Get the free IFTA & Special Fuel UserUtah State Tax Commission

Get, Create, Make and Sign ifta amp special fuel

How to edit ifta amp special fuel online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ifta amp special fuel

How to fill out ifta amp special fuel

Who needs ifta amp special fuel?

IFTA AMP Special Fuel Form: A How-to Guide

Understanding IFTA and its significance

The International Fuel Tax Agreement, or IFTA, is a collaborative agreement among the continental United States and Canadian provinces to simplify the reporting of fuel use by inter-jurisdictional motor carriers. It allows truckers to pay fuel taxes to their home state, which then distributes the taxes to the jurisdictions where the fuel was consumed. This agreement is vital for commercial operators who primarily operate across state lines as it mandates compliance to ensure fair taxation while minimizing roadblocks and administrative burdens.

Compliance with IFTA is crucial for maintaining operational legality and avoiding penalties associated with improper fuel taxation. Successfully navigating the complexities of IFTA reporting requires thorough documentation and adherence to specified guidelines, making tools like the Special Fuel Form indispensable. This form helps streamline the data collection necessary for accurate and timely filing, thus ensuring compliance and maintaining a good standing with tax authorities.

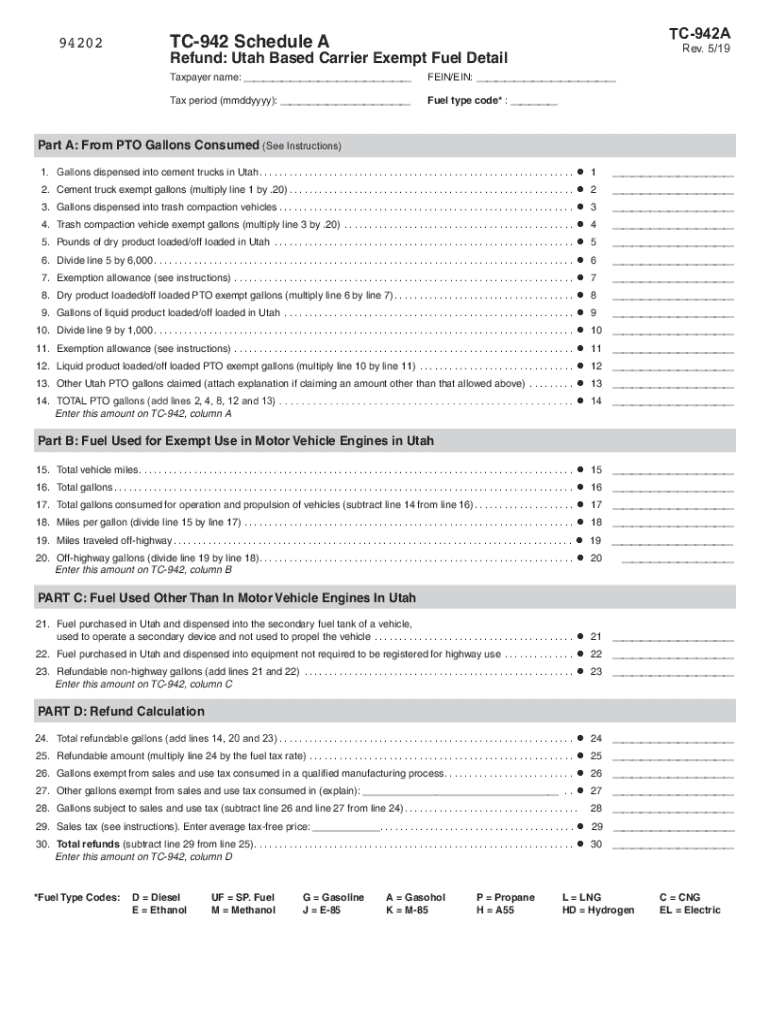

Overview of the IFTA AMP Special Fuel Form

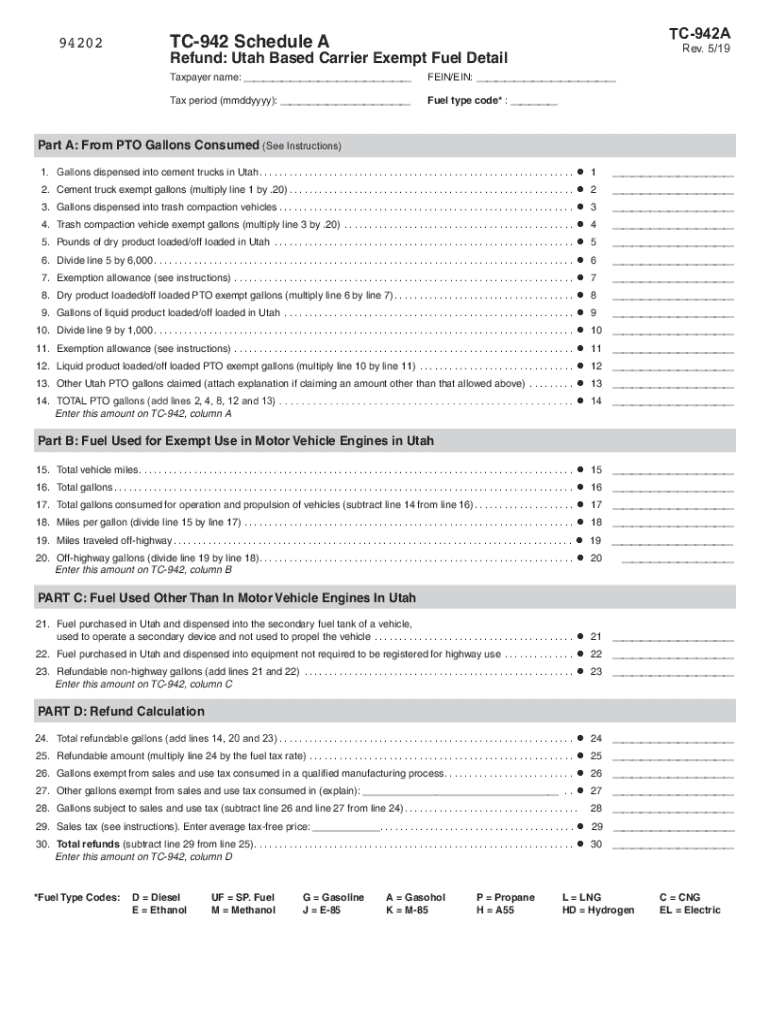

The IFTA AMP Special Fuel Form is a specific document designed for operators who utilize alternative fuels such as compressed natural gas, liquefied natural gas, propane, or electricity in their motor vehicles. Unlike standard IFTA forms that primarily deal with diesel and gasoline, this form is tailored to accurately record the consumption of special fuels, ensuring compliance with the varied state and provincial regulations that govern their taxation.

