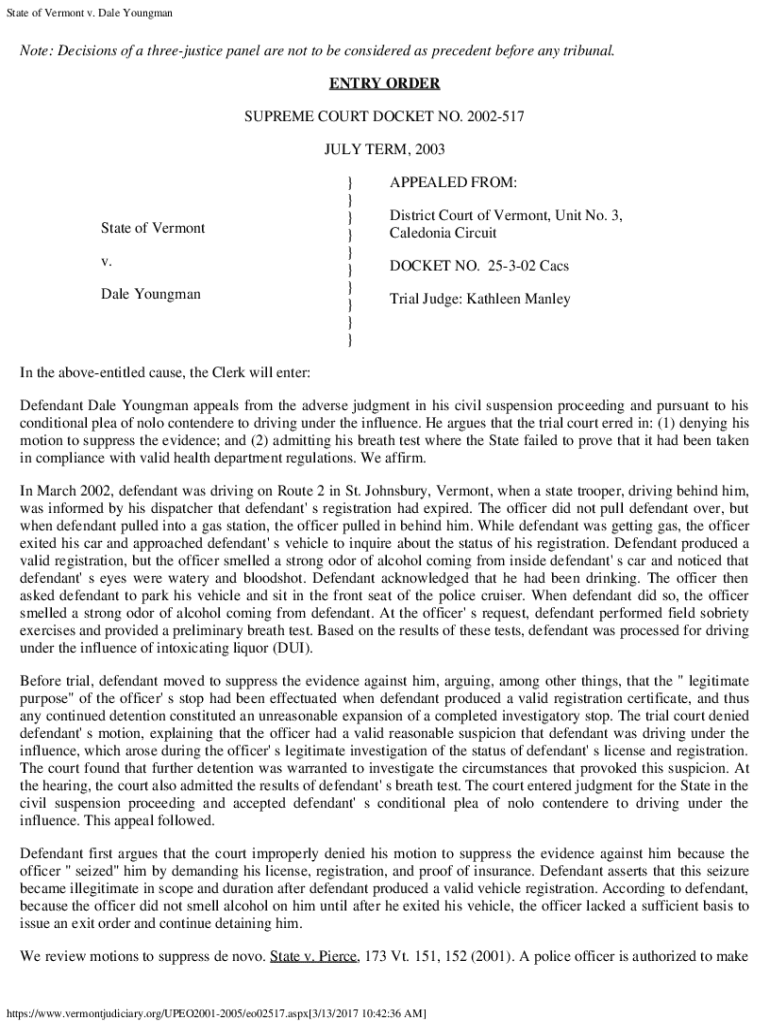

Get the free State of Vermont v. Dale Youngman

Get, Create, Make and Sign state of vermont v

How to edit state of vermont v online

Uncompromising security for your PDF editing and eSignature needs

How to fill out state of vermont v

How to fill out state of vermont v

Who needs state of vermont v?

State of Vermont Form: A Comprehensive How-to Guide

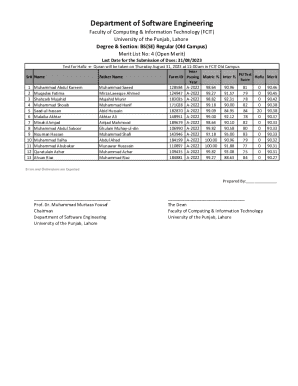

Overview of the Vermont Form

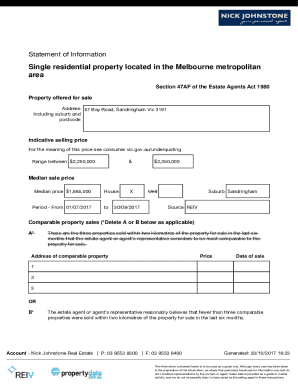

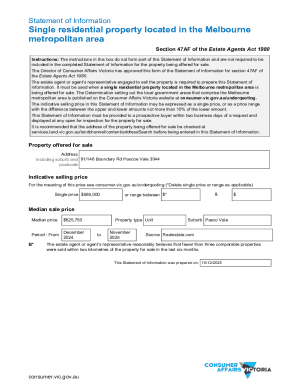

The Vermont V Form serves as a crucial document for taxpayers in the state of Vermont. It is primarily used to report property transfer tax information during the sale or transfer of real estate. Understanding what this form entails, its purpose, and essential details about who is required to file it is pivotal for ensuring compliance with state regulations.

