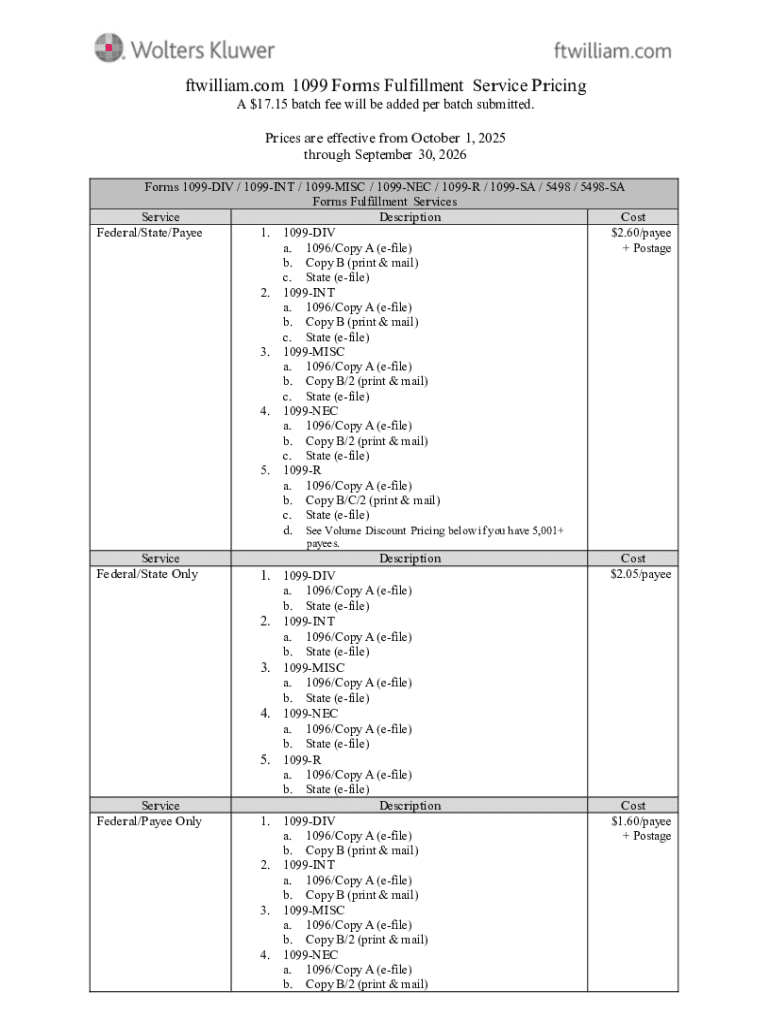

Get the free ftwilliam.com 1099 Forms Fulfillment Service Pricing - Wolters Kluwer

Get, Create, Make and Sign ftwilliamcom 1099 forms fulfillment

How to edit ftwilliamcom 1099 forms fulfillment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ftwilliamcom 1099 forms fulfillment

How to fill out ftwilliamcom 1099 forms fulfillment

Who needs ftwilliamcom 1099 forms fulfillment?

Understanding and Managing the ftwilliamcom 1099 Forms Fulfillment Form

Understanding 1099 forms

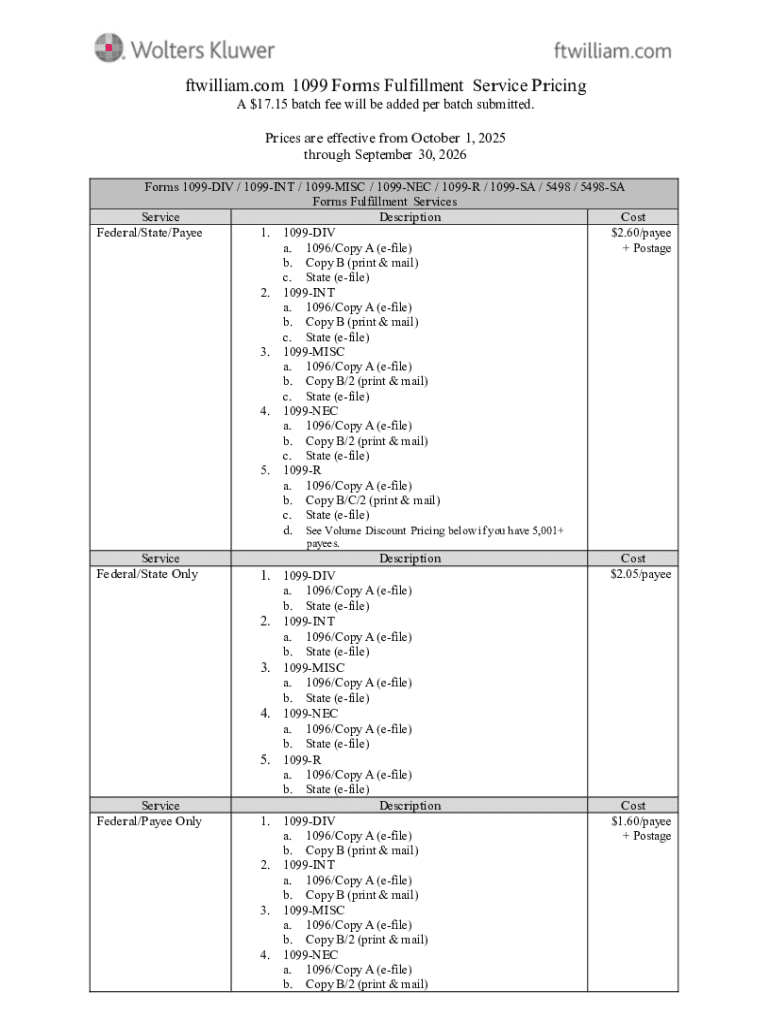

1099 forms are essential tax documents used in the United States to report various types of income other than wages or salaries. Their significance cannot be overstated, as they are used by the IRS to track taxable income that may not be covered under regular withholding. For both businesses and individuals, ensuring accurate completion and timely submission of 1099 forms is crucial for compliance with federal tax regulations.