One key difference between the IFTA AMP Special Fuel Form and standard IFTA forms lies in the detailed accounting for various fuel types. This form not only tracks different fuel sources but also requires operators to provide meticulous mileage records. All operators using alternative fuels must complete this form, which underscores the commitment of IFTA jurisdictions to accommodate evolving fuel technologies and their corresponding regulatory frameworks.

Step-by-step instructions for completing the IFTA AMP Special Fuel Form

Completing the IFTA AMP Special Fuel Form effectively begins with gathering all necessary information. This ensures a smoother filing process and reduces the likelihood of errors that could result in compliance issues. Essential data points you will need include vehicle details, fuel purchases, and travel miles. These variables are crucial for accurate reporting and tax assessments.

Filling out the form requires attention to detail. Begin with Section 1, where you will provide vehicle information. Make sure to accurately input the VIN and ensure the vehicle type aligns with your registered category. Moving to Section 2, log each fuel purchase, specifying the type of fuel, quantity, and cost. Finally, in Section 3, record mileage maintained during the reporting period, ensuring that it corresponds with fuel purchases. Double-check each section for common errors, such as misreported fuel types or missing purchase receipts.

After completing the form, reviewing and verifying the entries is paramount. Use a checklist to confirm that all required fields are filled in and accurate. This may include reconciling fuel logs with travel records to ensure consistency, as accuracy in data entry is essential for compliance and avoids potential audits or penalties.

Editing and managing your Special Fuel Form with PDFfiller

Managing your IFTA AMP Special Fuel Form is simplified with PDFfiller’s robust document editing platform. Users can leverage a myriad of features designed to facilitate easy edits, including text additions, annotations, and diverse export options suitable for various reporting requirements. This versatility is particularly beneficial for companies with multiple vehicles or varied fuel types, enabling centralized management of fuel tax reporting.

