Get the free Beneficiary Change For Life Insurance Policies

Get, Create, Make and Sign beneficiary change for life

How to edit beneficiary change for life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary change for life

How to fill out beneficiary change for life

Who needs beneficiary change for life?

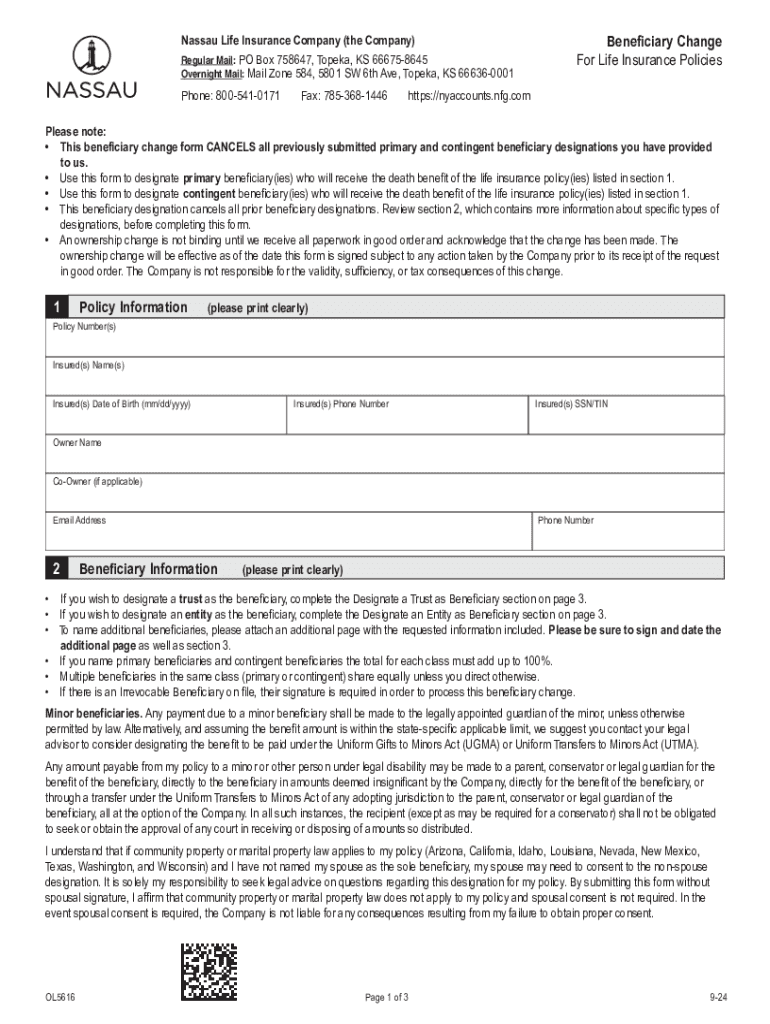

Beneficiary Change for Life Form: A Comprehensive How-to Guide

Understanding beneficiary designations

A beneficiary designation is a critical part of life insurance and retirement accounts, marking who will receive the benefits upon the account holder's death. This designation provides clarity and avoids disputes, ensuring that the assets are transferred as intended. Keeping your beneficiary designation current is essential to reflect your current life circumstances.

Having a current beneficiary is vital for ensuring your loved ones receive your life insurance benefits or retirement funds without legal complexities. In the United States, outdated beneficiary designations can lead to unintended consequences, such as the assets being distributed according to state law instead of your wishes.

Overview of the beneficiary change process

Understanding when to change your beneficiary designation is crucial for maintaining control over your financial legacy. Significant life events trigger the need for a review of your beneficiaries. For instance, marriage can make you want to add a spouse, while divorce may require you to remove an ex-spouse. Furthermore, welcoming a new child into your family often leads parents to update their designations to include their children.

Life circumstances can also affect your financial situation and priorities. For example, if you have recently experienced a substantial increase or decrease in income, it might make sense to reassess and change your beneficiaries accordingly to protect your loved ones. Regular review of these designations ensures that your financial decisions reflect your current values and commitments.

Step-by-step guide to changing your beneficiary

To initiate a beneficiary change for life form, start by accessing your life insurance or retirement policy. This process usually involves logging into your account with your provider. Once logged in, navigate to the section labeled 'Beneficiary' to find the necessary forms.

Completing the beneficiary change form correctly is crucial. You typically need to provide personal information, including the names and addresses of your new beneficiaries. Be clear about who you wish to designate as primary or contingent beneficiaries, as this can affect the distribution of your assets.

After completing the form, double-check all details to ensure accuracy. Reviewing the information can prevent future complications in the distribution of your benefits. The submission options vary; you may submit the form online, mail a printed version to the designated office, or submit it in person at your insurer's office.

Interactive tools for managing your beneficiary designation

pdfFiller offers robust online tools that facilitate the creation and editing of your beneficiary change for life form. With features that allow for easy document management, users can access, fill out, and update forms from anywhere in the United States. This accessibility is especially beneficial for those who travel or require remote access to their documents.

Utilizing cloud-based features enables collaborative work on beneficiary changes, allowing family members or financial advisors to contribute and ensure that all necessary adjustments are made. These tools also include eSignature capabilities, streamlining the process so that signing and submitting documents can occur seamlessly and securely.

Specific considerations based on employment status

Your employment status significantly influences your beneficiary designation processes. Active employees need to be aware of their employer-specific requirements. Every organization may have different policies regarding how and when designations can be changed, so ensure you understand the protocols your employer has established.

For federal retirees or compensationers, there are specific form requirements that must be adhered to. The government issues protocols that need to be followed to ensure compliance with applicable laws. Familiarizing yourself with these protocols can simplify the process and prevent any delays in the beneficiary change.

Ensuring your beneficiary designations are up-to-date

Given how life events can alter personal circumstances, it is prudent to regularly review your beneficiary information. Setting reminders for annual reviews can help maintain current designations that align with your life situation. Regular assessments minimize the chances of unintended consequences regarding your financial assets.

Legal considerations further emphasize the importance of maintaining up-to-date beneficiary designations. State laws may dictate how assets are distributed in the absence of a designated beneficiary. Consulting with an attorney can provide clarity and ensure that your designations comply with legal requirements.

Frequently asked questions (FAQs)

Understanding common questions that arise in the context of beneficiary changes is advantageous. One major concern is what happens if you don't designate a beneficiary at all. In such cases, your assets may be distributed according to state laws, which may not reflect your wishes.

Another frequently asked question is whether it's possible to change your beneficiary after submitting the form. Generally, beneficiaries can be changed any time before the account holder's death, so long as the new change has been processed. Furthermore, many policies do not require any fees associated with changing a beneficiary—however, always verify with your provider to ensure clarity.

Related information

There are various related considerations when changing beneficiary designations. For instance, a divorce can significantly impact your designated beneficiaries. In many states, divorce automatically revokes beneficiary designations to the ex-spouse, but verifying this with your insurance provider is critical to avoid mix-ups.

Similarly, for parents, naming a guardian for minor children in your will is a crucial task that should align with your beneficiary designations, especially if you want to ensure financial support and protection in the event of your death. Additionally, keeping other crucial documents updated, such as wills and trusts, should complement your efforts in maintaining accurate beneficiary designations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete beneficiary change for life online?

Can I create an electronic signature for the beneficiary change for life in Chrome?

How do I fill out beneficiary change for life on an Android device?

What is beneficiary change for life?

Who is required to file beneficiary change for life?

How to fill out beneficiary change for life?

What is the purpose of beneficiary change for life?

What information must be reported on beneficiary change for life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.