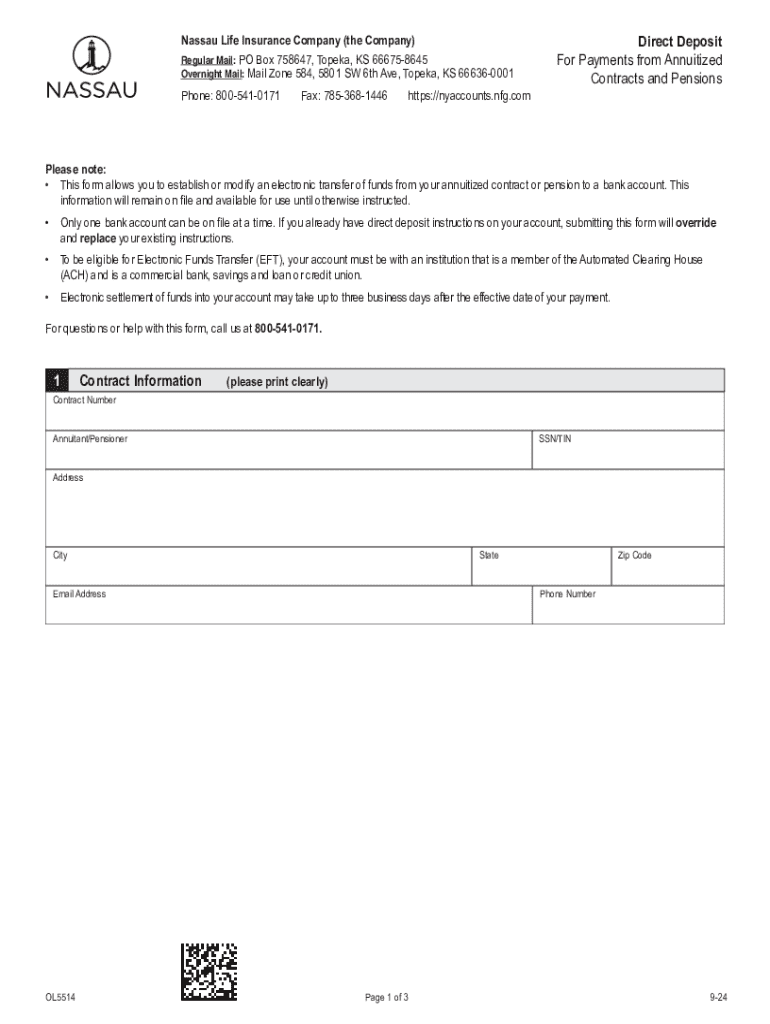

Get the free Direct Deposit For Payments from Annuitized Contracts ...

Get, Create, Make and Sign direct deposit for payments

Editing direct deposit for payments online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit for payments

How to fill out direct deposit for payments

Who needs direct deposit for payments?

A comprehensive guide to direct deposit for payments form

Understanding direct deposit

Direct deposit is a financial service that allows for the electronic transfer of funds directly into a bank account. This method of payment has gained immense popularity due to its convenience and efficiency. Unlike traditional payment methods where physical checks are issued, direct deposit streamlines the process by eliminating the need for checks altogether. When a payment is processed through direct deposit, funds are sent electronically, allowing for immediate availability in the recipient’s account.

The way direct deposit operates relies on electronic funds transfer (EFT). When an employer or agency processes payments, the total amount due is transmitted electronically to the bank where the recipient maintains their account. This process not only minimizes delays commonly associated with mailing checks but also significantly reduces processing times, ensuring that recipients have ready access to their earnings.

