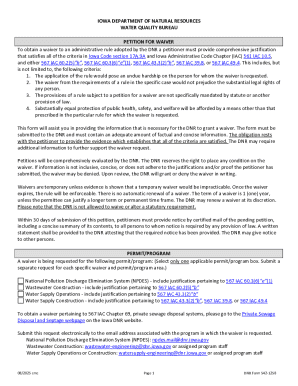

Get the free Financial Statements Summary for the Three Months ...

Get, Create, Make and Sign financial statements summary for

How to edit financial statements summary for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial statements summary for

How to fill out financial statements summary for

Who needs financial statements summary for?

Financial statements summary for form: A comprehensive guide

Understanding financial statements

Financial statements are critical documents that provide a comprehensive overview of a business's financial health. They summarize the financial performance and position of an entity over a specific period and are indispensable for informed decision-making.

The importance of these documents cannot be overstated. Investors, creditors, and business managers rely on financial statements to gauge profitability, liquidity, and solvency. They serve not just as a record but as a strategic tool in understanding potential growth, operational efficiency, and overall business health.

Key components of financial statements

Financial statements are composed of several key components, each of which serves a unique purpose in providing a holistic view of a business's finances.

Income statement

The income statement summarizes revenues and expenses, showing how much profit or loss a business has generated in a given period. Key terms include net income, which represents total income after expenses, gross profit, which is revenue minus the cost of goods sold, and operating income, which reflects earnings before interest and taxes.

Balance sheet

The balance sheet presents a snapshot of a company’s assets, liabilities, and shareholder equity at a specific point in time. It follows the accounting equation: Assets = Liabilities + Shareholder Equity, which is pivotal in understanding how a business is financed.

Cash flow statement

This statement breaks down the cash flow into three categories: operating, investing, and financing activities. It is crucial for assessing the liquidity of the business and highlights how cash is generated and spent within the operation.

Statement of retained earnings

The statement of retained earnings illustrates changes in retained earnings over time, detailing how profits are reinvested in the company rather than distributed as dividends.

Types of financial statements for specific forms

Different types of organizations—like small businesses, nonprofits, or individuals—each require specific financial statements tailored to their unique needs.

Small business financial statement format

Small business owners often need simplified formats that effectively present their financial situation without overwhelming detail. Typically, these include the basic income statement and balance sheet, tailored to track essential metrics.

Nonprofit organization financial statements

Nonprofits prepare financial statements differently, focusing on accountability over profitability. They usually must include a Statement of Activities and a Statement of Financial Position, each reflecting the unique mission-driven objectives they strive for.

Personal financial statements

Individuals may also maintain personal financial statements to track net worth, income sources, and expenses. Unlike business statements, these focus on personal assets and liabilities, guiding long-term financial planning.

Detailed guide on filling out financial statements

Successfully creating financial statements requires proper preparation and organization of financial data. Collecting accurate information is crucial for reliability and credibility in reporting.

Preparing financial data

Gathering financial data from various sources, such as invoices and bank statements, is the first step. Utilizing tools and templates available on pdfFiller can help streamline the data collection process, saving time and ensuring completeness.

Step-by-step instructions

To accurately fill out an income statement, follow these steps:

For constructing a balance sheet, use the following procedure:

When completing the cash flow statement, it's essential to:

Editing and customizing financial statements

Once financial statements are filled out, the next step involves refining them for clarity and presentation. Utilizing pdfFiller for document editing makes customizing templates simple and efficient.

Utilizing pdfFiller for document editing

Users can upload their financial statement templates to pdfFiller and take advantage of features like annotations, text editing, and formatting options. This allows for polished, professional documents ready for presentation or sharing.

eSigning financial statements

eSigning financial documents adds a layer of authenticity and accountability. With pdfFiller, users can securely sign financial statements, ensuring compliance and integrity in their financial reporting.

Special instructions for managing financial statements

Managing financial statements isn't just about creation; it's also about effective collaboration and version control.

Best practices for collaboration

Sharing financial documents securely within teams is critical. pdfFiller offers comment and review features that facilitate real-time collaboration, allowing stakeholders to provide feedback and necessary revisions seamlessly.

Managing document versions

Keeping track of changes in financial statements is essential. pdfFiller includes features that allow users to save and retrieve document versions, ensuring that previous iterations are always accessible for comparison and accountability.

Tools and resources for financial statements

Utilizing the right tools enhances the effectiveness of financial statement management. pdfFiller offers various interactive financial statement templates designed for diverse business needs.

Interactive financial statement templates on pdfFiller

These templates are tailored to suit specific financial reporting requirements. Users can select templates such as a balance sheet statement template or a cash flow statement template that match the nature of their business or personal finance goals.

Additional tools for analysis

Tools related to budgeting and financial planning are also critical. Templates for budget tracking or break-even analysis are invaluable for long-term strategic planning, ensuring businesses can optimize their operations.

Bridging the gap between financial statements and business strategy

Understanding how to utilize financial insights is key to informing business strategies. Financial statements are not just historical records; they actively shape future business plans.

Utilizing financial insights for decision-making

By analyzing financial statements, businesses can identify trends, measure success, and determine areas for improvement. This insight is pivotal in crafting both short-term actions and long-term strategies.

The role of financial statements in securing funding

Transparent financial reporting is essential when seeking funding from investors or lenders. Financial statements provide the necessary evidence of profitability, risk, and business viability, convincing stakeholders to invest in or lend support to the business.

Ensuring compliance and accuracy in financial reporting

Compliance with regulatory standards like GAAP or IFRS is non-negotiable in financial reporting. These frameworks ensure that financial statements are prepared consistently and transparently.

Common mistakes to avoid

Frequent errors in financial statement preparation include misclassification of expenses, failure to update statements regularly, and rounding inaccuracies. Awareness of these pitfalls can help businesses achieve higher accuracy and reliability in their financial reporting.

Interactive learning opportunities

Engagement with educational resources can further enhance understanding of financial documents. pdfFiller provides webinars and tutorials about financial statements.

Community forums for sharing best practices

Joining community forums allows individuals to gain insights and share best practices regarding financial statement management, fostering a collaborative learning environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute financial statements summary for online?

How do I edit financial statements summary for straight from my smartphone?

How do I fill out financial statements summary for on an Android device?

What is financial statements summary for?

Who is required to file financial statements summary for?

How to fill out financial statements summary for?

What is the purpose of financial statements summary for?

What information must be reported on financial statements summary for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.