The importance of the Vermont V Form cannot be overstated. It helps the Vermont Department of Taxes collect the appropriate transfer taxes during real estate transactions, thus supporting vital public services and infrastructure. Homeowners, real estate agents, and property buyers or sellers should familiarize themselves with the requirements tied to this form.

Understanding the legal context

Vermont tax laws provide a framework within which the Vermont V Form operates. The legal basis for its requirement is found under Title 32, Chapter 13 of the Vermont Statutes, which outlines property transfer and the associated tax obligations. Filing this form indicates compliance with state law, ensuring that both buyers and sellers are informed of their tax liabilities.

Common legal scenarios involving the Vermont V Form include changes in residency or ownership, which often trigger a need to file the form. Additionally, tax disputes may arise if the form is incorrectly filled or not submitted on time. Homeowners and property representatives should consult legal experts or resources from the Vermont Supreme Court regarding any specific queries related to potential rehearings or decisions impacting their transfers.

Step-by-step instructions for completing the Vermont Form

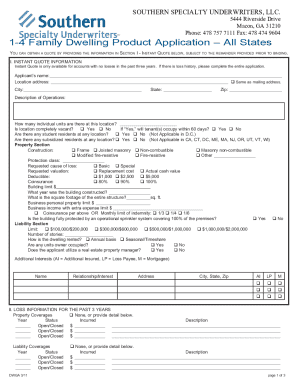

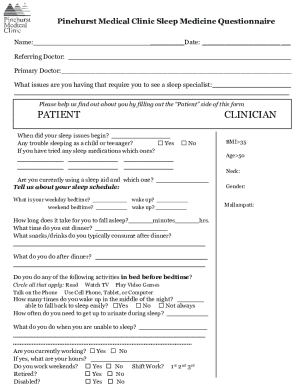

To ensure the accurate completion of the Vermont V Form, follow these outlined steps diligently. The first step is gathering all necessary information to avoid delays or errors. Specific personal identification details, including your name, address, and Social Security Number, are essential. Additionally, ensure you have financial documentation on hand, including prior property tax information and transaction details.

Next, accessing the Vermont V Form should not be difficult. The form is available for download directly from the Vermont Department of Taxes website. It is crucial to always use the most current version of the form to ensure compliance with any legal updates. Once downloaded, take a moment to review each section for clarity before filling it out.

The detailed breakdown of each section is vital. Start with personal information: clearly state your name, address, and Social Security Number as required. Be meticulous in completing the tax information section—ensure that all income and deductions are accurately reported. Finally, pay attention to the signatures and certification section, as it carries legal implications regarding the honesty and accuracy of your filing.

Before submitting your form, review it thoroughly for any errors. Common mistakes include misreporting income, leaving out signatures, or filling in incorrect dates. Ensure that your form complies with all Vermont regulations to minimize the risk of any potential disputes.

Interactive tools for editing and managing your form

Utilizing pdfFiller's features can significantly streamline the management of the Vermont V Form. This platform offers interactive editing tools that allow users to add text, signatures, or comments easily. Such features help ensure that everyone's input is captured efficiently during the collaborative filing process.

The benefits of a cloud-based document platform are extensive. Users can access their forms from anywhere, making it highly convenient for busy professionals or teams working remotely. Furthermore, pdfFiller employs robust security measures to protect sensitive information, ensuring that your data remains confidential and secure throughout the filing process.

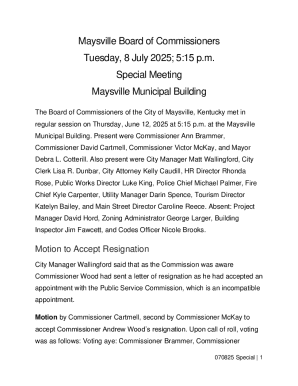

Submitting the Vermont Form

The submission of the Vermont V Form can be done through various methods depending on your preference. Electronic submission options are available, allowing for a faster processing time compared to traditional mailing. For those opting for a physical submission, ensure that you follow the specified mailing instructions provided by the Vermont Department of Taxes.

Timely submission is crucial, with specific deadlines impacting tax assessments. Generally, forms must be submitted within a certain timeframe following the transfer of property, so it's essential to be aware of important dates each year. Having a calendar or reminder system in place can help you avoid penalties associated with late submissions.

Frequently asked questions (FAQs)

Understanding what to do in case of mistakes on the Vermont V Form is essential for all taxpayers. If you realize you have made an error after submission, depending on the nature of the mistake, you may need to amend your submission. This typically involves filing a correction form with the Vermont Department of Taxes.

For further assistance when encountering challenges with the Vermont V Form, it's important to know who to contact. Several resources are available, including tax professionals and legal advisors, as well as the Vermont Department of Taxes hotline, which can provide clarity on specific issues.