Preparing for direct deposit

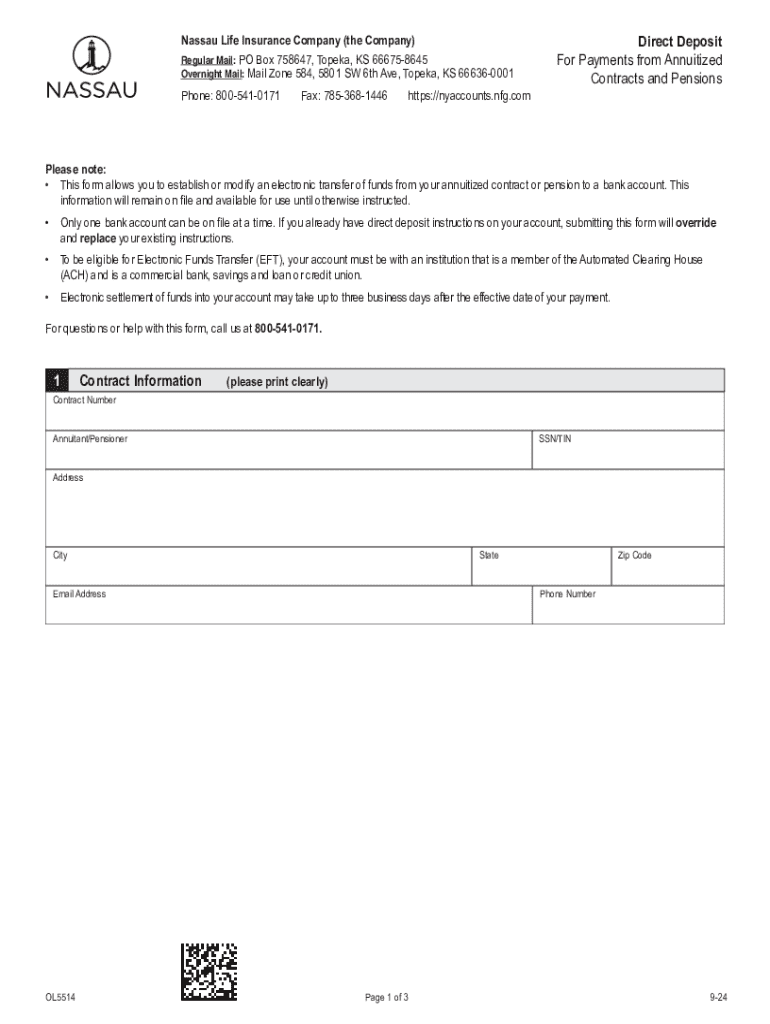

Before you can set up direct deposit, it’s crucial to gather the necessary information required for the direct deposit for payments form. This not only ensures a seamless process but helps prevent potential delays in accessing your funds. Key information includes your bank account number, which uniquely identifies your account at the bank, and your routing number, which indicates the financial institution where your account is held. Additionally, personal identification details such as your name, address, and social security number may be necessary for completing the form accurately.

Selecting the right financial institution is equally important. Factors to consider include the bank's reputation, fees associated with your account, and whether it supports direct deposit services. It’s advisable to verify directly with your bank or visit their website to confirm their capabilities regarding direct deposits.

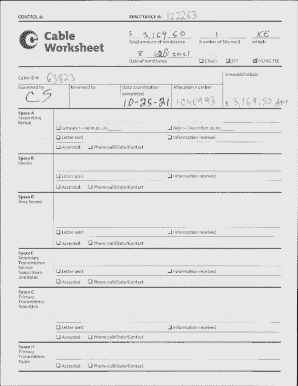

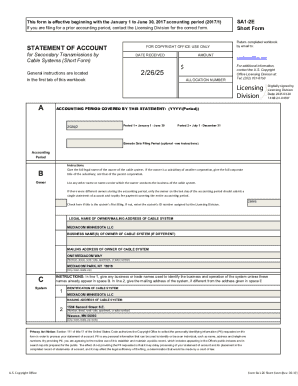

How to obtain the direct deposit for payments form

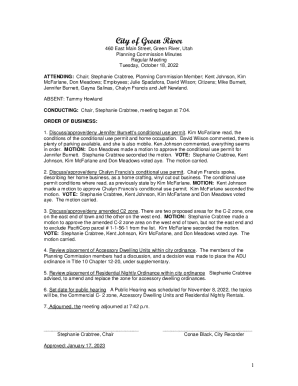

Obtaining the direct deposit for payments form can usually be done easily online or through your employer’s payroll department. Many companies offer downloadable forms on their websites, allowing for a quick and convenient way to access the necessary documentation. Additionally, HR representatives can provide assistance and guidance on filling out the form correctly.

Utilizing tools like pdfFiller can greatly enhance your direct deposit experience. With capabilities to edit, fill out, and sign forms in a cloud-based environment, pdfFiller streamlines the process, making it more efficient than traditional methods. This means you can tackle your paperwork from anywhere, avoiding the hassle of printing and mailing.

