provided for tax form submission.

For those opting for mail-in submissions, it is crucial to double-check your forms for accuracy and completeness before sending them off. Always send forms via certified mail or another trackable service to ensure timely delivery. Include any necessary attachments and verify the correct mailing address to avoid delays in processing your forms.

What to expect after submission

Once you have submitted your business tax forms, it's essential to understand the potential outcomes. The Mississippi Department of Revenue may respond with confirmations, requests for additional information, or notifications regarding your tax liabilities. Familiarize yourself with how to interpret these responses, as they will guide you in addressing any follow-up actions required.

In case of audits or inquiries, staying organized will be beneficial. Keep a digital record of your submissions and correspondence with the department. Proper filing and organizing of your tax documentation will ensure you are prepared for any questions that may arise regarding your submissions.

Frequently asked questions (FAQs)

Business tax inquiries often include questions about filing deadlines, available deductions, and common pitfalls. A common deadline is April 15 for corporate income tax filings, though specific businesses might have different timelines. Penalties for late submission can be substantial, reinforcing the need for timely filings. It's crucial to stay informed about any tax reforms that may impact your obligations.

For more complex tax situations, connecting with tax professionals or consultants may provide the guidance you need. Utilizing local resources ensures you receive personalized assistance tailored to your specific business needs. Knowing where to turn for help can alleviate some of the stress associated with tax compliance.

Conclusion: staying compliant and efficient with business taxes

Effective management of business taxes in Mississippi requires a clear understanding of the forms and regulations involved. By following these structured steps and utilizing tools like pdfFiller for filling out, signing, and managing forms, you can streamline the entire process. Remember, the goal is to maintain compliance while ensuring that you're optimizing your tax obligations.

In summary, preparation and accuracy are key components of successful tax submissions. Leverage all available resources and tools to enhance your efficiency while staying up-to-date with the Mississippi Department of Revenue's expectations and requirements. Through proactive management of your business tax obligations, you can ensure a smooth and hassle-free experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete business taxmississippi department of online?

How do I fill out business taxmississippi department of using my mobile device?

How do I complete business taxmississippi department of on an iOS device?

What is business taxmississippi department of?

Who is required to file business taxmississippi department of?

How to fill out business taxmississippi department of?

What is the purpose of business taxmississippi department of?

What information must be reported on business taxmississippi department of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.