Collaboration is seamless on PDFfiller. Teams can share forms, gather feedback, and collaborate efficiently in real-time. This is especially useful for larger operations where multiple team members may contribute to fuel data. Utilizing these collaboration tools, you can ensure that all inputs meet the necessary compliance standards before submission.

eSigning your IFTA AMP Special Fuel Form

The benefits of eSigning your IFTA forms cannot be overstated. It not only enhances the speed of document processing but also ensures that each submission is legally binding and easy to verify. Within PDFfiller, the eSigning process is streamlined, allowing users to quickly sign the IFTA AMP Special Fuel Form electronically, which can greatly expedite the overall filing process.

To eSign, simply upload your completed form in PDFfiller, and follow the prompts to add your signature. It's essential to understand that in the context of IFTA reporting, electronic signatures hold the same legal weight as traditional signatures, provided they adhere to established regulations.

Common pitfalls and how to avoid them

Navigating the IFTA AMP Special Fuel Form can often present various challenges, particularly for those unfamiliar with the reporting process. Misreporting fuel types and mileage is a common mistake, which can lead to incorrect assessments or potential audits. Additionally, many operators overlook documentation requirements, such as retaining fuel receipts or logs. These documents are not just crucial for your own records but also form the basis for any audits or compliance checks.

To avoid these pitfalls, double-check all entries on your form. After completing the Special Fuel Form, take a moment to review the data against your logs and receipts to ensure everything matches. Implement a consistent filing system for receipts and mileage records, allowing easy access should you need to substantiate your reports.

Handling audits and notices

Receiving an audit notification regarding your IFTA filings can be daunting. The first step is to understand that audits are routine checks and do not inherently imply wrongdoing. If selected for an audit, promptly gather all documentation that supports your IFTA reports, including vehicle logs, fuel purchase receipts, and the IFTA AMP Special Fuel Form itself.

Best practices for keeping track of records include utilizing cloud-based solutions, such as PDFfiller, for document storage. This way, you can organize and access your documents easily, ensuring that you can respond promptly to any requests from tax authorities. Having a well-organized digital filing system is invaluable should you face an audit, as it not only saves time but also provides peace of mind.

Benefits of using PDFfiller for your IFTA AMP Special Fuel Form

PDFfiller serves as an exceptional tool for document management, particularly when it comes to completing the IFTA AMP Special Fuel Form. Its cloud-based platform allows for seamless access from anywhere, meaning that whether you’re on the go or working from the office, you can easily manage your fuel tax reports. This flexibility is crucial for teams striving to maintain efficiency amid varying workloads.

Additionally, the collaboration features offered by PDFfiller make it easy for teams to work together in preparing and finalizing forms. With tools for shared access, document revision, and real-time feedback, your team can ensure every aspect of the reporting process is covered, minimizing the risk of errors and ensuring compliance with the necessary guidelines.

Further steps in IFTA compliance

After filing your IFTA AMP Special Fuel Form, it's essential to remain vigilant about reporting deadlines and compliance requirements. Each state may impose specific regulations regarding additional documentation or unique fuel types. Keeping an eye on these guidelines ensures you are compliant and prepared for future filings.

Implementing best practices, such as regular updates to your fuel records and maintaining organized documentation, will enhance your ongoing IFTA compliance. Consider setting reminders for filing dates and staying educated on any changes within IFTA regulations that may affect your operations across jurisdictions.

FAQs about the IFTA AMP Special Fuel Form

Understanding the IFTA AMP Special Fuel Form can generate a few questions. Here are some common inquiries: How often do I need to submit my Special Fuel Form? Typically, this is submitted quarterly, in line with standard IFTA reporting schedules. What happens if I make a mistake after submitting the form? If an error arises, it's critical to amend the submission promptly and explain the changes. Can I amend a submitted form? Yes, amendments can be made, but they must be communicated promptly to the jurisdiction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the ifta amp special fuel electronically in Chrome?

How do I fill out the ifta amp special fuel form on my smartphone?

How do I edit ifta amp special fuel on an Android device?

What is IFTA & special fuel?

Who is required to file IFTA & special fuel?

How to fill out IFTA & special fuel?

What is the purpose of IFTA & special fuel?

What information must be reported on IFTA & special fuel?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.