There are several types of 1099 forms, each designed for specific purposes. Understanding these variations is vital for anyone involved in the financial reporting process.

Understanding who needs to file 1099 forms is equally important. Any business or entity that has paid $600 or more in a calendar year to a nonemployee – such as freelancers, independent contractors, or suppliers – must issue a 1099 form. This requirement underscores the importance of record-keeping and documentation for compliance.

The ftwilliamcom 1099 forms fulfillment process

Requesting 1099 forms through ftwilliamcom is a straightforward process designed to streamline your tax reporting duties. Here’s how you can navigate it effectively:

Essential information required for 1099 forms includes:

Utilizing pdfFiller for easy 1099 form management

pdfFiller enhances your ability to manage 1099 forms effortlessly. The first advantage lies in the seamless editing capabilities it offers. You can upload existing 1099 forms for further modifications or start from scratch using their intuitive interface.

With a suite of editing tools, filling out forms with pdfFiller becomes a hassle-free experience. You can easily input required information, adjust formatting, and ensure accuracy.

Additionally, signing your 1099 forms electronically is simple with pdfFiller. Follow these steps to eSign your forms:

Collaborating on 1099 forms

Collaboration is key when managing 1099 forms, especially in a team environment. With pdfFiller, you can invite team members to collaborate on a single 1099 form, allowing for collective input and oversight.

The platform offers real-time editing and commenting tools, which means everyone involved can contribute their thoughts and changes seamlessly. This feature helps to eliminate confusion and ensures everyone is on the same page.

Managing changes and keeping track of version control is crucial when multiple people are interacting with a document. pdfFiller allows you to track who made which changes and revert to previous versions if necessary.

Ensuring compliance and accuracy

Filling out 1099 forms accurately is essential to avoid complications with the IRS. There are several common mistakes that filers should be aware of. For instance, overlooking the TIN, misspelling names, or entering incorrect amounts are frequent errors that can lead to penalties.

Validating the information before submission is critical. Double-check payee and payer details, payment amounts, and ensure that all required fields are filled in to prevent any issues. Understanding the tax implications of incorrect reporting is equally vital; inaccuracies can result in fines or audits.

Filing 1099 forms: step-by-step instructions

Filing 1099 forms electronically has become the preferred method due to its efficiency and simplicity. To e-file, you need to follow specific requirements set by the IRS, such as using approved e-filing software.

Key dates to remember for filing include January 31 for submitting to the recipient and February 28 for paper filing or March 31 for electronic filing to the IRS.

Alternatively, if you decide to file by mail, adhere to the following steps:

To ensure you stay on top of compliance, tips for tracking filed 1099 forms include maintaining a filing log and ensuring you get confirmation of receipt from the IRS if e-filing.

Additional features of pdfFiller for 1099 management

pdfFiller provides additional functionalities that enhance 1099 management significantly. Its cloud storage feature allows you to access your 1099 forms securely from anywhere, enabling efficient management and quick retrieval when needed.

The platform's ability to integrate with various accounting software solutions adds to its versatility. This feature is crucial for those who rely on robust tax preparation software to keep their books clean and minimize discrepancies.

Moreover, pdfFiller offers analytics and reporting features, allowing users to generate insights on their 1099 submissions, track trends, and prepare better for future reporting.

FAQs about 1099 forms and pdfFiller

For anyone transitioning to using online platforms for 1099 forms, it's natural to have questions. Common queries about the 1099 filing process often include the types of forms needed and deadlines for submission.

Troubleshooting common issues with 1099 forms is another significant area of concern. pdfFiller offers robust support channels to assist users in resolving any issues quickly, ensuring compliance and accuracy in submissions.

If you need additional assistance, pdfFiller's dedicated support team is available to help navigate any challenges you may face during the filing process.

Best practices for 1099 form management

Staying informed about changes in 1099 reporting requirements is crucial for compliance. This includes attending training sessions, seminars, or webinars focused on tax updates.

Effective record-keeping is another best practice. Maintain organized files, whether digital or physical, to ensure you can easily retrieve documents during audits or for reference.

Preparation for year-end taxes using your 1099 data is an ongoing process; ensure you are gathering all relevant materials throughout the year rather than waiting until tax season.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ftwilliamcom 1099 forms fulfillment?

How do I complete ftwilliamcom 1099 forms fulfillment on an iOS device?

How do I fill out ftwilliamcom 1099 forms fulfillment on an Android device?

What is ftwilliamcom 1099 forms fulfillment?

Who is required to file ftwilliamcom 1099 forms fulfillment?

How to fill out ftwilliamcom 1099 forms fulfillment?

What is the purpose of ftwilliamcom 1099 forms fulfillment?

What information must be reported on ftwilliamcom 1099 forms fulfillment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.