Tips for ensuring compliance and avoiding issues

To ensure compliance with the Vermont V Form requirements, it's advisable to follow best practices outlined by experts. Regularly review your form content and stay updated on any changes in tax laws that could affect your filing. Keeping your information accurate and timely helps maintain your credibility as a taxpayer and protects against audits.

If you find yourself facing an audit, having well-maintained records and documentation can be invaluable. Be proactive by organizing your paperwork related to the Vermont V Form so that you can present everything needed during an examination. Being transparent and prompt in your responses can often ease the process.

Conclusion and final thoughts

Utilizing pdfFiller for managing the Vermont V Form not only simplifies the filing process but enriches your overall document management experience. With powerful features that facilitate collaboration, editing, and secure storage, pdfFiller positions you to file efficiently, stay organized, and minimize compliance issues.

Overall, understanding the Vermont V Form and leveraging modern tools like pdfFiller empowers taxpayers in Vermont to navigate the complexities of property tax submissions with confidence. By embracing these available resources, individuals can effectively manage their documentation and focus on making informed real estate decisions.

Real-life scenarios and testimonials

Many individuals and organizations have effectively employed the Vermont V Form, benefiting from a streamlined filing process. Alumni from local colleges who were first-time homebuyers described their confidence in using pdfFiller’s community features where they could consult with other homeowners for advice on completing the form correctly.

Additionally, numerous success stories involve students and real estate professionals collaborating through pdfFiller to fill and submit their Vermont V Forms in a timely manner, ensuring compliance and understanding of the tax implications associated with their property transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my state of vermont v in Gmail?

How do I complete state of vermont v online?

How can I edit state of vermont v on a smartphone?

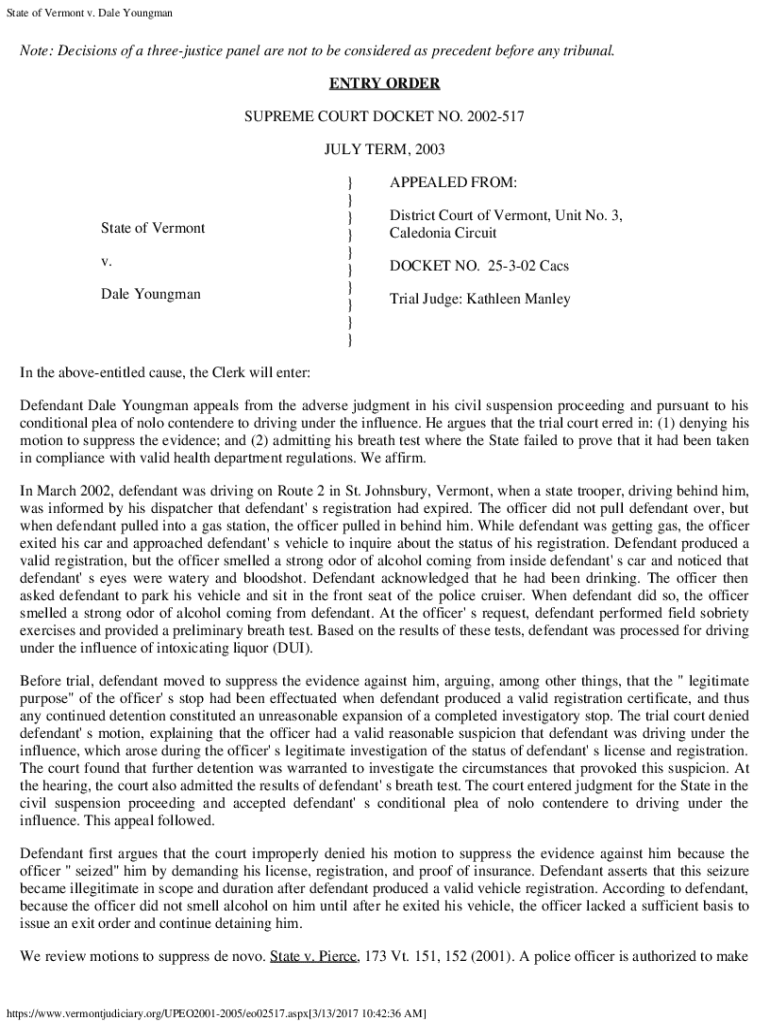

What is state of vermont v?

Who is required to file state of vermont v?

How to fill out state of vermont v?

What is the purpose of state of vermont v?

What information must be reported on state of vermont v?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.