Filling out the direct deposit form

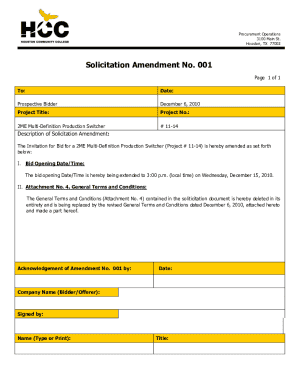

Completing the direct deposit for payments form can be straightforward if followed in a step-by-step manner. Start by downloading the appropriate form from a trusted source, such as your payroll department or the pdfFiller site. Ensure that you enter your personal details, including your full name and contact information, accurately to avoid any connectivity issues with your funds.

Next, carefully input your bank account and routing numbers, as errors here can lead to misdirected payments. After filling out the entire form, review all details meticulously to ensure accuracy before submission. This step is crucial to avoid common mistakes that could hinder the direct deposit process.

Submitting your direct deposit form

After completing your direct deposit for payments form, it’s time to submit it. Submission methods can vary; you might be able to mail, email, or hand-deliver your form to your payroll department. It's essential to confirm receipt with the payee to ensure that your application is processed without issues.

Tracking your submission is equally important. Follow up with your employer or agency after a few days to ensure your direct deposit has been activated. Knowing when to expect your funds can help you manage your finances more effectively while providing peace of mind.

Managing your direct deposit

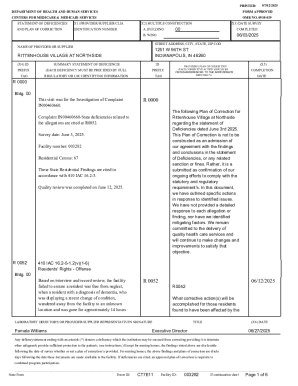

Once your direct deposit is set up, managing it requires diligence, especially if your banking details change. Whenever you need to update your banking information, it’s essential to submit a new direct deposit form with the revised details promptly. Guidelines for changing accounts or employers should also be adhered to strictly to prevent any interruptions in fund availability.

Additionally, troubleshooting common issues is part of maintaining your direct deposit. If you notice delays in your deposits, it’s advisable to contact your employer or the bank immediately to resolve any issues. Similarly, if you see erroneous deposit amounts, promptly report it through the appropriate channels, whether to your bank or employer, to ensure rectification.

Frequently asked questions (FAQs)

Common concerns about direct deposit often revolve around security and operational procedures. One frequent inquiry is whether your information is secure. It’s generally considered more secure than traditional checks because it reduces exposure to fraud. Another common concern is about changing banks. Yes, you can continue using direct deposit if you switch banks; just remember to update your information timely.

Lastly, if an incorrect submission occurs, it’s important to address it immediately. Contact your HR or payroll department before the payment is processed to alter your data.

Keeping your documents organized

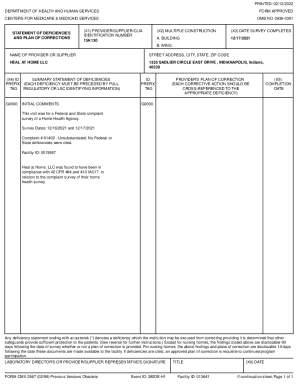

Using pdfFiller for document management related to your direct deposit forms can significantly enhance the organization of your paperwork. With pdfFiller, you can save, edit, and manage your forms effortlessly, ensuring that you always have the latest versions accessible. This is particularly beneficial for collaborating with HR or payroll departments, as it eliminates the need for cumbersome email exchanges and allows for real-time updates.

Overall, managing your direct deposit and associated paperwork should be a seamless experience with the right tools and resources. pdfFiller empowers users to maintain organized and up-to-date records, facilitating a smoother financial management process across the board.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my direct deposit for payments in Gmail?

Can I edit direct deposit for payments on an iOS device?

Can I edit direct deposit for payments on an Android device?

What is direct deposit for payments?

Who is required to file direct deposit for payments?

How to fill out direct deposit for payments?

What is the purpose of direct deposit for payments?

What information must be reported on direct deposit for payments?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.